You might be interested in

Experts

Criterion: What to do when your shares are taken into custody

News

Closing Bell: ASX closes week higher as Appen, Novonix race ahead

Experts

News

Wall Street futures moved higher on Monday morning in Sydenham after the major US averages ended last week in a tickled green a mood thanks to a weaker-than-expected jobs report.

The somewhat ideal-for-the-moment jobs data revivified Wall Street dreams of a US Federal Reserve pulling out the interest rate scissors sooner than later.

The nonfarm payroll catalyst on Friday added fewer-than-expected jobs in April and an increase in unemployment, easing fears of an overheating economy.

Traders became enthusiastic that the Fed could start lowering rates sooner this year. As the rain fell in Sydney, the rainmakers fell upon the broader US market index and the Dow Jones hearty buying ensuring both indices enjoyed their best days in about 10 weeks.

The punchy end to last week saw the Dow and Nasdaq rise 1.1% and 1.4% each, while the S&P 500 gained 0.5%.

Shares of Apple surged 6% on Friday as investors gawked at a little-bit-better-than-expected Q2 and the spectacle of a scene-stealing biggest stock buyback plan in actual corporate history.

Apple shares heading into the report were down 10% on the year, a clear sign the street expected a mealy mouthful of China-thwacked numbers. And while Apple’s quarter was pretty bad – sales evenue was down 4% from this time a year-ago (a 5th revenue fall out of the last six quarters) – it was better than feared.

Mathematically, Apple’s US$110 billion stock buyback should support the slipping stock price by adding buying pressure to the market and, by slashing shares available, should lift EPS (earnings per share).

On a related note, in its Q1 earnings report released Saturday, Berkshire Hathaway reported that its Apple bet was worth $135.4 billion, implying around 790 million shares.

That amounts to a hefty 13% slash and burn in the Oracle’s stake. Apple was still Berkshire’s biggest holding by far at the end of the quarter.

The jobs data boosted rate-sensitive megacap tech – let’s run through them for the newbies – Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA).

On Friday it was NVDA and Advanced Micro Devices (AMD) ahead over 3%, while MSFT and META found circa 2%.

Elsewhere, the biotech Amgen (AMGN) notched its best day since 2009, closing nearly 12% the better after posting better-than-expected earnings and tantalising with an update on its experimental obesity drug.

The week also closed out two days of closing arguments around whether Google exploited its market dominance to unlawfully squeeze out internet search competitors in the US government’s landmark we-antitrust-you District court case against Google.

US District Judge Amit Mehta implied he might make a call on this in the weeks to come, saying that the “importance and significance of this case is not lost on me, not only for Google but for the public”.

There’s been 10 weeks of testimony from more than 50 witnesses, including Sundar Pichai, CEO of Google and its parent company, Alphabet.

Wall Street will get a slight amount of relief next week as both the economic calendar and the first quarter earnings season will lighten up somewhat.

It will be quieter on the Western macro, after a busy week with the Federal Reserve decision and the hoopla around jobs data.

Market punters will be looking ahead to Monday’s senior loan officer opinion survey from the Federal Reserve to assess credit conditions in the economy. Also in focus will be Friday’s University of Michigan preliminary consumer sentiment data for May.

Meanwhile, some of the spotlight will be back on the clever pips at Apple, which rolls out a special iPad event on Tuesday.

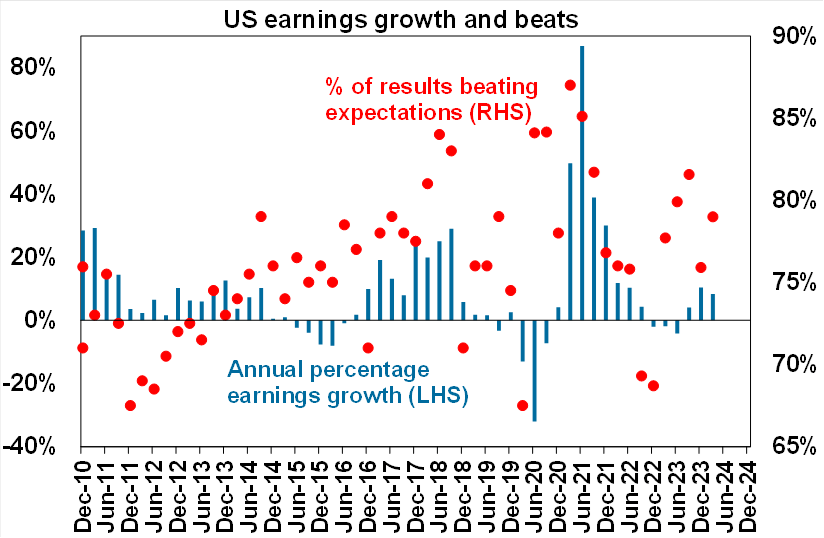

For all the angst, US March quarter earnings remain pretty decent.

80% of S&P 500 companies have reported so far and the good news is that 79% have beaten expectations, against a norm of 76%.

Earnings growth expectations for the quarter have increased to 8.3% yoy, from 4.1% three weeks ago and seem likely to end around +10% yoy, according to AMP data.

Heaps of the big US corporates, including members of the “Magnificent 7” have already reported.

Still, a full-on 56 S&P500 companies report earnings this week, including biggies like Star Wars owner Disney (DIS), Roblox owner Roblox (RBLX), Dropbox owner Dropbox (DBX), AMC Entertainment (AMC) and buddy AMC Networks (AMCX) and the ride-hailing juggernaut Uber (UBER).

Monday

Tyson Foods (TSN), Vertex Pharmaceuticals (VRTX), Palantir (PLTR), and Realty Income (O)

Tuesday

Disney (DIS), McKesson (MCK), Ferrari (RACE), GlobalFoundries (GFS), Coupang (CPNG), Electronic Arts (EA), Rivian Automotive (RIVN), and Datadog (DDOG)

Wednesday

Uber Technologies (UBER), Anheuser-Busch InBev (BUD), Airbnb (ABNB), Shopify (SHOP), Arm (ARM), Energy Transfer (ET), Trade Desk (TTD), Beyond Meat (BYND), Affirm (AFRM), and AMC Entertainment (AMC)

Thursday

Warner Bros. Discovery (WBD), US Foods (USFD), Hyatt Hotels (H), Roblox (RBLX), Dropbox (DBX), and Genpact (G)

Friday

AMC Networks (AMCX) and Enbridge (ENB)

MONDAY

CN Caixin Services PMI

ID GDP Growth Rate

TUESDAY

US Fed Barkin Speech

US Fed Williams Speech

BR S&P Global Services PMI APR

JP Jibun Bank Services PMI Final APR

GB S&P Global Construction PMI APR

EA Retail Sales MoM MAR

WEDNESDAY

US RCM/TIPP Economic Optimism Index MAY

US Fedspeak Kashkari

US API Crude Oil Stock Change MAY

THURSDAY

US EIA Gasoline Stocks Change MAY

US Fedspeak Jefferson

US 10-Year Note Auction

US Fedspeak Cook

BR Interest Rate Decision

JP BoJ Summary of Opinions

CN Balance of Trade

GB BoE Interest Rate Decision

US Initial Jobless Claims

FRIDAY

JP Current Account MAR

GB GDP MAR

CN Current Account Prel Q1

EU ECB Monetary Policy Meeting Accounts

BR Inflation Rate