Short and Caught: Which uranium play is now the ASX’s most-shorted stock?

Pilbara Minerals has finally lost an unwanted title. Pic: Getty Images

- Did you guess right? Paladin Energy is now the ASX’s most shorted stock with other uranium plays Boss Energy and Deep Yellow also a target

- Katana Asset Management says short sellers have dropped bearish bets on lithium prices

- Mineral Resources the fifth most shorted stock in “year from hell”

Before we delve into the ASX’s most shorted, just a quick reminder right off the bat here about what short selling actually is.

Short sellers effectively borrow a stock from a broker, and go wager it (sell it) on the open market. The plan is to then buy the same stock back later after it’s made a hefty drop in price. That done, the short seller buys it back at the lower price and returns it to the lender.

The difference between the sell price and the buy price is the short seller’s profit. Investors are in effect making a bet that prices of a security will fall.

Because shorting is restricted under Australian law (and because it’s an all or nothing bloodsport) any substantial shorting of stocks is worth knowing about, even if you only trade long.

And perhaps there’s method in the madness.

Stockhead has utilised the number of short positions as a percentage (5% or more) of total shares on issue according to ASIC’s Short Position Report.

With resources stocks dominating the most ASX shorted stocks currently, Stockhead spoke to Katana Asset Management portfolio manager Romano Sala Tenna for his view on what is driving short sellers to the sector.

The most-shorted stocks on the ASX

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Short positions | Shares on issue | % short positions |

