Rental housing market left reeling by COVID-19 downturn: RBA report

Pic: d3sign / Moment via Getty Images

- Treasury lowers Australian population forecast by 1.5 per cent for June 2021

- Airbnb listings fall 20 per cent between February and May, still falling

- Rental housing supply rising on new inner-city apartment completions

Australia’s rental housing market has been left in a severe crisis by the COVID-19 pandemic which the Reserve Bank of Australia said has delivered the largest economic shock to the sector since the 1930s.

“In the wake of the pandemic, the rental market has experienced shocks to demand and supply,” said the Reserve Bank in a report ‘The Rental Market and COVID-19’ on its website.

Australia’s border closures have reduced to a trickle the number of international arrivals for business, migration, study and tourism, said the central bank.

One-in-five international student visa holders had yet to arrive in Australia by March.

“The closure of international borders magnified the demand shock, as the flow of international students and other migrants (who typically rent) has slowed,” the bank said.

Population to decline with less migration, fewer students

The Treasury has lowered its forecast for Australia’s population by 1.5 per cent in June 2021 compared with pre-pandemic forecasts, representing 400,000 fewer residents.

A decline in population of this size could lead to a 3 per cent fall in rents in the years ahead.

Rentals house one-third of Australian households who tend to be younger – two-thirds of adult renters are aged under 35 – and have lower than average incomes than owners.

“Weak labour market conditions, including the temporary closure of many service businesses, have reduced demand for rental properties as households have consolidated to save money and requested rent reductions and deferrals,” the Reserve Bank said.

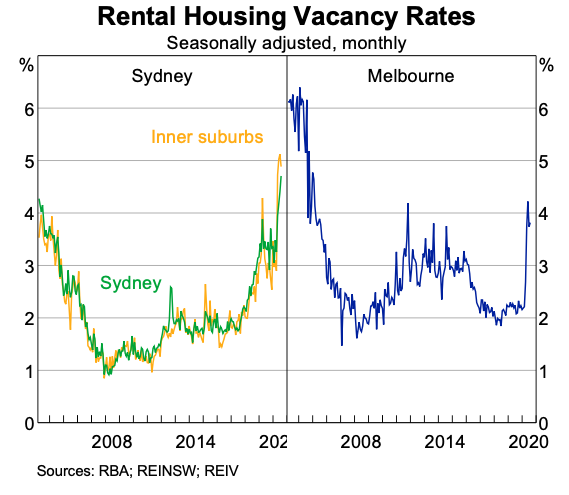

Vacancy rates for Melbourne and Sydney rental property have jumped

Short-term accommodation switched to long-term lets

“On the rental market’s supply side, a large number of short-term accommodation providers have shifted their properties on to the long-term rental market,” said the report.

“The vacancy rate has increased sharply in some markets,” it said.

The government’s moratorium on evictions from rental properties has encouraged tenants and landlords to re-negotiate the terms of existing leases, leading to lower market rents.

Close to 15 per cent of tenants have received some form of rent relief from landlords since March.

The blanket ban on tenant evictions from rented housing ends September 30-mid-October in some states, however, South Australia and Victoria have extended the protection to March 2021.

“These policy measures combined with the provision of income support measures, including the Jobkeeper program and Coronavirus Supplement, helped offset the acute fall in rental demand and stabilise the rental market,” said the bank.

Airbnb listings nosedive

Many short-term accommodation providers have stopped listing their properties in response to the sharp fall in international visitors and domestic travellers.

“On Airbnb alone, listings declined by around 20 per cent or 40,000 properties, between February and May,” said the Reserve Bank in its report.

The report showed that Airbnb listings had fallen to 150,000 properties in August, from 210,000 in February.

Airbnb filed paperwork with the US Securities and Exchange Commission last month for a planned IPO later this year on a US stock market.

Three-quarters of all Airbnb listings are homes and apartments and their owners have taken the decision to list these for longer-term rental instead, adding to the rental market’s vacancy rate.

The Reserve Bank expects some of these properties to switch back to short-term letting if virus containment measures are successful.

Fewer listings for short-term accommodation on Airbnb

New apartment building also boosts rental supply

Supply in the rental housing market is also increasing with the completion of high-rise apartment buildings in inner city Melbourne and Sydney that were started in better times.

Setbacks in controlling the COVID-19 virus in Australia and internationally may delay the reopening of international borders, and prolong lower demand in the rental housing market, the bank said.

“Over the next few years, it is likely that rents in these inner-city areas will remain lower than expected pre-pandemic given lower population growth and the anticipated supply of apartments coming on line in these markets,” said the report’s conclusion.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.