Short & Caught: Bets remain against travel sector

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

- Travel sector the most shorted

- Punts bet agains sports betting sector

- Healthcare not so healthy with short sellers

In Short & Caught, Stockhead recaps the ASX stocks that are the most shorted and have had the greatest increase in short interest right now.

How does shorting work?

Shorting works by selling stocks you do not actually own in the hope of buying them back at a lower price. Investors are in effect betting they will fall.

Because shorting is restricted under Australian law, any substantial shorting of stocks is worth knowing about, even if you only trade long.

Stockhead has utilised the number of short positions as a percentage of total shares on issue. The most shorted ASX stocks all have 5.5 per cent or more.

Here are the top 30 most shorted ASX stocks

| Code | Company | Short positions | Shares on issue | % short positions |

|---|---|---|---|---|

| FLT | FLIGHT CENTRE TRAVEL ORDINARY | 35,739,707 | 199,747,439 | 17.9% |

| BET | BETMAKERS TECH GROUP ORDINARY | 113,235,404 | 903,460,347 | 12.5% |

| NAN | NANOSONICS LIMITED ORDINARY | 36,136,801 | 301,833,182 | 12.0% |

| WEB | WEBJET LIMITED ORDINARY | 38,584,423 | 380,509,819 | 10.1% |

| EML | EML PAYMENTS LTD ORDINARY | 35,619,292 | 373,460,316 | 9.5% |

| PNV | POLYNOVO LIMITED ORDINARY | 57,796,782 | 661,688,044 | 8.7% |

| KGN | KOGAN.COM LTD ORDINARY | 9,329,483 | 106,926,718 | 8.7% |

| Z1P | ZIP CO LTD. ORDINARY | 57,638,473 | 669,055,804 | 8.6% |

| AMA | AMA GROUP LIMITED ORDINARY | 84,979,297 | 1,022,435,377 | 8.3% |

| MSB | MESOBLAST LIMITED ORDINARY | 51,504,050 | 650,454,551 | 7.9% |

| OBL | OMNI BRIDGEWAY LTD ORD US PROHIBITED | 21,143,023 | 268,639,670 | 7.9% |

| RRL | REGIS RESOURCES ORDINARY | 54,938,763 | 754,776,298 | 7.3% |

| APX | APPEN LIMITED ORDINARY | 8,873,199 | 123,383,996 | 7.2% |

| PDN | PALADIN ENERGY LTD ORDINARY | 191,009,636 | 2,679,167,890 | 7.1% |

| TYR | TYRO PAYMENTS ORDINARY | 36,471,991 | 516,771,154 | 7.1% |

| PBH | POINTSBET HOLDINGS ORDINARY | 18,047,456 | 264,868,212 | 6.8% |

| ING | INGHAMS GROUP ORDINARY | 23,686,139 | 371,679,601 | 6.4% |

| TPW | TEMPLE & WEBSTER LTD ORDINARY | 7,600,612 | 120,452,928 | 6.3% |

| CUV | CLINUVEL PHARMACEUTICALS | 3,085,668 | 49,410,338 | 6.2% |

| IEL | IDP EDUCATION LTD ORDINARY | 16,442,609 | 278,336,211 | 5.9% |

| NEA | NEARMAP LTD ORDINARY | 27,938,037 | 498,956,560 | 5.6% |

| MFG | MAGELLAN FIN GRP LTD ORDINARY | 9,326,363 | 185,713,004 | 5.0% |

| NHC | NEW HOPE CORPORATION ORDINARY | 41,775,768 | 832,357,082 | 5.0% |

| CCX | CITY CHIC COLLECTIVE ORDINARY | 11,564,056 | 231,920,086 | 5.0% |

| MP1 | MEGAPORT LIMITED ORDINARY | 7,828,434 | 157,949,016 | 5.0% |

| BRG | BREVILLE GROUP LTD ORDINARY | 6,809,411 | 139,359,544 | 4.9% |

| ADH | ADAIRS LIMITED ORDINARY | 8,327,012 | 170,889,856 | 4.9% |

| PME | PRO MEDICUS LIMITED ORDINARY | 4,977,544 | 104,372,753 | 4.8% |

| RBL | REDBUBBLE LIMITED ORDINARY | 13,111,572 | 275,920,223 | 4.8% |

Punters bet against travel sector

