CLOSING BELL: Solid effort from the techies leads a post-lunch recovery to -0.08%

Be careful what you wish for, says the man with giant golden balls. Pic via Getty Images.

- An afternoon rally has put some lead back in the market’s pencil, closing down 0.08%.

- Tech stocks and Small Ordinaries drive the wins, with InfoTech up 1.5% for the day.

- Lithium’s back on the menu, with three big names making some chunky, chunky gains.

Just when it looked like another limp, soggy day on the bourse, an afternoon turnaround from has helped the ASX save a fair bit of face this afternoon, leaving the benchmark with enough steam to come back from a 0.3% deficit to finish just 0.08% lower for the day.

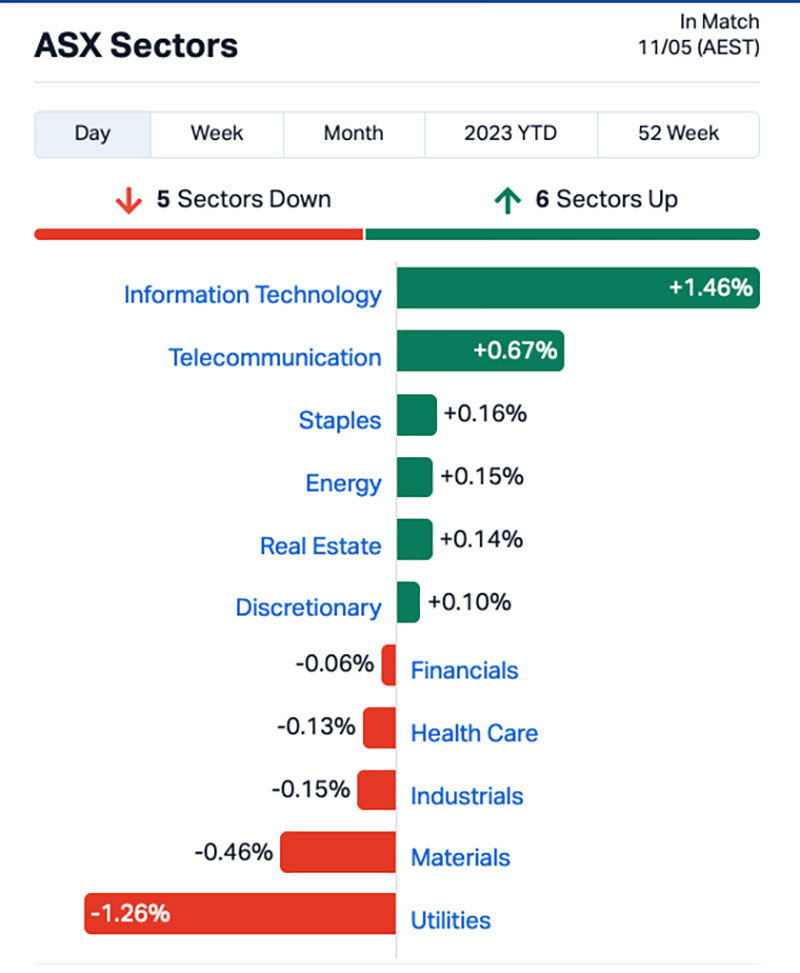

Taking a leaf from my colleague Rob Badman this morning (and borrowing a chart from the good folks at MarketIndex.com.au), here’s an at a glance of what’s happening across the sectors today.

Up the top end of town, the lithium re-boom is clearly back in full swing, with three market heavyweights stacking on some serious poundage throughout the day.

$9 billion market capper Allkem (ASX:AKE) is working its way towards being a much, much bigger company, after a whopping 18% surge in price today after it’s after-hours announcement that it’s signed a definitive merger deal with Livent, in an all-stock merger of equals valuing the combined company at US$10.6 billion (A$15.7 billion).

Core Lithium (ASX:CXO) got an 8.2% boost today as well, on the back of news of two milestones for the Finniss Lithium Operations – the first being the loading of the maiden cargo of spodumene concentrate commencing at the Port of Darwin.

The second milestone is the granting by the NT government of the mining authorisation and approved the Mine Management Plan (MMP) for BP33, the final step in the approvals process for BP33 ahead of a potential investment decision by the Core Lithium Board.

