Puttin’ on the lists: IPO land is silent, so here’s a list of the world’s greatest ever

What a terrific list. Via Getty

The global IPO market has been a fizzler so far this year. There were some initial hopes of an initial public party after the hangover of ’22 following the binge of ’21.

But potential IPOs in ’23 have evaporated in a puff of panic.

And why not. It’s a world of uncertainty. The VIX is volatile. Inflation is quasi-rampant. The cost of money might never stop rising. Wall Street’s mustered another bank crisis.

Washington could still default as the debt ceiling nonsense drags on sans fin.

As Bloomers put it yesterday, China can at least claim victory over the states in one area. It’s suddenly dominating the global IPO market. But even China’s circa 100 plus deals and its unnaturally sugary US$25 billion of raised capital, year-to-date, is far from the way any mature IPO market would want to function.

At home, there’s been only 10 new listings in 2023 amid the constellation of macro issues.

Earlier this month, Eddy spoke with James Posnett, the ASX General Manager of Listings, about the factors keeping a lid on local IPOs.

Posnett told Stockhead there’s a second half IPO bounce in the post.

The ASX IPO class of 2023 is doing

Here are the 10 ASX IPO listings this year, and their returns up to the first week of May.

| Code | Name | IPO Price | Current Price | Return | Day 1 return | Market cap | Listing date |

|---|---|---|---|---|---|---|---|

| EG1 | Evergreen Lithium | $0.25 | $0.43 | 70.00% | 20.00% | $23.9m | 11/04/2023 |

| PL3 | Patagonia Lithium | $0.20 | $0.18 | -12.50% | 10.00% | $8.58m | 31/03/2023 |

| LM1 | Leeuwin Metals | $0.25 | $0.32 | 26.00% | -4.00% | $12.69m | 29/03/2023 |

| SQX | SQX Resources | $0.20 | $0.14 | -32.50% | -15.00% | $3.38m | 20/02/2023 |

| HTM | High-Tech Metals | $0.20 | $0.23 | 15.00% | 2.50% | $5.67m | 23/01/2023 |

| ADC | Acdc Metals | $0.20 | $0.09 | -54.00% | 0.00% | $4.3m | 17/01/2023 |

| DYM | Dynamic Metals | $0.20 | $0.17 | -17.50% | -5.00% | $5.78m | 16/01/2023 |

| GHY | Gold Hydrogen | $0.50 | $0.38 | -25.00% | 2.00% | $19.13m | 13/01/2023 |

| ACE | Acusensus | $4.00 | $3.44 | -14.00% | 0.00% | $86.74m | 12/01/2023 |

| VHM | VHM | $1.35 | $0.88 | -34.80% | -15.60% | $131.01m | 09/01/2023 |

Meanwhile, in the states, direct listings and IPOs with an initial valuation of at least US$50 million numbered just 71 last year, down from nearly 400 in 2021, according to official data.

The biggest IPO in 2023 so far has been that of Johnson & Johnson’s spun-off consumer brands division, Kenvue, which made its debut on the NYSE bourse last week at a market cap of around US$40 billion.

An initial public offering (IPO) is the first time a company lists its shares on a stock exchange. The process is commonly referred to as ‘taking a company public’, as it’s the first time a company offers shares to the public.

A possible benefit of going public for a large company is that selling shares can potentially raise the value of the company and increase its available capital. And as long as it is attractive to investors, a company can profit if the share price increases after the IPO.

