Part 3: So now you DON’T want to buy a semiconductor? Well, there’s an ETF for that

News

News

There’s a growing semi-smorgasbord for those with a hunger for what’s at the tiny chemical hearts driving the modern world into the wonderful technological abyss.

Semiconductor sales hit US$580b last year, a 4.4% year-on-year growth rate for the year.

Intel (INTC), Qualcomm (QCOM) and Taiwan Semiconductor (TSM) down to lesser-known names like Qorvo (QRVO) and Microchip Technology (MCHP), are businesses in the business of creating the DNA of all that goes, tick, beep, brumm, humm and if you’ve a Volvo like mine, rattle.

From data centers and satellites, to video games and robodogs, the chipmakers rule our universe from within.

Back in the day, it used to be the domain of a select few like Intel and Qualcomm.

There was always AMD (AMD) and Nvidia (NVDA) hanging around nearby.

Names like Samsung got involved. The giant Dutch firm ASML has a nice niche in making the tools for the makers of chips, while Taiwan Semiconductor (TSCM) has been the silent giant up until it was undressed before our very eyes during COVID.

ASML reckons 175 zettabytes of data will be generated every year by as soon as 2025. This is the equivalent of 1 trillion USB sticks, with a holding capacity of 1 gigabyte of data each.

To process this insane volume, we’re gonna need a lot more computer chips.

Today we’re seeing the world play catch up, Amkor Technology (AMKR), KLA Corporation (KLA) and Microchip Technology (MCHP), ON Semiconductor (ON), Broadcom (AVGO) to name a few more familiar among the near 700 firms in pursuit of chip treasures in a global industry expected to hit a trillion US dollars in a few years.

The largest Semiconductors ETF is the iShares Semiconductor ETF SOXX with $7.5bn in assets. Over the last 12 months, the best-performer was Van Eck’s SMH at 5.6%.

Largest US-listed Semiconductors ETFs by value (March)

Suddenly there’s a fair bit of choice.

Which is why the too hard basket ETF options are a decent starting point. Your exchange-traded fund (ETF) is a sensible beast, providing a fairly convenient way to diversify one’s portfolio exposure to the sector without stressing too much about which individual stocks to bank everything on.

With 13 ETFs traded on Wall Street alone, semiconductors funds have total assets under management of around US$23.5 billion. According to ETF.com, their average expense ratio is 0.69%.

Here’s some of the better performers.

The all-in-one ETF play in the semiconductor space, for the set-and-forget investor…

The SMH investment objective is to try to replicate the price and yield performance of the Market Vectors US Listed Semiconductor 25 Index.

The fund owns 25 stocks encompassing semiconductor chip companies from around the globe.

It does what it says – the fund is made up of common stocks (and depository receipts) of US exchange-listed companies on in semiconductor sector.

I like their blurb:

“Electrify your portfolio with the VanEck Semiconductor UCITS ETF.”

And their to the point bullies:

The fund is in the process of implementing a 2-for-1 split and was scheduled at the time of writing to wake up Friday trading on a split-adjusted basis – meaning the SMH started trading Friday at half the price implied at the overnight close.

VanEck told investors there’ll be no impact on the overall value of the ETF.

“VanEck periodically assesses its ETF lineup to determine when and where share splits would most benefit investors.”

