Capfathers Part 2: They’re making offers which are actually pretty refusable in this environment

Via Getty

Welcome back V-Con fans.

For you uninitiated, V-Con is Stockhead’s investing focused video conference series. It’s bloody great, as you’d expect.

This is not a vid though. This is more like the book of the film.

So… for the video you may go straight here.

To you 3 or 4 remaining print media champions – let me quickly orientate you. Our V-Con series aims to bring you lots of expert insights, discussions, disagreements, personalities and presentations via the exciting medium of – what is it.. video? webcam? Live streaming? Anyway, without getting too technical it’s something you watch, which can be great because you can catch the nuance and personality of very, very smart people. (Ed: Get back to the blurb, pls)

Speaking with the very best, brightest and boldest of Australian small cap specialists and sector experts, Stockhead is delighted to present but a snippet of the latest V-Con cracker of a conversation between our own Oriel Morrison, Ron Shamgar the head of Australian equity strategies at TAMIM Asset Management and Argonaut’s executive director Liam Twigger.

Both these gentlemen are passionate, fascinated investors.

Liam has over 30 years of experience in the fields of investment banking and corporate finance and is the executive director and deputy chair of Argonaut. Ron is a lifelong student of value investing and believes in a systematic approach to research and businesses evaluation, leading as the head of Australian equity strategies at TAMIM Asset Management.

And now for those who still believe print is not dead – a few highlights:

(Ed: This conversation was recorded live on July 27, 2022)

Equity capital markets and the bottom of the revaluation – where are we Mr Twigger?

Liam Twigger: The last 12 months was one of the best years ever for equity capital markets in the mining space. You could raise money for anything.

We had 106 IPOs funded, which I think was the highest number ever. And they were all like little, little turtles, you know, being hatched, finding their way to the beach. And, that’s a sign of very good times.But when the market turns, that that gets switched off and in the last couple of months where inflation’s picking up, interest rates, slowing economy – it’s been chaos.

And the first casualties, when the market gets volatile: the junior stocks, people run for cover. They can inspire high-risk investment mentalities and they get dropped quick and people focus on value.

So we’ve seen pretty much everything in the mining sector’s dropped by at least 50%. It’s been really, really hard. Edgy investors don’t like volatility and uncertainty, and when they do get it, they sell and they keep their heads down.

So I think we’ve still got a little bit of turbulence ahead, but I’m hopeful that, um, we’re seeing signs that were close to the bottom. It’s sentiment that drives it, and consumer confidence is super important. So I’m hopeful that we’ve seen the bottom, but we could, uh, bounce along here for a while…

Ron, are you in agreement with Liam? We’re close to the bottom at these levels?

Ron Shamgar: Well, I mean, I definitely mirror the sentiment of Liam in terms of the markets. I mean this calendar year, in industrials and especially the technology sector it’s been just as, uh, as bad.

Just to give you an idea – in financial year, 2022, up until the end of June, the technology sector in Australia was minus 36%. So it was, I think it was one of the worst performing or the worst. And then at the sort of mid-June lows this year it hit, I think minus 45%.

June was I think, the third worst month in history, don’t quote me, (Ed: I am quoting you Ron – and although I can’t disprove it right now – I can confirm the third week of June was the worst for Aussie markets in two years)… either way it was pretty bad.

So it’s been a rough ride. And as Liam mentioned, I think the biggest concern for investors really in this more vulnerable sector has been rising interest rates and inflation.

It does impact the technology stocks because they’re very rate sensitive, because they don’t usually make money straight up. Investors value them on a discounted cash flow into the future… And if the rates rise, the valuation comes down quite materially.

So there’s been a lot of adjustments, whether we, we hit the bottom… we definitely had a short-term bottom in that mid-June malaise.

The Small Ords was down minus 14%. The tech sector was down minus 18%, everything was oversold and we’re seeing the market bounce back now. So I don’t know if we hit the bottom, but we’re definitely closer to the bottom than we are to the top.

Probably the most sensitive sectors to this current environment in the tech sector are either buy now pay later stocks and the ecommerce stocks – they’re the ones we’ve definitely avoided in the last 12 months.

We did quite well out of them back in 2020, when they obviously were booming what with everyone at home and shopping online… But as you know, as things open up and consumer spending is slowing down I think those ecommerce businesses are really struggling.

