Stake data shows Aussie investors have taken an interest in global COVID-19 vaccine stocks

Aussies have been buying Covid-19 vaccine producing stocks since March 2020. Picture Getty Images

As of today, 21 million COVID-19 vaccine doses have been administered in Australia, with 31% or 7.87 million people now fully vaccinated in the country.

Words like Pfizer, AstraZeneca and Moderna have become a part of our everyday lingo, and that familiarity has also translated into action on the stock market.

According to digital trading platform Stake, more than $100m in vaccination stocks has been traded by investors on its platform since W.H.O. declared COVID-19 a pandemic back in March 2020.

The two main vaccine companies, Pfizer (PFE) and AstraZeneca (AZN), have attracted interest from Stake investors to the tune of $11.7m and $2.7m respectively.

Moderna (MRNA) attracted more than $60m traded in the past 18 months, while lesser-known Novovax (NVAX) – whose vaccination is still not approved for use in Australia – had $33m traded since the start of the pandemic.

Hundreds of Australians took part in clinical trials for the Novavax jab last year, but the vaccine has still not been recognised on our immunisation register. Investors are however still hopeful that it will soon be part of Australia’s booster campaign.

Meanwhile Johnson & Johnson (JNJ), which is also not currently included in Australia’s COVID-19 vaccination program, had more more than $1.6m of its shares traded on the Stake platform since the start of 2021.

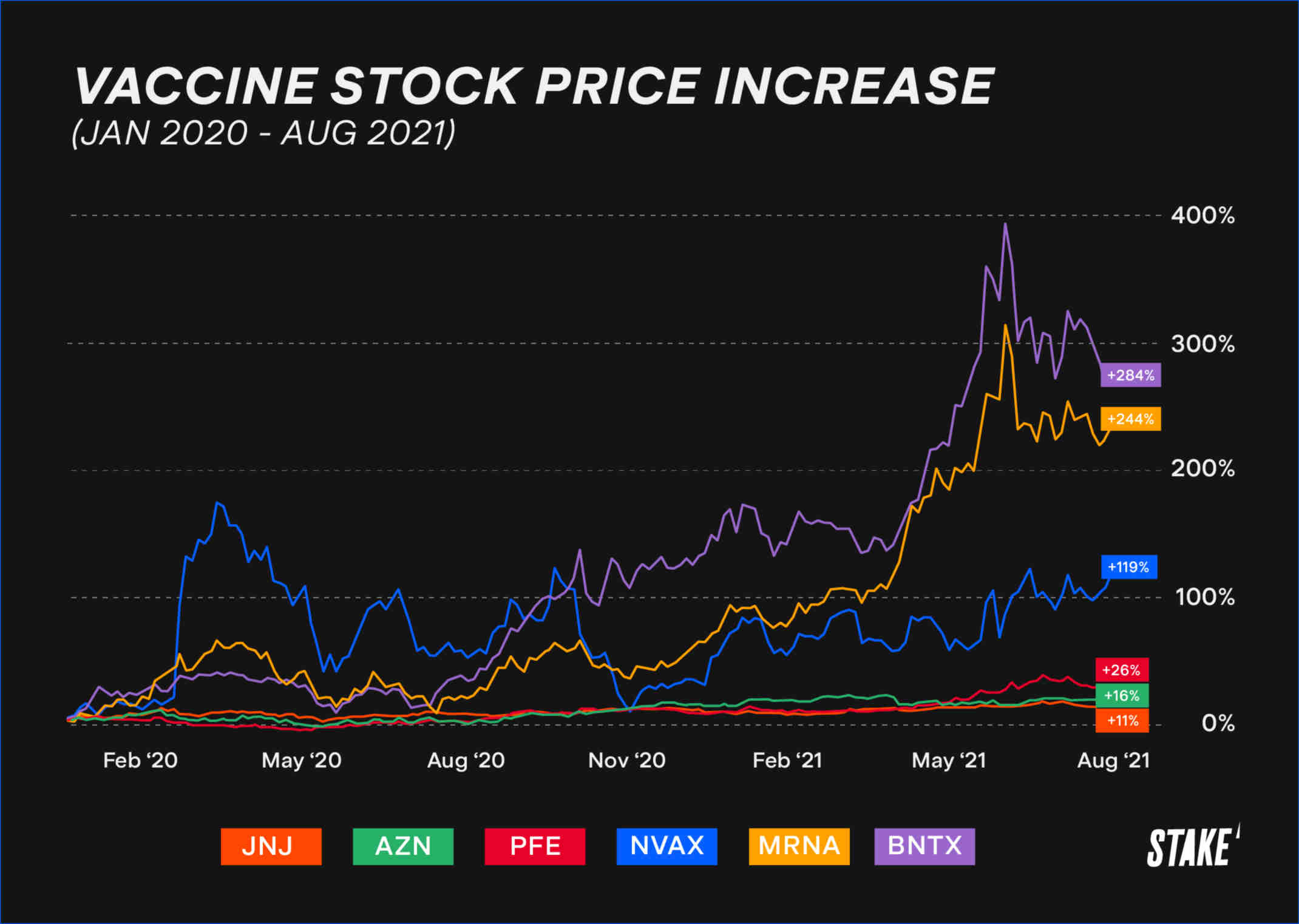

In terms of price action, German company BioNTech SE (BNTX) has soared after partnering with Pfizer to develop a much lauded RNA vaccine.

Since the start of the pandemic, BNTX’s stock price is up 284%, trading more than $16m on the Stake platform, $9m of which was in the past three months.

“The interest in these stocks shows that investors are looking beyond their backyard when it comes to diversifying their portfolios,” said Matt Leibowitz, Stake CEO and founder.

“Investing is one way in which they can back the scientists working around the world to bring us out of this pandemic.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.