RBA’s hard choice: No point dwelling on weak approvals when China and home lone arrears drag the AUD toward a nasty new low

Hard decisions ahead for the RBA. Via Getty

Just when you though it was safe to get back in the water…

Late last week the Australian dollar had a moment of courage and pulled the handbrake on its long and often painful slow motion tilt over the edge of some great and unnamed ravine.

The Australian dollar has now made a descent of around 6.5% from its most recent high at the beginning of February.

Surprisingly upbeat Chinese manufacturing and services PMIs were behind the glitch, but as IG analyst Manish Jaradi noted on Monday, for AUD/USD’s rebound to be sustainable however, our growth and monetary policy divergence with the US “may need to reverse”.

“Australian macro data since the beginning of March have been underwhelming,” Jaradi says.

Over in the US, the macro signals have been far warmer – excelling expectations since the start of February. US rate futures are now pricing in a Fed rate at 5.43%, up from 5.25% two weeks ago.

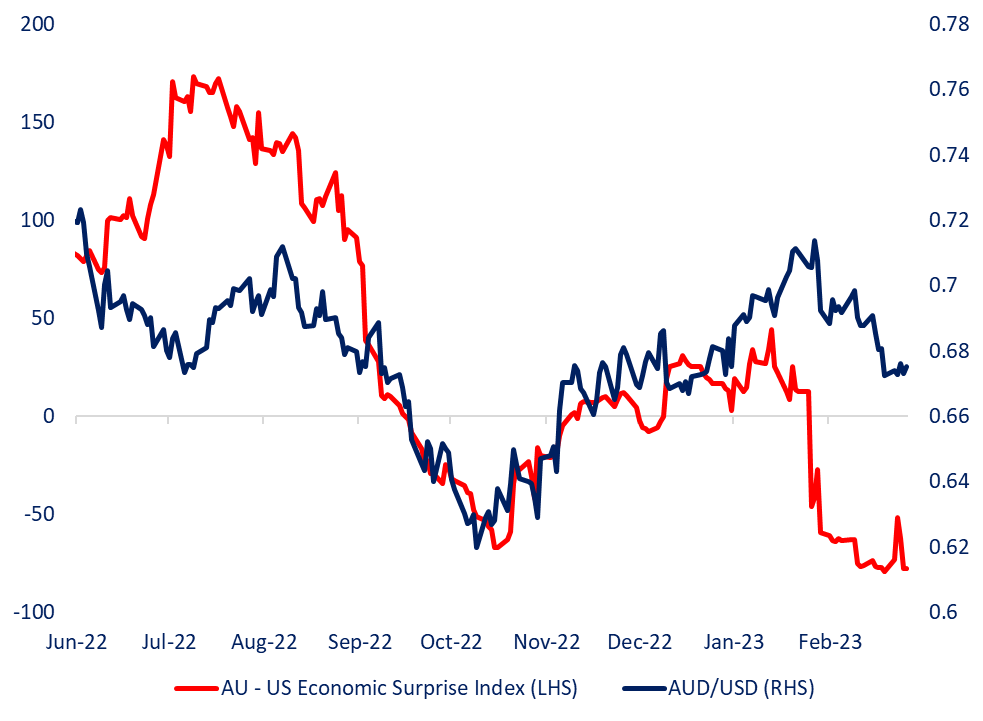

“The relative underperformance of the Australian economy and AUD/USD recently is reflected in the Economic Surprise Indices (ESI) – the Australian ESI is languishing around the 2020 lows, while its US counterpart is at the highest level in 10 months.”

AUD/USD vs Australia Economic Surprise Index (ESI) relative to US ESI

Our economy grew at the weakest pace in a year last quarter while monthly consumer prices rose less than expected in January.

“Building approvals fell the most on record suggesting that the housing market is feeling the heat of the Reserve Bank of Australia’s rate hikes. Rate futures are nearly unchanged, now pricing in the terminal cash rate at 4.18%, around 4.17% two weeks ago.”

