Small Cap Lunch Wrap: Grab a spoon. Plenti to share ‘cos its All You Can Eat Tuesday on the ASX

News

News

Patience, penance and a little bit of greed is the Tuesday theme on local markets, as Monday’s lacklustre effort on a traders’ paradise of a wicket has ushered in a Day 2 run fest.

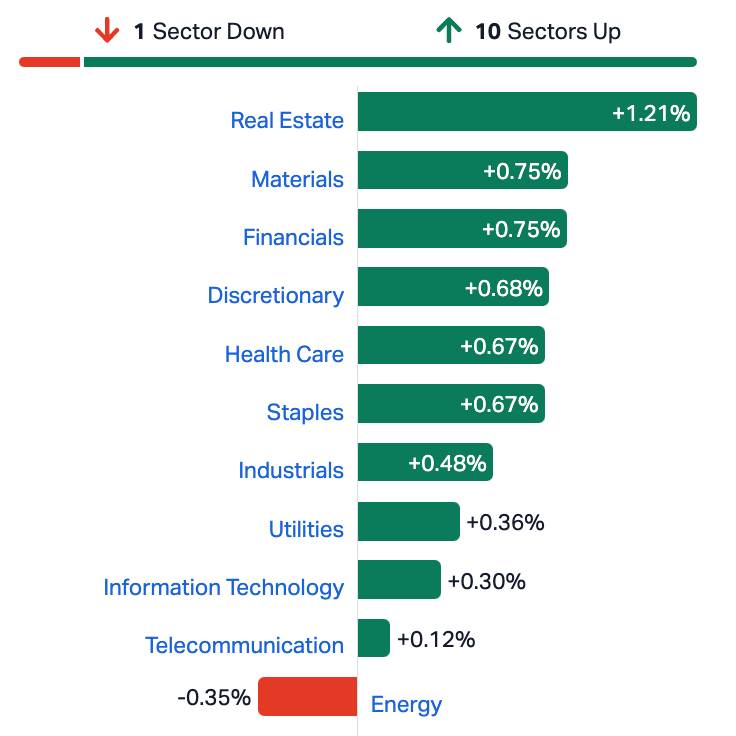

The ASX200 is hitting them to all corners of the bourse and all 11 Sectors (no make that 10, now) are making up for Monday’s session of lost opportunities.

At midday on Tuesday Nov 28, the S&P/ASX 200 index was ahead by 46 points or +0.66% to 7033.

It’s a rare sight to clock the benchmark looking so green and vibrant, especially after Wall Street looked so uninspired overnight as all three major US indices ended across the border in red town, the Nasdaq getting closest to parity at -0.06%.

At home, some guilty-lookin’ large caps wot dragged the index lower on Monday have come out swinging.

