Sydney property prices are rising by $1,000 every single day

Pic: d3sign / Moment via Getty Images

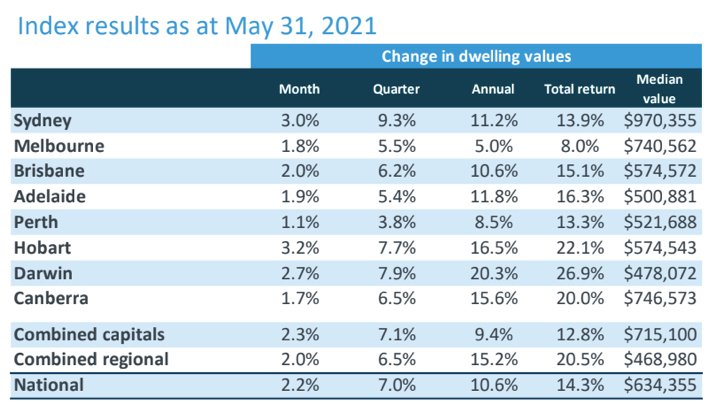

- Sydney property prices rose by 3% in May, or more than $30,000, according to the latest CoreLogic data.

- Rising at a rate of $1,000 a day, Sydney median home values are on track to crack $1 million by the end of the month.

- It has helped drag prices higher nationwide, rising 2.2% over the month.

Sydney property prices are soaring but regardless of where you live right now in Australia, the local property market is almost certainly running hot.

National prices soared 2.2% higher during the month of May, with every major market and property type in lockstep as part of an unrelenting march higher, the latest data from CoreLogic on Tuesday shows.

“Values were up by more than 1% across every capital city over the month, with both house and unit values lifting across the board,” research director Tim Lawless said. “Such a synchronised upswing is an absolute rarity across Australia’s diverse array of housing markets.”

It marks the second fastest month of growth this year, only trumped by March in which prices jumped 2.8%. Curiously though, it is now the top end of the market that is growing at the fastest clip, with Sydney up 3% in the space of four weeks. The frenetic pace is consistent with the last three months, in which values have swollen by 9.3%, or $83,000.

To put it another way, every single day Sydney homebuyers delay they can expect to pay $1,000 more for any property, apartment or house, in Sydney. The median home in the Emerald City now costs $970,000 and is on track to break seven figures next month. That’s not to be confused with median house prices, which broke $1 million long ago in Sydney and more recently in Melbourne.

Sydney values meanwhile are expected to rise more than $216,000 this year, amid warnings that the government’s loan guarantees are too risky.

The next two most expensive cities to buy, Melbourne and Canberra, meanwhile rose by 1.8% and 1.7% apiece in May. Hobart rocketed 3.2% higher, while Brisbane rose by a not immodest 2%.

Zooming out, it’s clear the largest growth has been witnessed in smaller capitals, albeit from lower starting prices. Darwin prices are now up more than 20% since last April. The trend is mirrored somewhat in Hobart and Canberra, which are up 16.5% and 15.6% respectively.

While record low interest rates, government incentives and a fear of missing out have all helped heap fuel onto the market, there’s another major driver clearly at play. CoreLogic notes there are nearly 40% more sales occurring now compared to long term averages, while buyers continue to outnumber sellers.

“The sales to new listings ratio remains around 1.1, meaning for every new listing there is more than one sale occurring,” Lawless said. “This rapid rate of absorption is keeping advertised inventory levels extremely low, despite the rise in new listings.

“As a consequence, vendors remain in a strong selling position while buyers have a weak position at the negotiation table.”

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.