Spending in China’s ‘small’ cities will triple to $6.9 trillion; here’s who’ll benefit

A table full of 100-yuan banknotes given away in a tourist promotion in Hangzhou, China, in 2017. Pic: Getty

China’s “smaller cities” are becoming bigger, richer, and more eager to spend — which is good news for ASX-listed China-focused exporters.

Private consumption in China’s smaller cities “could be on track to triple between 2017 and 2030”, investment bank Morgan Stanley predicts in research released yesterday.

The ASX’s 55 or so (non-resources) China-focused exporters have performed strongly over the past year.

Measured over 12 months, more than half of the stocks show gains — some very significant.

Dairy or infant formula exporters such as Jatenergy, Bubs, Bioxyne, Wattle Health, Bellamy’s and A2 Milk have all made gains of more than 200 per cent.

>> Scroll down to see which ASX-listed China exporters are performing well

That kind of performace looks set to continue, Morgan Stanley says.

“This increased consumption potential could mean bright prospects for a range of consumer-focused industries with implications for the overall Chinese economy and global investors.

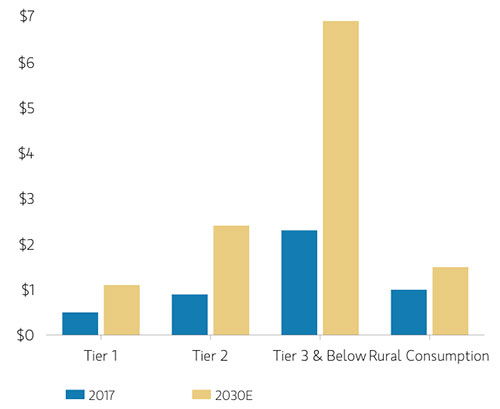

“We expect consumption in lower-tier cities to surge from $US2.3 trillion in 2017 to $US6.9 trillion in 2030,” said Morgan Stanley’s Chief China Economist Robin Xing.

Small cities drive China’s overall consumption

“These smaller cities could be the engine driving China’s overall private consumption market of $US11.8 trillion over the same period,” Mr Xing said.

Morgan highlights five key regions: Jing-Jin-Ji, Yangtze River Delta, Guangdong Bay Area, Mid-Yangtze River and Chengdu-Chongqing.

These so-called “small regional” areas have enormous populations by Australian standards.

The Jing-Jin-Ji area in north-eastern China, for example, houses more than 100 million people. The Yangtze River Delta area on the eastern coast has more than 150 million redidents.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

There are in fact more than 100 cities in China with a population of one million or more.

These smaller cities are set to contribute more than three-quarters of China’s urban population growth by 2030 due to improved transport including high-speed rail, regional development, lower living costs and a more flexible “Hukou” policy.

China is reforming its Hukou system which designated a resident’s status as rural or urban based on their registered birthplace — restricting migrant workers from public services in cities.

Which products and services will benefit?

Residents in smaller cities are increasingly valuing quality over price — which explains why expensive Australian infant formula flies out the door.

Retail segments set to benefit include home appliances, express delivery, online shopping, groceries, food and beverage milk products, movies, gambling and online entertainment.

“Consumers in the five city clusters [named above] also have a higher intention than the national average to spend on airlines and travel, property investment and education, home decoration, and electronics.

“In addition, lower-tier city households are spending more for high-frequency, low-ticket products such as beauty supplies, makeup, snacks, beverages and online groceries.

Online shopping — especially via mobile devices — was preferred.

Here is a list of ASX stocks that sell into China:

| ASX Code | Company | One-year price change | Price May 30 (intraday) | Market Cap |

