Property: Aussies now need six figures to make a 20pc deposit; Unit squeeze, migration accelerate demand imbalance

Not quite. Via Getty

No matter where you live in Australia, saving enough for a 20% home loan deposit is now synonymous with having six figures in the bank, according to analysis from Mozo.com.au.

Australian Bureau of Statistics (ABS) data released last week shows that, in the June quarter, the mean price of residential dwellings rose to $912,700.

Australia’s looming unit shortage not helping

The news will come as as a shock to Australians trying to fight their way into a reinvigorated property market, where the lagging medium- to high-density sector has left a huge hole where more affordable properties could’ve been taking the sting out of the increasingly out of touch Australian residential real estate market.

In August, CoreLogic estimated that units made up 25.9% of national housing stock and around 30.4% of Australia’s capital city housing stock, up from 19.6% and 22.9% at the start of 2010, respectively.

The continued reliance on the unit sector to deliver fresh housing stock is particularly evident across some of Australia’s largest capitals, including Sydney and Melbourne, as well as the ACT, where limited land supply has made further development of low-density dwellings increasingly difficult.

The medium- to high-density sector is increasingly becoming an important tool in delivering additional housing stock for Australia’s growing population, especially as households continue to congregate in metropolitan areas.

With a median value of $637,593 (around 30% cheaper than capital city houses), capital city units offer a significantly more affordable entry point for first home buyers, as well as a lower maintenance option for both investors and downsizers.

However, the latest National Housing Finance and Investment Corporation (NHFIC) ‘State of the Nation’s Housing’ report forecasts a national housing deficit of approximately 106,300 by 2027 (later upgraded to 175,000), with around 59% of the shortfall expected in the unit market.

Below-average unit approvals and completions (below) shows the latest ABS building approvals data by property type.

In July, 4,490 units were approved for construction, down -19.9% from the month prior and -39.8% below the decade average. Excluding a handful of volatile months, the trend in new unit approvals has largely held below the decade average since mid-2018 and well below the trend in house approvals since late 2017.

National monthly housing approval by property type

To afford a 20% deposit, borrowers now need six figures in savings:

• A 20% deposit in NSW is now (on average) a whopping $233,500.

• A 20% deposit is (on average) roughly one and a half times the average annual

earnings.

In NSW, it’s more than double, and that’s pre-tax.

Mozo experts warn that getting a home loan with a smaller deposit has its pitfalls, and borrowers should be cautious of buying with low deposits.

“Despite rising interest rates historically leading to a drop in housing prices, the cost of buying a home in Australia is becoming increasingly unaffordable,” Mozo banking and rates expert Peter Marshall says, “and borrowers are now searching for more than $100,000 to cover a 20% deposit.”

A 20% deposit puts a borrower’s loan to value ratio (LVR) at 80%, which is where interest rates start to become more competitive and the need to buy Lenders Mortgage Insurance (LMI) is removed.

However, this standard 20% deposit is becoming increasingly out of reach for the average Australian.

HOW MUCH EACH STATE NEEDS FOR A 20% DEPOSIT:

The ABS data shows NSW has been the hardest hit in terms of affordability, but the solution is not as simple as moving interstate.

In all states and territories, borrowers need to find six figures to cover a 20% home loan deposit.

According to the ABS average earnings data, the pre-tax weekly earnings across Australia is $1,838.10 per week, or $95,581 per year.

That’s not even enough to cover a 20% deposit for a house in the cheapest state to buy property, the NT, where the average dwelling value ($521,700) is less than half that of NSW and borrowers need to find $104,340 to cover a 20% deposit.