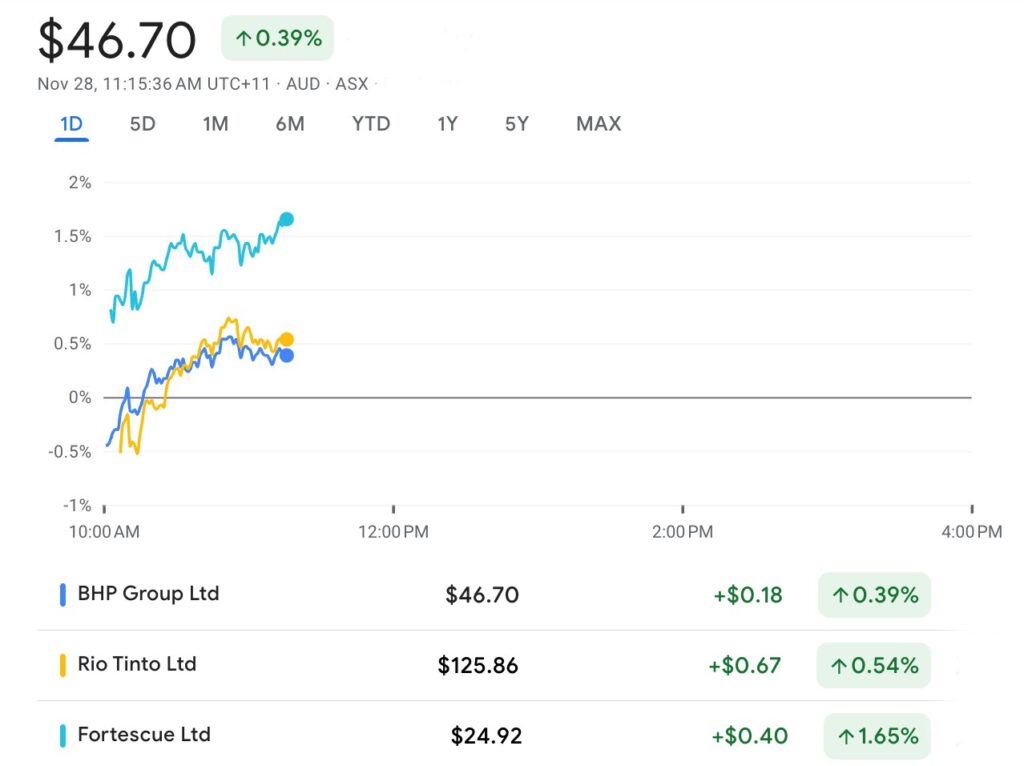

The major iron ore triumvirate, for example, look like easy money after yesterday’s giveaway:

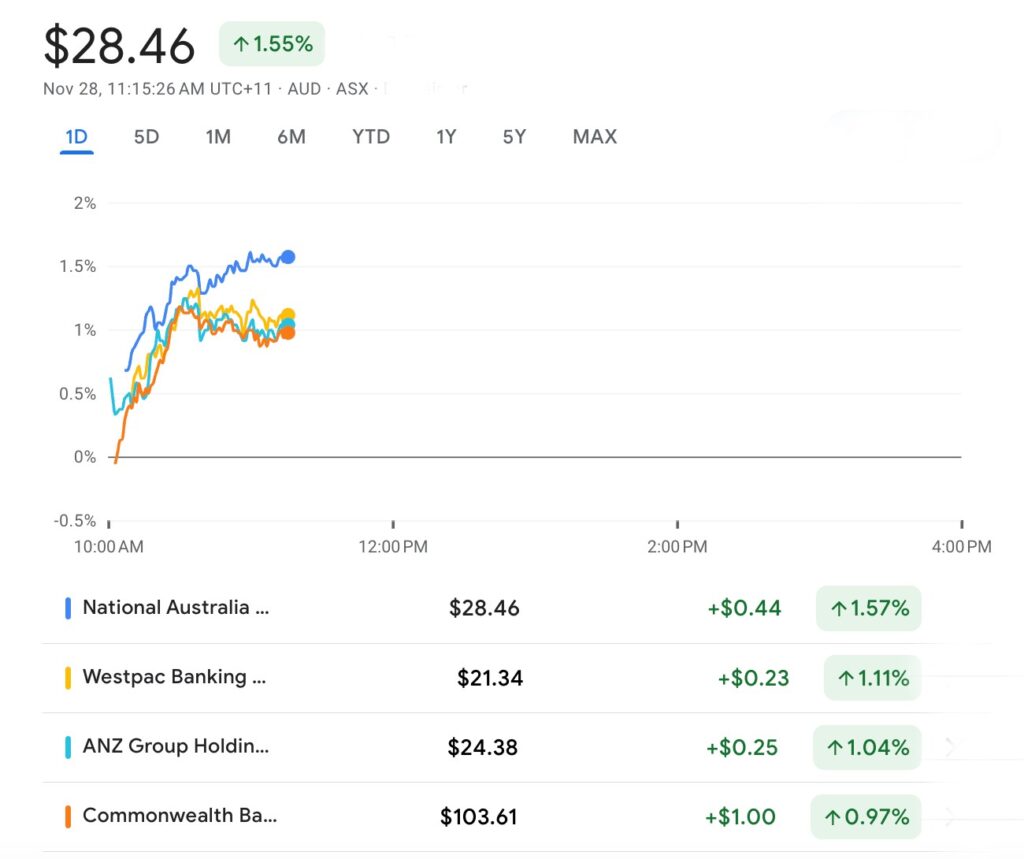

The big Aussie banks are also getting bigger.