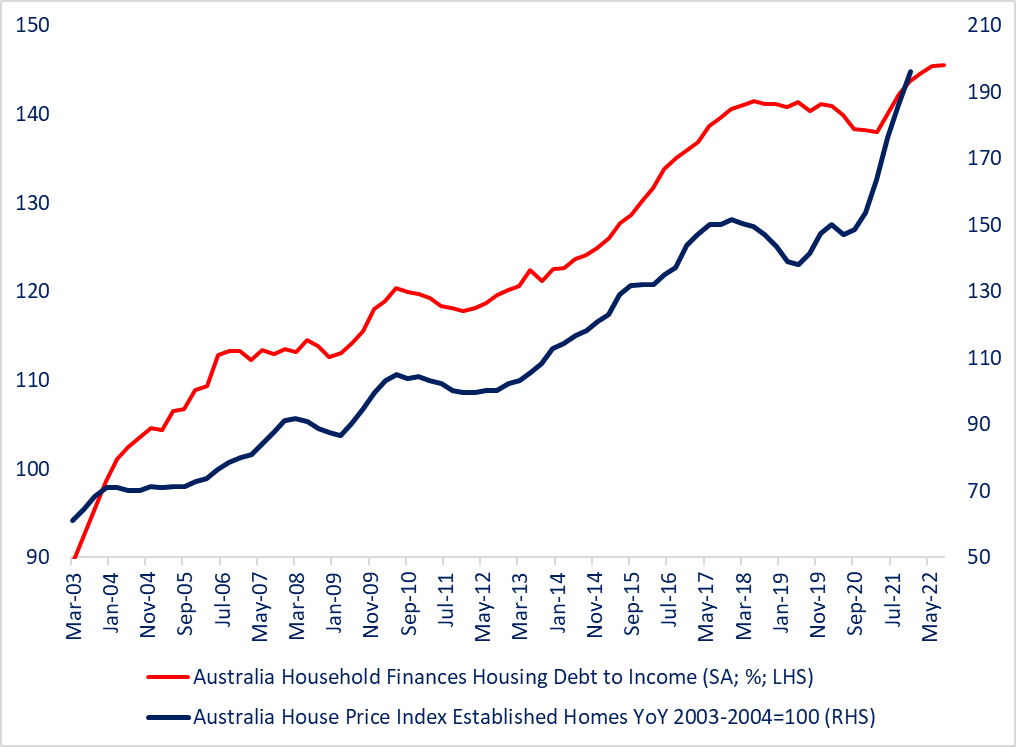

Australia household finances vs housing prices

But as we’ve come to learn very well, what China giveth, China taketh away pretty quickly.

We might’ve done some decent diversifying after the Chinese Communist Party decided to use its economic clout to try and punish the then Liberal/National coalition for its strident commentary, but China still accounts for about half of the globe’s industrial metal demand and 65-70% of the world’s iron ore imports.

China is still hands down our biggest export market and iron ore remains our big ticket export earner.

Fortescue Metals (ASX:FMG) remains our most China exposed doyen of ore, and it slipped well over 3% on Monday.

As CBA’s Vivek Dhar puts it, global base metals and iron ore markets (of which we are enthusiastic participants), are “particularly exposed to China’s policy decisions” given that it accounts for 40-60% of base metal demand too.

Over the weekend, China’s Premier Li Keqiang offered up his final yearly economic appraisal and outlook for 2023, implyoing China is less likely to use debt – doshed out to local governments – to prop up the economy. That hasn’t thrilled metals markets.

All in all, it looks likely that China’s infrastructure-related commodity demand impulse may ease this year, Vivek said on Monday.

Bloomberg estimates that there’s RMB 1.1tn of unused local government special bond issuance left over from last year.

“This could still be used in 2023 if the economy falters. China’s infrastructure sector accounts for 20-35% of China’s copper, steel, aluminium and zinc consumption.”

CBA: A more selective use of debt can still boost China’s commodity demand

According to CBA, China’s property construction sector accounts for 35-40% of China’s steel demand and 20-30% of China’s copper, aluminium and zinc consumption.

“The government is looking to engineer a soft landing for the property sector after the severe downturn last year. The government will look to prevent property developers from increasing risks to the financial system, while supporting first-home buyers.

“China’s commodity demand will likely remain strong through H1 2023 on pent-up demand linked to the reopening of China’s economy at the end of last year.”

Vivek says if China manages to engineer a soft landing for the property sector, commodity demand in the second half of this year will likely only ease moderately from H1 2023 (but still remain slightly above H2 2022 levels).

“Additional infrastructure investment will only likely be an option if China’s economy looks at risk of growing below 5% (GDP target) in 2023.”

But speaking more plainly and possibly from a darker place, the ANZ says China’s “relatively modest” 5% growth target is simply “a headwind for exports” – taking it as a clear sign “large-scale stimulus” is probably off the table.

