Peter McGuire: Rate cut bets in overdrive

News

So global markets look keen to continue going about their business in 2024 upon the theme that the big central banks have done the heavy lifting and will start their various easing cycles sometime soon this year.

XM Australia CEO Peter McGuire, writing from sunny Coogee, says this theme has dominated trading activity in recent weeks as investors ramped up bets that interest rates will be slashed rapidly come Spring, against the backdrop of slowing economic growth and fading inflationary pressures.

With this kind of speculation for Fed rate cuts running wild, Pete says the previously toppy yields on US government bonds have been slammed lower and the likewise formerly unstoppable greenback has copped a hit as collateral damage.

“This has been a bullish cocktail for zero-yielding assets such as gold, which is also priced in dollars,” says McGuire.

Gold closed at US$2,077 per ounce last week, its highest closing price on record and a level it failed to hold earlier this month, when it briefly spiked into unseen heights.

Beyond the sharp retreat in real yields and the dollar, gold has also been supercharged by the fragile global geopolitical scene as well as some mega-sized buying by central banks looking to diversify their reserves – most notably by the People’s Bank of China.

Pete says in the year ahead, gold’s performance will be decided mostly by how the economic landscape evolves and whether the rate cuts that have been priced in are delivered on time.

“Geopolitics will play a role too, and in fact might be the biggest downside risk for gold in an otherwise favourable macro environment, considering recent reports that Russia is quietly angling for a ceasefire in Ukraine.”

Stock markets have performed well this past entire year, but the rally has gone into overdrive lately with the Dow Jones and the Nasdaq 100 cruising to fresh record highs.

The S&P500 is trading moments from its own record peak.

“Even though the latest melt-up in equity prices can be attributed to seasonal factors, like underperforming investment managers chasing the year-end rally in an environment of scarce liquidity, the bigger story is that the US recession everyone feared got canceled, or at least postponed.

“Many investors came into this year positioned for a recession, and when that never materialised, they were forced to raise their risk exposure. The problem is that the tables have turned and US equities are now pricing in the dream scenario for next year – no recession, a sharp acceleration in corporate earnings growth, and a series of Fed rate cuts.”

In other words, equity markets are currently priced for perfection.

“With valuations already stretched, that is a recipe for turbulence, particularly if earnings growth undershoots as the global economy loses momentum.”

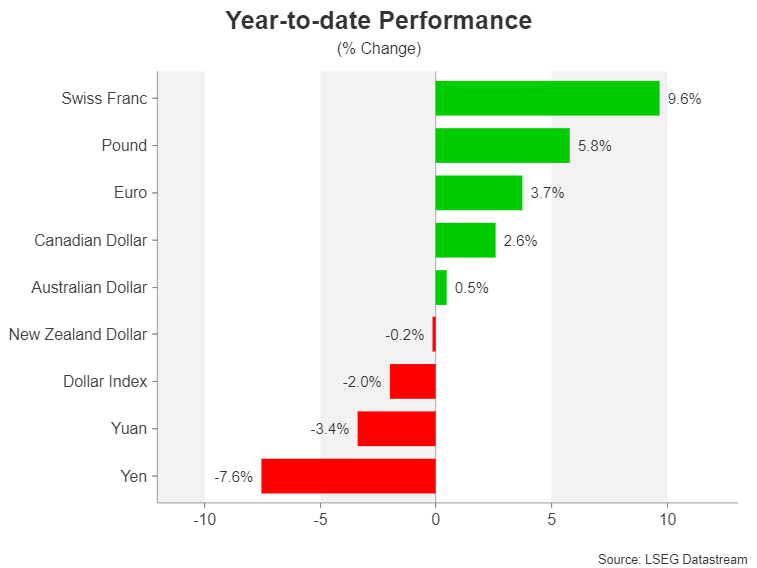

“It’s been one big rollercoaster ride for the US dollar in 2023, as hopes of a Fed pivot were repeatedly dented by surprisingly strong economic data, which more often than not, has come from the robust performance of the American labour market.”

