Profit margin is key focus this earnings season. Which ASX stocks are doing it best?

Here are the highest and lowest profit margins for ASX companies

- Rising inflation has put the spotlight on the ability for corporates to maintain profit margins

- Which sectors are the most inflation resistant

- ASX stocks with the highest and lowest profit margins

The shock headline US CPI print of 9.1%, the highest in 41 years, has put the spotlight on the ability of businesses to hold on to profit margins.

Analysts are particularly concerned about the threat of “margin compression”, where profit margins contract even as sales rise.

In the US, Goldman Sachs has predicted that higher input prices, wages, and interest rates will cause a decline in profit margins by 18 basis points to 12.2% on average this year.

Excluding the energy sector, this contraction could even be as high as 3% in 2022, according to GS. That’s 300 basis points.

Back home, the ASX earnings season is about to get under way, and analysts are concerned about a potential correction in profit margins for Australian companies.

Signs are already there that we might see a contraction, with the collapse of a dozen or so private building companies over the last few months.

Two major Australian construction companies, industry giant Probuild and Gold Coast-based Condev, have gone belly up amid rising costs for construction materials.

The scarcity of labour in the country also means that nearly every sector is struggling to find workers, pushing wages higher. In May, the ABS said that our annual wage increase was 2.4%, the highest annual rate recorded since December 2018.

Which sectors are the most inflation resistant

Although analysts unanimously agree that rising costs will drag down the Price Earnings (P/E) Ratios of most companies, some will be more resistant than others.

So which sectors are the most likely to offer shelter against rising inflation?

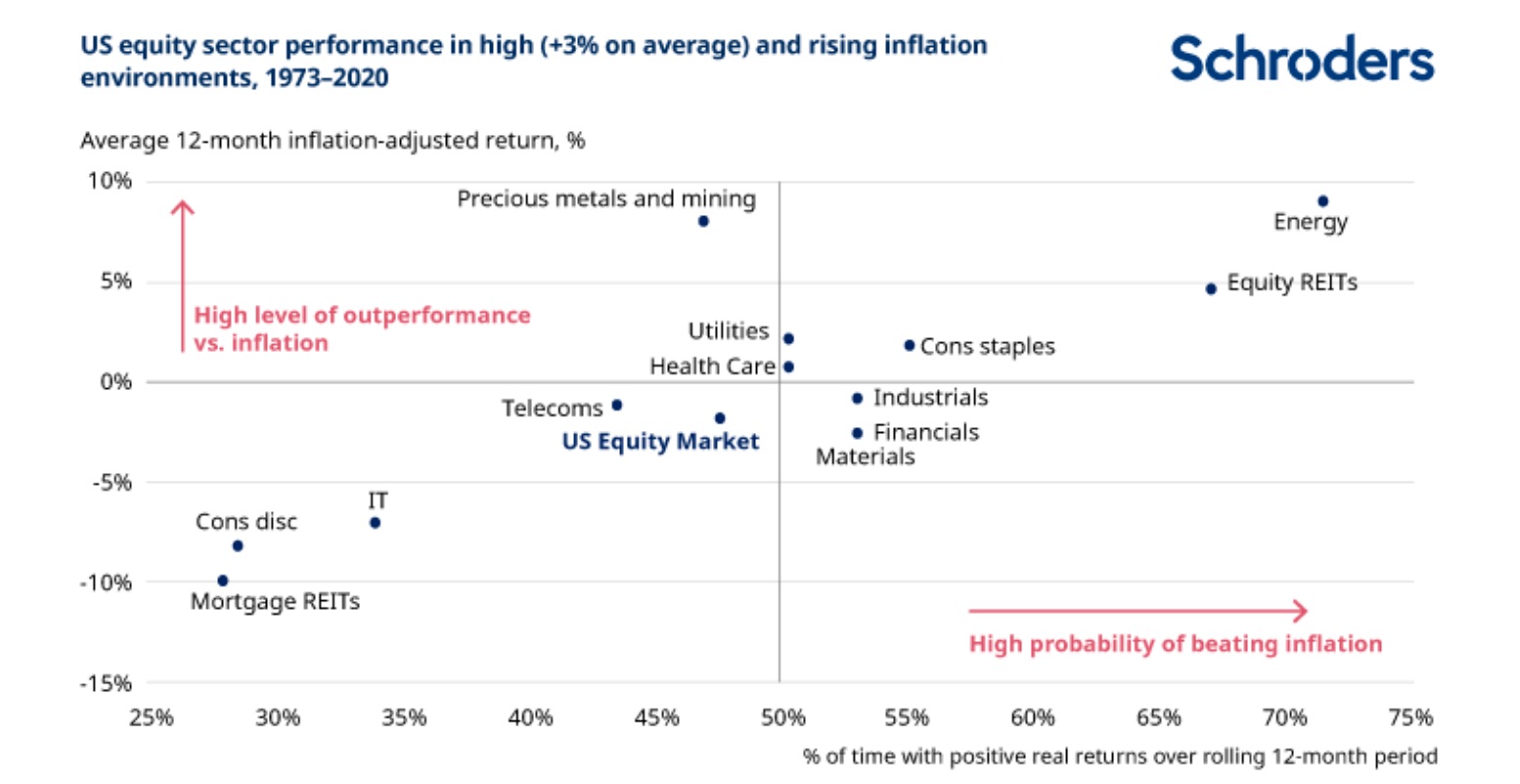

According to Schroders:

The energy sector, which includes oil and gas companies, is the most likely to stem the tide of inflation. In fact, history shows that such firms beat inflation 71% of the time.