And most of them – even the ones that made a lot of profits back in 20-21 – like Kogan (ASX:KGN) and, and Redbubble (ASX:RBL), they’re all going into losses now.

So it just shows you that they can’t really make money, unless, you know, we have another lockdown.

Liam, you’re focused on the resources space; how’s the shape of M&A at the moment?

Liam Twigger: Well. Okay. I think everyone’s been hammered. So you can expect the exploration sector is being parked up. They’ve had their opportunity.

Now, people are focused on valued existing producers and juniors that have got a clear pathway to production. But within that, one of the early movers, when you’re calling the bottom, are the corporates and we’ve seen Genesis Minerals (ASX:GMD) come through with a takeover for Dacian Gold (ASX:DCN). And we’ve seen Andrew Forrest trying to come in and pick up a big stake in Regis Resources (ASX:RRL).

(Editor’s note: From Josh at the Digger’s and Dancer’s thing – “The prevailing view in the market is the Leonora consolidation play, which started with Genesis’ deal to merge with Mt Morgans gold mine owner Dacian ends with Raleigh as the controlling boss of the assets.“)

When you see the corporates come in, I wouldn’t say it’s sort of sharks in the water smelling blood, but they can see opportunity. And (M&A) is also an excellent leading indicator… certainly in the mining space, there are a bunch of areas that could be consolidated and there are great opportunities – we’re seeing just the start.

So I think the Leonora-Layerton region is one in particular and Raleigh Finlayson is up there with Genesis. Anyone with any resources around there is going to be in the crosshairs of some consolidation over the next 12 months or so.

So actually it is a good time.

It’s part of why I think w’re near the bottom, and there is a light at the end of the tunnel – and it ain’t a train.

Ron, in the tech space – is M&A a focus area for you?

Ron Shamgar: Definitely. Obviously we don’t buy a business because we’re hoping that it’s going to get taken over, but definitely we’re starting to see more M&A action.

There’s definitely a lot of expressions of interest and approaches to companies. And we’ve seen quite a few recently, EML payments (ASX:EML), Pushpay, uh, and there’s been quite a few other ones, Elmo (ASX:ELO) and so on.

It seems like, you know, they’re getting a lot of approaches. But acquirers are a little hesitant, especially the private equity guns. They’re not rushing in because there’s still quite some uncertainty in terms of what’s going to happen in the next 12 months.

If you look back last couple of years before this year, you know, these businesses, they didn’t really need to make any money. They were valued on revenue multiples, you know, eight times revenue, 10 times revenue, 20 times revenue.

And now that’s really come back down. A lot of these businesses are trading on sort of 2, 3, 4 times revenue multiples, and the market is telling them, look, you gotta reach, breakeven profitability.

And so I think a lot of these management teams have to sort of adjust to the new environment. They can’t just keep reinvesting into growth without profit.

And we seeing that change I think how these companies adapt to this new environment and how quickly they can reach a breakeven will determine, I mean, have a look at Megaport (ASX:MP1) . They reached small breakeven on profitability for the quarter and the stock shot up 32% at one point.

And this is a billion dollar company, this is not a, you know, a $50 million company. It just shows – you have to adapt.

So I believe we’ll see a lot of M&A if valuations stay where they are.

So Liam you wanna put forward a name for us today?

