CLOSING BELL: A massive win for Zelira’s new pain drug has polished an absolute turd of a day

it's... it's not chocolate... Pic via Getty Images.

- The ASX 200 fell 1.37%, and the bad news kept piling up all day

- Inflation data knee-capped the market mid-morning, because rate hikes are on the way

- Two Small Caps hit triple-figure home runs today, which is kinda amazing

Welp… that was most certainly a day – one of those special kinda days that start off a bit grim before shit just gets weird and before you know it, the major banks are being sold off like crates of beer at a buck’s night, while a handful of Small Cappers hit the kind of highs that most companies can only dream about.

The banner headline is that the ASX 200 benchmark fell 1.37% today, which – obviously – isn’t fantastic news.

I’ll do my best to break it down for you, but if you could be so kind as to bear in mind that there was a lot going on today, plus I burnt the roof of my mouth by foolishly tucking into my microwave lasagne lunch about 20 seconds too early, so I’m a little distracted by injuries sustained by popping something into mouth that was approximately the temperature of the sun.

Let’s start at the top, with a weak lead-in from the US from a mixed result on Wall Street had the ASX set for a dip right outta the gate.

And dip it most assuredly did, falling -0.35% in the opening minutes of the session, and then continuing to slide deeper into the darkness, sinking as low as -1.4% shortly after lunch.

At almost exactly 11:30am, however, the wheels came off and things got a bit hectic – right around the time that the bean counters at the Australian Bureau of Abacus Wielding hit the nation in the kneecaps with some pretty bad news.

Inflation figures arrived that were quite a lot worse than expected, at 6.8% for the year to April, much higher than the expected 6.4%.

The jury (by which, my ability to sift through the avalanche of data I’ve spent my day attempting to process) is still out on whether the timing of that and the timing of a sudden and massive sell-off on bank stocks are directly linked to each other.

But, erring on the side of “correlation ≠ causation”, it’s more likely that a whole big bunch of other hugely complicated stuff that I really don’t have time to dig into here today is making it look more like an unhappy coincidence than anything else.

That said, those two things definitely aren’t great news.

For the first bit (inflation data), speculation is now mounting on how the RBA is going to deal with the problem – because, despite a very lengthy run of interest rate rises, for all the pain they’ve caused and the half-arsed apologies the RBA has offered, it doesn’t look like they’ve done the trick just yet.

Hence, we’re already seeing some gloomy outlooks from the numbers guys, including this from Capital Economics: “With inflation set to overshoot the Reserve Bank of Australia’s forecasts this quarter, we’re now pencilling in two more 25bp rate hikes, including one at the upcoming meeting on 6th June. And we don’t expect the Bank to cut rates until Q2 2024.”

Blergh.

