Hands up who had ‘sunflower oil shortage’ on their 2022 bingo card?

Pic:Getty Images

- The war in Ukraine has led to a global sunflower oil shortage

- Sunflower oil is a key ingredient of polyunsaturated margarine and infant formula

- The price of sunflower oil has skyrocketed more than 50% in the past year

Forget the US infant formula crisis and don’t worry about the price of gas in Sweden (we mean, literally don’t worry, we think they’re good). No, we have a much bigger global crisis on our hands.

We’re almost out of sunflowers.

We know what you’re thinking – there are prettier flowers and who’s got time to stop and smell one anyway, right?

Fair. But as it turns out, Google Analytics reckons sunflower seeds are a big hit all over the place, either eaten raw as a tasty but messy snack, or in fancy salads or perhaps hidden inside those flavourless crackers that companies like Arnotts offer up as a non-distracting cheese delivery system for the enhanced appreciation of wines, beers and homemade eau de vie.

But – and this is the kicker – they can also be pressed into sunflower oil.

Unfortunately the supply of sunflower oil, which makes up a not insignificant whack of the edible oils used in kitchens globally today, is drying up, according to the International Food Policy Research Institute.

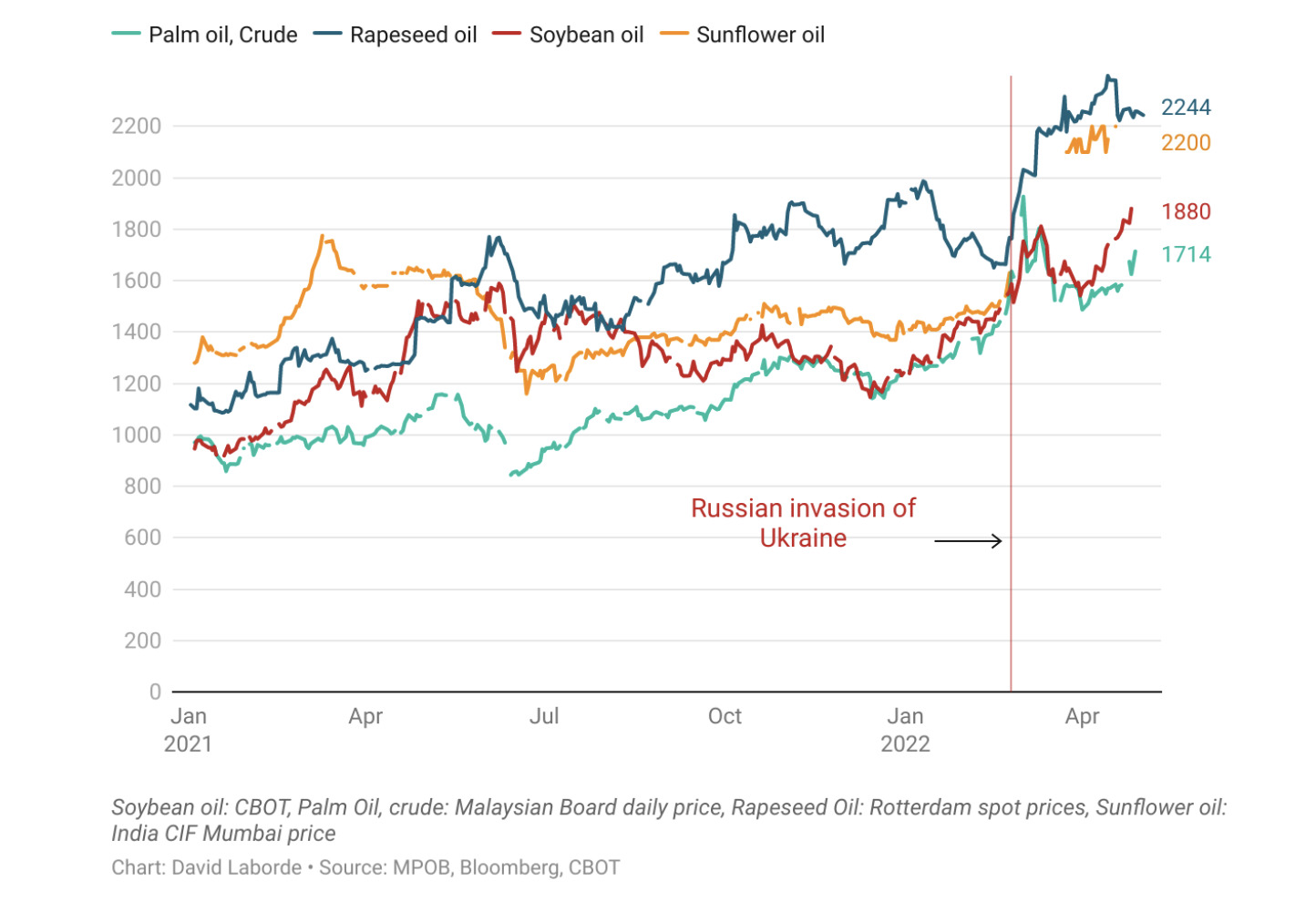

While all kinds of oils have been hit by this nasty business in the Black Sea, it’s sunflower oil that’s been most directly affected, with prices jumping almost 50% since Russia’s invasion of Ukraine in February.

Daily vegetable oil prices

Oils ain’t oils

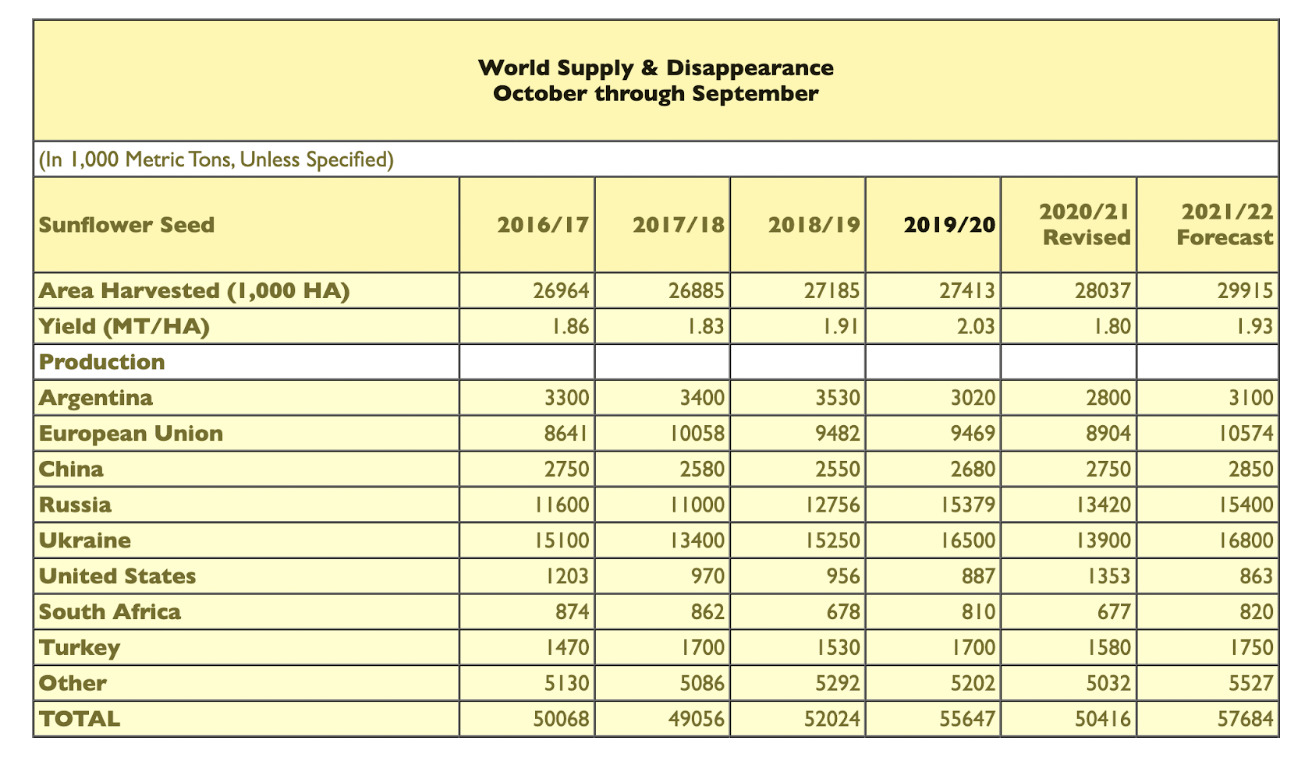

It turns out sunflower oil is like the world’s favourite go-to vegetable oil, accounting for about 13% of vegetable oils traded in global markets. Ukraine and Russia account for about 25% each of the global sunflower trade.

