Semiconductors: The weapon of choice in new US-China trade war and key to everything modern in your life

This scientist could be from anywhere. Via Getty

That was a through the looking glass few days for global semiconductor stocks.

Friday last week they endured a momentary collapse of reason, falling hard on the inevitable but still unnerving news that the White House was intervening in the lucrative China export market (without needing to mention national security reasons) and instantly decimating the combined market cap of Chinese chipmakers to the tune of about $12 billion in one day.

Every American executive and engineer working in China’s semiconductor manufacturing industry resigned yesterday, paralyzing Chinese manufacturing overnight.

One round of sanctions from Biden did more damage than all four years of performative sanctioning under Trump.

— Jordan Schneider (@jordanschnyc) October 14, 2022

Semiconductors are snazzy, complex and utterly essential little critters now, emerging as the secret sauce in computer chips that power anything and everything electronic – from cars and smartphones, to Nintendos and nuclear submarines (if you’ve got any or might have some in the post).

They gained some prominence during the COVID-19 supply shortage and have now taken centre stage again as the weapon of choice for US commerce officials looking to smack china with a ‘don’t be bad’ stick.

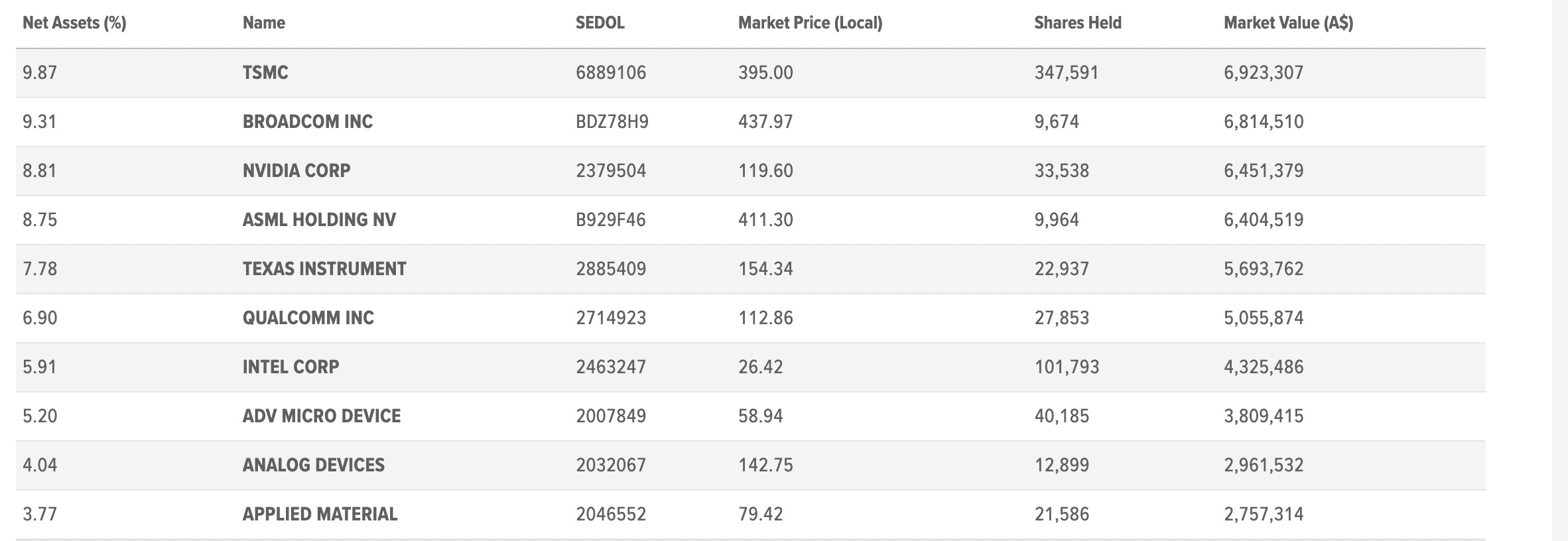

These are the probably the 10 leading US chipmakers, their road is fraught and shrouded with geopolitical and trade fog of war, but the thematic remains compelling: I don’t think anyone’s got a new way of making computers work without chips.

Leading US Chipmaker Stocks:

What Joe did next:

The latest American Vulcan neck pinch on domestic tech exports to China will prove to be the most damaging yet, escalating a silent tech war that’s been simmering between the two global superpowers into a near irreversable spiral and instantly tearing a hole in in the market cap stocks of the most prominent Chinese chipmakers.

The shiver of fury which passed through the politburo late last week, when the administration of President Joe Biden scuppered all sales of semiconductors and semiconductor-making kit to China, must’ve been rather intense.

More than 30 key Chinese companies, headlined by key memorychip maker YMTC, were relegated to corporate doom, joining the US “unverified” company blacklist opening the fast track to joining the one-way “entity” blacklist where US companies are simply banned from dealing with you.

In this case there’s exceptions – an export licence is supposed to be available, but sounds like a hassle to obtain and since supply chains remain a total hassle there’s an exception for US or US-ally-run chipmaking shops in China.

Crimes against free trade

This splendid reaction from the state-run CCP champion The Global Times, pretty much summarises how China feels about it all, pointing out with a shaking finger of verbal fury that the move is a bit of an insult to the principles of free trade and although they didn’t mention lobsters, wine or coal tariffs, I’m pretty sure it was on their minds.

According the the Aussie numbers office, the latest (ABS) data shows China’s share of Australia’s exports has crashed a year after they peaked at 42.1% for 20/21, hitting 29.5% in the 12 months to August.

It is the first time China’s share of Australia’s exports has dropped below 30% in a 12-month period since October 2015 and mainly because we’ve been getting whacked with the ‘don’t be bad stick’ too, punishing us for possibly being too lucky of a country and perhaps for not being gracious winners.

The total magnetic appeal of semiconducting

Morningstar points out semiconductor manufacturing is rather hardcore.

It requires machines which only the Dutch or the Finnish or someone clever like that can build and well, after that it gets extremely specialised – and cash intensive.

Only a few select corporates worldwide have the chutzpah to get it done – and Taiwan’s TSMC has emerged as a world champion, just as China was looking for a solid reason to invade Taiwan.

Because, perhaps above all things else, China is desirous of expanding its semiconductor nous, which is getting better, but remains adolescent – much as that remains the standard view of anything Chinese-techy. Nevertheless, it was baked in that the US would eventually get to banning chip exports to China and Russia.

The US is also aiming to ramp up its own semiconductor production as a further safeguard, while here at home even the Australian Strategic Policy Institute (ASPI) has recommended we become our own chip off the own block and get in the game to fortify national supply.

For fans of the semiconductor thematic, Bloomberg shares your optimisim, pointing out that the market may have largely priced in these concerns, and five-year returns are up 18% a year.

Looking ahead, brokers are predicting more than 40% upside on key stocks like Nvidia and AMD.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.