However, he adds, traders “seem surer this time that a pivot is just around the corner”, not least thanks to the US Fed chief J. Powell – who’s now dropped several subtle hints about it.

“Thus, after a powerful rebound during the summer and autumn, the greenback looks set the finish the year with losses of almost 3% against a basket of currencies. That rally was driven by a surge in Treasury yields, which have since been tarnished by heightened expectations of aggressive rate cuts over the coming year,” Peter says.

Cumulative rate cut odds for 2024 via LSEG are fast approaching 160 basis points.

“This seems excessive when considering that the US economy is not in recession and Fed officials are only predicting about three 25-bps cuts. The minutes of the December meeting that produced those forecasts are due on Wednesday and FOMC members might attempt to use the publication to reinforce their view of only modest policy easing over the next couple of years.”

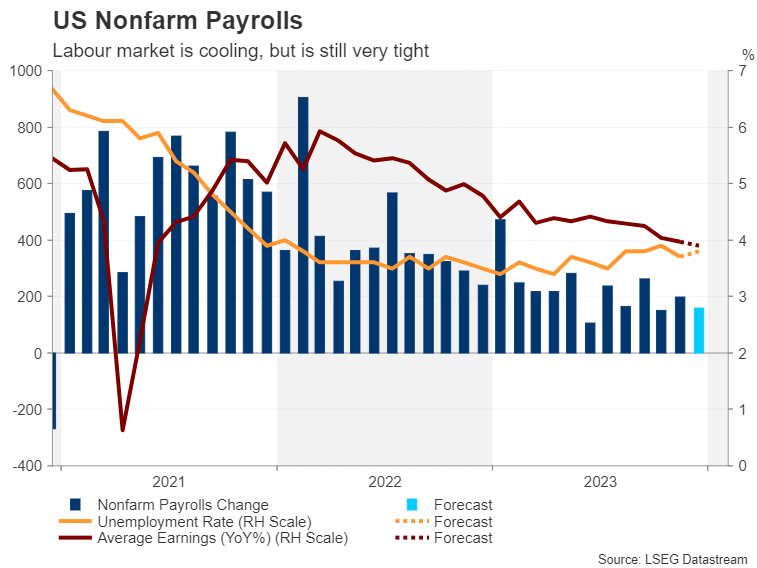

Another clue on the rate path will be policymakers’ outlook on the jobs market as they’ve recently indicated that as inflation comes down, their focus on the Fed’s other mandate – employment – will increase.

This might explain Powell’s lack of caution in being eager to steer policy towards easing on fear that holding rates at restrictive levels for too long might push up the unemployment rate. However, it’s been so far so good as far as the labour market is concerned. Jobs growth has slowed but companies aren’t laying off staff in big numbers, allowing wages to rise at a moderate pace.

Analysts don’t expect this picture to have altered much in December, says Peter.

“Nonfarm payrolls are projected to rise by 158k, down from 199k in November, while the jobless rate is forecast to tick up slightly to 3.8%. Average earnings aren’t anticipated to rock the boat either, with the month-on-month rate expected at 0.3% and the year-on-year figure at 3.9% versus 4.0% previously.”

Will there be a rude awakening for the markets?

“Given investors’ strong conviction that the Fed will soon start slashing rates, a small beat or miss in the headline print is unlikely to generate anything more than a knee-jerk reaction in the dollar.

“A very disappointing report isn’t very probable as weekly jobless claims have been very low during the month. So if there will be a shock, it will be from a very hot report,” Peter says.

“The US dollar could jump higher along with yields, while Wall Street could succumb to panic selling from investors scaling back their rate cut bets on the back of upbeat NFP readings. But in the event that the jobs data fails to provide any fresh direction, investors will probably turn to the other releases of the week.”

These will include the ISM manufacturing and non-manufacturing PMIs, due on Wednesday and Friday, respectively, the JOLTS job openings on Wednesday, Challenger layoffs on Thursday, and factory orders on Friday.