And since vegetable oils require little or no processing, the high prices have already been passed through to consumers.

Helianthus annuus is a non-volatile oil extracted by squashing the hell out of those sunflower seeds, producing a triglyceride mainly consisting of palmitic acid, stearic acid, oleic acid and linoleic acid. And while the residue cake makes for a handy, if not delectable protein-rich livestock feed, its other uses are legion.

In India, for example, sunflower oil is regarded as having these 10 rather miraculous qualities:

- Improves heart health

- Improves skin health

- Prevents arthritis

- Prevents asthma

- Prevents cancer

- Improves immune system

- Improves hair health

- Improves digestion

- Aids weight loss

- Reduces depression & anxiety

That’s an impressive list and certainly gets the backing of the absolutely non-partisan US peak sunflower lobby group, the National Sunflower Association, who largely say two things – it’s great and it’s suddenly scarce.

“The conflict in Ukraine pushed sunflower prices to all-time record highs this spring (*our autumn). In Australia, the price per metric ton jumped from $2095.39 in February, to $3202.71 in March. That’s a tasty 52.85%. And it’s so far stayed above the $3000/t mark since.

“The rally has continued setting fresh highs each week as the lack of global sunflower seed availability and strong oil demand have encouraged crushers to pay more for the available crop,” the NSA said in its monthly newsletter.

“Sunflower oil exporters are reportedly fielding unprecedented call volumes from new customers seeking to replace Black Sea sunflower oil.”

The NSA said the oil is ideal for a variety of food formulations. For example, sunflower oil is a fabulously superior oil for stir-fries and burning stuff in a wok, with a high smoke point.

Oh, and great for baby formula

Yep, here we go. Remember how the US is gripped in an infant formula crisis right now because one of its big providers had to shut down its factory?

Aussie infant formula maker Bubs Australia (ASX:BUB) was among firms from overseas to ship stock over to help US families after founder and chief executive Kristy Carr presented their case to President Joe Biden via a Zoom meeting.

Already Stateside, Bubs last week announced it’d brokered two supply agreements a few of the bigger US supermarket chains. Bubs will be landing in more than 4,000 American retail stores this month.

The BUB share price spiked into double digits again on the news and is up 70% since this saga began.

Sunflower oil is now a common key ingredient in modern production of infant formula. And while they’ve been literally freaking out in the States – invoking the Defense Production Act to get formula into the country – at this stage nothing’s been invoked over sunflower oil.

So, when Russia invaded the world’s largest producer, effectively cutting supply lines from the other top producers – Argentina, France, Romania and Russia itself – well then, you have a problem. You have a screaming baby problem the likes of which makes the temporary shuttering of Abbott’s Laboratories’ manufacturing plant in Michigan sound like a choral lullaby sung by the bastard love-children of Aled Jones and the entire Welsh nation.

Russia & Ukraine major producers

According to the NSA, Ukraine and Russia account for about half the world’s supply.

While some of the last northern crop made it onto world trade markets before the war started in late February there was still significant disruption.

Australian Oilseed Federation executive officer Nick Goddard told Stockhead Ukrainian farmers are now trying to plant summer crops but the hourly concert of artillery fire is a bit of a concern, making a successful harvest and ongoing supply unlikely amid the backdrop of bloody conflict.

“There’s concern around the ability of ongoing supply of sunflower as it is scarce and no signs that shortages will be eased in the next 12 months,” he said.

“With the crop being planted now there’s not a great confidence or understanding about how that will get on the world market until the ports open up as nearly all of it is shipped in bulk from ports out of the Black Sea.”

Goddard said as an interim measure traders in the UK have been shipping sunflower oil by rail but those volumes just don’t cut it when compared to the load of a ship.

“A ship might be 50 or 60,000 tonne where a train might be 1000 tonne if you’re lucky,” he said.

Australia: close but no sunflower

First up, with a heroic agri-business sector of our own, we’ve usually got a cracking substitute at hand, but this is one scenario where Australia can’t help out much with the immediate crisis as we are now more of a canola oil producing nation, despite producing sunflowers crops in the past.

