Real estate prices in Australian capital cities are set to surge 18.5% in 2021 — so where to next?

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

The historic surge in real estate prices has been a central feature of Australia’s post-COVID capital markets.

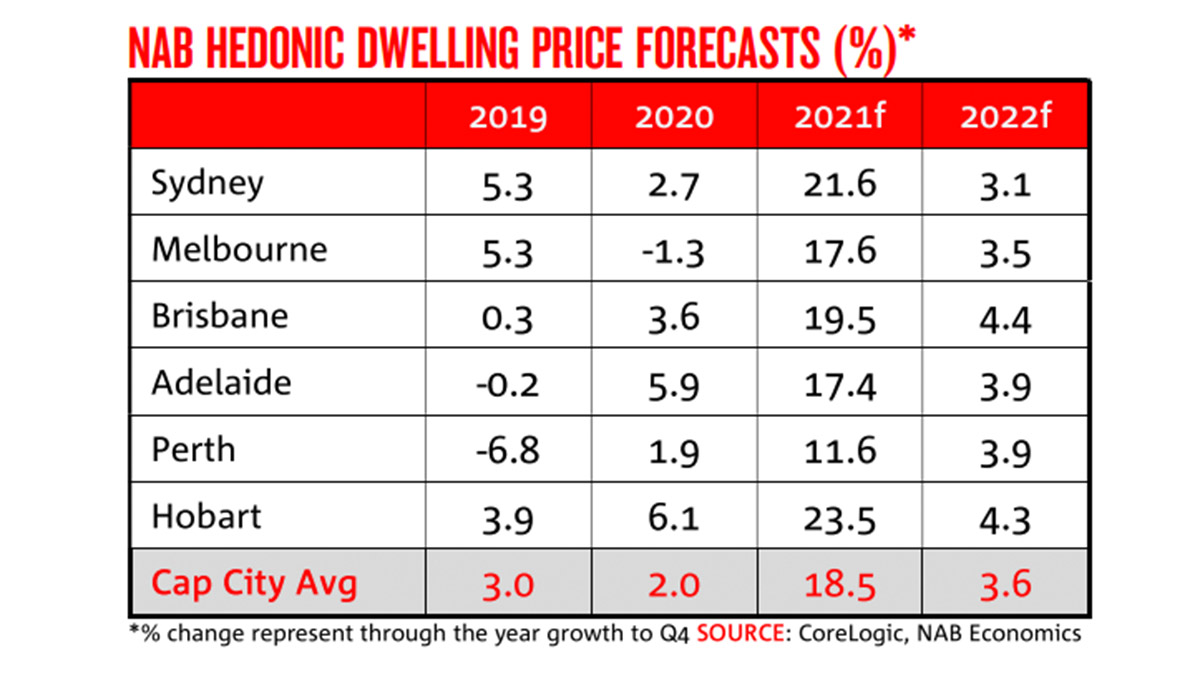

For a quick wrap of the numbers, here’s the latest set of price data and market forecasts from NAB:

Who needs stonks when capital city real estate prices are set to rip higher by 18.5% this year?

Snap up Hobart property while you still can (+23.5%). And despite the impact of COVID-19 lockdowns, the bank still expects Sydney real estate prices to rip higher by 21.6% this year.

While 2020 is an outlier, the table puts the price action into a recent historical perspective given the aggregate gain in 2019 — when interest rates were cut three times — was just 3%.

Real estate prices — where to next?

Markets are always forward-looking, and NAB doesn’t expect those 2021 returns to flow into next year.

The bank’s economics team still expects steady growth across the board in 2022, but at an average rate of only 3.6%.

