Rent! Nothing musical about this performance as new Aussie property listings hit record low

Antonio Banderas attends the closing event of the ESAEM theater school, the representation of the musical "Rent", on June 11, 2021 in Malaga, Spain. (Photo by Daniel Perez/Getty Images)

They’re bombing tobacco shops in Melbourne.

That’s just an example – though hardly related – to just how mad it is for renters in this pressure-cooker nation.

The PropTrack Rental Report for the December 2023 quarter is out and however well-written, I can report the reading of it is rather unpleasant.

To save you Victorians the time, as you drive interstate for a safe vape – in short the last three months of 2023 on the Aussie rental market were a familiar story of maddeningly low supply and stonkingly strong demand.

These kind of crap conditions made it even harder for renters to find a decent place and – more importantly – saw landlords start to really increase rents for anyone not locked in on a long-term contracts.

From first-hand reports up here in Sydney – the gouging has well and truly begun and, according to PropTrack Director of Economic Research and report author, Cameron Kusher, rent hikes are a trend likely to continue through the new year.

Given the persistent low supply of rental stock and the significant demand for accommodation, there is a critical need for additional housing, particularly in the major capital cities.

Ok, there’s a solution Cameron says, and the best way to address insufficient supply is to build more homes.

So, the Albo government has a goal to build 1.2 million new homes over the coming five years.

But dwelling approvals and commencements are evaporating. Cam says both metrics are at decade lows and it’s unlikely this will change substantially in the near-term.

In the meantime, other solutions should encourage better use of current properties and further investment in the housing market, or dig up more support to get first-time buyers into homeownership, which would likely free up the rental stock they currently occupy.

Either way – Cameron says it appears unlikely that there will be “any significant relief from the tough rental market conditions in the major capital cities in the coming months.”

“We expect supply to remain tight and demand to stay strong, which is likely to push rents higher.”

The vicious circle

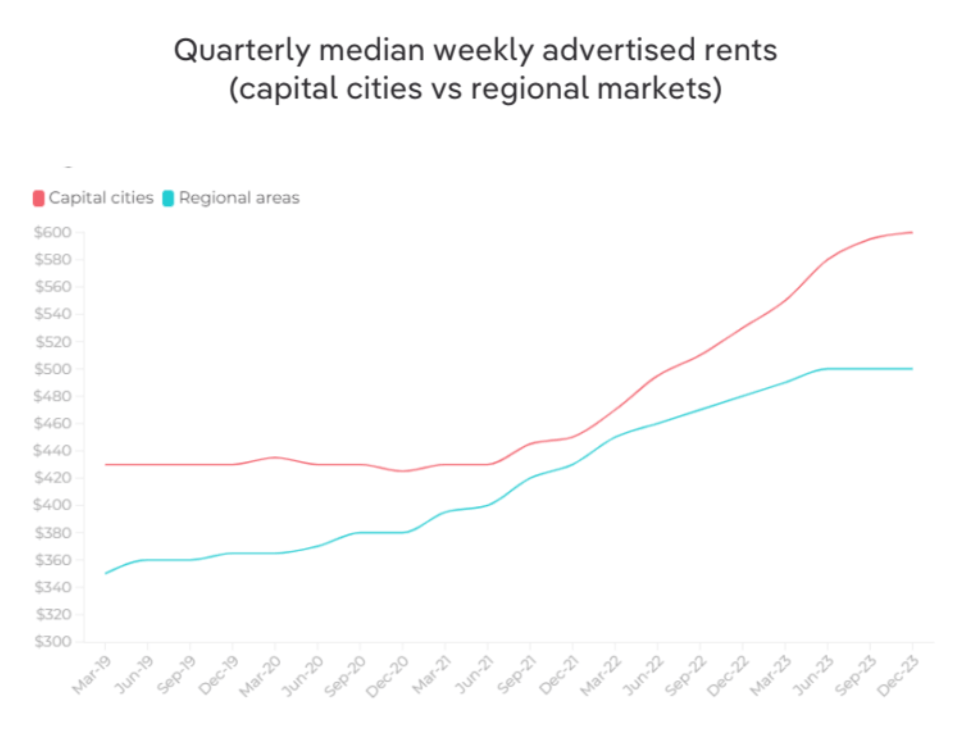

At the end of 2023, the median rent on realestate.com.au was recorded at $580 per week, an increase of 1.8% over the quarter and 11.5% over the year.

In dollar terms, median advertised rents nationally increased by $60 per week.

Rental growth was varied across Australia. It was much stronger in capital cities – particularly major capital cities – than it was in regional markets.

For renters hoping to purchase a property, higher rents made it difficult to save a deposit, while higher interest rates make servicing a mortgage more expensive.

Let’s not muck about, Australis. So here’s the key takeouts from the last quarter:

![]() Rental stock is at historic low levels while population growth is driving strong demand, exacerbating tough conditions for renters.

Rental stock is at historic low levels while population growth is driving strong demand, exacerbating tough conditions for renters.