“We are capable of producing sunflower oil and in the past have, but over the years sunflower crops have fallen out of favour and given way to other summer crops like sorghum, cotton and so on,” Goddard said.

“Canola fitted into the farming rotations better as a winter crop and we produce about 6.4 million tonne of canola seed, which is 2.9 million tonnes of oil annually.”

Australian Trade and Investment Commission reckons Aussie vegetable oil exporters are likely to gain from record high prices, citing ABARES research showing ongoing high prices and favourable seasonal conditions for vegetable oils are expected to lead to record Australian oilseed exports in 2022.

The largest importer of sunflower oil into Australia and New Zealand, Graincorp (ASX:GNC), told Stockhead it actually sources the sunflower oil from multiple regions, the majority from South America.

“The global supply constraint on sunflower oil has been driven by the conflict in the Black Sea, which has impacted global supply chains and pricing,” Graincorp said.

“GrainCorp’s supply chain has shown resilience through this period, and we have continued to deliver for our customers, some of whom have taken the opportunity to consider alternative inputs like canola oil to manufacture their products, a choice which we have been able to supply,” GrainCorp said.

$$$ make Aussie farmers re-consider sunflower trade

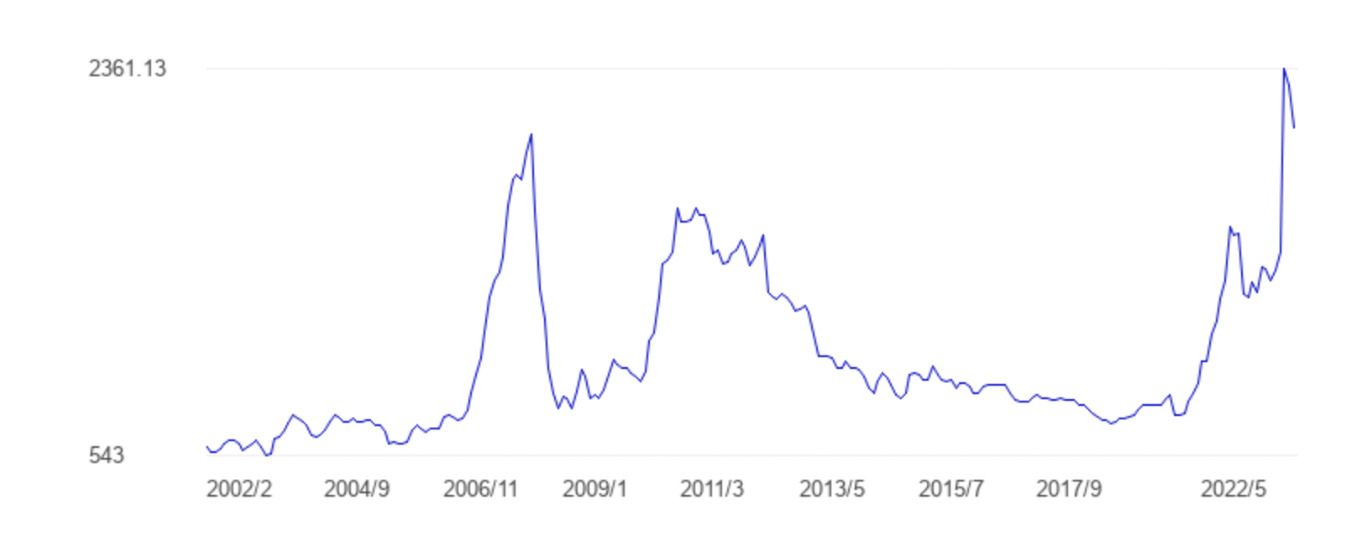

Thanks to the extraordinary spike from around April this year, the average value of sunflower oil, between 2003 and April 2022 was about $US986 per metric tonne.

As we noted earlier, it topped out most recently at $US2361.13pmt in March and has risen more than 50% in the past year.

Here – it’s always better in a drawing we done using World Bank data, in USD per metric tonne.

“There is obviously growing interest from farmers to get back into growing sunflowers because the price is likely to remain firm for some time yet,” Goddard said.

“But we don’t have the supply chain to switch to sunflower seed and oil instantly so there’s a bit of work that needs to be done downstream but nonetheless the market is providing signals that probably enable people to invest in the infrastructure to handle the crop.”