The market’s gone nuts for Plenti Group (ASX:PLT), after the fintech revealed a genuine money-related deal with NAB (more of that below). While the other three also have some ground to make up following Monday’s retreat to nowhere, pretty much offering traders a free shot, which they’re not missing, it seems:

However, the standout performer is the ASX Real Estate Sector.

Lendlease Group (ASX:LLC) is up +3.39%, Cromwell Property Group (ASX:CRW) and Unibail-Rodamco-Westfield (ASX:URW) have added +2.50%, while Scentre Group (ASX:SCG) and National Storage REIT (ASX:NSR) are both ahead +2.2%

Meanwhile, just ahead of lunch, the bureau of numbers has retail turnover falling for October.

Sales were down by -0.2% from September, missing consensus estimates for a 0.1% monthly rise and going some way to appeasing hawk-eyed watchers from the central bank.

Retail sales rose 1.2% compared to October 2022.

A flat-footed Wall Street ended in the red on Monday as US investors reluctantly returned to the grind having distributed all the thanks they could over the holiday.

What awaits them are a few truth bombs, which might displace the serenity which has overcome both uncertainty and anxiety of late.

This week sees the US Fed’s preferred inflation measurement – the Personal consumption expenditures (PCE), drop on Wednesday – and while CME’s FedWatch tool says the chances of another pause already looks as much a reality as is mathematically possible (it’s at 99.4%), an unwelcome PCE could upturn the apple cart, literally.

On that note, losses on Wall St mirrored the mess we left the ASX in on Monday – with Energy, Materials and the Healthcare Sectors among the worst performers, although in the US, the retail stocks outperformed… whereas here no-one did.

And speaking of dissapointment – the Energy Sector has tarnished the Tuesday visuals – the only sector lower at lunch.

Takeover target Origin Energy (ASX:ORG) can cop some of the blame (although I believe it’s technically a utility play).

It’s falling again on both LNG export delays at Curtis Island, almost a welcome distraction to the voluble fury out of major shareholder AustraliaSuper demanding ORG walk away from unwelcome negotiations with US giant Brookfield, with more shareholders adding their weight to nix the $20bn bid.

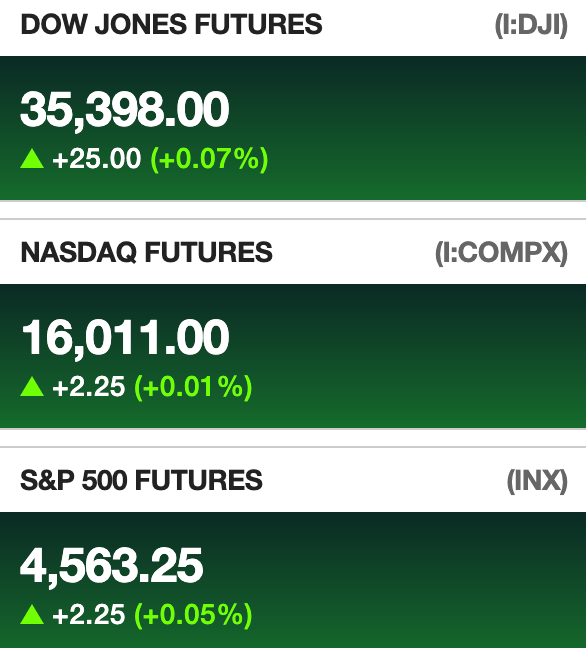

Wall Street closed out a sullen session in the red.

The Dow Jones lost more than 55 points and the S&P 500 back-peddled -0.2%.

