ASX Small Caps Lunch Wrap: Who else is battling upset tummies today?

Glurrrrp. Pic via Getty Images.

The ASX 200 is down 1.9% as US rate hikes and psychotic dictators are – again – playing havoc with the markets. Hmph.

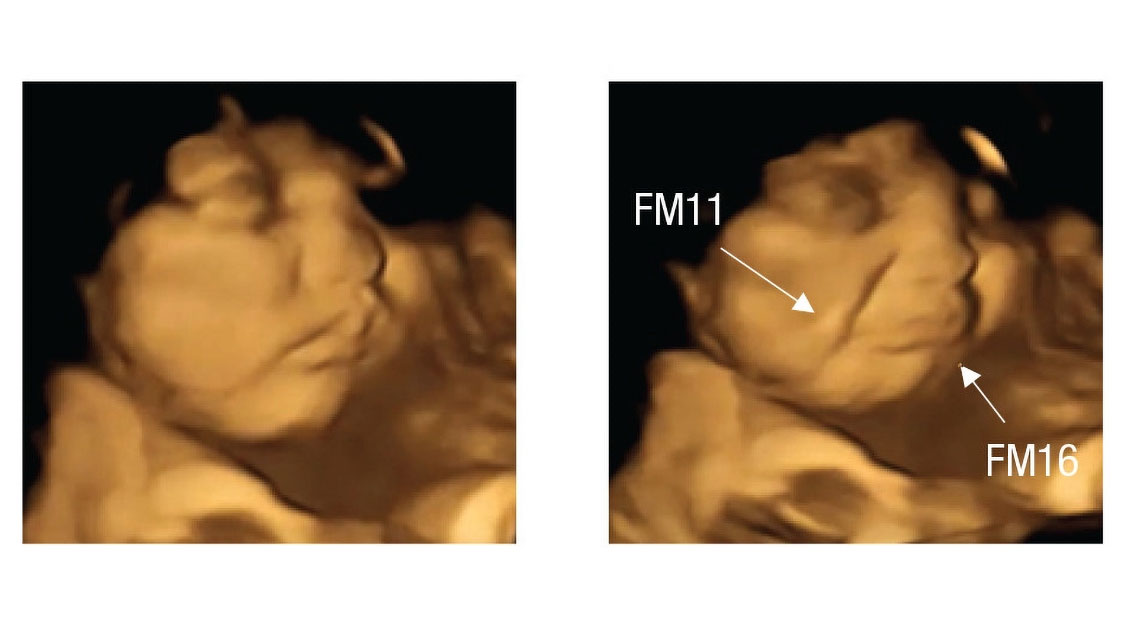

But in lighter news, research from the UK’s Durham University has scientists proclaiming that even unborn babies hate kale.

This means either unborn babies are heaps smarter than we gave them credit for, or – more likely – kale is the leafy equivalent of a glass of hot bin juice.

Once hailed as something of a Super Food, kale has since walked the fine line between those who fell for the Big Kale marketing ploy, and those of us who live in the real world and understand that it’s hugely disgusting.

It is a weed that tastes like someone extinguished a pile of burning green waste with the tears of the ABC’s gardening guru, Costa Georgiadis.

There. We said it.

Despite that being a well-known fact, researchers, led by study co-author Professor Nadja Reissland, decided to perform some deeply weird research on unborn babies, by feeding their mothers kale and then grossly invading their foetal privacy by taking photos of the babies clearly not loving the flavour.

Turns out, kids hate vegetables and make faces when they taste them – even in the womb.

Spoiler alert: we’ve known for quite some time that babies can taste whatever their mother’s been eating and drinking, and that when it’s a flavour that the foetus enjoys, they show their appreciation by increasing the amount of amniotic fluid that they drink.

A quick explanation of amniotic fluid. Most folks understand that the baby grows inside a womb, which is basically a hypermuscular avocado. Inside the avocado is the amniotic sac, which is just like the bladder from inside a box of goon.

The baby floats around in the wine inside the goon bag, drinking up to three cups of the fluid per day, depending on how tasty it is. Fruity Lexia, apparently, is a bit of a favourite.

But if you were to replace that sweet, sweet garbage wine with a kale smoothie, the baby will get sad and make sad faces and ball up its tiny fists and grind its gums in impotent rage.

The good news for expectant mums is that there’s a very simple solution to the issue, and that’s to stop feeding kale to your baby – unless you actually want something to emerge from your womb bearing a terrible grudge from the moment it draws its first breath.

TO MARKETS

Australian markets have fallen this morning, down 0.9% at open and down around 1.6% as we head towards lunch.

Consumer Discretionary (-3.84%), and Real Estate (-3.55%), and InfoTech (-3.73%) are all lining the bottom of the litter tray this morning, in a house full of cats suffering severe intestinal distress.

Utilities (-2.13%), Communication Services (-2.36%) and Energy (-1.80%) aren’t faring much better – in fact, it’s Materials (-0.25%) providing the only bulwark against an enormous rout, despite being on the wrong side of the ledger itself this morning.

There are no Top Dollar Winners this morning – but there are certainly some taking big hits today.

Block Inc (ASX:SQ2) has fudged out a 9.0% drop this morning, bringing its trading price down to $84.30, a fall of nearly 23% over the past 10 days, while Latitude (ASX:LFS) is down 8.8% after going ex-div today.

How are things looking overseas this morning? Let’s go find out together, shall we?