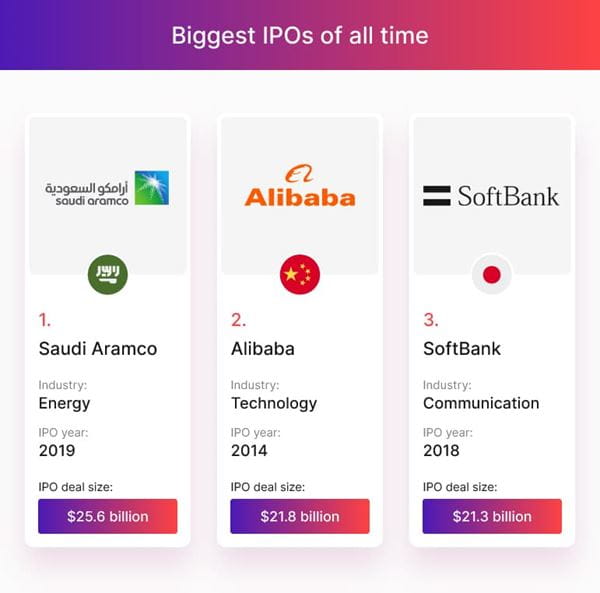

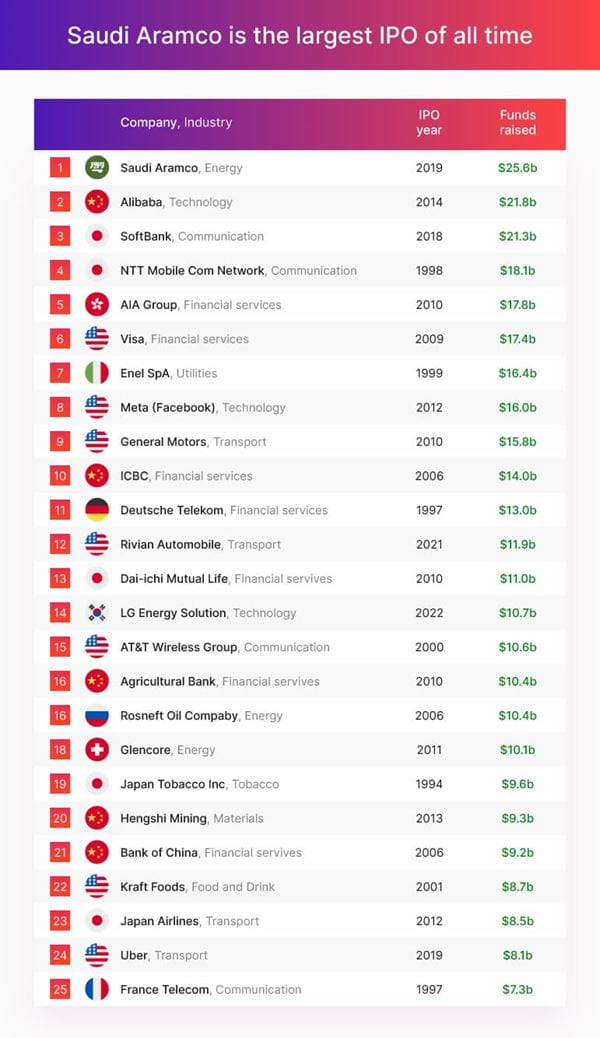

Over the years countless companies have gone public, with varying success. But which have been the biggest? The legends at City Index reeled out a cracking study of the largest IPO deals of all time across the globe, so here’s their definitive list.

All the numbers are in USD.

1. Saudi Aramco

IPO deal size: $25.6 billion

The largest IPO of all time occurred in 2019 when Saudi Aramco oil company was floated. The offering generated over $25 billion in investment, beating the previous record holder by almost $4 billion. Aramco’s public market cap is almost $2 trillion – as of March 2023 – making it the third most valuable company in the world (City Index) after technology giants Apple and Microsoft.

Based in Dhahran, Aramco is the biggest daily oil producer in the world with more than 270 billion barrels in crude oil reserves and has the sixth-highest revenue of any company, reporting over $400 billion2.

2. Alibaba

IPO deal size: US $21.8 billion

Alibaba is a Chinese technology company founded by Jack Ma in 1999 which has gone on to become one of the most valuable companies in the world, it made over $100 billion in revenue in 2022. Its IPO generated almost $22 billion when it was floated on the New York Stock Exchange in 2014, a record for an IPO at the time.

3. SoftBank

IPO deal size: US $21.3 billion

The SoftBank Group is a Japanese holding company which has interests in many different industries, including owning almost 24% of Alibaba. The SoftBank Corporation is an affiliate business that is the third-largest wireless carrier in Japan, and it was this wing of SoftBank which had the third-largest IPO in history in 2018.

The offering made $21.3 billion, just $500 million less than Alibaba four years earlier.