|---|---|---|---|---|

| PDN | PALADIN ENERGY LTD ORDINARY | 46,278,240 | 299,113,022 | 15% |

| BOE | BOSS ENERGY LTD ORDINARY | 57,996,557 | 409,688,058 | 14% |

| SYR | SYRAH RESOURCES ORDINARY | 135,063,553 | 1,034,891,766 | 13% |

| IEL | IDP EDUCATION LTD ORDINARY | 35,742,173 | 278,336,211 | 13% |

| MIN | MINERAL RESOURCES. ORDINARY | 23,801,127 | 196,518,604 | 12% |

| PLS | PILBARA MINERALS LTD ORDINARY | 363,246,522 | 3,011,543,934 | 12% |

| DMP | DOMINO PIZZA ENTERPR ORDINARY | 10,010,814 | 92,496,790 | 11% |

| DYL | DEEP YELLOW LIMITED ORDINARY | 102,207,203 | 969,741,926 | 11% |

| LTR | LIONTOWN RESOURCES ORDINARY | 234,444,818 | 2,426,260,974 | 10% |

| LYC | LYNAS RARE EARTHS ORDINARY | 83,756,430 | 934,718,185 | 9% |

| ADT | ADRIATIC METALS CDI 1:1 | 24,899,670 | 278,062,106 | 9% |

| KAR | KAROON ENERGY LTD ORDINARY | 66,045,029 | 776,457,299 | 9% |

| LIC | LIFESTYLE COMMUNIT. ORDINARY | 10,216,334 | 121,740,054 | 8% |

| GMD | GENESIS MINERALS ORDINARY | 86,400,875 | 1,128,548,275 | 8% |

| CTD | CORP TRAVEL LIMITED ORDINARY | 10,927,196 | 146,325,746 | 7% |

| JLG | JOHNS LYNG GROUP ORDINARY | 20,859,812 | 281,403,433 | 7% |

| CTT | CETTIRE ORDINARY | 27,964,554 | 381,238,220 | 7% |

| SEK | SEEK LIMITED ORDINARY | 24,339,733 | 356,820,190 | 7% |

| RIO | RIO TINTO LIMITED ORDINARY | 24,508,403 | 371,216,214 | 7% |

| MP1 | MEGAPORT LIMITED ORDINARY | 10,430,066 | 160,375,680 | 7% |

| CUV | CLINUVEL PHARMACEUT. ORDINARY | 3,249,681 | 50,060,680 | 6% |

| AD8 | AUDINATEGROUPLTD ORDINARY | 5,358,847 | 83,342,014 | 6% |

| STX | STRIKE ENERGY LTD ORDINARY | 181,913,494 | 2,865,373,749 | 6% |

| SLX | SILEX SYSTEMS ORDINARY | 14,730,148 | 237,241,524 | 6% |

| CHN | CHALICE MINING LTD ORDINARY | 24,113,169 | 389,026,788 | 6% |

| IMU | IMUGENE LIMITED ORDINARY | 450,087,005 | 7,438,310,643 | 6% |

| BGL | BELLEVUE GOLD LTD ORDINARY | 76,329,152 | 1,279,998,987 | 6% |

| CIA | CHAMPION IRON LTD ORDINARY | 28,347,429 | 518,251,001 | 5% |

| LOT | LOTUS RESOURCES LTD ORDINARY | 113,921,611 | 2,110,286,748 | 5% |

| FLT | FLIGHT CENTRE TRAVEL ORDINARY | 11,949,807 | 221,911,982 | 5% |

| EDV | ENDEAVOUR ORDINARY | 95,718,926 | 1,790,980,017 | 5% |

| SGR | THE STAR ENT GRP ORDINARY | 151,921,217 | 2,868,680,877 | 5% |

| APE | EAGERS AUTOMOTIVE ORDINARY | 13,458,439 | 258,074,137 | 5% |

| SFR | SANDFIRE RESOURCES ORDINARY | 22,300,122 | 458,705,193 | 5% |

| VUL | VULCAN ENERGY ORDINARY | 9,073,028 | 188,188,571 | 5% |

| LOV | LOVISA HOLDINGS LTD ORDINARY | 5,220,364 | 110,715,589 | 5% |

| IDX | INTEGRAL DIAGNOSTICS ORDINARY | 10,780,402 | 233,961,997 | 5% |

| SYA | SAYONA MINING LTD ORDINARY | 524,066,658 | 11,543,296,014 | 5% |

Uranium play Paladin Energy (ASX:PDN) has become the most shorted stock on the ASX, with a short position of 15%. Other uranium stocks are also being targeted by short sellers with Boss Energy (ASX:BOE) the second most shorted stock with a short position of 14% and Deep Yellow (ASX:DYL) also on the list of ASX most shorted stocks with a short position of 11%.

It ends months of flagship ASX lithium producer Pilbara Minerals (ASX:PLS) sitting at the top of the list, with its stock spending long periods shorted at over 20%.

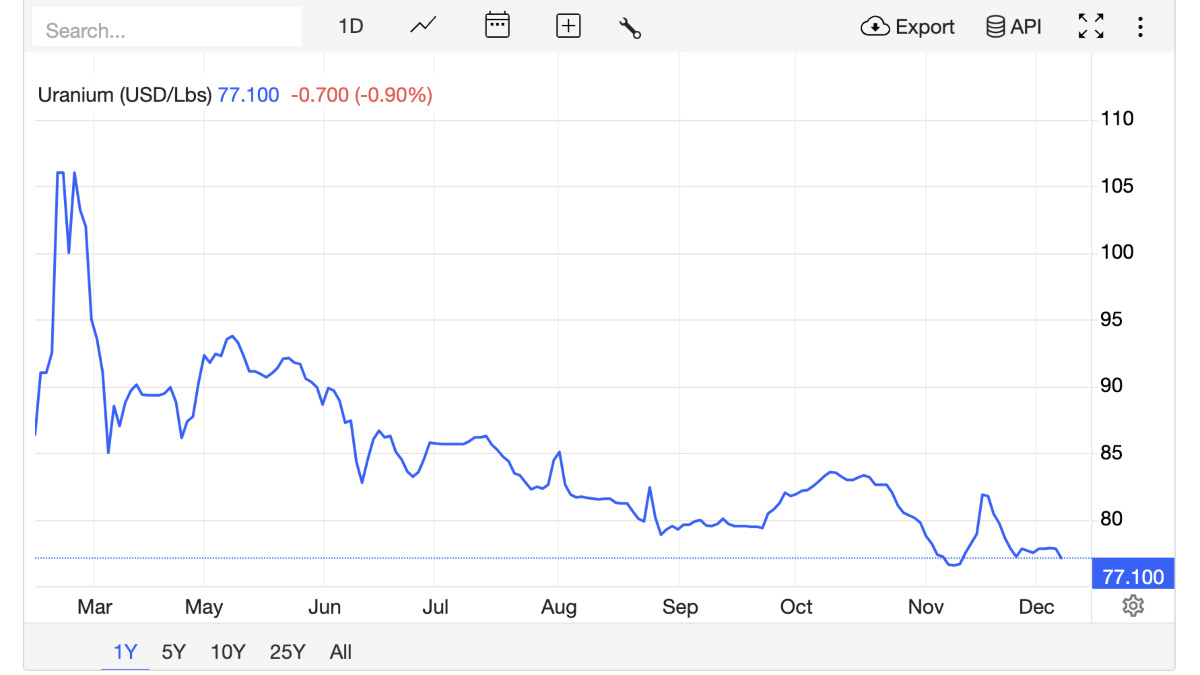

Sala Tenna believes the thematic of uranium continues to be strong, despite falling from highs earlier in the year.