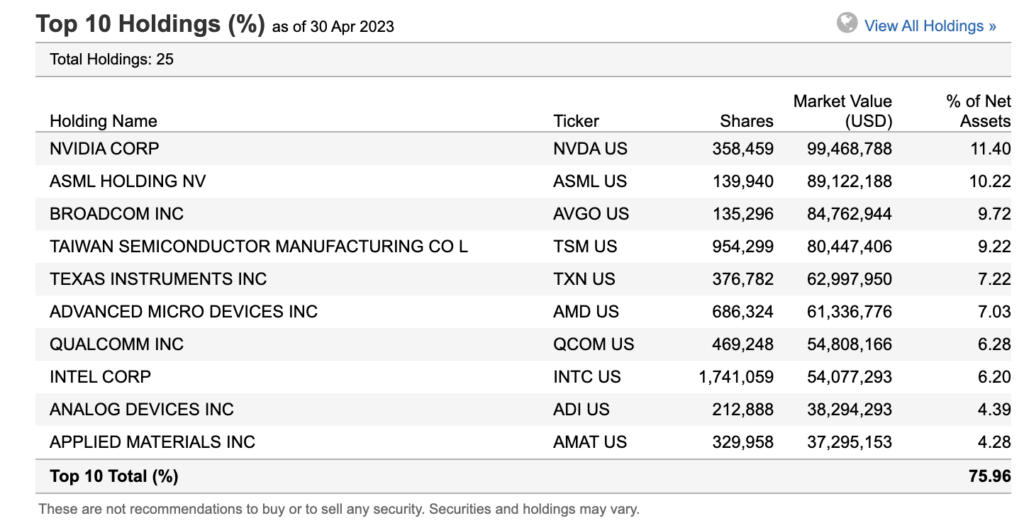

And NVDA runs point for SMH, with some 11.4% of net assets.

SMH Top 10 holdings (as of April 30):

Year-to-date performance: around 23%.

Expense ratio: 0.35% in annual fees.

30-day average trade volume: about 75 million.

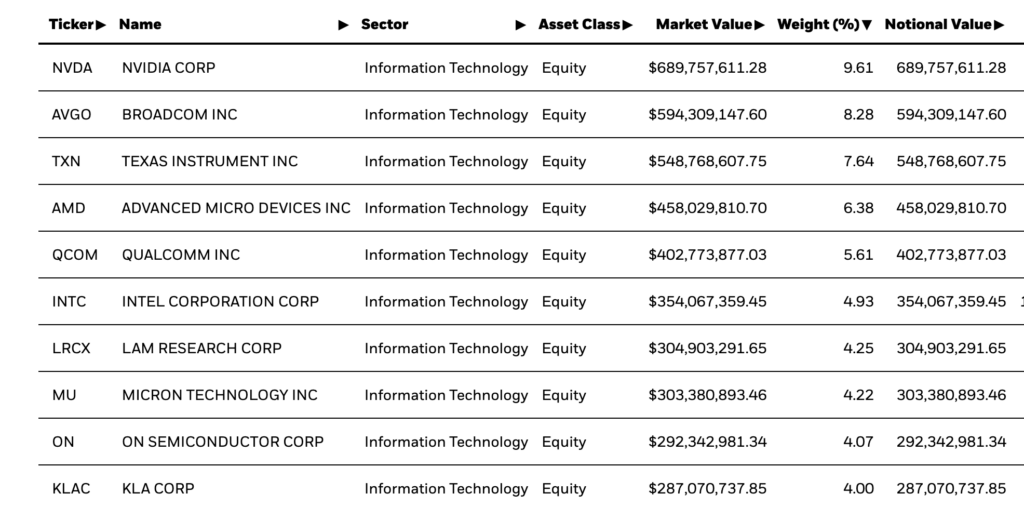

SOXX has been described as the ‘bread and butter’ of chip ETFs. The fund contains the 30 largest chip makers in the US and manages $7.34 billion in assets.

Sponsored by Blackrock, SOXX enjoys a very solid Hold rating among most analysts.

Year to date the fund is up about 18%.

iShares says its investment objective is a simple one – and it does it simply – to track the investment results of an index composed of the 30 largest chip makers in the US listed equities in the semiconductor sector.

With assets over US$7.5 billion, it’s one of the largest ETFs in the Tech field.

Before fees and expenses, SOXX seeks to match the performance of the PHLX SOX Semiconductor Sector Index. Annual operating expenses for this ETF are 0.35%, making it one of the least expensive products in the space.

SOXX’s 12-month trailing dividend yield is 1.07%.

About 80% of the holdings are in chips, about 19% in chip equipment makers.

SOXX Top 10 (as of May 3):

Year-to-date performance: around 19%.

Expense ratio: 0.35%, annually.

65-day average trade volume: about 1 million.