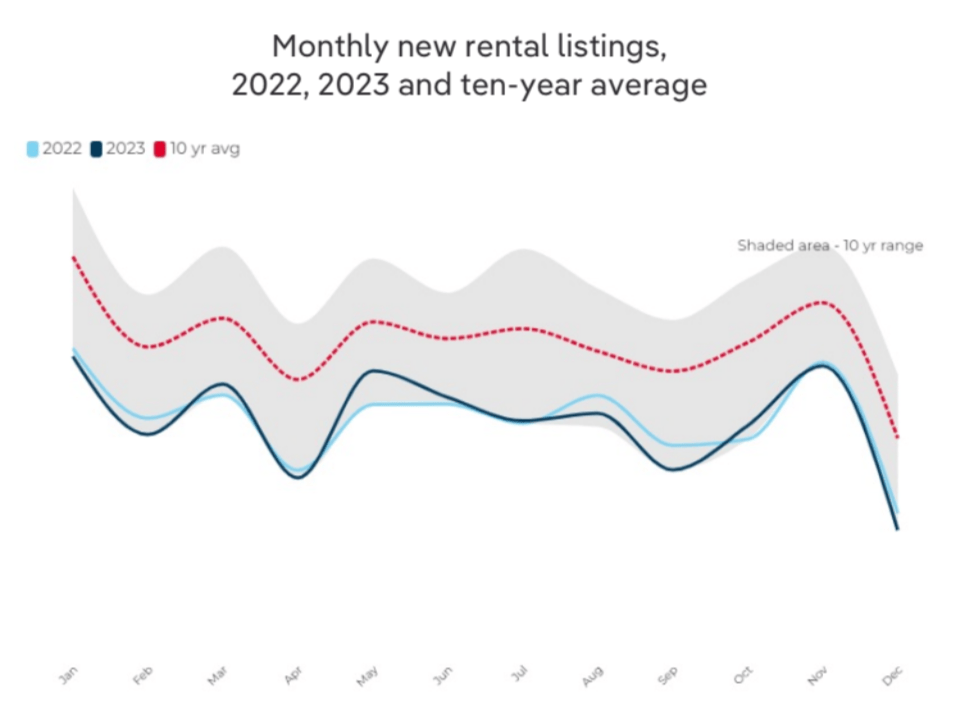

![]() New rental listings on realestate.com.au in December were 4.6% lower than a year ago, and 20.7% lower than the ten-year average for the month.

New rental listings on realestate.com.au in December were 4.6% lower than a year ago, and 20.7% lower than the ten-year average for the month.

![]() Total rental listings were at a record low, falling 4.7% annually to sit 30.2% below the December decade average.

Total rental listings were at a record low, falling 4.7% annually to sit 30.2% below the December decade average.

![]() Demand based on the number of enquiries per rental listing on realestate.com.au remained at elevated levels after climbing 3.3% over the year.

Demand based on the number of enquiries per rental listing on realestate.com.au remained at elevated levels after climbing 3.3% over the year.

![]() Limited supply and high demand saw rental prices skyrocket in 2023, with the median advertised rent on realestate.com.au rising 11.5% over the year to sit at $580 per week.

Limited supply and high demand saw rental prices skyrocket in 2023, with the median advertised rent on realestate.com.au rising 11.5% over the year to sit at $580 per week.

![]() However, 2023 saw a slower rate of rental price growth than the 15.6% increase in 2022.

However, 2023 saw a slower rate of rental price growth than the 15.6% increase in 2022.

In December 2023, new rental listings reached a historic low and were 4.6% below the previous year.

The number of new rental listings in December 2023 was 20.7% lower than the 10-year average for the month.

Out the back door

On that, Kusher says while he expects rents to continue to rise this year, it’s likely the rate of growth will slow.

“The already higher cost of renting and overall increase in the cost of living will limit rent price increases moving forward.

“For renters hoping to purchase a property, higher rents are making it difficult to save a deposit, while higher interest rates will make servicing a mortgage more expensive.”

PropTrack concludes that nationally, investors are still exiting the market.

“There has been a rebound in new investor lending this year but it is not enough to sufficiently improve stock levels,” Cameron adds.

![]() The national rental vacancy rate remained near record lows at 1.1% and was lower than the 1.3% recorded in December 2022.

The national rental vacancy rate remained near record lows at 1.1% and was lower than the 1.3% recorded in December 2022.

![]() Across the combined capital cities, annual rental growth slowed from 17.8% in 2022 to 13.2% in 2023. In regional markets, it slowed from 11.6% to 4.2%.

Across the combined capital cities, annual rental growth slowed from 17.8% in 2022 to 13.2% in 2023. In regional markets, it slowed from 11.6% to 4.2%.

![]() The number of days a rental property is listed on realestate.com.au remains at historically low levels, reflecting tightness in the rental market.

The number of days a rental property is listed on realestate.com.au remains at historically low levels, reflecting tightness in the rental market.

![]() The median days on site nationally in December 2023 was 19 days.

The median days on site nationally in December 2023 was 19 days.

“With total rental listing volumes at historic lows and well below their decade average, rental conditions are likely to remain challenged, Cameron says.

“There is a critical need for additional housing, particularly in the major capital cities. Serious consideration needs to be given to the financing of these projects and the capacity to build the volume of housing we need.”

The key metrics for the report include rental prices, rental yields, new rental listings, total rental listings, rental vacancy, rental days on site and enquiry per listing.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.