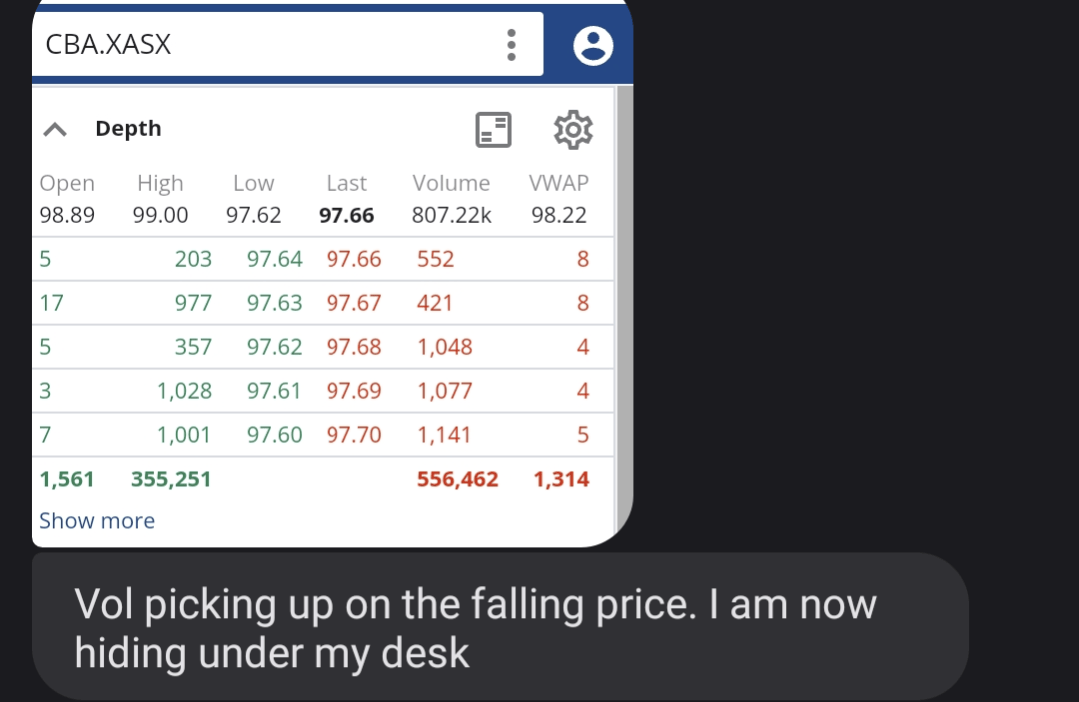

The second part had Stockhead’s resident up-to-the-minute guru – we call him Bottom Picker and you should, too – feeling a little queasy.

The 11:30 bank plunge looked nasty – accelerating losses on massive volume spikes is never a good sign, especially when it’s hitting the pillars of the nation’s faith in its money.

“What we are seeing is a lack of support for Australian blue chips which will flow through to the smaller caps,” Bottom Picker told me, from a hastily constructed fort underneath his desk.

(What he actually said was this – a very real screenshot of the conversation).

“Coal is down 40% in a month and tax-year-end selling will only increase the downside, especially among African miners,” he also said, once he’d had a cup of tea and fistful of codeine.

And yea verily, there was much moaning and crying in dismay, widespread gnashing of teeth and even some rending of garments, for Bottom Picker was right, and the news was – as foretold – Very Grim.

Anyway, a couple of hours after that, predictably enough, gold stocks started climbing. The XGD All Ords Gold index put on its big boy pants and went strutting off to greener pastures (up 0.7%) throughout the afternoon, as Safe Haven Mania started kicked in again.

The banks got hit hard, and remained on the canvas for the rest of the day: CBA (ASX:CBA) down 1.9%, ANZ (ASX:ANZ) down 1.7%, NAB (ASX:NAB) down 1.3%… the list goes on.

And that brings us to the end of the day, as the Closing Bell rings and blood pressures return to somewhat more normal levels.

WHERE DID WE LAND?

Utilities was the only broad sector on the right side of the line today, ending the day 0.2% higher, while InfoTech got terribly close to breaking even but couldn’t quite managed to get it across the line, down 0.06%.

Well and truly down the bottom end of ugly were a swag of sectors reporting falls of more than 1.5%.

Energy suffered the most, falling 2.21%, followed by Discretionary (-1.69%), Materials (-1.63%) and Financials (-1.57%).

Up the fancy end of town, Weebit Nano (ASX:WBT) was up to its old unusual movements tricks again, defying overall market direction and sentiment to add 6.4% on no news… which is a lot of value on a $1.02bn market cap company.

Likewise, Mader Group (ASX:MAD) – which was up on no news yesterday – is up another 4.8% today, also on no news.

But even though a goodly chunk of the broader ASX reportage looks like fairly depressing news, today was anything but crap for a couple of Small Caps, with two of them reaching the end of the session to bank triple-figure gains.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ZLD | Zelira Therapeutics | 3.18 | 238% | 1,173,179 | $10,666,326 |