This is a fairly intuitive because the revenues of energy stocks are naturally tied to energy prices, a key component of inflation.

Equity REITs (real estate investment trusts) may also provide protection because real estate assets can usually pass through their costs via increases in rentals.

Financial stocks can also maintain their margin in times of inflation because banks can also pass on these higher rates to consumers – as we have seen first hand in the last few weeks.

Although major bank stocks on the ASX have taken a tumble in the past month, experts predict they will be able to maintain their net interest margins (NIM) this reporting season.

ASX stocks with the highest profit margins

It’s pretty clear the list is dominated by miners and financials, the two biggest sectors in Australia.

For the giant miners, scale has enabled them to generate these profit margins. Their ability to expand mining operations and extract higher ore grades and metal recoveries at lower costs are also reasons why they’re able to optimise returns.

But size doesn’t always guarantee immunity from rising costs. As Rio Tinto (ASX:RIO) effectively conceded on Friday, its cost of exporting iron ore from WA this year would be 5% higher than previously expected.

Financial stocks like Macquarie are also able to extract high profit margins due to astute capital management, as well as scale.

Meanwhile investors are advised to be careful when looking at profit margins of the smaller caps. This is because the margins might include some of the high upfront costs these companies incur in the early stage development of their products.

All sources: Commsec

Highest profit margins for Medium and Large Caps

| Code | Name | Sector | Last reported Profit Margin |

|---|---|---|---|

| MQG | Macquarie Group | Financials | 65.00% |

| DRR | Deterra Royalties | Materials | 63.60% |

| OBL | Omni Bridgeway | Financials | 56.90% |

| ASX | ASX | Financials | 50.00% |

| AAC | Australian Agricultural | Staples | 49.60% |

| FMG | Fortescue Metal | Materials | 46.30% |

| PME | Pro Medicus | Healthcare | 45.50% |

| ZIM | Zimplats Holdings | Materials | 41.60% |

| GRR | Grange Resources | Materials | 40.90% |

| CIA | Champion Iron | Materials | 37.00% |

| MIN | Mineral Resources | Materials | 35.00% |

| RIO | Rio Tinto | Materials | 33.80% |

Highest profit margins for Small Caps

| Code | Name | Sector | Last reported Profit Margin |

|---|---|---|---|

| MTR | Metal Tiger Plc | Materials | 79.90% |

| DCC | DigitalX | Tech | 69.60% |

| GIB | Gibb River Diamonds | Materials | 60.70% |

| XRG | xReality Group | Discretionary | 56.60% |

| BMH | Baumart Holdings | Industrials | 54.40% |

| CUV | Clinuvel Pharmaceuticals | Healthcare | 51.50% |

| GUL | Gullewa | Materials | 51.00% |

| TMH | The Market Herald | Communications | 47.10% |

| FEX | Fenix Resources | Materials | 42.90% |

| FNX | Finexia Financial Group | Financials | 42.90% |

ASX stocks with the lowest profit margins

Lowest profit margins for Medium and Large Caps

| Code | Name | Sector | Last reported Profit Margin |

|---|---|---|---|

| XRO | Xero | Tech | 1.40% |

| VNT | Ventia Services | Industrials | 1.40% |

| DOW | Downer EDI | Industrials | 1.70% |

| VEA | Viva Energy Group | Energy | 1.80% |

| NUF | Nufarm | Materials | 1.90% |

| MTS | Metcash | Staples | 2.00% |

| EBO | EBOS Group | Healthcare | 2.10% |

| TPG | TPG Telecom | Communications | 2.10% |

| WOR | Worley | Energy | 2.60% |

| WOW | Woolworths | Staples | 2.60% |

Lowest profit margins for Small Caps

| Code | Name | Sector | Last reported Profit Margin |

|---|---|---|---|

| DTI | DTI Group | Tech | 0.10% |

| MCP | McPherson's | Staples | 0.20% |

| GLE | GLG Corp | Discretionary | 0.30% |

| KNO | Knosys | Tech | 0.30% |

| TTI | Traffic Technologies | Industrials | 0.40% |

| CTP | Central Petroleum | Energy | 0.40% |

| RDG | Resource Development | Industrials | 0.50% |

| ABY | Adore Beauty Group | Discretionary | 0.50% |

| XF1 | Xref | Tech | 0.60% |

| ECG | Ecargo Holdings | Industrials | 0.60% |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.