Stairway to US$2100: All that glitters really is gold

Via Getty

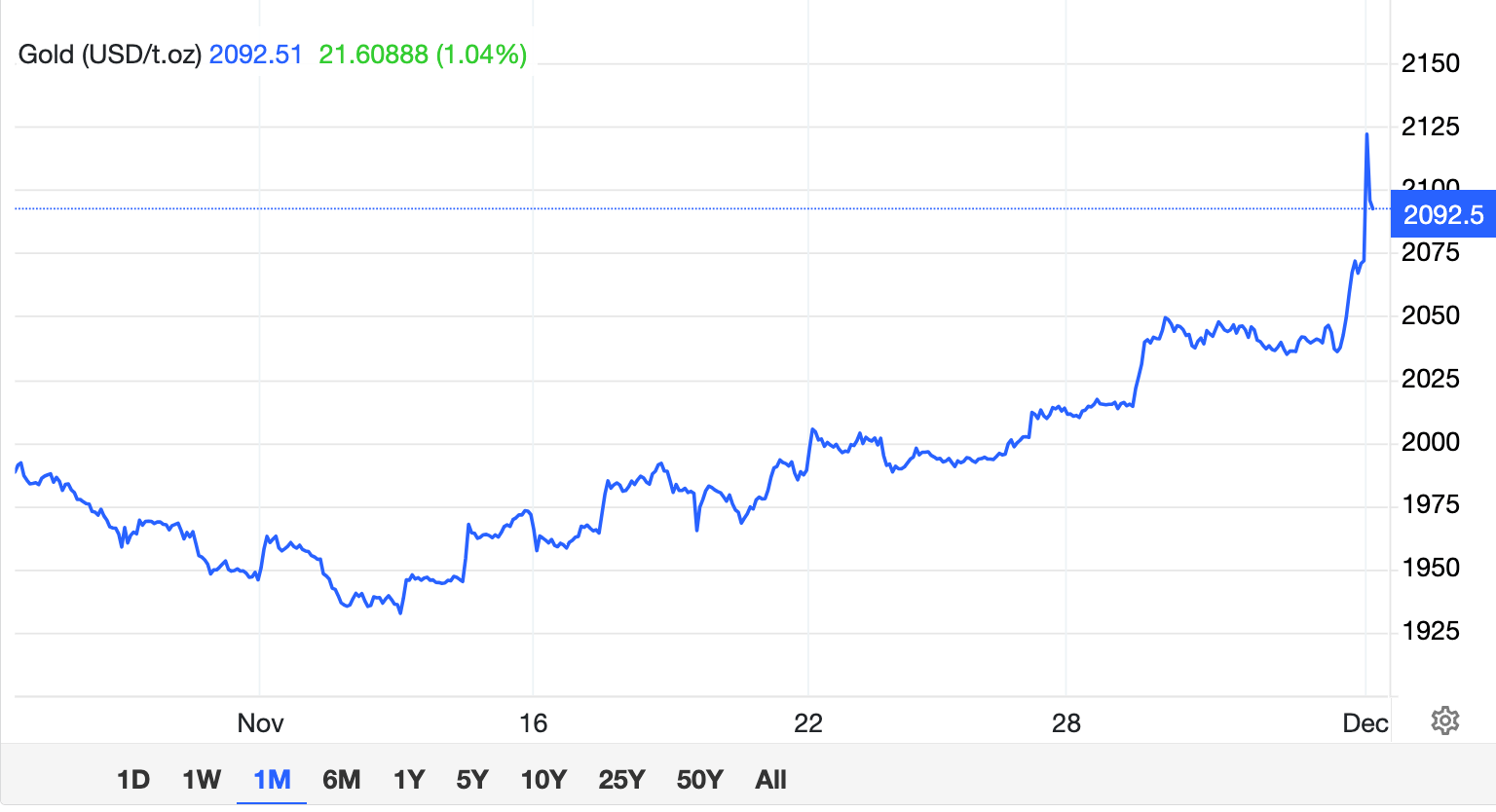

The yellow metal is casually crash-tackling new and scary record highs for a second straight session.

