TECH HEAVY: Crypto crumbles as A.I. rumbles on

Breathe. Via Getty

Wall Strut

T’was Monday in New York and the flagship cryptocurrency of this universe or any other we know of – Bitcoin (BTC) – looks ready to bust through some of those terribly important psychological levels people like to agonise over.

Crypto markets have come under heaps of pressure lately, despite the apparently easy gains over on equities. Mega Tech especially.

Bitcoin has already retraced more than -20% from its March made all-time high, while all sorts of altcoins have copped an even bloodier beating. The global altcoin market cap ex Ethereum is down an average of 33% from similar timed recent highs according to Coinmarketcap.

In general, capital flows into cryptoassets have significantly decelerated compared to the levels seen in the aftermath of the spot Bitcoin ETF launch in the US.

At night time, quite late in Sydenham, BTC was heading toward US $60,000 at pace.

It’s now plumbing some of the lowest levels in a few months.

Last week, the newly minted crypto investment products saw their lowest trading volumes globally since the US bitcoin ETFs launched in January.

The moral to this story isn’t that someone hacked crazy legend rapper 50 Cent’s soc media accounts – his X account and website were hacked at the same time with instructions beamed out joyfully instructing everyone to go buy a memecoin called GUNIT (they did).

The exact amount these hackers made off woth is unknown. On Insta, Fiddy himself freckoned, “whoever did this made $3,000,000 in 30 minutes.”

The true moral of the story is probably not to take investment advice from someone who calls himself 50 cent, let alone someone pretending to be 50 cents.

A walk down Wall Street last week saw the S&P500 end the Friday 0.2% lower at 5,465, the Nasdaq Composite also dipped 0.2% to 17,689, while the Dow Jones Industrial Average rose just 0.04% to 39,150.

The S&P 500 hit an intraday record of 5,505.53 on Tuesday, and closed up 0.6% for the week.

The Dow was the best performer of the major indexes adding 1.45%.

But let’s not be in any doubt about where the returns are from: what they’re now calling “The Magnificent 5” – Microsoft (MSFT), Nvidia (NVDA), Alphabet (GOOGL), Amazon (AMZN) and Meta (META) – are where the thanks are due – and where potentially the losses might accrue.

They’ve accounted for 60% of the S&P 500’s gain this year

Democracy in traction

Excitingly, the Americans will give us the first look at what makes up a US presidential debate in the lead up to the 2024 election.

That goes down on Thursday – although with incumbent President Joe Biden and his equally ancient challenger the ex-president Donald Trump on stage it’ll look like a 2020 rematch, sans distancing etc.

The best factoid worthy of print here is that the combined ages of Biden and Trump is two-thirds the age of the country whose top job the two are seeking.

Worth considering – given the dire state of the polls for the UK’s Conservative party, and one poll even showing Prime Minister Rishi Sunak losing his seat, one wonders how useful this head-to-head will be in changing voter opinion before the campaign’s final week.

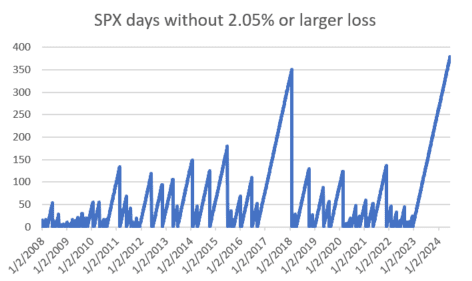

Wall Street’s climb to record highs has come with conspicuously little volatility.

The S&P 500 has now gone 377 days without a 2.05% sell-off.

That’s the longest stretch for the benchmark since the great financial crisis, according to FactSet data compiled by CNBC.

The index hasn’t experienced a gain of at least 2.15% in that time either.

A.I. News

Here’s the latest take on where Nvidia (NVDA) is off to.

Overnight the stock began to retrace some of the losses of the previous session, when NVDA shed some 6% – its biggest one-day slide since April.

Nvidia’s sudden hat-trick of losses pulled the chipmaking darling deeper into correction land some 13% below NVDA’s recent intraday record.

Yet Nvidia – after amassing a market cap of US$3.34 trn last week, briefly overtaking Microsoft to become the world’s biggest company – has now been hit by profit taking and sits circa 10% lower than its record high.

It’s rated a buy by 89% of sell-side analysts with its revenue expected to grow 98% next year.

So… I guess this is a buying opportunity? US fundie Rosenblatt thinks so.

The broker’s semiconductor analyst, Hans Mosesmann, reckons that even after its 200%-plus 12-month gain, NVDA stock still has 50% upside from its current levels.

Rosenblatt retained its Buy rating on NVDA last week and also lifted the price target to a Wall Street high of $200 from $140.

Mosesmann’s position would put NVDA at a pretty amazing US$5 trillion valuation.

