Sandfire reckons its new $350m copper-silver project will pay for itself in 4 years

Sandfire has given the green light to the T3 Motheo copper-silver project in Botswana. Pic: Getty Images.

Sandfire Resources has declared the dawn of a new global copper province, giving the green light to the development of its US$259 million ($352 million) T3 Motheo copper-silver project in Botswana.

The long-life project was given the all-clear by Sandfire Resources (ASX:SFR) today, following the completion of a definitive feasibility study which highlights robust economics on a base-case operation of 3.2 million tonnes per annum with clear visibility to rapidly expand to 5.2Mtpa.

At the base case, the project will generate an estimated life-of-mine revenue of US$2.45 billion, and earnings before interest, tax, depreciation and amortisation of US$987 million based on a forecast long-term copper price of US$3.16 per pound.

Payback is expected to take just 3.8 years from the beginning of production with post-tax free cashflow of US$440 million, inclusive of the project’s development capital – a sum which covers mining pre-strip, a processing plant and infrastructure.

All-in sustaining costs are forecast at US$1.76/lb for the first 10 years of operation. First production is expected in 2023.

Importantly, the company has also approved an additional investment of US$20 million as part of the base case development for the potential expansion of the project, which it says will provide a clear pathway to expand its processing capabilities to a planned 5.2Mtpa.

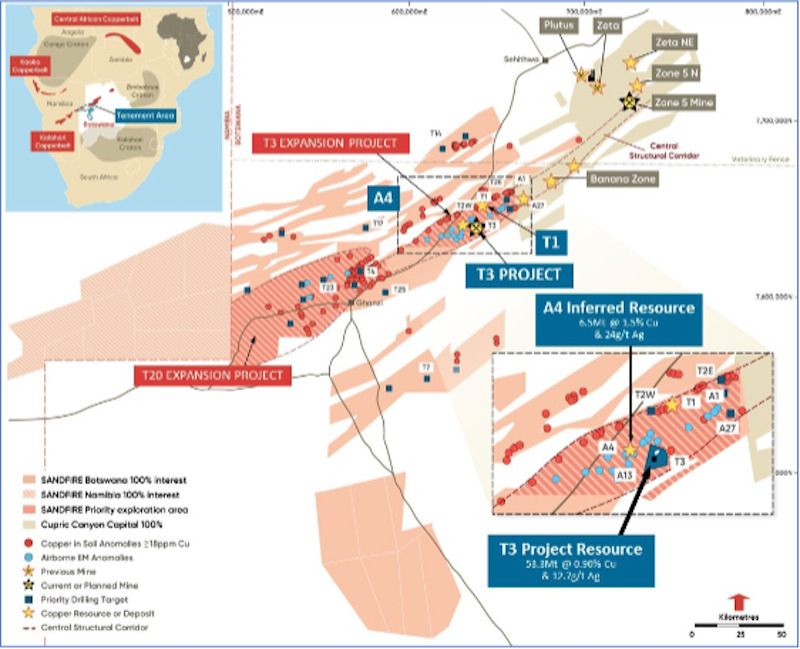

This would allow T3 Motheo to accommodate other ore sources, with planned expansion to come from the A4 deposit 8km west of the project, where a maiden inferred mineral resource of 6.5Mt at 1.5% copper for 100,000t of contained copper was also announced today.

Sandfire managing director and CEO Karl Simich said today marked a significant milestone for the company and its shareholders.

“Today we have given the green light to the development of a new, long-life copper operation based on the T3 open pit, which we envisage will become the core of our Motheo Production Hub – a new copper production hub in the central portion of the world-class Kalahari Copper Belt, where we have a dominant 26,645km2 ground-holding in Botswana and Namibia,” he said.

“While the Definitive Feasibility Study and board approval announced today encompass the Base Case 3.2Mtpa development of the T3 Project, the key message for our shareholders and investors is that this is the start of a much bigger long-term copper production and exploration story for Sandfire in Botswana.

“This is, in effect, the dawn of a new global copper province – as evidenced by the scale of the new underground mining operation currently being constructed immediately to the north-east of our project by Cupric Canyon Capital at their Khoemacau Project.”

While the compelling base case numbers provide a significant beginning for Sandfire at the project, Simich said the focus would be concurrent growth alongside project development.

“The bigger picture for us is the key growth steps that we are confident will be taken soon after we start production in early 2023,” he said.

“The recent A4 discovery, for which we have today announced a maiden Inferred Resource containing 100,000 tonnes of copper at an average grade of 1.5% Cu, is the most immediate and obvious opportunity within the ~1,000km2 T3 Expansion Area.

“We are making a significant upfront investment in several key infrastructure items, including the primary crusher and the flotation cells, which will allow us to up-scale the project quickly from 3.2Mtpa to 5.2Mtpa with relatively modest incremental capital investment.

“We anticipate being in a position to commit to that expansion during project construction, with the overall goal of ramping up to the higher production rate shortly after commissioning.”

Exploration ongoing

A4 comprises a big part of today’s series of announcements, with the maiden inferred resource key to bringing the project up to that 5.2Mtpa target.

“We will advance the maiden A4 mineral resource quickly, with drilling already underway to upgrade it to indicated status and work beginning on a prefeasibility study aimed at integrating it as a source of satellite ore feed for an expanded 5.2Mtpa Motheo production hub,” Simich said.

That exploration has returned some outstanding high grade copper-silver intersections during the latest drilling.

Highlights among today’s announcements included 7.15 metres at 16% copper and 222 grams per tonne silver, and 12.4m at 13.3% copper and 232.8g/t silver.

The new intersections were not included in the announced inferred mineral resource – highlighting the significant potential of A4 as a high grade source of Motheo ore.

The latest results include the highest copper and silver assays reported at the project to date.

Simich said they highlighted the underexplored province’s globally significant potential.

“Seeing widths and grades of copper-silver mineralisation of this magnitude is a really important development,” he said.

“These very high-grade assays eclipse anything else we have seen in the belt previously and show that smaller, high-grade deposits are a very realistic exploration target within the Kalahari Copper Belt.

“As we continue to increase our geological knowledge of the district, our ability to vector into high-grade zones like this is also improving.

“Continuing success at A4 gives us great confidence that we are just at the beginning of a long journey in this emerging copper province which, in comparison with other more mature districts, is one of the very few globally that is really at the start of its evolution with a rising discovery rate.”

Exploration will soon ramp up across a series of high priority targets in the T3 expansion area.

With copper trading at seven-year highs, it appears Sandfire is pulling the right trigger at the right time.

At Stockhead, we tell it like it is. While Sandfire Resources is a Stockhead advertiser, it did not sponsor this article.

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.