The tech heavy Nasdaq also ended slightly in the red, despite mega-tech movement for the likes of Messrs Nvidia (+1.0%), Microsoft (+0.3%) and Amazon (+0.7%) as Cyber Monday sales sent the US into an online shopping frenzy.

This was offset by all the other US retailers not currently a trillion dollar company flagging softer consumer spend, even as analysts called a +7.5% boost in US e-commerce sales for Black Friday vs last Black Friday.

Elsewhere and even though earnings season is officially over in New York, HP, Salesforce, and Dell are ALL expected to report earnings during the week ahead.

All 3 Futures tied to the major indices were just above water ahead of the open in New York:

Here are the best performing ASX small cap stocks for 28 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap PLT Plenti Group Limited 0.62 82% 896,293 $58,534,455 ICR Intelicare Holdings 0.023 53% 2,386,597 $3,133,731 BP8 BPH Global Ltd 0.0015 50% 1,985,393 $1,615,563 CLE Cyclone Metals 0.0015 50% 43,057,286 $10,264,505 VPR Volt Power Group 0.0015 50% 1,578,027 $10,716,208 NAM Namoi Cotton Ltd 0.48 35% 487,375 $72,810,627 CTN Catalina Resources 0.004 33% 2,500,000 $3,715,461 OAR OAR Resources Ltd 0.004 33% 126,250 $7,879,948 TMB Tambourah Metals 0.175 30% 141,999 $11,196,948 HRZ Horizon 0.0435 28% 1,890,280 $23,833,445 AX8 Accelerate Resources 0.052 27% 19,319,920 $19,352,090 ACP Audalia Res Ltd 0.015 25% 666,779 $8,305,634 ME1 Melodiol Global Health 0.0025 25% 7,939,282 $8,436,084 VKA Viking Mines Ltd 0.016 23% 10,959,345 $13,328,360 ARD Argent Minerals 0.011 22% 437,317 $10,610,831 BNR Bulletin Res Ltd 0.195 22% 3,522,277 $46,974,576 RGL Riversgold 0.017 21% 8,408,770 $13,317,660 TSO Tesoro Gold Ltd 0.023 21% 1,805,701 $21,868,817 IMU Imugene Limited 0.11 21% 55,941,773 $652,012,712 INR Ioneer Ltd 0.18 20% 3,769,601 $316,711,822 LBT LBT Innovations 0.006 20% 2,039,609 $5,779,502 NRX Noronex Limited 0.012 20% 25,046 $3,783,018 PKO Peako Limited 0.006 20% 90,000 $2,635,424 YOJ Yojee Limited 0.006 20% 720,978 $6,529,926 AL8 Alderan Resource Ltd 0.007 17% 3,550,582 $6,641,168

Plenti Group (ASX:PLT) looks plenty good on this nondescript lookin’ Tuesday.

The non-bank lender has dropped some decent results for the first half of its 2024 (six months to September 30), but it’s entirely possible investors have come for the PLT’s results, but stayed for its shiny new partnership with National Australia Bank, one which actually involves money and integration into the bank’s embrace.

PLT says the tie-in is all about “initially launching a ‘NAB powered by Plenti’ car and electric vehicle (EV) loan and then making Plenti renewable energy finance available to NAB customers.”

There’s also an equity investment deal – allowing NAB to ‘acquire up to 15% of Plenti’s share capital’ through placements and market purchases and such.

That, in fintech parlance, is commitment.

Meanwhile, the books look strong for Plenti. Its closing loan portfolio for the first half was at $2bn – up +29% on the pcp, the key measurement for these chaps – and loan originations amounted to $624mn, a +12% improvement on the same time last year.

Plenti’s CEO and founder Daniel Foggo was probably more chuffed than he lets on here:

“We’ve had a productive first half, building on the great momentum in our business, and further demonstrating the benefits of our strengths across our technology, our credit capabilities, the ever-increasing diversity of our activities and our team.”