Jefferies meanwhile reiterates Nvidia as a buy, raising its price target on Monday to $150 from $135.

“NVDA remains both king and kingmaker – for example, we still see growth for MRVL and ALAB alongside NVDA, but NVDA’s decisions on each generation could materially alter that,” the broker says

Citi also reiterated Micron as a top pick on Monday in the States. The price target is lifted to $175 per share from $150 ahead of a big earnings drop on Wednesday.

“Our Top Pick Micron will report F3Q24 results on June 26 after market close and we expect the company to post results and guidance above Consensus given the DRAM upturn and Micron’s increasing AI memory exposure,” Citi says.

Other semiconductor stocks which were also under pressure on Monday, including Super Micro Computer, Qualcomm and Broadcom, have managed to staunch the bleeding.

US market movers

Inflation is the biggie again with the focus on Friday’s US personal income and outlays data for May – that’s got the reading on the core personal consumption expenditures (PCE) price index, the Fed’s preferred inflation gauge.

US economic growth will also be in focus on Thursday, as the second estimate of Q1 gross domestic product growth drops.

Largely the data run ahead is led by final takes on first-quarter GDP plus a few surveys and Fedspeaking.

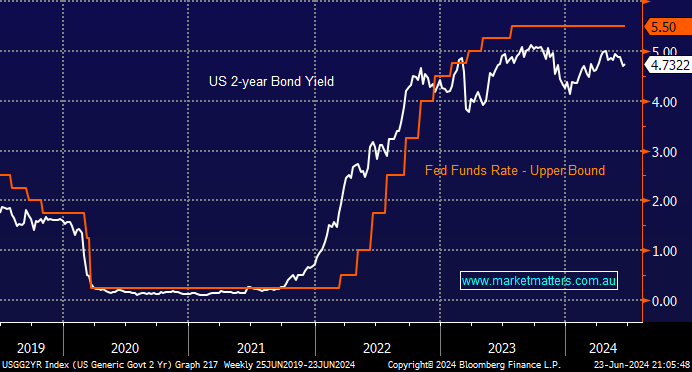

According to Shaw and Partners’ James Gerrish, FOMC members believe they’re fighting the good inflation fight right now by stifling US economic conditions via their high interest rates:

“However, in reality, they might push the US economy into a recession if they don’t remain open-minded – we often think the Fed should let the two-year T-Note yield determine the Fed Funds target rate and if it had today we would have already enjoyed some rate cuts in 2024.

“The highly qualified FOMC members usually think that they know better than the bond market but when they keep rates too low, as they did after COVID, inflation runs riot and when they keep rates too high, like they are doing now, they pull the handbrake too hard, leading to economic problems.

James says his team at Market Matters are concerned that the Fed may be too slow to cut rates but ultimately rate sensitive stocks/sectors should fare well over the coming year(s).

Elon Watch

Here he is being ultra libertarian late last week. Free speech and damn the torpedoes. One does that, after buying a social media company.

— Elon Musk (@elonmusk) June 22, 2024

But perhaps most unsurprising is the news Our Elon copped some outrageous deep fakes over the weekend.

On YouTube, a rip off of Mr Musk told gormless viewers by the bucketloads to deposit their crypto on some unrelated, promising free crypto in return.

The looped deep fake looked a helluva lot like a livestream from a Tesla event and reports suggest some 30,000 Muskovites were all for it at one point, pushing it to the top of YouTube’s Live Now recommendations.

It was rather ordinarily titled “Tesla’s [sic] unveils a masterpiece: The Tesla that will change the car industry forever.”

According to Engadget, the now-removed video used an AI-generated version of Musk’s dulcet tones to lure viewers to deposit Bitcoin (BTC), Ethereum (ETH) or Dogecoin (DOGE) for a supposed giveaway, promising to “automatically send back double the amount.”

It’s actually the latest of a recent surge in Elon Musk deepfake scams. Earlier in June, Cointelegraph reported on 35 accounts posing as SpaceX running similar scams during the Starship launch.

US Earnings

The world’s largest cruise line operator Carnival (CCL) and global economic bellwether FedEx (FDX) reported quarterly results on Tuesday, followed by Betty Crocker and Cheerios parent General Mills (GIS) and memory chipmaker Micron Technology (MU) on Wednesday, and pharmacy chain Walgreens Boots Alliance (WBA) and the world’s largest shoemaker Nike (NKE) on Thursday.

Tuesday

Baker Hughes (BKR), Carnival (CCL) and FedEx (FDX).

Wednesday

General Mills (GIS), Paychex (PAYX), Levi Strauss (LEVI), Micron (MU), and AeroVironment (AVAV).

Thursday

Nike (NKE), McCormick (MKC), Walgreens Boots Alliance (WBA), and Acuity Brands (AYI)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.