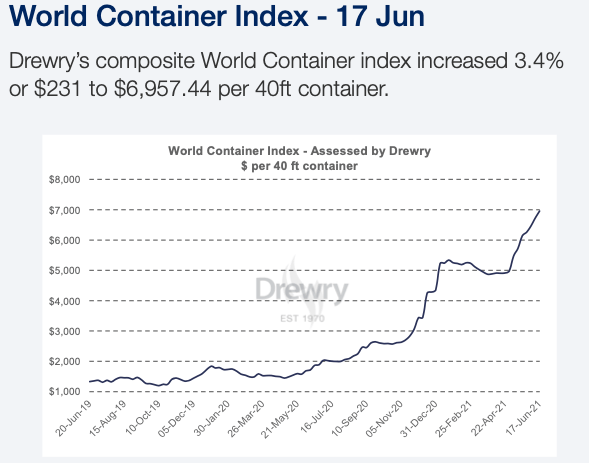

All you need to know about the global shipping crisis, in one chart

Pic: Getty

As stimulus-charged economies reopen, online shopping expands and Covid outbreaks continue to impact global ports, the overheated shipping market is continuing to explode.

Want to move something halfway across the world in a 40ft container?

It’ll cost you, on average, 305.7% more than this time last year.

The World Container Index maintained by supply chain advisory Drewry hit $US6957.44 per 40ft container this week, with most of its parabolic gains registered in the first half of 2021.

And the consultancy has warned prices will go higher, “due to GRI implementations, high volumes and equipment shortages.”

Shipping routes from China to Europe are particularly hot, with the main Shanghai to Rotterdam route – already having climbed above $US10,000 a unit for the first time since consolidated prices were recorded a decade ago – rising 6% to $US11,196.

Shanghai to Genoa rates averaged $US10,845, a 4% increase.

High prices being felt down the supply chain

Exploding shipping costs have been felt in Australia too, in both the retail and mining sector, with the former raising the prospects of higher prices downstream for consumers.

The Reject Shop (ASX: TRS) has cited shipping costs and delays among the reasons for a disappointing trading update earlier this month.

Bauxite miner Metro Mining (ASX: MMI) said last month that soaring freight rates combined with lower prices had impacted cash flow from its Bauxite Hills mine in Queensland, along with its wet season shutdown.

Its shares remain suspended as it continues negotiations with lenders regarding bridging finance and could raise new equity to shore up its financial position.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.