| SLM | Solismineralsltd | 0.275 | 96% | 13,744,672 | $6,517,696 |

| GSM | Golden State Mining | 0.051 | 70% | 29,594,655 | $3,510,426 |

| TYM | Tymlez Group | 0.005 | 67% | 165,785,664 | $3,276,586 |

| CAZ | Cazaly Resources | 0.036 | 44% | 13,493,566 | $9,295,545 |

| IS3 | I Synergy Group Ltd | 0.01 | 43% | 13,940 | $2,023,563 |

| MTL | Mantle Minerals Ltd | 0.002 | 33% | 3,598,269 | $9,221,169 |

| SRJ | SRJ Technologies | 0.08 | 31% | 29,830 | $5,783,779 |

| AXE | Archer Materials | 0.6 | 26% | 2,683,630 | $121,052,331 |

| BEX | Bikeexchange Ltd | 0.01 | 25% | 698,654 | $8,967,868 |

| RDN | Raiden Resources Ltd | 0.005 | 25% | 1,109,568 | $7,418,330 |

| HYD | Hydrix Limited | 0.033 | 22% | 619,306 | $6,863,909 |

| AKP | Audio Pixels Ltd | 14.65 | 20% | 58,195 | $354,345,852 |

| BET | Betmakers Tech Group | 0.15 | 20% | 12,738,754 | $117,942,700 |

| SGC | Sacgasco Ltd | 0.006 | 20% | 15,833 | $3,078,619 |

| TTI | Traffic Technologies | 0.012 | 20% | 166,894 | $7,576,702 |

| ALM | Alma Metals Ltd | 0.013 | 18% | 1,485,467 | $10,054,009 |

| G50 | Gold50Limited | 0.175 | 17% | 90,000 | $8,541,450 |

| SHN | Sunshine Gold Ltd | 0.021 | 17% | 2,790,674 | $17,264,809 |

| NAE | New Age Exploration | 0.007 | 17% | 13,785,249 | $8,615,393 |

| LER | Leaf Res Ltd | 0.015 | 15% | 221,172 | $26,806,505 |

| AZS | Azure Minerals | 0.54 | 15% | 3,266,638 | $183,410,954 |

| CYQ | Cycliq Group Ltd | 0.008 | 14% | 257,455 | $2,432,617 |

| GMN | Gold Mountain Ltd | 0.004 | 14% | 1,308,773 | $6,894,764 |

| LMLND | Lincoln Minerals | 0.008 | 14% | 125,000 | $5,827,347 |

Top of the pops today was Zelira Therapeutics (ASX:ZLD), after it kicked the mother of all match-winners this morning, after an IRB-approved 1 multi-arm head-to-head study of its proprietary diabetic nerve pain drug ZLT-L-007 showed that it outperforms the current go-to drug Lyrica.

This is massive news – Lyrica (also known as pregabalin) is a multi-billion dollar money spinner, prescribed heavily around the world to tackle pain associated with horribly painful peripheral neuropathy (nerve damage) brought on by diabetes and other ailments. And my gout.

Zelira was already up 192.55% by lunchtime, and my incredibly insightful and brave prediction at that stage of the day was that “despite being tightly held, looks like it’s going to continue to climb for a while” – I’d like to point out – was 100% correct, because ZLD finished more than 220% higher for the day.

Meanwhile, Solis Minerals (ASX:SLM) has also gone soaring, up 107% today on news that the company has executed an option to acquire the Jaguar hard rock lithium project in Bahia State, Brazil.

Rock chip samples from Jaguar’s pegmatite has confirmed spodumene grades in oxidised pegmatite up to 4.95% Li2O, and the project has extensive pegmatite body mapped over 1km of strike, with widths in excess of 50m with coarse visible spodumene exposed across pegmatite body.

Solis will have some excellent assistance in getting started at the site, with its largest shareholder, Latin Resources (ASX:LRS), lined up to provide exploration guidance and in-country experience.

And in third place, it’s Golden State Mining (ASX:GSM), also flying very high, but without any fresh news to provide an explanation.