The travel sector is the most shorted, while Flight Centre (ASX:FLT) remains the most shorted stock. Hard hit from the Covid-19 pandemic Flight Centre and the travel sector has been recovering as Australia’s borders started to re-open both domestically and internationally. But short sellers seem to think the market is being too optimistic on the travel industry recovery.

Short positions in Flight Centre is 17.9%, despite its share price increasing ~4.92% in the past month to be trading at $19.43.

Punters bet against sports betting sector

Short sellers were betting losses for the sports betting sector which came in as the second most shorted. Betmakers (ASX:BET) was the second most shorted stock with a short position of 12.5%.

Betmakers, which operates a platform model providing the back-end technology for bookmakers primarily in horse racing, has seen its share price has fallen ~51% in the past year to 56 cents.

Pointsbet (ASX:PBH) has been making ground in the US. The company took its first sports book bet in Pennsylvania in February, following authorisation by the state’s gaming body for a soft launch.

Philadelphia represents the company’s 10th online sportsbook operation in the US, following successful launches in New Jersey, Iowa, Indiana, Illinois, Colorado, Michigan, West Virginia, Virginia, and New York.

However, its share price has fallen ~76% in the past year to $3.16.

Healthcare not so healthy

The healthcare sector has been diagnosed as not too well among short sellers. With inflation rising and continued volatility on global markets the healthcare sector has been out of favour of late with investors looking towards more value sectors.

The S&P/ASX 200 index has fallen ~10% in the past year. Nanosonics (ASX:NAN), which has developed and commercialised the trophon EPR device, an automated disinfectant technology for ultrasound probes, saw ~12% of its stock shorted. The company has seen pressure on its stock after it making changes to its US sales model.

Among other health stocks targeted by shorter sellers was Clinuvel (ASX:CUV), despite it releasing positive preliminary results from its pilot study in arterial ischaemic stroke (AIS).

Both companies have seen their share prices fall in the past year with Nanosonics down ~35.% to $3.86 and Clinuvel even further at ~42% to $17.22.

Payments, e-commerce, gold stocks among others shorted

Short sellers have also taken aim at payments, e-commerce, gold, automotive, uranium and tech stocks. EML Payments (ASX:EML) saw ~9.5% of its stock shorted, while Zip Co (ASX:ZIP) ~8.7%.

Crash repair company and auto parts provider AMA Group (ASX:AMA) has 8.3% of its shares held in a short position, while uranium explorer and miner Paladin Energy (ASX:PDN) has 7.1%.

The e-commerce stocks Kogan (ASX:KGN), City Chic Collective (ASX: CCX) and RedBubble (ASX:RBL) also attracted the attention of short sellers.

Gold stock Regis Resources (ASX:RRL) which has seen its share price drop ~31% in the past year has ~7.3% of its stock in a short position. The company has seen its share price recover slightly of late as gold prices go higher with market volatility.

