Overnight: Musk quits, meme stock crashes, Nasdaq slides and the USA always gets its man

Via Getty

The Dow Jones Industrial Average has shed a heap of points on Thursday in New York, not taking the news of lower first-time jobless claims and a higher estimate for Q3 US GDP.

Chinese stocks did some nice outperforming early in the trading day, after the Hang Seng Index surged nearly 3% yesterday on the promise of bold new growth initiatives and some easing of geopolitical angst, probably thanks to Our Penny.

Alibaba (BABA) rose nearly 1%.

The day on Wall Street began with a little positivity but not a heap of momentum after stocks gained for a second session, thanks largely to the outstanding quarterly numbers out of both – best in show – Nike and FedEx.

Tony Sycamore at IG told me that those are the kind of results which ease recession fears.

The two-day rally on Wall Street eases fears that markets could repeat the sharp sell-off viewed the week before Christmas December 2018. However, the S&P500 needs to reclaim resistance at 3910/20 and then see a sustained break above the 4100/4110 resistance zone to negate downside risks.

Also doing its bit – a stronger-than-expected consumer confidence print (108.3 vs 101 exp) which lifted to its highest level since April.

There’s also a little extra love today for Tesla (TSLA) shareholders, with chief money bags architect Elon Musk saying he’s a done deal as CEO of Twitter (TWTR). The electric-vehicle giant has dropped more than 3%, almost 5% by USD volume.

Musk confirmed he’d be stepping down as chief Twitter whatever as soon as he finds “someone foolish enough to take the job!”.

Twitter and tesla fans will be hoping that he’s got Seek (ASX:SEK) on the job, because Tesla shares shed weight for a 4th straight session closing at $137.57.

A little after the opening bell, the Dow Jones Industrial Average lost 1.3%, the S&P 500 fell 1.6%.

The tech-heavy Nasdaq composite crashed hard – down 2.2% in the morning session.

