Rise and Shine: What you need to know before the ASX opens

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

On Stockhead today, 2019 was a hot year for IPOs and Sam Jacobs looks at what’s to come, there are some lofty gains to made by heavy rare earths players this year according to Lynas and public transport is keeping infrastructure deals speeding ahead.

But first…

The week ahead

Despite a shortened trading week there is a fair amount of economic data to look out for. Today, NAB will release business confidence for December.

The regular ANZ-Roy Morgan consumer confidence will be delayed until Wednesday. Also tommorrow will be 4th quarter inflation figures – which the RBA will be watching closely prior to its first meeting in 2020 next Tuesday.

Finally on Thursday, the Australian Bureau of Statistics will release export and import price indexes.

The following companies are in trading halts and are expected to exit in the next 2 trading days:

Tuesday:

Lifespot Health (ASX:LSH) – capital raising

ZipTel (ASX:ZIP) – acquisition

Sensera (ASX:SE1) – financing

UUV Aquabotix (ASX:UUV) – legal dispute update

BPH Energy (ASX:BPH) – Advent Energy investment update

Wednesday:

Artemis Resources (ASX:ARV) – capital raising

Neurotech International (ASX:NTI) – TGA registration

9Spokes (ASX:9SP) – capital raising

Auteco Minerals (ASX:AUT) – acquisition

Markets

Gold: $US1,584.74 ($2,278.20) (+0.65%)

Silver: $US18.05 (-0.30%)

Oil (WTI): $US52.92 (-2.29%)

Oil (Brent): $US59.19 (-2.62%)

Coal: $US68.15 (-0.55%)

Iron 62pc Fe: $US94.35 (-0.05%)

AUD/USD: $US0.6760 (-1.05%)

Bitcoin: $US8,941.69 (+4.32%)

What got you talking last week

If and when uranium prices will rebound is still anyone’s guess. But last week one uranium industry executive, Boss Resources’ (ASX: BOE) Duncan Craib gave us the level his company is waiting for to commence work at its South Australian project.

$US60 per pound is the incentive price for new [uranium] mines to come on the market…I'd like to think a rebound is going to happen this year” – one #uranium executive says https://t.co/PLWmeZcvlQ $BOE

— Stockhead (@StockheadAU) January 21, 2020

Meanwhile, in our Facebook Small and Micro cap chat group talking points included what’s next for 2019’s greatest cannabis winner and Rachel Williamson’s story on the market opportunity of climate change. If you’re not already a member we’d love to have you join – which you can here.

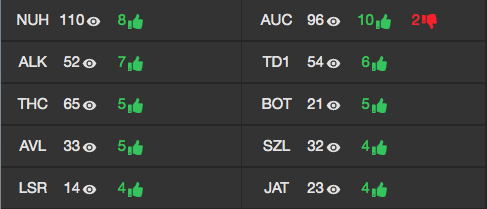

These were the most tipped stocks (weekly) on Stocks in Play:

