REVIEW: We test-drove Stake, the app that gives Aussie investors access to US stocks and ETFs

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

For many Australian stock investors, getting exposure to the huge US market has historically been a bit easier said than done.

But with the entrance of new competitors, there are now additional pathways for local traders to buy and sell US stocks without excessive fees or wait times.

One of those new entrants is Sydney-based fintech Stake (stake.com.au) — the share trading platform that gives investors exposure to thousands of US stocks and exchange traded funds (ETFs).

The company has gained some traction in the local market with its brokerage-free trading platform, which now has a user-base numbering around 30,000.

To form a view of my own, I spent a week taking the Stake app for a test drive — buying and selling stocks and researching different industries.

And to help me get started, CEO Matt Leibowitz and the Stake team deposited $US350 into my account — funds I could use to make different trades and get a feel for how the app works. Here’s how I went:

Getting started

To begin with, I found the signup process quick and easy with the usual list of personal and banking details.

The app also asks each user for a selfie holding their driver’s license. It reminded me of the super-quick signup I completed for a UK neobank prior to a recent trip to London.

Once my account was up and running I had a scroll around from the drop-down menu and found my way to the Funds page, where users make their initial deposit.

With my company donation I already had $US350 in buying power, so I skipped the deposit step. But the Add Funds page is where users make AUD deposits which are automatically converted to US dollars.

Stake charges a forex conversion fee on each deposit, which forms the basis of its revenue model. For a $10,000 deposit, the company says it charges an effective FX fee of $73.50, or 0.735 per cent.

Buying & selling

With some money to play with, my next task was to figure out what to buy and sell. I began by perusing the big-name US tech stocks via the app’s search function.

But as a long-time fan of the legendary Warren Buffett, I took the opportunity to become a shareholder in Buffett’s huge investment conglomerate, Berkshire Hathaway.

One share of Berkshire’s Class B stock will set you back around $US200. (Class A is a different story — they trade at a cool $US310,000).

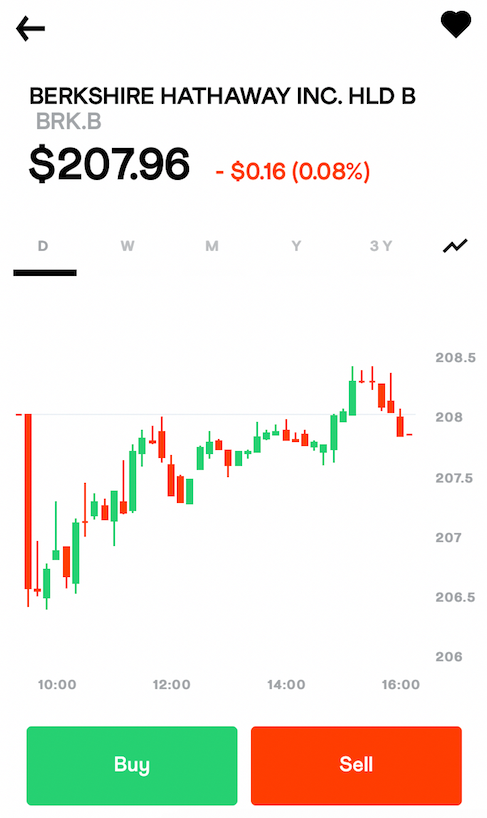

Here’s what Stake’s interface looks like for buying & selling shares:

I chose the bar chart, but the interface offers a line chart as well. And hitting the love-heart in the top right corner will add the stock to your Watchlist which is shown on the Stake homepage.

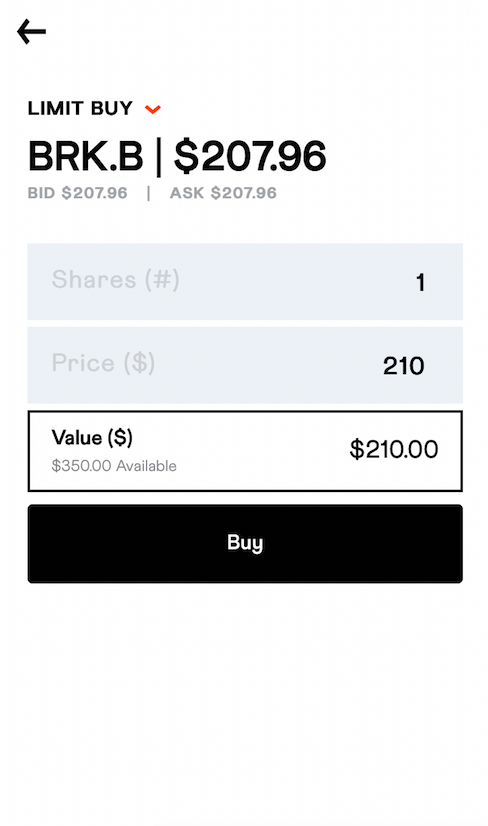

Just like other share-trading platforms in the market, once you hit Buy the app gives you the choice between setting a price limit or buying at market rates.