Some recent catalysts for a more positive price outlook have included the re-election of Donald Trump as US president and Russia’s export ban on enriched uranium to the US in November.

“Depending on how things play out in January and with what is happening in Russia, the thematic of uranium might get even stronger so it might seem strange that the likes of Paladin and Boss are the top two most shorted ASX stocks,” Sala Tenna said.

He believes the reason for Paladin and Boss being heavily shorted comes down to operational issues, lack of execution on projects and high valuations.

“Both of those companies at different stages have really disappointed the market in terms of their speed to which they are bringing on new projects and also the current valuations you’re expected to pay for those companies,” he said.

“Most people would be of the view uranium prices have found a level and the outlook is more positive than negative but on a bottom up basis they’re thinking those companies aren’t of the valuation.

“We do own Boss Energy in the portfolio still at the moment and we do think that is probably the best of the Aussie listed uranium plays but it is a tough field because there’s not a lot of high-quality uranium plays and investors really have to go off-shore for the better names.”

Pilbara Minerals no longer ASX most shorted stock

It’s seasons greetings for lithium producer Pilbara, which has seen its short position fall to 12%.

In our last Short & Caught column in November Pilbara was the ASX’s most shorted stock with a short position of 17%, dropping slightly from 20% in September and 19% in October.

“We’ve talked to a lot of institutional peers over the years and the view seems to be because we don’t have a dedicated lithium futures market, the way that equity managers were playing the lithium price was through the Pilbara stock as the largest dedicated lithium player on the ASX,” Sala Tenna said.

“If you’re negative lithium you’d short sell Pilbara and vice versa.

“I think a lot of investors are starting to say that the lithium price is as bad as it gets, so it may not recover quickly but it doesn’t get much worse from here.”

Investors are starting to doubt the prospect $7bn-capped PLS’ price could fall further after a 43% YTD drop.

“It’s probably where it’s going to sit in terms of lithium price so they’ve been covering some of these shorts,” Sala Tenna said.

Another lithium stock worth noting is Liontown Resources (ASX:LTR), which has a short position of 10%.

“For Liontown it’s a top down view of the lithium price and in some respects the company is in a very difficult position, having brought on a sizeable new project at a time when lithium prices are down,” he said.

“So it has all the teething issues which come with a new project and at the same time they don’t have any surplus to be able to sort that out with breathing space.”

Syrah ‘perpetually shorted’

Graphite company Syrah Resources (ASX:SYR) is currently ranked as the third most shorted ASX stock with a short position of 13%.

“Syrah has been a perpetual short sold stock,” Sala Tenna said.

“Graphite was a market darling seven or eight years ago when the EV and electrification thematic started to take off,” Sala Tenna said.

“The first commodity to move was cobalt and the second was graphite but then people started to understand that there was no shortage of graphite globally.”

Sala Tenna said Syrah had been running below capacity and at a loss for a long time, making its short position a bottom up look at the company.

“The view is that the outlook for that specific stock is not good, more so than the outlook for graphite,” he said.

‘Year from hell’ for Mineral Resources

Mineral Resources (ASX:MIN) is the fifth most shorted stock with a short position of 12%.

“2024 has literally been the year from hell for Mineral Resources,” Sala Tenna said.

He said the company had the convergence of corporate government issues, weakening commodity prices – especially lithium and iron ore – and record debt levels as it built its largest project in history, the Onslow Iron Ore project in Western Australia.

“Iron ore is stronger at the moment but lithium is crawling along the bottom,” he said.

“The market has got nervous with those three things converging to create a really negative outlook.”

Hard market for resources in 2024

Sala Tenna said it has been a market of two halves this year with banks and financials rallying strongly and materials by default sold down.

“Between banks and materials you make up about 65% of the index so you have to be underweight either one or the other and investors have been more concerned about issues in China so have wanted to be underweight materials and overweight banks,” he said.

“In the new year we would expect to see a rotation out of financials and materials recover as China stimulus unfolds and India continues to push ahead.”

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.