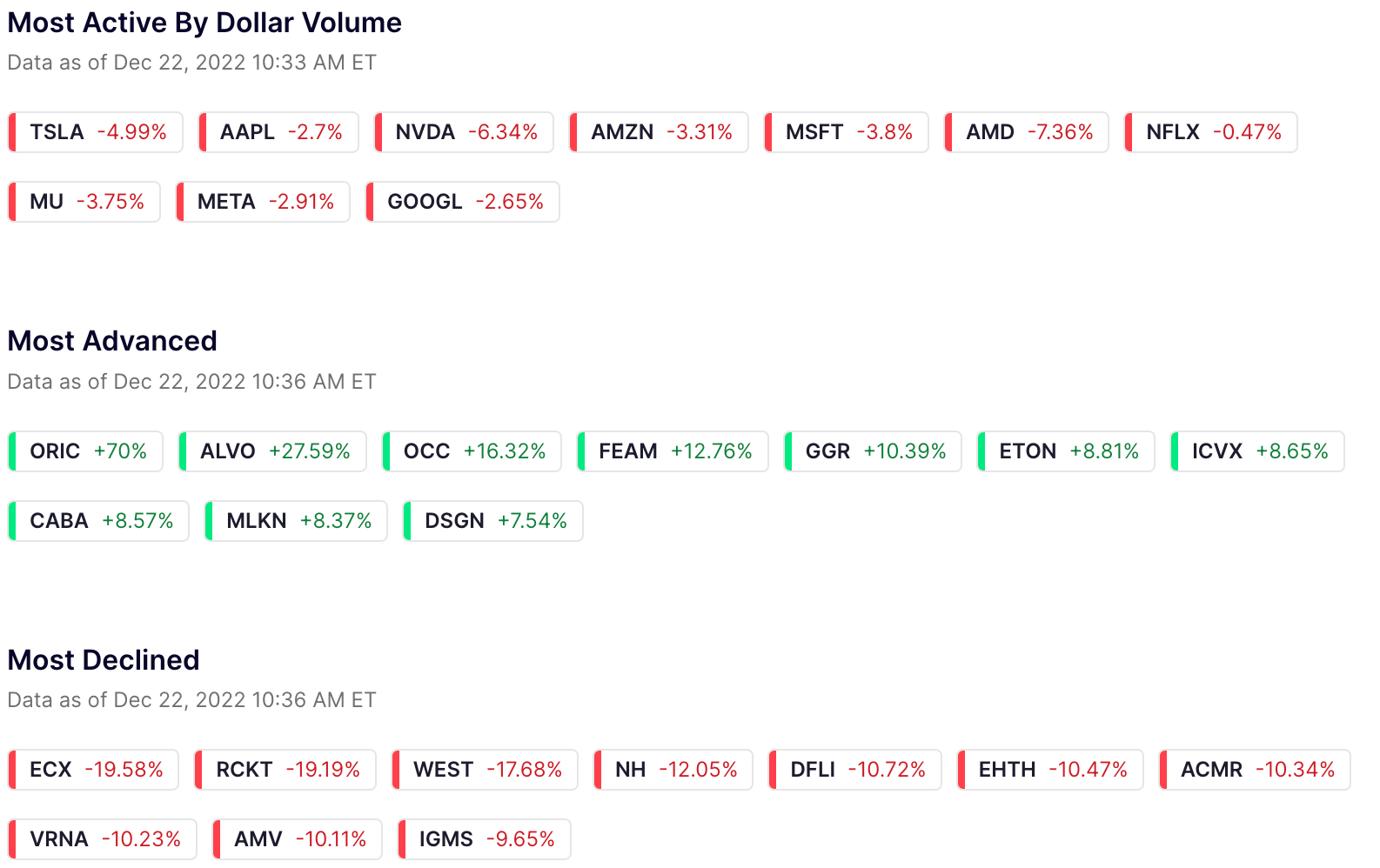

These are Wall St’s main movers at lunchtime:

Game’s up for meme stock as AMC looks to raise

Here’s a quick shoutout to our partners with the funny pics. It’s not the biggest news overnight, but the brokers at Wedbush have – perhaps finally – initiated coverage of Getty Images, starting the stock image firm with an Outperform rating.

Wedbush says it’s kicking off coverage of the long-term media images provider with the expectation that Getty will continue to gain market share.

“We believe that our valuation multiple is warranted given a history of strong execution and a compelling and consistent profit profile. We see opportunities to gain market share within agency, corporate, and media budgets given the comprehensive nature of the content library, the customisation inherent in its subscriptions, and the utility provided by its platforms.”

Also overnight, shares in funny meme stock and computer gaming co. AMC have crashed about 25% with a less amusing plan abroad to raise US$110 million in preferred stock sales of its “APE” preferred stock, as per CNBC.

Antara Capital will purchase the “APE” stock at an average price of 66 cents per share, the company said. The preferred stock closed Wednesday at 68.5 cents.

French regulators crack whip as SBF comes home

With SBF of FTX now arriving in the states to face some hard truths about stealing, the French Financial Market Authority (AMF) app[ears to have taken hard note, flagging some 15 majorly fraudulent FOREX websites, offering forex investment services to both retail and institutional takers. The AMF says it’s also nabbing an illegal platform offering derivative products with various underlying assets including cryptocurrencies.

That’s been happening, while 2 x FTX execs have been turning state’s evidence against their boss, telling officials that the bankrupt cryptocurrency exchange once valued at $32 billion, that they’ll be pleading guilty to criminal charges, saying they broke the law at the direction of founder Sam Bankman-Fried.

The US Attorney Damian Williams made the slightly gloaty announcement in a video released late Wednesday, which is all just more of the crap news for the FTX co-founder who was extradited from the Bahamas overnight.

SBF has now conceded there was one or two risk-management failures at FTX, but has said he does not believe he has criminal liability.

At a court hearing in The Bahamas Reuters says, SBF’s lawyer read an affidavit in which the former golden boy said he’d agreed to extradition in part out of a “desire to make the relevant customers whole.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.