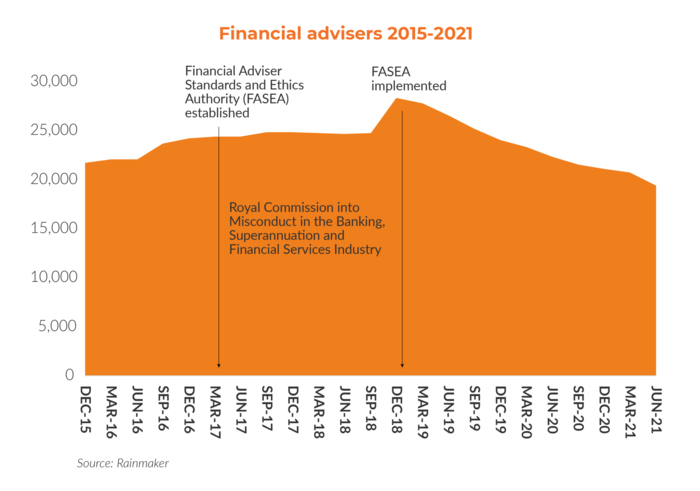

Number of Australian financial advisers at 5 year low as 9000 exit industry

There's been an exodus of financial advisers in Australia and arguably increased regulation is to blame (Image via Getty)

The disruption and regulation of Australia’s financial advisers has caused the industry to shrink to levels not seen since 2015.

Data out of Rainmaker Information shows 19,382 registered financial advisers in Australia as at June 30 2021.

This is the first time since 2015 numbers have been below 20,000 and Rainmaker also says 9,000 have left the industry since 2018.

The exodus has also continued into FY22 with over 100 leaving a practice in August alone.

Rainmaker blames increasing regulation that has affected financial advisers in Australia since 2015.

Regulation on financial advisers Australia

Many of these have come since the Hayne Royal Commission which concluded in early 2019.

The most publicised recommendation was transitioning to a user-pays mortgage broker commission model.

This move ultimately that didn’t eventuate after industry pressure and ironically mortgage broking businesses have boomed amidst the current property market.

But financial advisers were not spared the same fate and had already been hit with more regulations even prior to Justice Hayne’s recommendations.

Some include:

- Obtaining client consent to continue a service fee arrangement every year

- Requiring all existing registered advisers to pass an exam from the Financial Advisers Standards and Ethics Authority (FASEA) to keep their license

- Proactively identifying the target market for their products and not distributing a product without such determination

Further legislation on Australian financial advisers is sitting before parliament right now.

The Financial Sector Reform (Hayne Royal Commission Response – Better Advice) Bill 2021 will have several implications including additional penalties and sanctions and moving to a single disciplinary body.

Has it been worth it?

Alex Dunnin, executive director of research and compliance at Rainmaker Information says while the Australian government’s intention was right, the exodus of financial advisers was a direct consequence.

“This adviser exodus has been associated with the massive disruption now befalling the financial advice sector,” he said.

“The regulatory disruption that Australia’s financial advice sector is facing is due in large part to the huge push by government, regulators and other stakeholders to improve the quality of financial advice.”

“We are yet to see the evidence, however, of how all these regulatory changes have improved the outcomes for those who seek financial advice.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.