And everyone’s favourite swingin-est lithium player Sayona (ASX:SYA) has put on 7.5% today, because that’s how Sayona likes to do things. There was no particular news driving the result.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PRM | Prominence Energy | 0.002 | 100% | 2,269,867 | $2,424,609 |

| ADS | Adslot Ltd. | 0.006 | 50% | 136,930 | $8,817,394 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 130,626 | $15,642,574 |

| BMO | Bastion Minerals | 0.03 | 43% | 7,017,671 | $3,347,643 |

| 8VI | 8Vi Holdings Limited | 0.7 | 41% | 58,964 | $20,978,804 |

| HMG | Hamelin Gold | 0.15 | 36% | 194,808 | $12,100,000 |

| FTC | Fintech Chain Ltd | 0.015 | 36% | 27,441 | $7,158,465 |

| BAT | Battery Minerals Ltd | 0.004 | 33% | 3,684,261 | $10,070,827 |

| HCT | Holista CollTech Ltd | 0.017 | 31% | 10,000 | $3,624,401 |

| CDR | Codrus Minerals Ltd | 0.175 | 30% | 2,909,362 | $5,458,050 |

| PPK | PPK Group Limited | 1.79 | 25% | 365,999 | $127,683,689 |

| XTC | Xantippe Res Ltd | 0.005 | 25% | 15,251,449 | $42,320,399 |

| GLN | Galan Lithium Ltd | 1.26 | 22% | 5,784,122 | $316,122,867 |

| ILA | Island Pharma | 0.1 | 22% | 289,900 | $6,664,014 |

| SLM | Solis Minerals | 0.15 | 20% | 151,000 | $5,819,371 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 774,999 | $1,737,583 |

| LEL | Lithenergy | 0.87 | 19% | 1,236,136 | $43,909,500 |

| BGT | Bio-Gene Technology | 0.125 | 19% | 38,886 | $18,588,498 |

| PNN | Power Minerals Ltd | 0.415 | 19% | 370,936 | $25,316,999 |

| NIM | Nimy Resources | 0.23 | 18% | 372,124 | $13,234,416 |

| WMG | Western Mines | 0.75 | 17% | 1,610,213 | $33,078,611 |

| STN | Saturn Metals | 0.205 | 17% | 2,176,255 | $26,520,992 |

| HOR | Horseshoe Metals Ltd | 0.021 | 17% | 1,027,622 | $11,501,166 |

| CPT | Cipherpoint Limited | 0.007 | 17% | 41,415,212 | $6,955,450 |

| CXU | Cauldron Energy Ltd | 0.007 | 17% | 250,000 | $5,589,412 |

Leading the Small Caps ladder for the day is 8VI Holdings (ASX:8VI), after the Singapore-based FinEduTech company soared 44% on no news, and remarkably slim volume for the kinda price hike. Hrm.

Bastion Minerals (ASX:BMO) added 33.3% after the company provided an update on the McCombe North Lithium property, a package of three recently-optioned lithium prospects in Canada, which is where all the cool kids are digging lithium at the moment.

Orix Geoscience has been sent in to have a good look around on behalf of Bastion, conducting intensive mapping and sampling over the properties, concentrating on the greenstone units, to evaluate the potential extension of pegmatites from the GT1 McCombe prospect into the western properties optioned by Bastion.

And in third place today – Codrus Minerals (ASX:CDR) is back on the winners list again, bagging a Benaud-pleasing 37.8% gain, still riding the wave of good feelings from news of its high-grade clay-hosted rare earth mineralisation at Karloning on 05 May.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| VPR | Volt Power Group | 0.001 | -50% | 590,832 | $21,432,416 |