|---|---|---|---|---|

| JAT | JATENERGY | 9.35714285714 | 0.145 | 76.55M |

| BUB | BUBS AUSTRALIA | 4.59259259259 | 0.755 | 286.40M |

| WHA | WATTLE HEALTH AU | 3.18639053254 | 1.415 | 225.64M |

| BXN | BIOXYNE | 3.125 | 0.066 | 44.81M |

| BAL | BELLAMY'S | 2.28678206137 | 16.71 | 1.79B |

| AU8 | AUMAKE | 2.25 | 0.26 | 73.00M |

| A2M | A2 MILK | 2.12578616352 | 9.94 | 7.02B |

| CLV | CLOVER CORP | 1.90217391304 | 1.335 | 209.78M |

| SM1 | SYNLAIT MILK | 1.6171875 | 10.05 | 1.74B |

| S66 | STAR COMBO (*listed May 2018) | 1.51 | 1.255 | 77.02M |

| GRB | GAGE ROADS BREWING | 1.45714285714 | 0.086 | 75.72M |

| NNW | 99 WUXIAN | 1.32558139535 | 0.2 | 278.32M |

| LON | LONGTABLE GROUP | 1.24285714286 | 0.785 | 74.70M |

| PPS | PRAEMIUM | 0.868421052632 | 0.71 | 282.23M |

| PHK | PHOSLOCK WATER | 0.823529411765 | 0.31 | 154.18M |

| AHF | AUSTRALIA DAIRY | 0.590909090909 | 0.175 | 44.92M |

| MHD | MILLENNIUM | 0.4375 | 0.046 | 6.35M |

| AB1 | ANIMOCA BRANDS | 0.407407407407 | 0.038 | 18.56M |

| FOD | FOOD REVOLUTION | 0.375 | 0.055 | 23.87M |

| CSS | CLEAN SEAS SEAFOOD | 0.368421052632 | 0.052 | 90.03M |

| WNR | WINGARA | 0.277777777778 | 0.345 | 33.39M |

| NAM | NAMOI COTTON | 0.25 | 0.5 | 66.49M |

| AVG | AUSTRALIAN VINTAGE | 0.234693877551 | 0.605 | 168.79M |

| SFG | SEAFARMS GROUP | 0.208955223881 | 0.081 | 110.53M |

| AWY | AUSTRALIAN WHISKEY | 0.2 | 0.036 | 24.00M |

| CZZ | CAPILANO HONEY | 0.142167011732 | 16.55 | 156.52M |

| D2O | DUXTON WATER | 0.0761904761905 | 1.13 | 87.54M |

| MCA | MURRAY COD AUSTRALIA | 0.0350877192982 | 0.059 | 23.56M |

| BAH | BOJUN AGRICULTURE (*listed Dec 2017) | 0 | 0.3 | 36.45M |

| SBB | SUNBRIDGE GROUP | 0 | 0.012 | 5.66M |

| FFI | FFI HOLDINGS | 0 | 4 | 42.84M |

| HUO | HUON AQUACULTURE | -0.064 | 4.68 | 401.75M |

| BFC | BESTON GLOBAL | -0.0731707317073 | 0.19 | 84.23M |

| MTM | MARETERRAM | -0.0862068965517 | 0.265 | 41.72M |

| RGP | REFRESH GROUP | -0.0909090909091 | 0.05 | 6.67M |

| BUG | BUDERIM GROUP | -0.101449275362 | 0.31 | 27.53M |

| EHH | EAGLE HEALTH (*listed Jun 2017) | -0.1625 | 0.335 | 105.08M |

| AAP | AUSTRALIAN AGRI | -0.189189189189 | 0.03 | 4.57M |

| MRG | MURRAY RIVER | -0.197368421053 | 0.305 | 39.55M |

| TFL | TASFOODS | -0.275 | 0.145 | 32.02M |

| JJF | JIAJIAFU MODERN | -0.285714285714 | 0.1 | 8.52M |

| FRM | FARM PRIDE | -0.290983606557 | 0.865 | 47.73M |

| AS1 | ANGEL SEAFOOD (*listed Feb 2018) | -0.3 | 0.14 | 16.95M |

| HCT | HOLISTA COLLTECH | -0.308333333333 | 0.083 | 15.81M |

| ABT | ABUNDANT PRODUCE | -0.329787234043 | 0.315 | 18.12M |

| OGA | OCEAN GROWN ABALONE (*listed Nov 2017) | -0.34 | 0.165 | 29.60M |

| WLD | WELLARD | -0.394736842105 | 0.115 | 63.75M |

| BEE | BROO | -0.566037735849 | 0.115 | 79.07M |

| OBJ | OBJ | -0.584905660377 | 0.022 | 39.81M |

| FLC | FLUENCE CORP | -0.586021505376 | 0.385 | 168.18M |

| DEM | DE.MEM | -0.611111111111 | 0.14 | 17.23M |

| SKN | SKIN ELEMENTS | -0.6125 | 0.062 | 4.82M |

| DW8 | DAWINE | -0.647058823529 | 0.006 | 3.51M |

| MGC | MG UNIT TRUST | -0.755555555556 | 0.22 | 125.96M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.