When I bought my BRK.B share, I checked the S&P500 futures markets during Asian trade and they were pointing higher. So I figured Berkshire would open above their previous closing price of $US207.96, but I decided I didn’t want to pay any more than $US210. That’s where I set the limit:

Once the order was placed, I waited that night for US markets to open and got an email notification from Stake confirming the purchase of one BRK.B share at $US208.

Next, I chose to look for some exposure to one of the many ETF options on the Stake platform. I searched “ETF” and “Leveraged ETF”, then scrolled through the Most Traded list before settling on UVXY — the ProShares Ultra VIX Short-Term Futures ETF.

The VIX index is a well-known measure of US market volatility, and the UVXY ETF offers a way to gain investment exposure to its movement.

When US stocks fall or rise more than expected, the VIX goes up. I thought that would make for a nice hedging strategy to complement my Berkshire investment, so I bought 3 units in the UVXY ETF for $US24.10 each.

As the new owner of two US securities, I held my investments for a period of one week — long enough for the markets to ebb and flow and generate a material change in prices (hopefully in my favour).

As it turned out, the week I held the shares had some serious bouts of volatility — largely related to the whims of US President Donald Trump regarding the US-China trade war.

On the first night, Trump came out with some aggressive rhetoric on trade, which put markets in risk-off mode and sparked a broader sell-down on the S&P500.

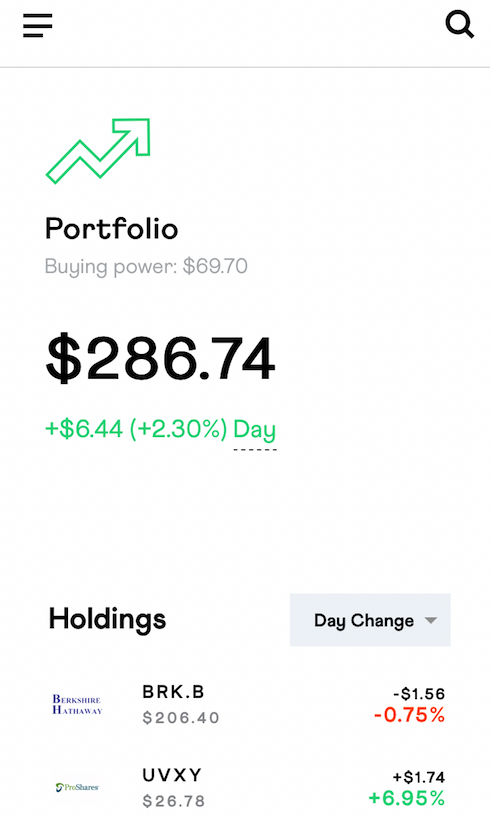

But on the plus-side, my investment in the VIX hedge came in handy — when stocks fall sharply the VIX rises, so I came out ahead on day one:

Over the course of the week I gave the search function a pretty good workout and spent some time on the Stake website, which has full trading functionality and the creature-comforts of a desktop interface.

In addition to individual searches, the app sets out investment categories such as cannabis, gold and emerging markets.

For Stake members, the team also sends out a weekly research wrap highlighting different thematics including monthly winners, stocks at 52-week highs (and lows) and the most-traded stocks by age group.

After I’d held my “trial” shares for a week, I was slightly ahead and decided it was time to sell up. (Unfortunately it was one day too early — US markets sold down sharply the following night and my VIX hedge jumped by more than 10 per cent).

But over the course of the week, my UVXY ETF still edged higher to a sale price of $26.03 — an increase of eight per cent. The value of my BRK.B share was pretty much unchanged, leaving me with an overall gain of $5.60.

Not a huge windfall, but at least I abided by one of Buffett’s famous investment quotes: “Rule No. 1: Never lose money. Rule No. 2: Don’t forget rule No. 1.”

Conclusion

Before test-driving the Stake app, my plan was to judge it on two main criteria — functionality and security.

In terms of functionality I was impressed with the simple interface and ease of use around depositing funds and buying and selling shares.

And I definitely got the sense that both the app and the desktop interface offer a secure platform to deploy actual funds in buying and selling US securities, along with email confirmations for each trade.

In summary, I found the overall user experience to be positive. And for investors who want to exposure to the almost 4000 stocks and ETFs on the platform, Stake offers a fast and secure way to incorporate the US market into one’s investment portfolio.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.