Stocks will outperform bonds and deliver annualized returns of 6pc over the next decade, Goldman says

Pic: Getty

Investors should continue to favour stocks over bonds from now until at least 2030, according to Goldman Sachs.

In a note published Monday, Goldman gave its long-term forecast for what stocks will do over the next decade.

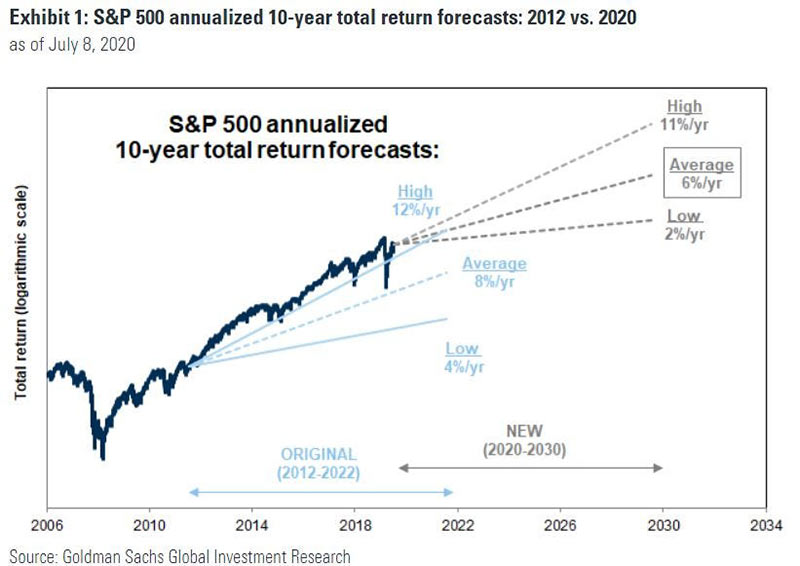

The firm estimated that the S&P 500 index will deliver an average annualized total return of 6 per cent and estimated that stocks have a 90 per cent probability of outperforming bonds due in part to record-low interest rates.

Goldman acknowledged that it’s difficult to forecast stock returns 10 years into the future, pointing to its last long-term forecast from July 2012.

In that forecast, Goldman suggested that stocks would deliver an average annualized return of 8 per cent.

But eight years later, the S&P 500 delivered an average annual return of 13.6 per cent.

The firm said that 25 per cent of its 2030 stock return forecast will be generated by dividends, while the other 75 per cent will come from price gains.

Goldman added that a more bullish scenario could result in average annualized gains of 11 per cent, while a more bearish scenario could see stocks return just 2 per cent.

This article first appeared on Business Insider Australia, Australia’s most popular business news website.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.