Property: Eliza says if inflation is on the rise again something at home is gonna give

Via Getty

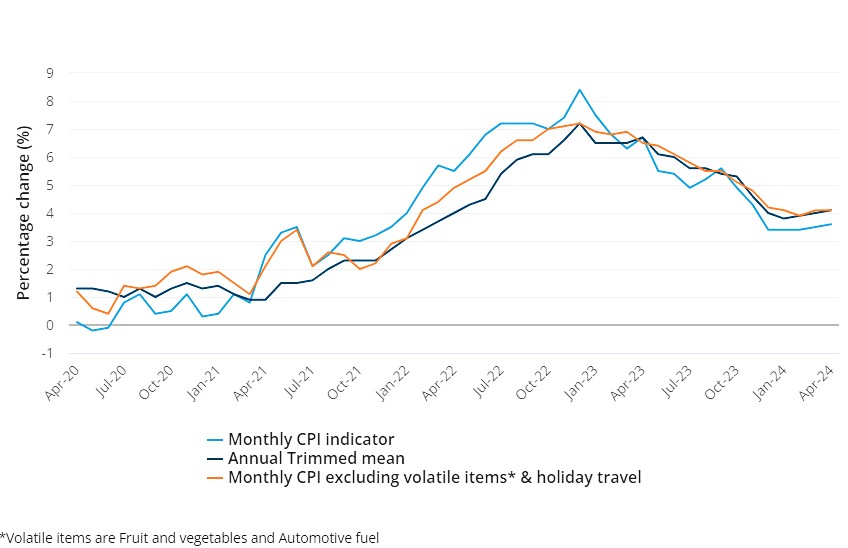

On June 26, the Australian Bureau of Statistics (ABS) dropped a hotter-than-expected monthly Consumer Price Index (CPI) on us, one which painted a pretty clear pic of inflation coming on, not backing off.

The CPI indicator showed the ‘trimmed mean’, measure of annual inflation lifting to 4.4%, up from 4.1% in April.

And while the monthly read isn’t as accurate a measure as the bureau’s quarterly inflation drop, there’s naturally growing concern that Aussie inflation is rising, instead of falling.

And will this necessitate another bump higher for the cash rate?

The ABS says that the largest increase in May prices were across housing, up 5.2% year-on-year.

Ironic and timely, really, because we just asked CoreLogic’s head of research Eliza Owen whether the May inflation bump could be the catalyst for another Reserve Bank rate hike.

And we also asked how that might impact the local housing market after CoreLogic revealed last week that local home prices added a further 0.7% in June, taking growth to 8.0% across FY2023-24.

That’s the equivalent of adding about $59,000 to the price of the average Australian home over 12 months.

They now cost on average $794,000, BTW.

No choice but to act

Memorably, Betashares chief economist David Bassanese called the May CPI data a shocker.

“The upshot is that it places enormous pressure on the Reserve Bank to not only not cut interest rates any time soon, but potentially lift them further.”

Monthly CPI Measures (YOY% change)

David says the June quarter CPI report, which drops on 31 July, will now be of immense significance to markets.

“If that confirms the still-bubbling inflationary pressure evident in the monthly CPI reports over recent months, the RBA will have no choice but to act.”

Eliza, why are housing values increasing despite higher interest rates?

“The Australian housing market has been fairly resilient despite higher interest rates.

“The chart above shows the cumulative change in national home values from May 2022, showing an initial peak-to-trough fall of -7.5% from the start of the rate-hiking cycle through to January 2023, which marked the low point of the downturn in housing values.

“From the start of 2023, the cash rate would increase a further five times, but home values consistently rose, staging a recovery by November 2023, and rising further to be 4.6% higher than in May 2022.”

Eliza notes there are a few explanations for why housing values have continued to rise even as the cost of debt has risen, and borrowing capacity has eroded.

“Part of the explanation comes from low supply relative to demand. Tight labour market conditions and an accumulation of savings through the pandemic have broadly underpinned mortgage serviceability, mitigating a need to sell as rates have increased, the construction sector remains squeezed, and unable to deliver a large backlog of dwellings, and strong population growth has increased demand for housing, both for purchase and rent.

“In the June quarter, there were around 127,000 homes purchased, but only about 125,000 new listings added to the market for sale.”

Eliza says as long as there are more people willing to purchase a home than sell, prices should theoretically continue to rise.

“The composition of buyers may also be propping up purchases, with higher deposit sizes indicating the current buyer profile may be less debt-dependent than when interest rates were at record lows.

Other demand-side factors influencing housing purchases could be the predominance of variable rate mortgages in Australia.

Eliza says home buyers may be pricing in a future cut in the cash rate to their purchasing decisions, with the expectation they’re buying in at the peak of the rate cycle, and their mortgage rates will trend lower over time.

“From this perspective, a further rate increase could certainly slow demand and signal to the market that interest rates are not yet at peak or at the very least, are likely to take longer to reduce.”

Another rate rise will hurt, and some cracks are already showing

Despite resilience in the headline numbers, Eliza says there’s some suggestions that demand is already weakening.

National home values were up 1.8% in the June quarter, but this has slowed from a 3.3% rise this time last year, when the market was rising off a lower base.