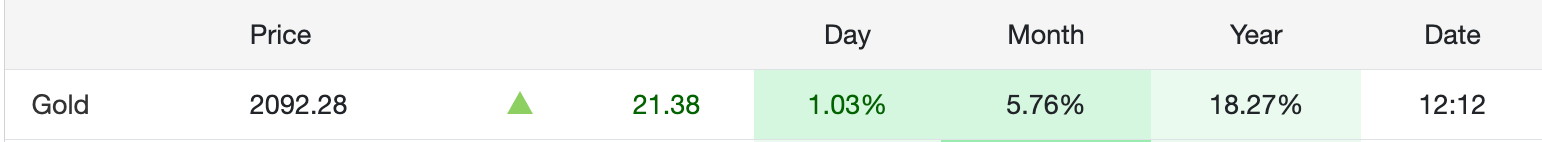

Spot gold prices rose to US$2,092.28 per ounce on Monday at lunch, after hitting $2,075.09 on Friday to smash the precious metal’s record intraday high of US$2,072.5 on Aug. 7, 2020.

It’s already proving a fine day for local goldies, after a rather terrific week.

#ASX #SmallCaps and #IPO Weekly Wrap: With two companies cracking double centuries and #gold above US$2,000 per ounce, someone somewhere must have had a fantastic week, surely. https://t.co/znWuF9SSWB