Linen lovers to linen shorters for Adairs

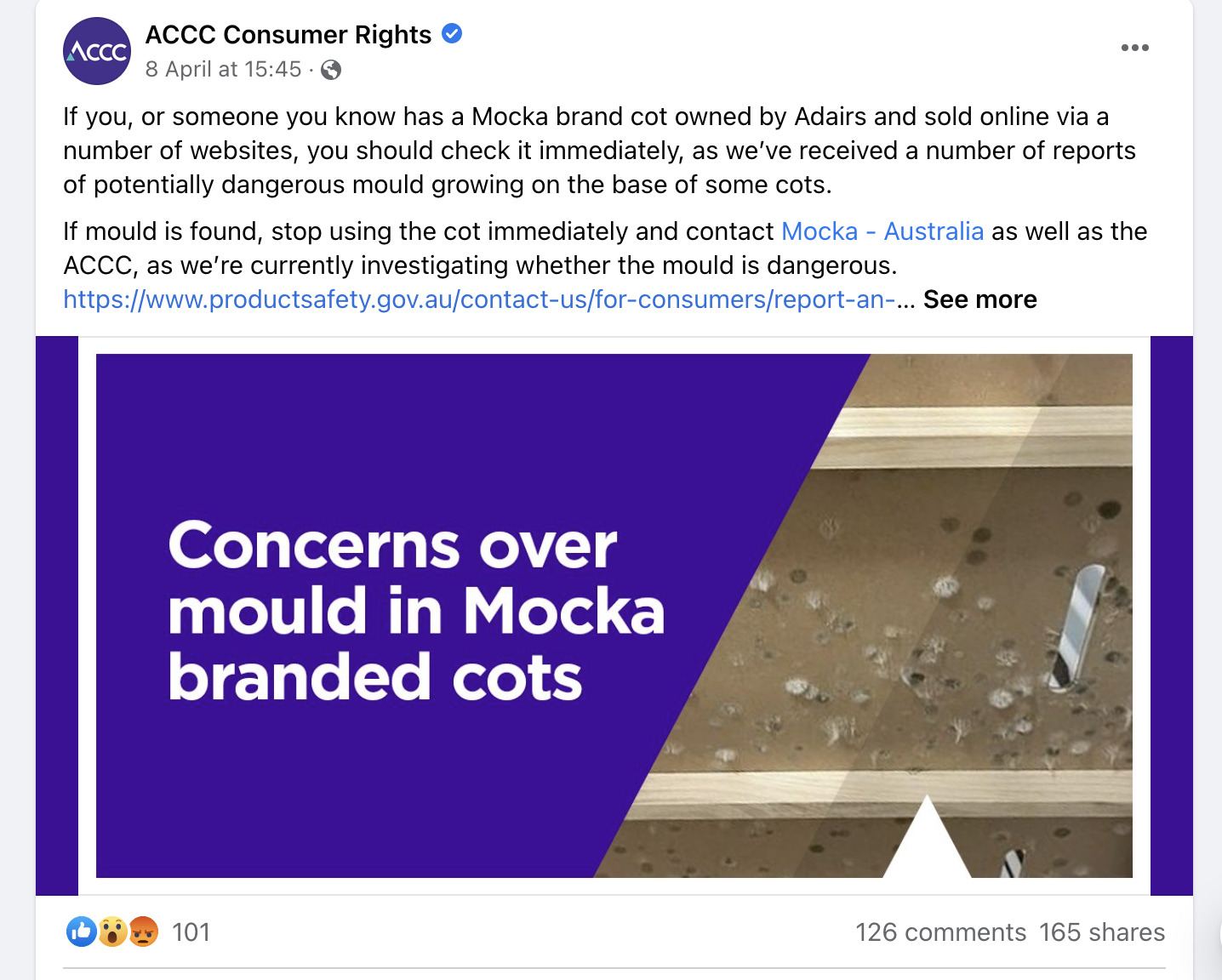

Homewares and linen company Adairs (ASX:ADH) has also seen ~4.9% of its stock shorted. Adairs has made headlines in recent days for the wrong reasons, with owners of Mocka baby cots sold by the company instructed to check immediately for signs of mould.

The ACCC said in a Facebook post it had “received a number of reports of potentially dangerous mould growing on the base of some cots”.

But it hasn’t been all bad news for Adairs. The company has been tipped by analysts to be a winner from Josh Frydenberg’s big spending Federal budget, aimed to alleviate some cost of living pressures.

The Adairs share price has fallen ~24% in the past year but has recovered ground in the past month, up 1.75% to $2.91.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.