Goddard said the shortage in prices in sunflower oil will flow through to other oil seed prices as well, meaning more expensive ingredients for manufacturers and in turn consumers.

“There’s an oilseed complex which is an interplay of all the vegetable oils on the world stage and supply pretty much equals demand, but when you take out a huge sector like sunflower oil then it creates disruption as the supply chain tries to rebalance,” he said.

“At the end of the day supply is less than demand and in turn we’re seeing a lift in oil seed prices around the world and this is likely to continue.”

Concern for infant formula and polyunsaturate margarine

Goddard said the shortage of supply is a concern for industry sectors which rely upon sunflower oil, such as polyunsaturated margarine and infant formula.

The polyunsaturated properties of sunflower oil is why it’s a key ingredient of that type of margarine.

“Some sectors are able to substitute sunflower oil for canola oil for example but there are some where sunflower oil is a critical part of their formulation and not so easy to change,” Goddard said.

Much of the global fast food market for example have reformulated oils to be healthier, and in doing so incorporated sunflower oil into their blend, but can more easily change their oil formulations again.

“It’s not rocket science to change that blend to something that will still cook the burgers and chips pretty well without sunflower oil, for example put in soya bean oil or canola oil,” he said.

“The areas of most concern are areas like the margarine market where products are labelled polyunsaturated, so you need products which are polyunsaturated like sunflower oil.

“Similarly, markets like infant formula where the polyunsaturated sunflower oils are required for that overall formulation to provide the potential fatty acids needed for the baby.”

Countries reduce exports

Australian Trade and Investment Commission says the global crunch on seed and vegetable oils has already led to major exporting countries to slam the brakes on exports of various oils.

Export restrictions are intended to ensure domestic supply and reduce domestic prices, but again with the rocket science – protectionist export restrictions further slashes the volume of vegetable oil across global markets, raising international prices.

It’s also likely to create a whole new ripple of supply gaps for some importing countries (that’s us), particularly those highly reliant on vegetable oil imports.

So while formula makers are scrambling for a shot at US profits, they’re also scrambling for a sunflower oil substitution – and with reductions in other supply chains, that may not be easy.

But rewriting infant formula recipes isn’t easy either. Anyone that’s had a baby sucking on a bottle of the good stuff knows what a problem it is if it’s not perfect.

A lot of science and research goes into infant formulas to ensure babies get all the nutrients they need to thrive and it’s a tightly regulated market.

Hmm. Let’s watch and wait

But Food Standards Australia New Zealand (FSANZ) – responsible for developing and maintaining theFood Standards Code – won’t just tweak the rules for anyone, saying foods produced for sale or imported into Australia or New Zealand must hit all the right compliance and enforcement notes.

In a statement to Stockhead, FSNAZ said it was monitoring the sunflower shortage.

“FSANZ is aware the conflict in Ukraine has created supply chain issues resulting in shortages of sunflower oil,” the food standards people said via email.

“These shortages may require ingredient substitutions for some food products, including infant formula.

They said where ingredient substitutions are required, labelling compliance would need to be considered by the manufacturer and enforced by the relevant jurisdictional authorities.

“FSANZ will continue to monitor the sunflower oil situation as it evolves.”

It’s evolving alright. The price of Crisco’s sunflower oil has jumped by 30% this quarter and isn’t slowing. In London it’s 60% higher.

Infant Nutrition Council: We’ll talk to the FSANZ

Infant Nutrition Council of Australia and New Zealand (INC) CEO Jan Carey told Stockhead she’s genuinely concerned.

“It could be very difficult to replace these ingredients at short notice as Ukraine is a major exporter of sunflower oil,” she said.

“The war in Ukraine has highlighted that we live in a global world relying on global trade – what happens on the other side of the globe has ramifications for Australia.”

INC’s trade and market access manager Simon Woolmer said he had been talking to its members about the shortage.

“A small number of our members have indicated that they may be impacted by a global shortage of sunflower oil, particularly if the Ukraine conflict continues for an extended period,” he said.

“The industry regulator, FSANZ, is aware of this and has a process in place that can provide some flexibility in terms of substituting ingredients where global supply chains are compromised in the short term.

“The INC has advised members to speak directly with FSANZ if they are concerned about the impact of a shortage of sunflower oil would have on their compliance.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.