Last week’s winners

| Code | Name | Price Last Friday | Price this Friday | % Return | Market Cap |

|---|---|---|---|---|---|

| PSZ | PS&C LTD | 0.02 | 0.03 | 74.02% | 11.6M |

| TGO | TRIMANTIUM GROWTHOPS LTD | 0.11 | 0.19 | 72.73% | 26.4M |

| GSM | GOLDEN STATE MINING LTD | 0.05 | 0.09 | 61.82% | 3.3M |

| ZNO | ZOONO GROUP LTD | 0.49 | 0.69 | 50.52% | 119.2M |

| BAS | BASS OIL LTD | 0.00 | 0.00 | 50.00% | 10m |

| MDI | MIDDLE ISLAND RESOURCES LTD | 0.00 | 0.01 | 50.00% | 8.2M |

| MRD | MOUNT RIDLEY MINES LTD | 0.00 | 0.00 | 50.00% | 8M |

| PNN | PEPINNINI LITHIUM LTD | 0.00 | 0.00 | 50.00% | 4.3M |

| AX8 | ACCELERATE RESOURCES LTD | 0.03 | 0.04 | 42.86% | 2.2M |

| AIV | ACTIVEX LTD | 0.09 | 0.11 | 38.89% | 22.2M |

| WNB | WELLNESS AND BEAUTY SOLUTION | 0.01 | 0.01 | 37.50% | 11.4M |

| SCN | SCORPION MINERALS LTD | 0.01 | 0.01 | 36.36% | 2.7M |

| AZY | ANTIPA MINERALS LTD | 0.01 | 0.02 | 33.33% | 33.3M |

| MRV | MORETON RESOURCES LTD | 0.00 | 0.00 | 33.33% | 12.4M |

| ICG | INCA MINERALS LTD | 0.00 | 0.00 | 33.33% | 8.1M |

| E2E | EON NRG LTD | 0.00 | 0.00 | 33.33% | 3.1M |

| SI6 | SIX SIGMA METALS LTD | 0.00 | 0.00 | 33.33% | 2.6M |

| AVW | AVIRA RESOURCES LTD | 0.00 | 0.00 | 33.33% | 2.3M |

| VUL | VULCAN ENERGY RESOURCES LTD | 0.17 | 0.21 | 33.33% | 10.7M |

| LI3 | LITHIUM CONSOLIDATED LTD | 0.03 | 0.03 | 32.00% | 4.9M |

| PGY | PILOT ENERGY LTD | 0.02 | 0.03 | 31.58% | 2M |

| WND | WINDLAB LTD | 0.72 | 0.94 | 31.25% | 64.5M |

| GMV | G MEDICAL INNOVATION HOLDING | 0.13 | 0.17 | 30.77% | 69.5M |

| WGO | WARREGO ENERGY LTD | 0.19 | 0.24 | 30.77% | 180.8M |

| RNE | RENU ENERGY LTD | 0.02 | 0.03 | 30.43% | 3.6M |

| SCT | SCOUT SECURITY LTD | 0.07 | 0.09 | 28.79% | 10.1M |

| RMI | RESOURCE MINING CORP LTD | 0.01 | 0.01 | 28.57% | 2.7M |

| CHZ | CHESSER RESOURCES LTD | 0.07 | 0.09 | 27.94% | 24.8M |

| N1H | N1 HOLDINGS LTD | 0.06 | 0.08 | 27.69% | 6.8M |

| BSX | BLACKSTONE MINERALS LTD | 0.17 | 0.20 | 27.27% | 40.3M |

Last week’s losers

| Code | Name | Price last Friday | Price this Friday | % Return | Market Cap |

|---|---|---|---|---|---|

| EHX | EHR RESOURCES LTD | 0.14 | 0.12 | -21.43% | 13.9M |

| OPL | OPYL LTD | 0.19 | 0.14 | -21.62% | 4.3M |

| SIS | SIMBLE SOLUTIONS LTD | 0.02 | 0.02 | -21.74% | 3M |

| ICN | ICON ENERGY LIMITED | 0.01 | 0.01 | -22.22% | 4.2M |

| OLV | OTHERLEVELS HOLDINGS LIMITED | 0.01 | 0.01 | -22.22% | 2M |

| MNS | MAGNIS ENERGY TECHNOLOGIES L | 0.14 | 0.10 | -22.22% | 65.4M |

| RFR | RAFAELLA RESOURCES LTD | 0.15 | 0.12 | -23.33% | 8.1M |

| MNW | MINT PAYMENTS LTD | 0.02 | 0.02 | -23.81% | 14.6M |

| CIO | CONNECTED IO LTD | 0.00 | 0.00 | -25.00% | 7.2M |

| SRY | STORY-I LTD | 0.02 | 0.01 | -25.00% | 4.4M |

| AYR | ALLOY RESOURCES LTD | 0.00 | 0.00 | -25.00% | 3.1M |

| IDZ | INDOOR SKYDIVING AUSTRALIA G | 0.01 | 0.01 | -27.27% | 2.7M |

| MRQ | MRG METALS LTD | 0.02 | 0.01 | -27.78% | 13.7M |

| OKJ | OAKAJEE CORP | 0.04 | 0.03 | -28.57% | 2.7M |

| TZL | TZ LTD | 0.18 | 0.13 | -30.56% | 9.8M |

| CLZ | CLASSIC MINERALS LTD | 0.00 | 0.00 | -33.33% | 14M |

| MLS | METALS AUSTRALIA LTD | 0.00 | 0.00 | -33.33% | 3.2M |

| RIM | RIMFIRE PACIFIC MINING NL | 0.00 | 0.00 | -33.33% | 3M |

| SBR | SABRE RESOURCES LTD | 0.00 | 0.00 | -33.33% | 1.7M |

| DDD | 3D RESOURCES LTD | 0.00 | 0.00 | -33.33% | 1.2M |

| ANA | ANSILA ENERGY NL | 0.03 | 0.02 | -46.87% | 8.6M |

| VPR | VOLT POWER GROUP LTD | 0.00 | 0.00 | -50.00% | 9M |

| GLV | GLOBAL OIL & GAS LTD | 0.00 | 0.00 | -50.00% | 3.1M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.