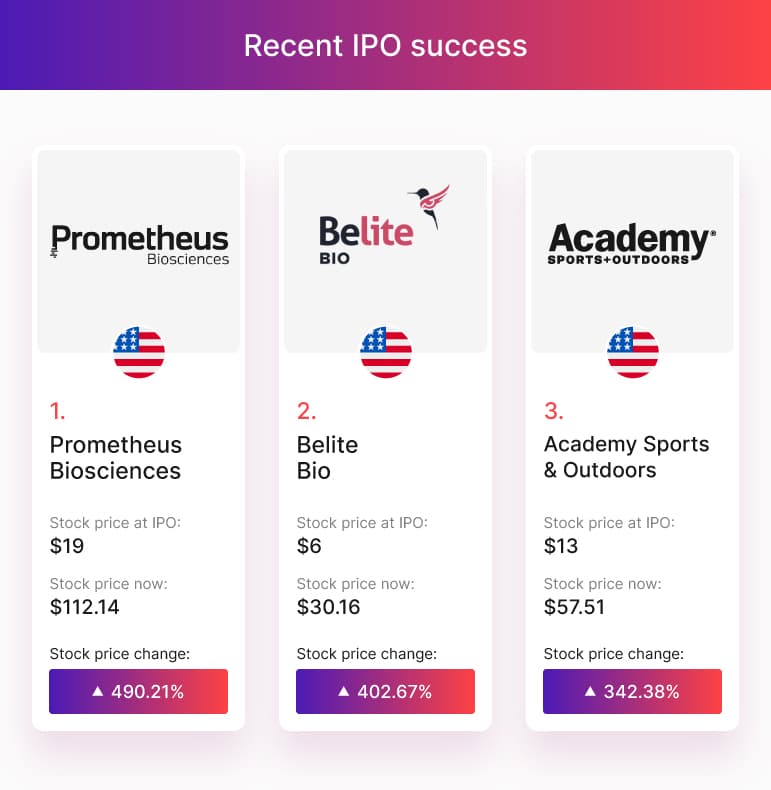

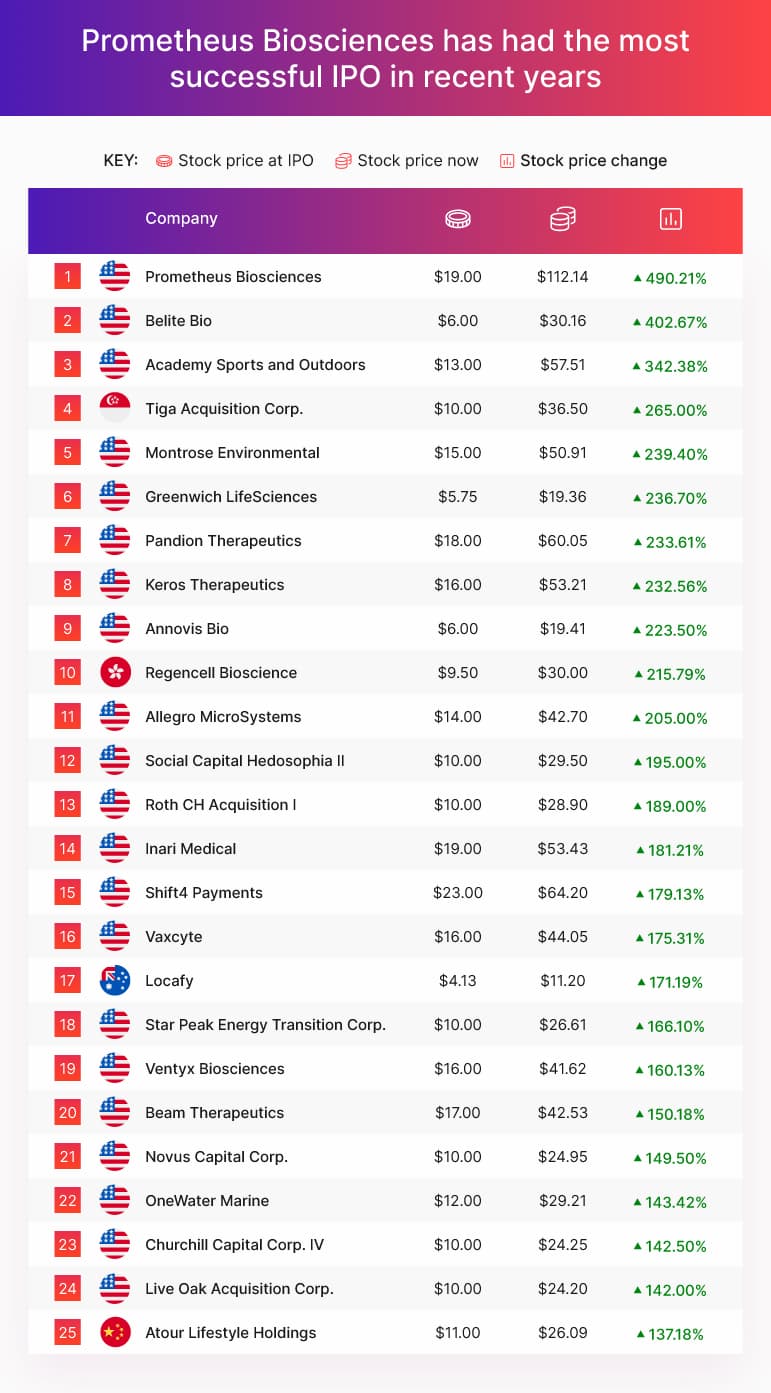

Recent IPO success

Which companies stock price has risen the most since their IPO?