Being older and possibly wiser than many Australian banks, this author’s pretty sure that China under a third term Xi Jinping is very unlikely to be able to keep his finger off the stimulus trigger for long. Even if it means handing back the Ferrari keys to the local governments which drive infrastructure builds and consequently metals demand. He’s just not going to wait for the ship to right itself, not when he’s finally secured the keys to the kingdom himself.

The Aussie doleur

Anyhoo. Amid all this abacus shaking, it’s the Australian dollar that’s now copping it badly from both directions.

The Aussie slipped as much as 0.5% in early trading on Monday to 67.43 US cents.

CBA’s currency whisperer Joseph Capurso reckons the AUD is potentially within reach of touching a fabulous new 2023 low point.

Because not only has Li Keqiang’s 2023 budgetary proposal not proferred the glorious growth targets Australia has come to expect of a flagging Chinese economy, but all this weak local data could trigger a brain snap tomorrow and have the central bankers readjust their inflation big guns at the crucial Tuesday policy meeting.

The Aussie will also be weighed by Federal Reserve Chairman Jerome Powell and Reserve Bank of Australia governor Philip Lowe taking different policy stances this week, according to Commonwealth Bank of Australia.

Feeling the strain of these headlines, and with local mortgage arrears on the rise and dwelling approvals on the decline, Matt Simpson, the senior market analyst at City Index, notes that these are likely to weigh on the Aussie, and any Aussie muffins living and working OS.

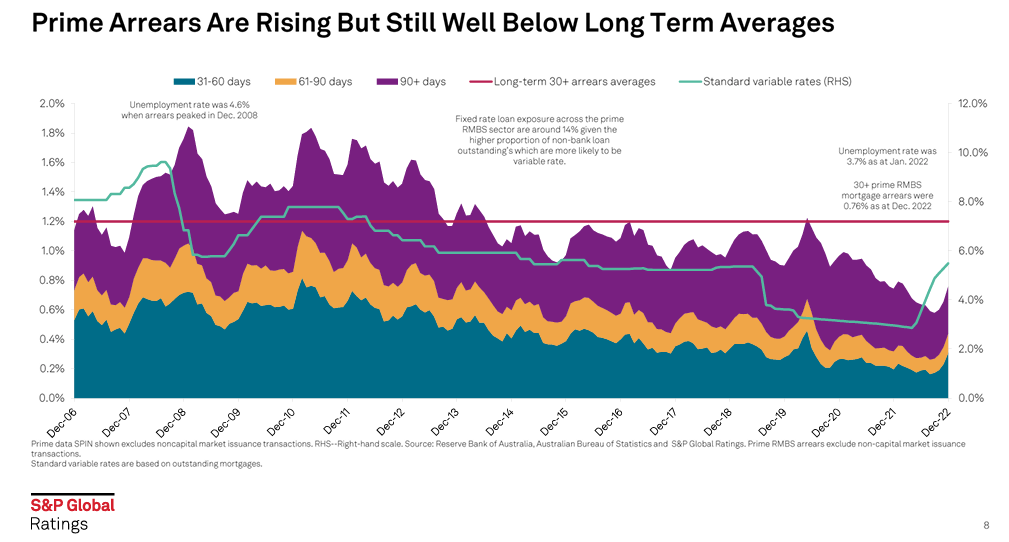

The S&P Global Ratings Agency claim that Australia’s prime and non-confirming mortgage arrears are on the rise, after a historic series of interest rate hikes.

“Whilst arrears remain beneath their long-term averages and just coming off their record lows, the trend is expected to continue to rise as former and futures RBA hikes finally make their way through the Australian economy,” Matt says.

“It shouldn’t come as too much of a surprise given recent hikes, but it may still surprise many who are yet to feel the effects a real recession in recent years.”

Matt adds that the building approvals report also revealed just over 12,000 units were approved in January – its lowest level since July 2012 and a 27.6% drop from December.

The annual rate is now -8.4%. NSW was the most affected state with a -49% fall in January, with Victoria close behind at -38.6%.

“The RBA are still likely to hike by 25bp with inflation will over 7%. But we can expect them to pay close attention to these developments, as it aims to cool the economy without completely cracking it.”

AUD/USD 4-hour chart:

The Reserve Bank Board of Australia is scheduled to meet at 2.30pm. All 27 economists surveyed by Bloomberg expect the RBA to lift rates by 25bp to 3.60%.

“Given that household leverage has risen significantly over the past two decades, the rate hikes could have adverse repercussions on household balance sheets. Key focus is now on RBA interest rate decision due Tuesday, March 7 – the central bank is widely expected to hike the cash rate by 25 basis points,” IG’s Manish Jaradi says.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.