“Buyer demand seems generally skewed to cheaper markets, with Perth now being one of the primary markets driving growth in the capital cities. In the month of June, it is estimated that Perth accounted for 32.4% of the 0.7% uplift in CoreLogic’s capital city home value index. Adelaide has also contributed more to the headline growth figure through June (14.2%), up from 4.1% a year ago.

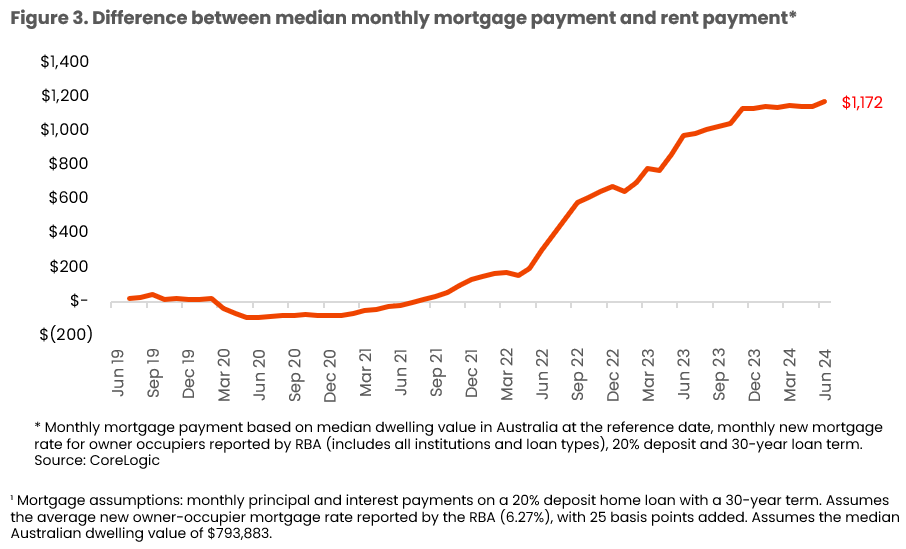

“Another 25 basis point rise in the cash rate in August, all else being equal, would take monthly repayments on the current median dwelling value to over $4,000 per month.

“Not only is this further out of reach for prospective buyers, it would likely also represent a further blowout in the premium of holding a mortgage relative to renting. The bigger that premium becomes, the weaker demand for purchases may become relative to renting, despite rent growth still sitting well above average.”

Figure 3 shows the difference between the median dwelling value mortgage payment, and median rent value estimate in Australia on a monthly basis, which was $1,172 in June.

According to CoreLogic data – and assuming rents and housing values were steady in August – a further 25-basis-point increase in average variable mortgage rates would push the mortgage premium to $1,276.

The 0.7% rise in home prices in June arrived in stark contrast to the FY2022-23 when CoreLogic’s national index was down -2.0%.

In that year, annual growth was weighed down by a -7.5% drop in values in the nine months following May 2022, when the cash rate target started to rise.

Despite the strong annual gain, the trend growth rate has eased since the highs of mid-2023 when the quarterly rate of change peaked at 3.3%.

The most recent June quarter saw dwelling values rise by 1.8% which is roughly in line with the March quarter (1.9%) and December quarter last year (1.8%).

“Despite the falls seen across all types of buyers in May, the value of new home loan commitments has still risen 18% over the past 12 months,” Fiona Cotsell, ABS head of finance statistics

Visit https://t.co/pZ7N5kUqBX pic.twitter.com/lgnzQTSvoo

— Australian Bureau of Statistics (@ABSStats) July 8, 2024

Meanwhile, the size of the average new owner-occupier mortgage in Australia has hit a record high, as borrowers sign up to bigger debts than ever before.

ABS lending indicator data, released today for the month of May, shows the average new owner-occupier mortgage clocked in at $626,055, the highest level in ABS records.

This is despite the fact the cash rate is at the highest level since November 2011.

The average new loan size for owner-occupiers hit record highs in Queensland, South Australia and Western Australia.

While NSW still leads the way in terms of the largest average new owner-occupier mortgage at $767,584, this remains below the peak recorded in January 2022 of $803,235.

The average new loan size in Victoria fell this month and remains significantly below the peak recorded in January 2022 of $651,364.

So… should we expect an August rate rise?

The RBA has expressed an extremely low tolerance for any further uplift in inflation. However, there’s no certainty around an August rate rise yet, according to Eliza.

“The Reserve Bank’s own Deputy Governor noted last week that it would be a bad mistake to base the August rate decision on one result, highlighting that quarterly inflation figures, the labour market report and retail sales data could also feed into the rate decision.

Other economists have pointed to the limitations of the monthly CPI measure, which does not always indicate the direction of the quarterly result. Westpac’s economics team had predicted the increase in the headline result to 4.0%, in part due to base effects.

Despite NAB and ANZ now revising the timing of the first rate cut to 2025, none of the four major banks are anticipating another rate rise just yet.

However, Eliza says that even if rates do not increase further, housing purchases are expected to slow as economic conditions become weaker and affordability constraints play out.

“Labour force conditions are clearly starting to unwind, as job vacancies drop, employment growth slows and the unemployment rate rises lifts, which will limit new demand, and possibly weaken mortgage serviceability if mortgage holders become unemployed or work less hours.

“The household saving ratio has already weakened to just 0.9% of income in the March quarter, which will slow the accumulation of deposits for prospective home buyers, and impact savings buffers for households that own their home.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.