Property: Busiest Feb auction week since Adam, Eve expelled from Henson Park beer garden

Pic: Getty

CoreLogic says we’ve just had an especially insane week of residential property auctions – the busiest February week in fact since the property data firm started counting them back in 2008.

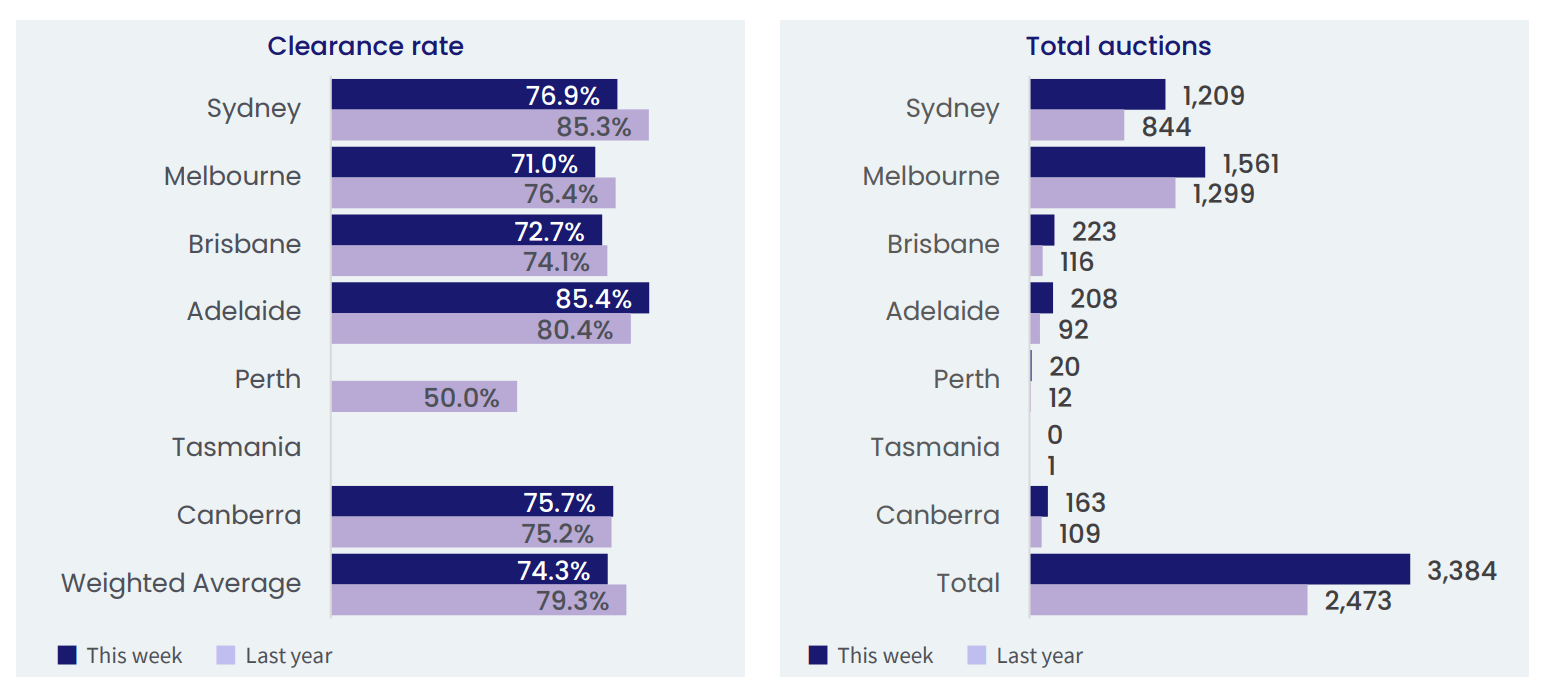

Some 3,384 homes went under the hammer across our combined capital cities, making something of a joke out of last week’s 2,898 auctions – or even better – the woeful 2,473 homes up for grabs the same week, last year.

Quantity not quality

CoreLogic’s research analyst Caitlin Fono, says of the 2,755 results collected so far, 74.3% were successfully flogged to some lucky moneybags – and that’s down slightly from the previous week’s final clearance rate of 72.8%.

This time last year, there were a good deal more moneybags about the place – with 79.3% of reported auctions finding a buyer.

Melbourne was easily Australia’s auction central, hosting 1,561 of them – some 45% of the entire lot and volumes are up over 18% compared to the week before(1,323), and up over 20% compared to this time last year (1,299).

The Thanos-like inevitability of the Sydney market enjoyed its busiest week of the year, with 1,209 auctions and a clearance rate of 76.9% also rising week-on-week despite the bump in volumes.

In the wee-cities – Adelaide recorded the highest preliminary auction clearance rate (85.4 per cent), followed by Canberra (75.7%) and Brisbane (72.7%).

In Perth, six of the nine results collected so far have been successful.

And there were no auctions in Tasmania this week.

Because, well, Tassie.

Spent on rent (but not as much as you will soon)

Its interesting to note – actually CoreLogic’s own Hypatia of Research Eliza Owen pointed it out – in the weeks leading up to the Feb 21 Great Reopening, the Bureau of Stats (ABS) flagged a real spike in OS arrivals as students, ostracised permanent residents but mainly Kiwis (40% of all short-term arrivals) – rode in as the Omicron wave played out here in December.

Now almost half of overseas migrants end up in the same 10 regions in and around Melbourne and Sydney, while the Coasts – Gold AND Sunshine Coast have always been the go to when it comes to domestic migration.

“The flow of people arriving from overseas is different to the flow of people moving internally in Australia, which is part of why housing market dynamics have looked a little different through a period of closed international borders,” says Eliza, who’s actual title is head of residential research at CoreLogic.

If the surge in migration continues Melbourne’s Inner city landlords will be cheering, where rental values have fallen in double digits (11.3%) in the past two years.

Pinpointing the pain

Eliza says there’s a “tenure cycle” – where newby-Aussie’s rent first, then go in for home ownership.

“The likelihood of home ownership increases with time in Australia, to the extent that rates of home ownership among overseas migrants is comparable with those that are Australian born,” Owen says.

“But this means recent arrivals to Australia are most likely to be renting, and this is where the housing market was most negatively impacted by border closures from March 2020.”

Owens reckons the fall in migration through the COVID period could have some tough implications for areas like Melbourne’s West and Sydney’s inner west markets, where there’s also been historically high internal migration flows from the inner city to these places.”

So if you’re reading this from those places, expect the landlord to come knocking soon.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.