— Stockhead (@StockheadAU) December 3, 2023

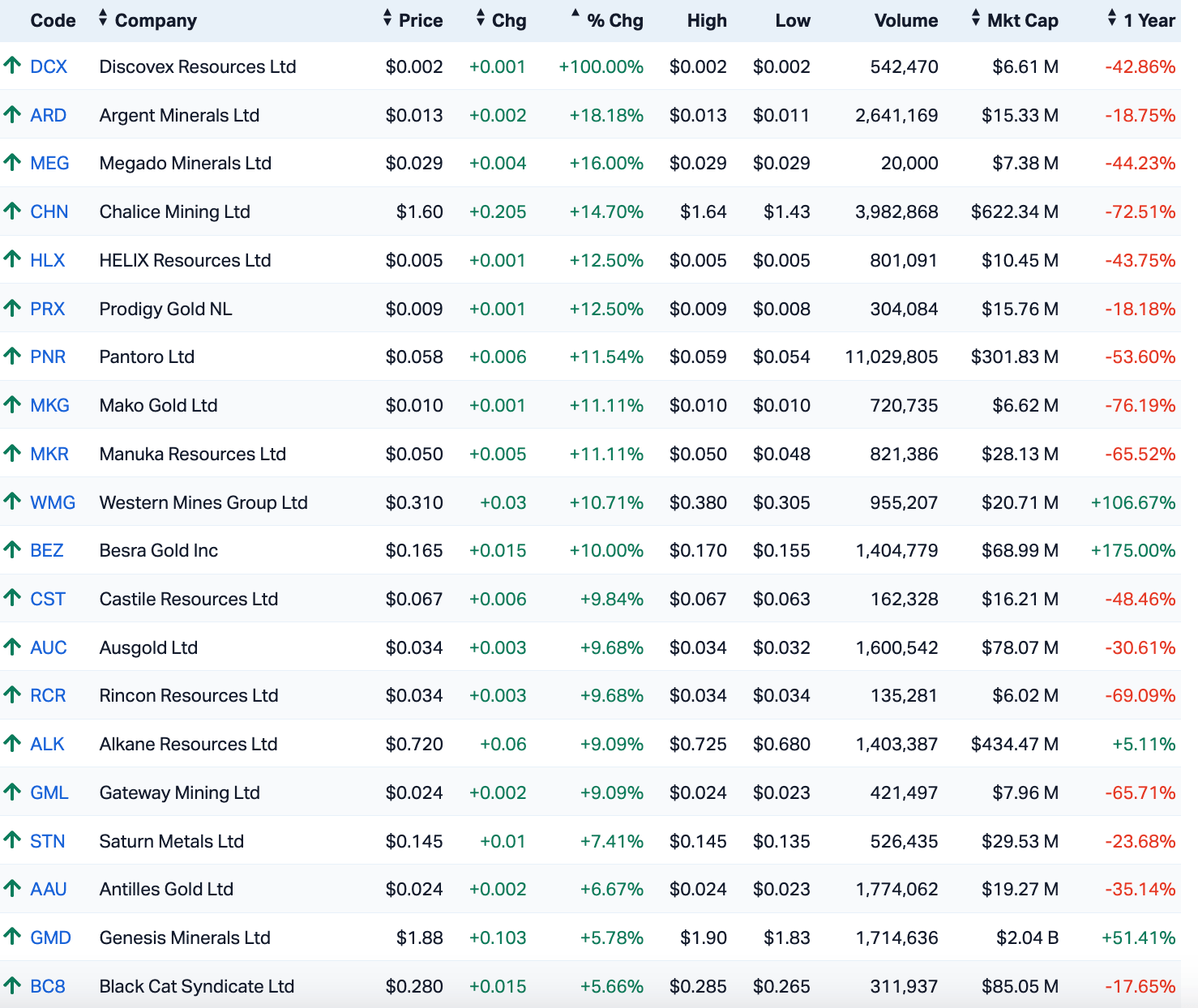

Here’s the Monday morning ASX Gold League Table and there’s been some fine performances so far.

The miners continue to make strong gains in early trade, led by Evolution Mining (ASX:EVN), Northern Star Resources (ASX:NST), Newmont Corporation (ASX:NEM), and Gold Road Resources (ASX:GOR).

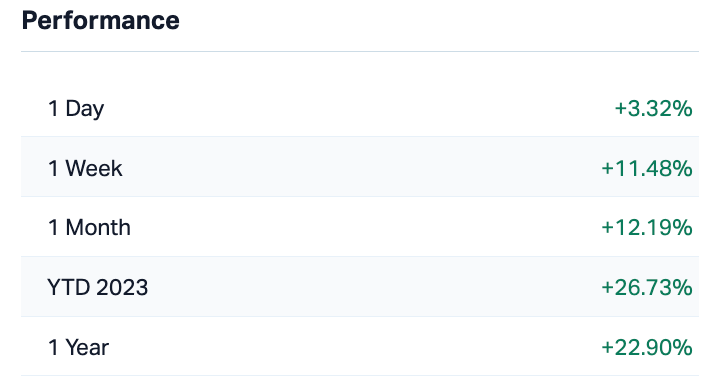

Which means the benchmark for Australian gold companies, the S&P/ASX All Ordinaries Gold (XGD) index has been having a field week:

According to Market Matters’ James Gerrish, gold prices are on course to hit fresh highs next year and are expected to remain above US$2,000 levels, as a sticky cake of war, geopolitics, a feeble US dollar, ongoing rates uncertainty, weaker bond yields and likely rate cuts do their work.

“As we’ve said previously, we believe it’s a matter of when, not if, gold breaks above US$ 2,100, and after the latest advance, that will likely be in the coming weeks,” Gerrish said.

“We continue to target a break-out in gold to new highs, a few more dollars, and it will be the fourth time lucky!”

Gold tends to perform well during periods of economic and geopolitical uncertainty due to its status as a reliable store of value. Prices of the yellow metal have risen for two straight months, the trajectory kicked higher ever since Hamas burst onto Israeli territory with the achieved goal of setting the Middle East back into the tinder box of conflict.

The effect has been to fire-charge safehaven demand, while a doubling-down of expectations of imminent interest rate cuts have provided further ballast.

“We believe the main factors buoying gold in 2024 will be interest rate cuts by the US Fed, a weaker U.S. dollar and high levels of geopolitical tension,” BMI recently said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.