While global markets have rallied at the start of 2023 after a tough year in 2022, contrarian long-term fund manager Allan Gray Australia is warning investors to not get over-excited just yet, think deeply about risk in 2023 and pay close attention to stock weightings.

But Koonin believes the future is likely to be far more challenging, as rising interest rates start to take hold, economic growth slows, and ongoing geopolitical issues create potential for equity investors to be punished.

Not surprising, you’d think. It’s big in global markets, too.

Japan is the world’s second-largest developed stockmarket and home to over 600 companies with market values above $1 billion, says Tsukasa Tokikuni, president at Orbis.

His team reckons that is as many sizable stocks as there are in every country in Europe combined. But despite its size, Japan is often left hanging on the periphery of investor attention.

The proof has history behind it, says London-based Brett Moshal, Orbis Portfolio Management (Europe) LLP.

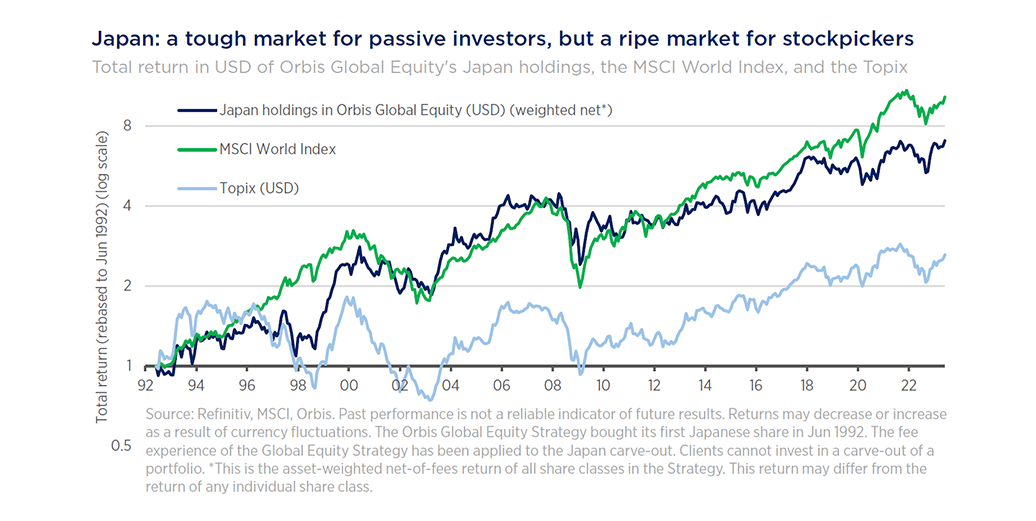

If investors know a single thing about Japan’s market, it’s that Japan has been a singularly bad market for investors. Since its epic bubble burst in 1990, the Japanese benchmark has returned less than 1% per annum in dollars, compared to 9% p.a. for other developed markets.

The warning here is that dismissing Japan after a glance at its passive returns would be a mistake. While Japan has been a depressing market for passive investors, it has been a tremendous hunting ground for active stockpickers.

“For a start, a textbook value style has worked much better in Japan than it has elsewhere. In Japan, value has beaten growth by 4% p.a. since 1975, far beyond the 1% p.a. value has delivered in other global stockmarkets,” Moshal says.

“The market’s cyclicality feeds big swings in greed and fear, providing a great setup for contrarians to exploit.

Moshal says “contrarian stockpicking has worked much better than a simple value approach.”

“Despite the poor returns of Japan’s market, Orbis Global’s Japan holdings have been competitive with world stockmarkets since we bought our first Japanese stock in 1992, and our Japan holdings have beaten world stockmarkets over the last 25 years.”

Orbis advises that “bottom-up stockpicking has worked better than a simple value style in part because doing our homework helps us avoid stocks that look cheap but remain cheap forever.”

There are plenty of such value traps in Japan, alas.

‘Unlike the rest of the world, the proportion of companies in Japan that trade below their book value is enormous, and many of them have traded at those low valuations persistently.

“In recent years the Japanese government has made efforts to untrap some of that value. These began in earnest after the election of the late Shinzo Abe, who in 2013 laid out the ‘structural reform’ arrow of his namesake economic strategy.

“In 2014, the government published the Ito Review, which took a frank look at the low capital efficiency of Japanese corporates. Japan’s Stewardship Code, which encourages engagement from investors, was also adopted in 2014, and we signed it the following year. In 2015, Japan introduced its Corporate Governance Code, which aims to encourage better behaviour from companies. It has since been revised twice, amid a smattering of smaller measures.”

Moshal says these policies have “greatly improved the quality of Japan Inc.’s investor engagement” — but that’s from an admittedly low base.

And at a glacial pace, he adds.

“That pace changed this year, when the Tokyo Stock Exchange singled out companies whose shares trade at a price-to-book ratio (PBR) of less than 1.0, obliging them to tell investors their plans to achieve a higher valuation. This has lit a fire under management teams and opened the door to greater shareholder activism.”