Across the border in Canada, the Loonie will be keeping tabs on the domestic labour market as rate cut bets for the Bank of Canada have also been ratcheted up lately.

“The Canadian dollar is on track to have gained about 2.5% against its US counterpart in 2023, faring somewhat better than the other commodity-linked currencies, the Australian and New Zealand dollars. Less exposure to China and a more unquestionably hawkish stance by the BoC have contributed to its relative outperformance against the Aussie and Kiwi.

“However, there’s a risk that 2024 might be more of a struggle for the Loonie if stagnating economic growth forces the Bank of Canada to start lowering rates. The country’s unemployment rate has been steadily edging up since May and likely rose further in December to 5.9%, data on Friday is expected to show.”

Although employment has been rising during this period, it hasn’t been able to keep pace with the growth in the number of jobseekers. It’s expected that the Canuck economy added just 13.2k jobs in December.

“Nevertheless, wage growth remains elevated at 5.0% so investors will be watching that figure too, as well as the latest Ivey PMI gauge on Friday,” Pete says.

PMI data will also be important for the Australian dollar as China’s two sets of releases are due this week.

“The official government survey is out on Sunday and the Caixin/S&P Global version will follow on Tuesday. Any slowdown in China’s manufacturing PMIs in December could hurt risk sentiment at the turn of the year, weighing on equities as well as the Aussie.”

A currency that will probably take the middle spot in the 2023 FX league table is the euro, according to XM.

“The single currency has had a few ups and downs of its own over the past year, but overall, has found support from a more hawkish-than-anticipated ECB. It’s likely, though, that in 2024, a weaker Eurozone economy will spur the ECB to slash rates more than the Fed. Yet, with US yields falling faster than Eurozone ones, the euro is so far a winner amidst all the rate cut speculation.”

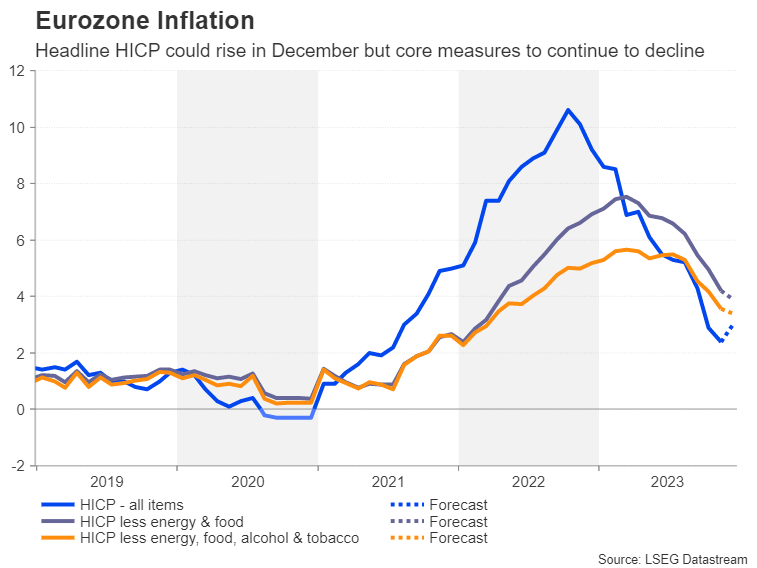

Unlike the Fed, the ECB is wary about sending any pivot signals before it can be sure that inflation is well and truly headed towards 2%.

The flash CPI readings for December will probably justify this caution on Friday, Pete says.

“EU headline CPI is forecast to accelerate from 2.4% to 3.0% y/y in December, suggesting there’s still some way to go before inflation settles around the 2% target.”

Forecasts for the underlying measures of inflation are more encouraging, with core CPI that excludes food and energy, as well as tobacco and alcohol prices, projected to decline from 3.6% to 3.4%.

“If that turns out to be the case, investors may well leave their rate cut wagers untampered, meaning there may not be any additional boost for the euro against the Greenback.”