1. Prometheus Biosciences

Stock price at IPO – $19

Stock price now – $112.14

Stock price change – 490.21%

Prometheus Biosciences has had the most successful IPO in recent years, the pharmaceutical company had an IPO in March 2021. When it was initially floated the share price was $19 but has since risen to over $112 – meaning that investing $1,000 in the IPO would be worth $5,902 today.

2. Belite Bio

Stock price at IPO – $6

Stock price now – $30.16

Stock price change – 402.67%

Another stock that’s risen over 400% since its IPO is Belite Bio, which is also a pharmaceutical company. This San Diego-based company was founded in 2016 and went public six years later in April 2022. If you had invested $1,000 in the Belite Bio IPO you’d now have $5,027 worth of stock.

3. Academy Sports and Outdoors

Stock price at IPO – $13

Stock price now – $57.51

Stock price change – 342.38%

Academy is an American sporting goods company which had the third-highest increase in the stock price of any company that has gone public in recent years. The share price rose by almost 350% since the company was floated in October 2020. This means that a return of $4,424 could have been made from a $1,000 investment in this IPO.

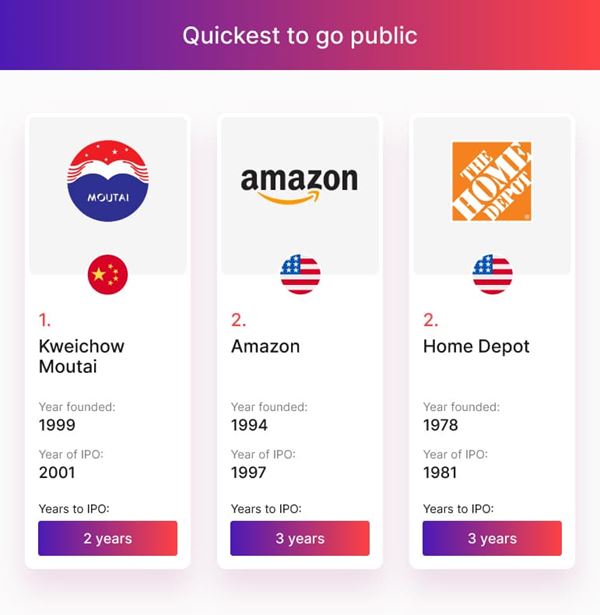

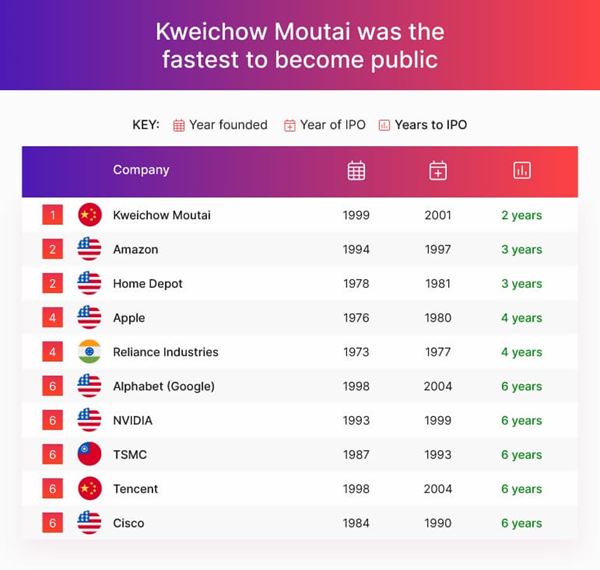

Quickest companies to go public

One of the most significant moments in the life of a company is when it announces its IPO. In order to reach this point, the business will have had to perform well and offer potential investors a promising return on their investment.

These are the companies that have sprinted from being founded as privately held companies to floating their stock for public purchase, completing the process in three years or less.

1. Kweichow Moutai

Year Founded – 1999

Year of IPO – 2001

Years to IPO – 2

Of the 25 largest companies by market cap, Kweichow Moutai was the fastest to become public. The Chinese government part owns this company, which makes an alcoholic spirit and is the largest beverage company in the world. In 2021 its revenue was just over $109 billion according to Reuters4.

2. Amazon

Year Founded – 1994

Year of IPO – 1997

Years to IPO – 3

AMZN boss Jeff Bezos is one of the richest men in the world based on the success of the online retail giant, Amazon. The company has thrived as the internet boom of the 21st century coincided with its operation growing across the globe. Amazon had an annual revenue of just under $514 billion in 2022.

3. Home Depot

Year Founded – 1978

Year of IPO – 1981

Years to IPO – 3

Another company that took just three years to become public after it was founded is the hardware and living store, Home Depot. The American retail giant made an annual revenue of over $151 billion in 2022.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.