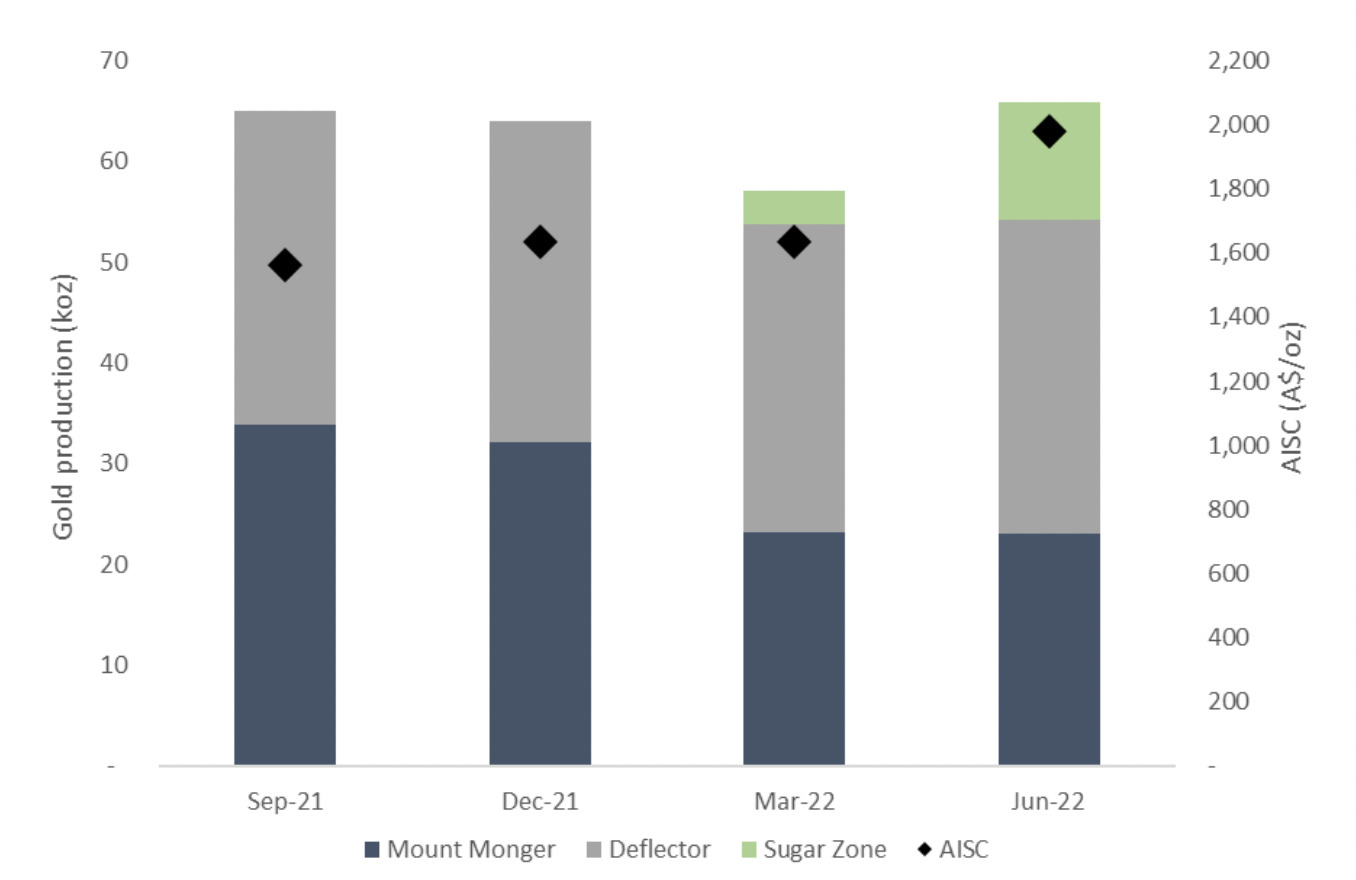

Liam Twigger: Silver Lake Resources (ASX:SLR) … are a gold producer, they put through about 250,000 ounces per annum.*

There’s a few of them in Western Australia that have been very good at managing their margins – even though we’ve been dealing with COVID and we’ve been dealing with inflation – so very good management, good production, reasonable market cap and very cheap.

They’re probably close to just trading off their 12-month low. They’re producing cash and they’ll surprise the market. So in terms of getting back in, you don’t necessarily wanna go to the risky end, but if you went for a producer – and a producer that’s historically performed well – you couldn’t do better.

*Editor’s note, Liam was right:

SLR last week upwardly reset sales guidance to 260,000 ounces of gold production for the 2023 financial year after withdrawing its previous quarterly guidance in April amid higher costs and labour issue uncertainty.

SLR generated quarterly production of 65,844 ounces of gold and 235 tonnes of copper in the three months through June.

For the financial year, output of the precious metal reached 251,887 and 991 tonnes of copper.

FY22 saw Silver Lake successfully progress its accretive growth strategy. Silver Lake’s strategy is designed to balance growth and shareholder returns, through a strengthened operating portfolio and growth pipeline, which positions the business to be larger, lower cost and longer life whilst retaining the potential to return cash to shareholders in an accretive and sustainable manner.

To get Ron’s picks and complaints as well, the full interview can be found here.

Ron Shamgar and Liam Twigger were interviewed by Stockhead for the Small Cap Showcase.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

At Stockhead, we tell it like it is. While surely one or two of these stocks are a Stockhead advertiser, they surely did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.