| APC | Aust Potash Ltd | 0.0115 | -36% | 24,499,699 | $18,696,201 |

| MRD | Mount Ridley Mines | 0.003 | -25% | 156,284,591 | $31,139,531 |

| PEC | Perpetual Res Ltd | 0.012 | -20% | 50,000 | $8,182,259 |

| AHF | Aust Dairy Limited | 0.02 | -20% | 6,725,418 | $14,712,889 |

| VAL | Valor Resources Ltd | 0.004 | -20% | 123,139 | $19,015,174 |

| WEL | Winchester Energy | 0.004 | -20% | 504,695 | $5,102,110 |

| CMO | Cosmo Metals | 0.1 | -17% | 95,764 | $3,061,200 |

| AXP | AXP Energy Ltd | 0.0025 | -17% | 381,360 | $17,474,042 |

| GTG | Genetic Technologies | 0.0025 | -17% | 2,904,266 | $34,624,974 |

| RBR | RBR Group Ltd | 0.0025 | -17% | 5,210,275 | $4,795,214 |

| ENV | Enova Mining Limited | 0.011 | -15% | 40,000 | $5,082,081 |

| RRR | Revolver Resources | 0.1125 | -15% | 139,680 | $14,753,756 |

| DAF | Discovery Alaska Ltd | 0.045 | -15% | 157,523 | $12,414,439 |

| FAU | First Au Ltd | 0.003 | -14% | 2,468,970 | $3,831,741 |

| KNM | Kneomedia Limited | 0.006 | -14% | 823,700 | $10,533,497 |

| AGR | Aguia Res Ltd | 0.034 | -13% | 556,586 | $16,920,316 |

| PVS | Pivotal Systems | 0.007 | -13% | 500,000 | $4,026,834 |

| RLG | Roolife Group Ltd | 0.007 | -13% | 737,500 | $5,756,465 |

| GSN | Great Southern | 0.021 | -13% | 27,320 | $16,640,568 |

| MDX | Mindax Limited | 0.11 | -12% | 1,465,835 | $255,694,848 |

| S3N | Sensore Ltd | 0.265 | -12% | 5,000 | $7,831,120 |

| MME | Moneyme Limited | 0.115 | -12% | 274,814 | $36,822,139 |

| LVH | Livehire Limited | 0.07 | -11% | 1,125,221 | $26,907,476 |

| FYI | FYI Resources Ltd | 0.12 | -11% | 1,681,638 | $49,452,875 |

LAST ORDERS

A quick one from Wildcat Resources (ASX:WC8), which went into a trading halt on 09 May, while it got ready to provide an update on negotiations with an unnamed entity regarding “a proposed conditional, significant transaction”.

It seems that those negotiations have turned out to be slightly more sticky than anticipated, with Wildcat asking for a suspension from trading this afternoon, to beat the deadline for its halt to be wound up.

The company is now aiming to have its news ready on or before Monday 15 May.

Elsewhere, SensOre (ASX:S3N) has supplied an amended version of its announcement from this morning, alerting the market that it needed to correct the total number of shares set to be issued to Directors under the placement it told the market about earlier.

The initial announcement said that 1.2 million shares (raising approximately $0.48 million) will be issued to Directors of the company, but that has since been corrected to 1.9 million shares, still raising the same dollar amount as before.

And Turaco Gold (ASX:TCG) has revealed that it has received binding commitments to raise $3.75 million through an equity placement, which has been “strongly supported by a number of new and existing institutional and sophisticated investors”.

The Placement is comprised of the issue of 75,000,000 fully paid ordinary shares at $0.05, raising $3.75 million (before costs), representing a 4% discount to Turaco’s last traded price and a 16% discount to the last 10-day volume weighted average price up to 8 May 2023.

“Combined with an existing cash position of $2.5 million (at 31 March 2023), the $3.75 million raised places Turaco in a strong financial position to continue to fund exploration success at all of Turaco’s projects in Cote d’Ivoire,” managing director Justin Tremain said.

And NextDC (ASX:NXT) has announced its exciting news about two new data centre developments, which form part of the company’s regional expansion strategy.

The centres are set to be developed on recently acquired commercial property in Kuala Lumpur, Malaysia, and Auckland, New Zealand.

Funding for the development – along with an an accelerated fitout at is coming via Company will fund the development of data centres on the New Sites, together with an accelerated fit out at the company’s S3 site in Sydney, via a ~$618 million fully underwritten 1 for 8 pro-rata accelerated non-renounceable entitlement offer of new fully paid ordinary shares in NextDC.

“As always, our focus remains on creating a highly diversified ecosystem of enterprise, connectivity, cloud, and managed service provider customers. New Zealand and Malaysia are just the first greenfield geographic expansion opportunities outside of Australia, and we are excited about the possibilities ahead,” CEO Craig Scroggie said.

TRADING HALTS

NextDC (ASX:NXT) – Equity raising.

Sunstone Metals (ASX:STM) – Capital raising.

Pancontinental Energy (ASX:PCL) – Capital raising.

Tempus Resources (ASX:TMR) – Capital raising.

GreenTech Metals (ASX:GRE) – Capital raising.

Optima Technology Group (ASX:OPA) – Capital raising.

Pivotal Metals (ASX:PVT) – Capital raising.

Chalice Mining (ASX:CHN) – Capital raising.

Adveritas (ASX:AV1) – Capital raising.

Magnum Mining (ASX:MGU) – Magnum halted to allow the company to provide clarification on the two announcements made on May 10 with respect to the non-binding MOU with Mitsubishi.

Cellnet Group (ASX:CLT) – Potential control transaction.

Australian Potash (ASX:APC) – Halt called until the federal Department of Climate Change, Energy, the Environment and Water issues a correcting statement.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.