GSM recently announced the acquisition of exploration rights adjacent to the Nomad lithium prospect at the Yule project in WA’s Pilbara region, but that was a week ago… still, its trading price was up 66.7% at lunchtime, but that eased a little to finish the day at 57%.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MRD | Mount Ridley Mines | 0.002 | -33% | 1,595,011 | $23,354,649 |

| SVY | Stavely Minerals Ltd | 0.125 | -29% | 1,707,953 | $57,097,900 |

| CTE | Cryosite Limited | 0.515 | -26% | 10,546 | $34,166,694 |

| PUA | Peak Minerals Ltd | 0.003 | -25% | 11,821,572 | $4,165,506 |

| DAF | Discovery Alaska Ltd | 0.027 | -25% | 942,848 | $8,432,449 |

| TOY | Toys R Us | 0.01 | -23% | 3,698,555 | $11,220,127 |

| AFW | Applyflow Limited | 0.011 | -21% | 228,250 | $2,070,329 |

| TTM | Titan Minerals | 0.04 | -20% | 1,136,203 | $70,563,659 |

| ZAG | Zuleika Gold Ltd | 0.014 | -18% | 378,698 | $8,891,861 |

| HAS | Hastings Tech Met | 1.705 | -17% | 1,716,091 | $265,017,137 |

| CAV | Carnavale Resources | 0.0025 | -17% | 842,666 | $8,200,655 |

| PYR | Payright Limited | 0.005 | -17% | 43,202 | $5,285,311 |

| ROO | Roots Sustainable | 0.005 | -17% | 3,558,705 | $832,333 |

| RFA | Rare Foods Australia | 0.064 | -16% | 10,055 | $15,374,431 |

| FEG | Far East Gold | 0.3 | -14% | 82,177 | $53,566,874 |

| ADR | Adherium Ltd | 0.003 | -14% | 45,744 | $17,487,534 |

| GFN | Gefen Int | 0.006 | -14% | 22,000 | $476,701 |

| FNX | Finexia Financialgrp | 0.25 | -14% | 135,793 | $13,910,018 |

| RXH | Rewardle Holding Ltd | 0.025 | -14% | 680,315 | $15,263,323 |

| FFT | Future First Tech | 0.019 | -14% | 196,000 | $15,726,404 |

| PET | Phoslock Env Tec Ltd | 0.019 | -14% | 1,200,256 | $13,736,591 |

| NXS | Next Science Limited | 0.49 | -13% | 135,344 | $121,356,426 |

| SEG | Sports Ent Grp Ltd | 0.2 | -13% | 2,650 | $60,055,766 |

| BDG | Black Dragon Gold | 0.04 | -13% | 544,842 | $9,230,823 |

| PPK | PPK Group Limited | 1.41 | -13% | 327,225 | $144,648,655 |

LAST ORDERS

Prodigy Gold (ASX:PRX) announced today that it’s the beneficiary of the NT’s “Resourcing the Territory” initiative, which saw a record total of $3.7m worth of co-funding for exploration activities handed out across 30 companies.

Prodigy reports that it’s managed to nab two exploration grants in the Tanami North

project area with the NT Government co-contributing a total of $158,148, which will go towards:

- Tanami North Regional Scale Gravity Survey, covering a large portion of EL9250 that hosts the Hyperion gold deposit and EL31331 that hosts the Tregony gold deposit

- Drilling of a single diamond core hole into the Tregony gold deposit to provide structural and stratigraphic context to the recently released mineral resource.

Both co-funded programs will expand Prodigy Gold’s understanding of the Tanami North project area and aid more detailed exploration planning moving forward., the company says.

Meanwhile a bit further north, Far East Gold (ASX:FEG) has revealed that it’s gotten into even more visible gold at its Woyla copper-gold project in the Aceh region of North Sumatra, Indonesia.

FEG says that the visible gold spotted in a drill core taken at the the Rek Rinti prospect as part of the Woyla project’s Phase-2 resource delineation drill program, which is exciting for the company as it confirms the lateral extension of the high-grade gold-silver mineralisation the company has already announced within the Agam vein.

TRADING HALTS

Aurelia Metals (ASX:AMI) – Capital raising.

Vintage Energy (ASX:VEN) – Capital raising.

Aruma Resources (ASX:AAJ) – Capital raising.

European Lithium (ASX:EUR) – Announcement regarding financing of the Wolfsberg lithium project.

Argenica Therapeutics (ASX:AGN) – Capital raising.

Immutep (ASX:IMM) – Equity raising.

Patagonia Lithium (ASX:PL3) – Announcement in relation to significant exploration results.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.