Rise and Shine: What you need to know before the ASX opens

happy woman stretches and opens the curtains at window in morning

On Stockhead today, why the coronavirus outbreak may not hurt Aussie iron ore exports to China as much as people think, modular nuclear power plants could be here by the mid-2020s and the hand sanitiser sellers are leading the bio-stock gains.

But first…

The day ahead

Today in economic data we’ll see monthly retail sales. Australia’s trade balance, which economists believe will slightly drop but still be a healthy surplus, is also due to be released today. Finally keep your eye out for NAB Business Confidence for the December quarter.

The following companies are in trading halts and are expected to exit in the next 48 hours:

Thursday:

De Grey Mining (ASX:DEG) – exploration results

Twenty Seven (ASX:TSC) – capital raising

STEMify (ASX:SF1) – disposal transaction

Friday:

Matador Mining (ASX:MZZ) – capital raising

Markets

Gold: $US1,553.54 ($2,303.25) (+0.29%)

Silver: $US17.61 (+0.01%)

Oil (WTI): $US51.06 (+2.88%)

Oil (Brent): $US55.37 (+2.76%)

Coal: $US71.85 (+2.54%)

Iron 62pc Fe: $US81.63 (+4.21%)

AUD/USD: $US0.6746 (+0.10%)

Bitcoin: $US9,657.42 (+5.49%)

What got you talking yesterday

Yesterday Elixir Energy (ASX:EXR) finished up 126 per cent. The catalyst was a 51m thick coal seam hit at its Mongolian project.

A 51m thick coal seam hit in Mongolia has sent Elixir more than doubling this morning https://t.co/8UwnPXo97U $EXR #csg #coalseamgas

— Stockhead (@StockheadAU) February 5, 2020

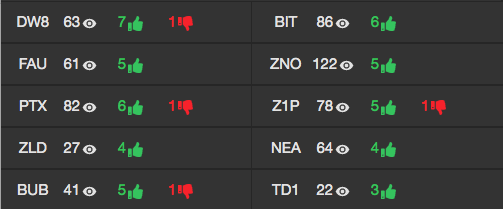

These were the most tipped stocks (weekly) on Stocks in Play:

Yesterday’s winners

| Code | Name | Price | % Chg | Market Cap | Volume |

|---|---|---|---|---|---|

| EXR | Elixir Energy Ltd | 0.04 | +126.32% | $21.5M | 90.8M |

| PRM | Prominence Energy Ltd | 0.002 | +100.00% | $2.6M | 3.7M |

| BET | Betmakers Technology Group Ltd | 0.38 | +56.25% | $177.6M | 29.1M |

| UCM | Uscom Ltd | 0.27 | +50.00% | $40.4M | 2.8M |

| RLC | Reedy Lagoon Corp Ltd | 0.003 | +50.00% | $1.2M | 50.0k |

| TYX | Tyranna Resources Ltd | 0.003 | +50.00% | $2.9M | 2.2M |

| FHS | Freehill Mining Ltd | 0.02 | +35.71% | $24.9M | 12.5M |

| CRM | Carbon Minerals Ltd | 0.23 | +35.29% | $4.3M | 40.0k |

| MEM | Memphasys Ltd | 0.06 | +34.04% | $47.5M | 2.2M |

| GTE | Great Western Exploration Ltd | 0.004 | +33.33% | $5.8M | 534.4k |

| SMI | Santana Minerals Ltd | 0.004 | +33.33% | $10.7M | 8.7M |

| BPL | Broken Hill Prospecting Ltd | 0.02 | +26.67% | $3.7M | 595.0k |

| AJJ | Asian American Medical Group L | 0.08 | +26.15% | $28.5M | 2.0k |

| LPI | Lithium Power International Lt | 0.35 | +25.00% | $91.9M | 1.3M |

| BUY | Bounty Oil & Gas NL | 0.005 | +25.00% | $4.8M | 500.0k |

| MSR | Manas Resources Ltd | 0.0025 | +25.00% | $6.6M | 93.6k |

| POW | Protean Energy Ltd | 0.005 | +25.00% | $1.6M | 200.0k |

| VAL | Valor Resources Ltd | 0.0025 | +25.00% | $4.8M | 1.7M |

| WCN | White Cliff Minerals Ltd | 0.005 | +25.00% | $2.4M | 241.5k |

| WRM | White Rock Minerals Ltd | 0.005 | +25.00% | $9.2M | 1.2M |

Yesterday’s losers

| Code | Name | Price | % Chg | Market Cap | Volume |

|---|---|---|---|---|---|

| CCE | Carnegie Clean Energy Ltd | 0.001 | -33.33% | $11.1M | 3.5M |

| AOA | Ausmon Resources Ltd | 0.002 | -33.33% | $1.3M | 11.4M |

| PCL | Pancontinental Oil & Gas NL | 0.0015 | -25.00% | $8.1M | 3.0M |

| OAR | Oakdale Resources Ltd | 0.003 | -25.00% | $1.7M | 18.9M |

| KAS | Kasbah Resources Ltd | 0.01 | -23.08% | $1.4M | 332.6k |

| MTB | Mount Burgess Mining NL | 0.002 | -20.00% | $1.1M | 800.0k |

| MGT | Magnetite Mines Ltd | 0.004 | -20.00% | $3.9M | 28.0k |

| KMT | Kopore Metals Ltd | 0.004 | -20.00% | $2.6M | 1.4M |

| ANL | Amani Gold Ltd | 0.002 | -20.00% | $12.3M | 42.1M |

| ZLD | Zelira Therapeutics Ltd | 0.05 | -16.92% | $47.1M | 7.1M |

| LCL | Los Cerros Ltd | 0.04 | -16.67% | $6.7M | 1.3M |

| HWK | Hawkstone Mining Ltd | 0.005 | -16.67% | $4.1M | 10.7M |

| EVE | EVE Investments Ltd | 0.005 | -16.67% | $15.2M | 7.6M |

| DDD | 3D Resources Ltd | 0.0025 | -16.67% | $2.9M | 1.6M |

| CLZ | Classic Minerals Ltd | 0.0025 | -16.67% | $17.5M | 17.2M |

| BSM | Bass Metals Ltd | 0.005 | -16.67% | $14.0M | 2.0M |

| ADY | Admiralty Resources NL | 0.005 | -16.67% | $5.8M | 1.0M |

| OLI | Oliver's Real Food Ltd | 0.07 | -16.28% | $18.1M | 2.1M |

| WWI | West Wits Mining Ltd | 0.011 | -15.38% | $10.3M | 4.2M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.