Increased demand as OS arrivals totally outstrip departures

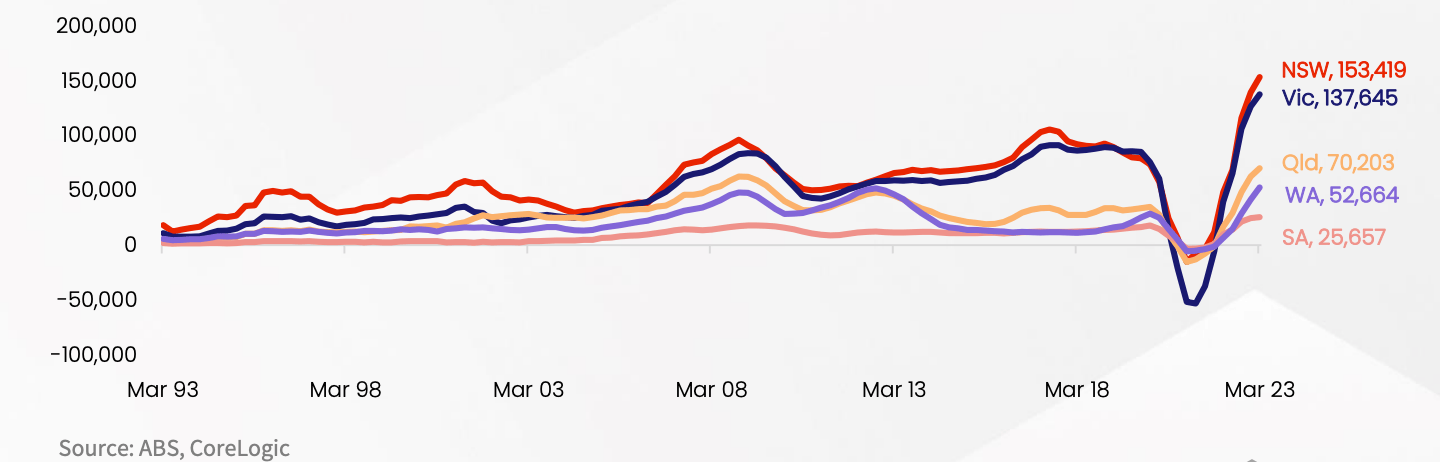

On the demand side, things have been allowed to run amok, as the pic showing our annual trend in net overseas migration by state, clearly shows.

The stronger-than-expected level of net overseas migration – the highest since 1966 – has seen overall housing demand skyrocket.

This has occurred amid high levels of overseas arrivals, and about a 25% drop off in departures relative to the pre-COVID average.

Annual count of net-overseas migration

In the year to March 2023, net overseas migration reached a new record high, with 454,400 people added to Australia’s population.

At the current average household size, this equates to an additional 181,723 households.

Historically, says CoreLogic Economist Kaytlin Ezzy, ABS migration data shows high-density markets in major cities have had higher exposure to uplifts in net overseas migration.

“Looking at historic averages from 2016 onwards, the SA4 regions of Melbourne’s South East, Melbourne Inner, Sydney’s Inner South West, and Parramatta saw the highest net overseas migration levels.”

The majority of recent long-term migrant arrivals rent before buying, Kaytlin Ezzy says.

“The impact of this additional demand has already been seen in the rental market, with capital city unit rents recording a new record high annual growth rate over the year to May (16.5%) before easing slightly over the 12 months to August (14.9%).

“While worsening rental affordability has seen the pace of unit rental growth ease in recent months, unit rents are likely to remain elevated for some time, especially with net overseas migration expected to remain high through 2023 and 2024.”

Meanwhile, based on the before-tax average earnings of $92,347 in the NT as of July this year, borrowers will need to save thousands more than their pre-tax annual income to cover that 20%.

In NSW, the average dwelling value now sits at $1,167,500, more than $200,000 more than the second-most expensive state or territory – ACT. A whopping $233,500 is now needed in NSW to secure a 20% deposit, despite average earnings of $95,259.

NSW borrowers looking to avoid the cost of LMI and access lower interest rates associated with an LVR of 80%, will now need to save more than two times their pre-tax annual income.

IS GETTING A HOME LOAN WITH A 2% DEPOSIT RISKY?

Although there are options out there to get on the property ladder with a deposit as little as 2%, borrowers should be careful. The Family Home Guarantee can help single parents and guardians buy a home with just a 2% deposit, but this could end up costing you in the long run.

“A 2% deposit may seem enticing,” Peter Marshall explains, “but a loan with a lower deposit will cost more in interest over the term of the loan, and higher LVR tiers associated with low deposit amounts can come with higher interest rates.”

“With smaller deposits, it’s also very easy for a negative equity situation to arise,” Marshall says, “so it’s crucial to get professional advice from a broker before being enticed by the low deposit amount.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.