Half-year revenue was $97 million, up 52% on pcp. Cash NPAT was $1.5 million, up 10% on pcp. The company had a strong credit performance in the half, with a 0.99% net loss rate.

Shot from a cannon out of last night’s trading halt is Equinox Resources (ASX:EQN) up 36% and moving across lunchtime at velocity.

EQN says it’s gone and put its hand up for what certainly looks like a “highly prospective rare earths tenements in Brazil.”

It’s no wee patch of land this one – the company says it’s submitted strategic pegging applications for a ~1,760km2 Mining Rights package to establish a newly defined “Campo Grande” Project, in the emerging rare earths province in Bahia state, nearby the Rocha da Rocha Rare Earths Project held by Brazilian Rare Earths Ltd.

That spot reportedly hosts a ginormous JORC Resource Estimate of 510.3Mt at 1,513ppm Total Rare Earth Oxide (TREO).

The timing works too, as Brazilian Rare Earths (BRE) is currently undertaking a $50mn Initial Public Offer (IPO) on the ASX with an expected market capitalisation of approximately $315m.

Equinox says it considers the Campo Grande Project as ‘a major strategic development in Equinox’s growth as a diversified global resources company.’

Such a project would look very nice next to EQN’s advanced iron ore asset in WA and its lithium assets in Canada.

Up around +60%,InteliCare (ASX:ICR)has jumped, after revealing its non-binding Memorandum of Understanding (MoU) with Bolton Clarke, which it says is a precursor to a Strategic Partnership Agreement.

ICR is a medtech of sorts, with a fair bit of SaaS and other stuff thrown in. It’s been developing predictive analytics hardware and software for use in the aged care sector.

In this case its MOU partner also happens to be Australia’s largest independent not-for-profit aged care provider, with ICR saying its platform will find a home somewhere across Bolton Clarke’s various sites and services.

What amounts to a pilot project will assess how ICR gels within the Bolton Clarke operating environment and help ICR assess and identify areas of possible enhancement.

Here are the most-worst performing ASX small cap stocks for 28 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap PLT Plenti Group Limited 0.62 82% 896,293 $58,534,455 ICR Intelicare Holdings 0.023 53% 2,386,597 $3,133,731 BP8 BPH Global Ltd 0.0015 50% 1,985,393 $1,615,563 CLE Cyclone Metals 0.0015 50% 43,057,286 $10,264,505 VPR Volt Power Group 0.0015 50% 1,578,027 $10,716,208 NAM Namoi Cotton Ltd 0.48 35% 487,375 $72,810,627 CTN Catalina Resources 0.004 33% 2,500,000 $3,715,461 OAR OAR Resources Ltd 0.004 33% 126,250 $7,879,948 TMB Tambourah Metals 0.175 30% 141,999 $11,196,948 HRZ Horizon 0.0435 28% 1,890,280 $23,833,445 AX8 Accelerate Resources 0.052 27% 19,319,920 $19,352,090 ACP Audalia Res Ltd 0.015 25% 666,779 $8,305,634 ME1 Melodiol Global Health 0.0025 25% 7,939,282 $8,436,084 VKA Viking Mines Ltd 0.016 23% 10,959,345 $13,328,360 ARD Argent Minerals 0.011 22% 437,317 $10,610,831 BNR Bulletin Res Ltd 0.195 22% 3,522,277 $46,974,576 RGL Riversgold 0.017 21% 8,408,770 $13,317,660 TSO Tesoro Gold Ltd 0.023 21% 1,805,701 $21,868,817 IMU Imugene Limited 0.11 21% 55,941,773 $652,012,712 INR Ioneer Ltd 0.18 20% 3,769,601 $316,711,822 LBT LBT Innovations 0.006 20% 2,039,609 $5,779,502 NRX Noronex Limited 0.012 20% 25,046 $3,783,018 PKO Peako Limited 0.006 20% 90,000 $2,635,424 YOJ Yojee Limited 0.006 20% 720,978 $6,529,926 AL8 Alderan Resource Ltd 0.007 17% 3,550,582 $6,641,168