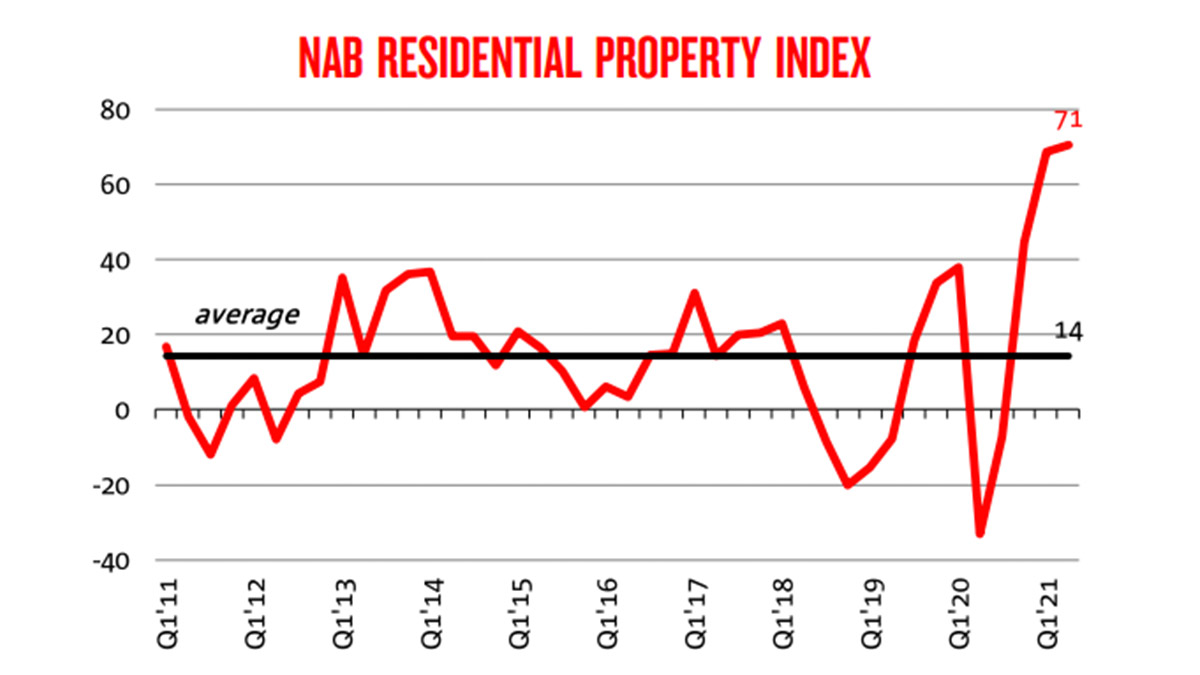

As a gauge of the unique market conditions, NAB’s residential property index — based on a survey of industry participants — rose to a new record high of +71 in the June quarter.

That’s just 15 months after it slumped to almost -40, and around 5x the long-term average for the index of +14.

In the near term, while NAB expects monthly growth rates to slow this year, “we still see solid growth over the next 6 months”, the bank said.

As for the 2022 outlook, NAB flagged a key feature of the post-COVID boom which is the prevalence of first-home buyers (FHB) entering the market (rather than investors driving prices higher).

In that context, the sheer pace of growth in 2021 real estate prices means resulting affordability constraints could cramp FHB activity.

“Affordability constraints will likely begin to bind over the year, and see a slowing in price growth as the impact of lower rates fades,” NAB said.

More broadly, NAB said the extended NSW lockdown will take a decent clip off Q3 GDP, while unemployment may rise.

“But we remain optimistic that as restrictions are eased activity will rebound, as has been the case in previous lockdowns,” the bank said.

In that context, it predicts Australia’s unemployment rate will hold steady below 5% through to the end of 2023.

Interestingly, NAB’s economics team shares the RBA’s view that interest rates — a central input in the outlook for house prices — won’t rise until 2024.

That differs from Commonwealth Bank’s call for rate hikes at the end of next year (although CBA’s economic team has flagged some more recent uncertainties stemming from the Sydney lockdown).

The bank’s economics team expects to see bouts of upward pressure on wage growth and supply chain bottlenecks that could flow through to higher inflation.

However, for now they are in the ‘transitory’ camp — that suggests such forces are unlikely to become entrenched enough to warrant a shift forward in the time-frame for rate hikes.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.