Recession fears: Why the Big Bad Wolf could be a load of hot air

Pic: Getty Images

- A lack of understanding of recessions and what they mean is what often sparks fear among investors

- Australia well-placed for long-term economic growth with history showing strong recoveries from recessions

- Morningstar believes Australian equities are currently 10% undervalued and make for good buying

The term “recession” can send a shudder up the spine of many an investor and is one which has been bandied around of late on the back of rising inflation, interest rate hikes, supply chain shortages from the war in Ukraine and concern about slowing global economies.

But for all the doom and gloom which hit the media last week as the ASX followed its US big brother with sharp declines, are recession fears warranted?

Morningstar equity research strategist Gareth James told Stockhead often the media and investors get fixated on the term recession and while it is possible, it should not be reason to invoke panic stations.

“Recession is quite an arbitrary term and technically defined as two consecutive quarters of negative GDP growth so all you need is GDP to fall for two quarters and then you have a recession,” James said.

“If your economy is growing at 10% and it slows down and falls to 1% that is massive but it wouldn’t be classified as a recession because it is still positive growth.”

He said recessions are a bit like a bear market which is defined as when a broad market falls by 20% or more from its most recent high, while a correction is when it falls around 10%. The ASX officially entered correction territory last week falling more than 10% from its 7632.80 high in August 2021.

“These are random arbitrary definitions that someone once came up with and we can ask why 10% or 20% and why two quarters of negative GDP growth?” James said.

He said such falls are not predictors of what is going to happen in the market going forward.

BetaShares chief economist David Bassanese told Stockhead in the US there is an organisation called the National Bureau of Economic Research (NBER) that officially declares when recessions begin and end. It judges a recession to have begun when there has been a “significant decline in economic activity that is spread across the economy and that lasts more than a few months”.

“In Australia there is no such organisation, and we tend to rely on the ‘technical’ definition of recession being two consecutive quarters of negative GDP growth,” he said.

Bassanese said recessions shouldn’t be feared and are like the seasons, they really can’t be avoided indefinitely as they are part of the ups and downs of the economic cycle.

“Indeed, to an extent it is sometimes better to let a recession take hold rather than allow massive credit or inflation imbalances to develop – as the latter can eventually result in even deeper and longer economic downturns,” he said.

“As with the seasons, the bitter winter of recessions are eventually followed by the flowering of spring and the warmth of summer.

“Far from fearing recessions, long-term investors should be on the lookout for opportunities to add stocks and ETFs to their portfolio at better valuations.”

Did you notice the 2020 recession?

James said a lot of people talk about a recession like it’s the end of the world. However, Australia had a recession in 2020 and most people didn’t even notice and it hardly impacted the stock market.

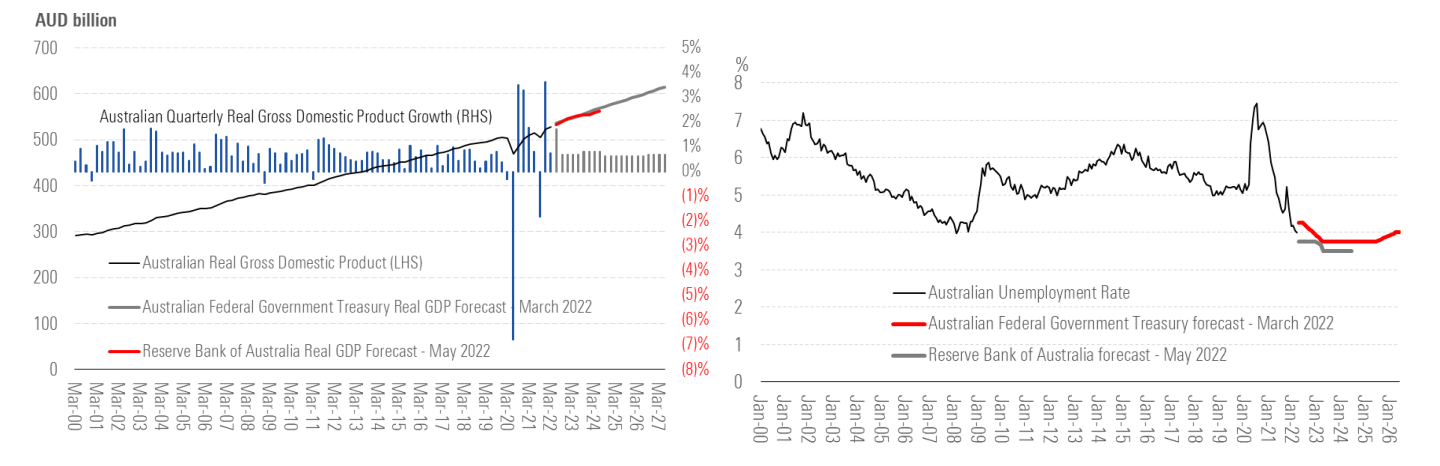

Australian GDP higher than ever; Australian unemployment near 50-year lows

“The blue bars are quarterly growth rates and you can see that between 2000 and 2020 there was the odd one that was negative but mostly it was positive all the way,” he said.

