People who manage their own superannuation funds are picking more small cap stocks

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

People who manage their own superannuation funds are more frequently looking beyond the ASX20 for opportunities — and many are starting to include small and mid-caps stocks.

That’s according to the latest analysis from CommSec.

Self managed super funds hold $749.9 billion of the nation’s $2.7 trillion retirement pot.

These “selfies”, as they are sometimes known, have long been buyers of blue chip shares, including the big four banks, because of the attractive full franked shares.

The three most traded shares by self-managed super funds (or SMSFs) are Commonwealth Bank, Telstra and NAB.

But there are signs that may be changing, reports CommSec.

“Frustrated by the underperformance of many of the large blue-chips that have until recently been among their favourite stocks, SMSF investors have increasingly turned to a more diversified group of mid and small cap companies that have shown strong gains over the past 12 months,” Commsec said in its September report.

“This trend has largely continued in 2018, with ASX20 shares now accounting for just 33 per cent of the total value of shares traded by SMSFs, down from 40 per cent a year ago and 34 per cent at the end of 2017.”

Commsec also highlighted the popularity of small caps with non-SMSF investors, including infant formula exporter Jatenergy and vanadium player King River Copper.

“Non-SMSF investors showed an obvious bias toward smaller, more volatile stocks like JAT energy (JAT) and King River Copper (KRC), reflecting a higher proportion of traders within their ranks.

“Trading values in JAT jumped from just under $1 million in the second half of 2017 to $136 million within the first half of 2018.”

The stockmarket’s strong finish to the financial year “was underpinned by large resource and energy companies, along with the continued strength of mid and small cap companies, despite lacklustre returns from some of the biggest companies in the ASX20”, Commsec said.

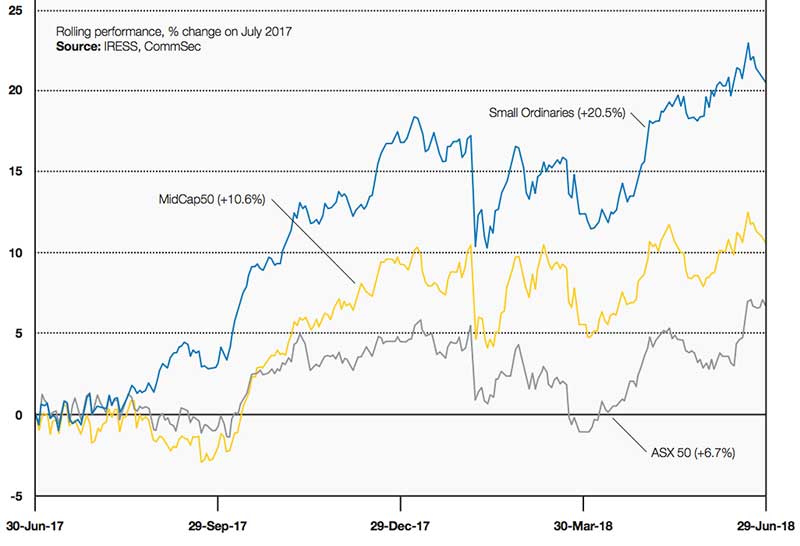

That’s supported by strong growth in the Small Ords index, which has outperformed the large and mid cap stocks over the past year:

SMSFs are also continuing to expand their investment offshore with a 30% increase in international share trades for the first half of the year, according to the CommSec SMSF Trading Trends Report.

Adding an Apple or a Facebook to a portfolio has become an increasingly attractive investment option for SMSFs.

“This trend to add international shares is strong among SMSFs who often use a core portfolio of Exchange Traded Funds (ETFs) or managed funds for diversification, then add high conviction individual stocks such as Facebook, Amazon, Apple, Netflix, Google or Berkshire Hathaway in an effort to enhance performance,” says Marcus Evans, Head of SMSF Customers for Commonwealth Bank.

The CommSec report shows investment in ETFs with an international focus continued to increase in 2018 with SMSFs using this investment option to increase their exposure to currency and property offshore.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.