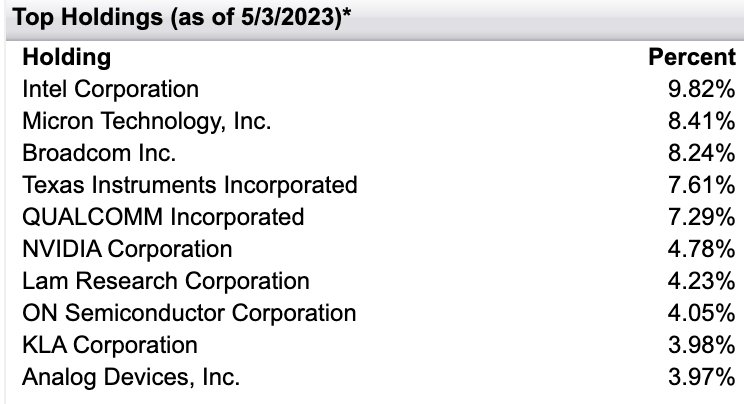

The First Trust Nasdaq Semiconductor ETF offers exposure to the most-liquid US semiconductor securities based on volatility, value and growth by tracking the Nasdaq US Smart Semiconductor Index.

FTXL holds 31 stocks in its basket, with Intel taking the top spot at 9.7% share.

Last week, the National Bank of Canada FI bought in a new position worth circa US$465,000. National Bank of Canada FI owned 0.58% of First Trust Nasdaq Semiconductor ETF at the end of the most recent quarter.

Other institutional investors and hedge funds that have upped their involvement include UBS which lifted its stake by about 850%, Geneos Wealth Management Inc. increased its stake by 72% and what’s left of Credit Suisse bought a new position worth about $70,000.

FTXL Top 10 (as of May 3):

First Trust Nasdaq Semiconductor ETF has some $910 million in assets under management.

The average 30 trading volume (is light) at around 250,000 shares.

The expense ratio is high, at 0.60%.

The Invesco PHLX Semiconductor ETF (Fund) is based on the PHLX Semiconductor Sector Index (Index).

The Fund will normally invest at least 90% of its total assets in the securities that comprise the index, which is designed to measure the performance of the 30 biggest US-listed securities of companies engaged in the semiconductor business.

The Index includes companies engaged in the design, distribution, manufacture and sale of semiconductors.