“When you get to 2020 you can see there is one negative and then a very big negative when we went into lockdown – now that is technically a recession, so you can see the black line turn down and then it rebounds.”

He said Australia is currently at record GDP again so it didn’t take very long. The grey and red lines are the RBA’s and Australian Federal Treasury’s forecast for GDP, showing they expect GDP to continue to grow.

The unemployment chart shows the jobless rate at 50-year lows, measuring 3.9% in April.

The charts show Australia’s strong economic position with record GDP and unemployment effectively at record lows.

“I get that this is backward-looking data to a certain degree but it is easy for investors to get caught up in the skittishness of the market and share prices and forget about the fundamentals and long-term trends,” James said.

Australia well-placed for long-term growth

James said Australia is a country that is set up really well for long-term success and he strongly believes that it will continue to become a stronger economy.

“It is what we have seen over the past 100 years and if you take that long-term view, then even if we have a recession, does it really matter?” he asked.

He said if you look at history, countries find a way to muddle through adversities such as wars, inflation, public health crisis, supply shortages and cost of living squeezes.

“Recessions will come and go… the economy won’t go up in a straight line and sometimes it will be growing quickly, sometimes it will be slowing down and sometimes it will fall a bit but generally speaking over the long term in Western countries economies have grown,” he said.

James said the reasons economies tend to grow is populations – while they may slow – tend to grow and there are technological advancements over time which combined drive the human race and economies forward.

“In 10 or 20 years time society will be more sophisticated and we will have more people so you tend to have this long-term growth in economies which is reflected in equity markets as a result,” he said.

While there’s been commentary around rising interest rates pushing the Australian economy into a recession, James said it is worth noting two things – rates have been at record lows of near zero since 2020, and the RBA’s reasons for hikes.

Central banks like the RBA have monetary policy goals which are generally to maintain steady economic growth and price stability with an inflation target of 2-3% per year.

If inflation runs too high (it’s forecast to nudge 7% in Australia in coming months), then tightening monetary policy and lifting rates should in theory reduce aggregate demand (what we all consume) and bring it back under control.

“The reason interest rates are going up is because the economy is very strong, so if it got to the stage that interest rate rises causes a complete collapse in the economy, which I don’t expect to happen, then interest rates will go down,” he said.

“They’re going up because unemployment is at near 50-year lows and there is so much demand that the economy can’t cope and it’s driving prices high.”

While we have demand-push inflation there is another type as well which we’ve seen over the past couple of years with Covid-19 lockdowns, logistics bottlenecks, war in Ukraine and volatile weather. It’s known as cost-push inflation.

With cost-push inflation people may not be consuming more but prices are still rising due to the extra costs in producing goods and providing services. Yet James remains positive that cost-push inflation will also pass in time.

“Supply shortages due to flooding or supply chain are almost certainly going to be temporary and not a long term concern,” he said.

Look past short-term cycles

James said whether we will have a recession in the short-term and company profits turn down for a while, it should not be a major concern for investors with a long-term outlook.

“If you look at a well-established company you could say maybe they will have a tough year or two but it doesn’t mean they are a bad company,” he said.

“If you’re a long-term investor and care about owning businesses which will do well over many years, then a recession for a year or two is not going to be a deal.”

James said the problem with a recession is it not a well-defined term and what you need to know as an investor is more details.

“When it comes to a recession you want to know how much decline will there be in the economy and how long will it go on?” he said.

James said that because these questions don’t have definitive answers, it’s like saying “there’s a downturn in equity markets” but not knowing by how much. He said it’s the uncertainty which is hard for investors to digest, which we discussed strategies for dealing with last week.

“Investors often read the news, see the scary headlines and think they’d better get out of their equities but actually you have to hold your nerve and realise it will be fine.”

Taking a contrarian view on ASX

Morningstar is positive on Australian equities at the moment, believing they are underpriced, and actually took a more conservative approach as markets rose steeply following the March 2020 sell-offs.

“We are not as pessimistic as the broader market and the first thing to say is we were initially very positive on equities back in March 2020 when the market crashed,” he said.

“But we became less positive as the market rose sharply to the point in 2021 where we were quite bearish and thought the market was about 15% overpriced in Australia.

“But equally as the market has fallen, we have become more positive and think it’s about 10% undervalued, so there has been a very big swing there.”

James said Morningstar has a more stable view of the valuation of equities than the broader market.

“That’s why we were negative in 2021 and now we are becoming increasingly positive,” he said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.