In short, Japan is changing, and in a good way

Not to mention the nigh-invaluabe endorsement of Omaha’s Oracle Warren Buffett.

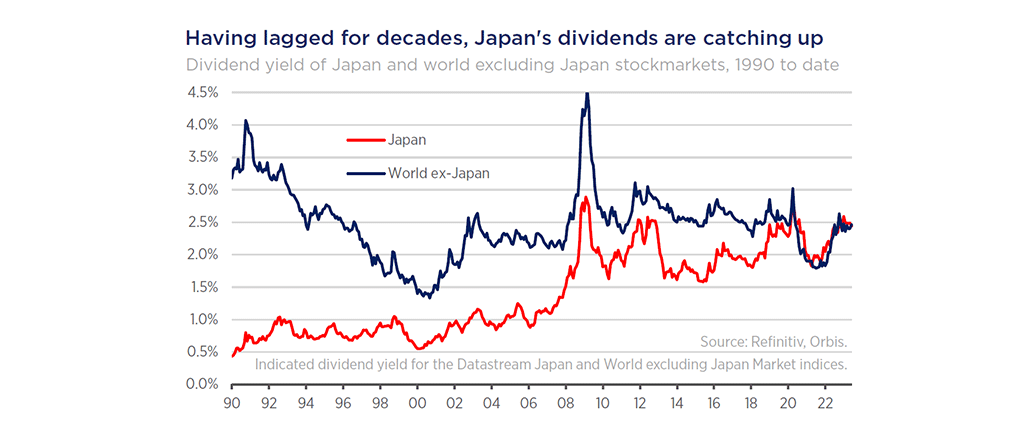

“Public enthusiasm for Japan’s trading companies, investors and the press are beginning to take notice. Companies are demonstrating an increased commitment to dividend growth, minimum pay-outs and share buybacks. Dividend yields in Japan now rival those of major western markets,” Moshal adds.

Orbis says: “We share the enthusiasm, but we believe it pays to be selective — passive investors are likely getting exposure to more expensive stocks that have less opportunity to improve.”

Some of the Orbis holdings are already starting to climb.

“Megabanks like Sumitomo Mitsui Financial Group and Mitsubishi UFJ Financial Group continue to reduce inefficient cross-holdings of other companies’ shares, have adopted progressive dividend policies, and increased share buybacks. In this, they are following the model of the trading companies Mitsubishi and Sumitomo, which have improved their capital allocation and been rewarded with much higher valuations.

“We know those businesses well, having owned them well before Berkshire Hathaway, and we have sold down those positions into the Buffett-induced euphoria.”

Yet there’s more out Tokyo way. And Orbis says there’s more companies ready to benefit greatly from “self-help measures within their own control”.

“Inpex, for example, is a highly cash generative oil and gas producer whose valuation has languished at 0.5 times book value. Part of the reason for that is its payouts.

“Although the company has bought back more than 10% of its shares over the past two years and pays out 40% of its earnings to shareholders, it can afford to do much more. Its free cash flow generation is prolific, but payouts are lower than those of international peers.

“Were Inpex to increase pay-outs in line with peers, it could be rewarded with a far higher valuation.”

Self-improvement is not Japan’s only required reading

In a global portfolio, currency matters too, and the setup there makes Japan look even more appealing.

“The policy interest rate in the US is at 5%, while the Bank of Japan has stubbornly kept rates at zero,” Orbis notes.

“Foreign investors looking to buy Japanese shares while hedging the currency essentially get this 5% difference, as they pay yen interest rates and receive dollar interest rates. If the exchange rate doesn’t move, foreign investors can pocket this 5% in addition to the yen return of their shares.

“However, in the view of our currency team, the exchange rate should move over the long term — in the yen’s favour. With 144 yen per 1 US dollar, our data suggests the dollar is more than 40% overvalued.”

Orbis notes when the team stacks up how buyers and sellers of the yen and dollar could change over time, it seems “unlikely that the forces supporting the dollar will remain as strong as they’ve been in the recent past.”

If that analysis is right, the currency tailwind for foreign investors could exceed 5%.

“But the biggest reason we find Japanese shares attractive is the simplest one—their valuations.

“Despite its improving fundamentals, the Japanese market remains inexpensive versus other world stockmarkets, particularly the US.

“As is the case elsewhere, valuation spreads remain exceptionally wide in Japan, with a wide gulf between the prices of cheap versus expensive stocks.

“When we look bottom up, we can find shares that are far cheaper than the Japanese market, while still picking up a higher dividend yield.”

So in brief. That is the Orbis case for Japan today.

It’s been a tough market for passive investors, but “an outstanding stockpicker’s market”.

Company fundamentals are improving, and a cheap currency provides additional upside potential. And above all, valuations are attractive. That sounds compelling to Orbis, and accordingly, Japan now represents 13% of its Global Equity portfolio.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.