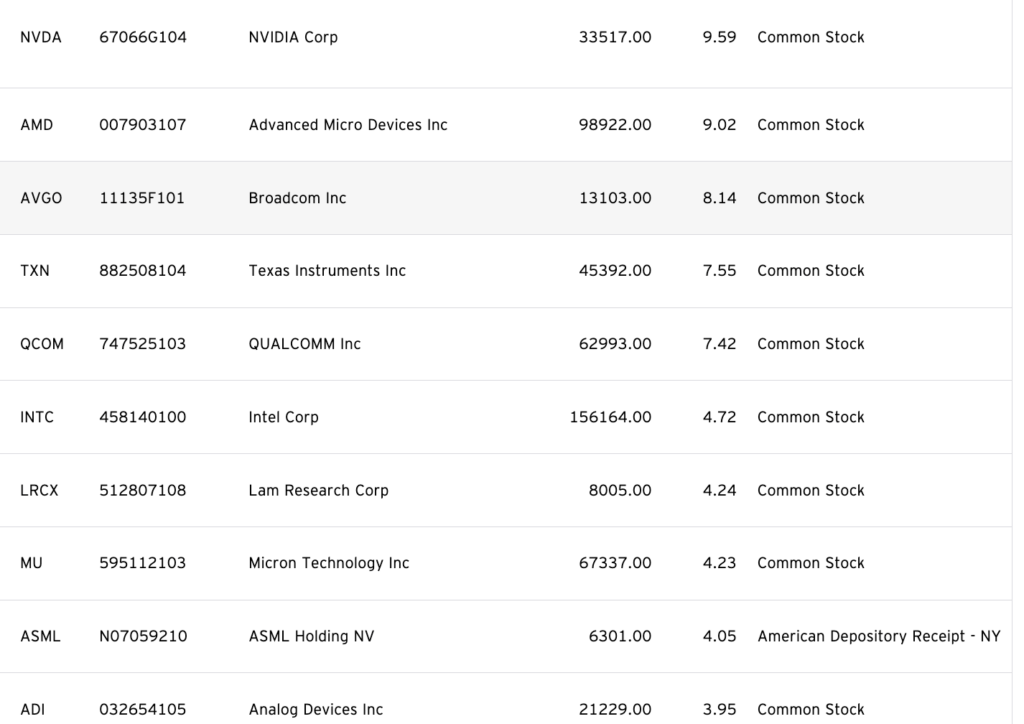

Invesco SOXQ Top 10 holdings (April 30)

The Fund and the Index are reconstituted annually in September and rebalanced quarterly in March, June, September and December.

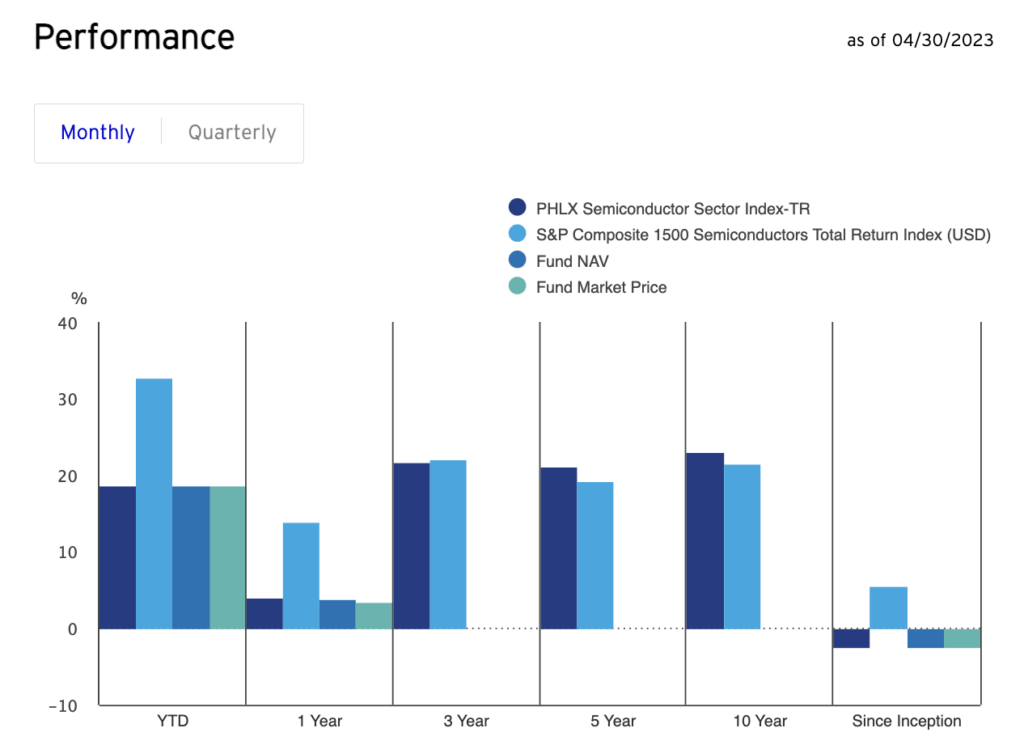

Invesco SOXQ comparative performance

Strive U.S. Semiconductor ETF seeks broad market exposure to the US semiconductor sector. It follows the Solactive United States Semiconductors 30 Capped Index and holds 31 stocks in its basket.

“Strive engages with management teams and boards to create value by protecting against a geopolitical risk.”

That’s concentrated exposure to the US semiconductor industry, which stands to benefit as countries shift semiconductor production away from Taiwan.

SHOC gets right away from the Taiwan Semiconductor Manufacturing Company.

Strive says its competitors don’t get into the whole array of China-specific risk factors due to their conflicts of interest inside China.

“Strive is free to openly engage with its portfolio companies to reduce any dependency on Taiwan.”

The Strive ETF has AUM of $22.4 million and charges 0.40% in annual fees. It trades in a volume of 8,000 shares a day on average.