NOT THE ASX

The drop on Australian markets this morning has come off the back of a couple of iffy days on Wall Street, where markets have been thoroughly pantsed by the US Fed’s widely anticipated 75bp rate hike that US investors had supposedly already priced in.

Looks like someone missed the memo. The S&P dropped -0.84%, the Dow fell -0.35% and the Nasdaq dumped -1.37%.

The rate hike in the US is part of a broader series of hikes as national policymakers around the world fight to rein in galloping inflation rates.

Our guy Eddy Sunarto was up early to report that “The Bank of England increased its rates by 50bp, the Swiss National Bank by 75bp, Norway by 50bp, and Canada is expected to hike by 50bp.”

In fact, it’s rate hikes almost as far as the eye can see, except for a few outliers including Japan, China and Russia. Most notable though is Turkey, which very recently cut its rate as inflation hit a ball-achingly massive 80.2%.

In Asian market news, Japan’s closed for a public holiday, Hong Kong is down 0.51% and Shanghai is flat.

In commodities, things are – pardon the pun – highly volatile as the sabre-rattling out of Russia continues to destabilise energy markets around the world.

The news that Russia is set to call out ~300,000 more recruits into active service for its “small operation” in Ukraine – and that President Putin is refusing to rule out dropping a few nukes if things go any further south – is, evidently, extremely alarming.

Oil prices have climbed +0.3% and natural gas (the most sensitive to Putin’s ‘roid rage clowning) have jumped 2.26%.

When asked for comment on gas prices, King Liam the Flatulent complained about being dragged away from playing Elden Ring to “talk about some stupid gas stuff”, but seemed pleased that he’ll have a bit more pocket money this week.

Meanwhile, gold inched down 0.04%, silver went up 0.22% and copper fell like the tresses of a Hollywood starlet, down 0.43%.

In the Crypto Pond, where the water’s murky and you definitely don’t want to catch any tadpoles, it’s XRP making waves this morning, up better than 20% at the time of writing.

As always, there’s more to the story, and Rob “Our Don Bradman” Badman is at the crease, ready to pound you on the head with a cricket bat until you’re also in a fit state to understand WTF is happening.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for September 23 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JAV Javelin Minerals Ltd 0.0015 50% 200,025 $9,454,153 TSC Twenty Seven Co. Ltd 0.0025 25% 3,794,706 $5,321,628 MXO Motio Ltd 0.041 21% 28,513 $8,758,473 AYM Australia United Min 0.006 20% 3,835,145 $9,212,887 RAS Ragusa Minerals Ltd 0.375 17% 8,075,034 $41,166,102 WC1 West Cobar metals 0.245 17% 315,070 $6,457,516 AVM Advance Metals Ltd 0.014 17% 107,142 $5,734,529 GLV Global Oil & Gas 0.0035 17% 1,743,292 $5,620,064 AJL AJ Lucas Group 0.18 16% 5,025,088 $185,424,428 GRX Greenx Metals Ltd 0.29 16% 107,404 $63,405,116 AEV Avenira Limited 0.015 15% 27,860,351 $15,825,357 GTG Genetic Technologies 0.004 14% 372,625 $32,318,878 IEC Intra Energy Corp 0.008 14% 272,256 $4,240,471 NUH Nuheara Limited 0.21 14% 142,042 $25,381,135 MTO Motorcycle Hldg 2.45 13% 66,630 $133,286,494 EPN Epsilon Healthcare 0.026 13% 2,033,020 $6,824,506 ADX ADX Energy Ltd 0.009 13% 4,365,005 $28,040,237 RDN Raiden Resources Ltd 0.009 13% 595,208 $11,876,415 HMI Hiremii 0.048 12% 25,000 $4,552,288 DXB Dimerix Ltd 0.15 11% 332,648 $43,317,945 GTI Gratifii 0.02 11% 263,167 $17,221,724 VAL Valor Resources Ltd 0.01 11% 2,601,193 $32,926,813 VAN Vango Mining Ltd 0.042 11% 125,562 $47,877,630 OLY Olympio Metals Ltd 0.21 11% 67,251 $7,233,589 RFA Rare Foods Australia 0.065 10% 8,500 $11,843,824

Topping the Little Guys Happy-Happy List this morning is digital-Place-Based and Location Intelligence media company Motio (ASX:MXO), up 20.5% this morning on news that “IBM Cognos with Watson users the opportunity to positively impact their business intelligence experience through the use of its MotioCI tool which is now fully supported whether using it on-premises or in the cloud”.

It’s great news for investors, and terrible news for anyone who would like to be able to pop down to the shops for two bottles of fruit-flavoured vodka, a pack of rubber gloves and a tube of KY without IBM’s computers wondering what kind of weekend you have planned.

Also roaring up the chart this morning is West Cobar Metals (ASX:WC1), smashing out a 19% blast on news that it’s going to hold a General Meeting.

WC1 has seen its trading price lurch about all over the place in recent times, so it’s hard to pinpoint why news of the meeting has everyone super-excited and piling back on this morning – but if we get to the bottom of this arvo, we’ll let you know in Closing Bell.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for September 23 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap VPR Volt Power Group 0.002 -20% 5,000,005 $23,361,334 XST Xstate Resources 0.002 -20% 728,761 $8,037,954 MCM Mc Mining Ltd 0.575 -18% 159,601 $139,346,683 GLL Galilee Energy Ltd 0.29 -18% 427,064 $120,180,812 GGE Grand Gulf Energy 0.016 -16% 25,140,969 $29,385,603 TG1 Techgen Metals Ltd 0.165 -15% 243,283 $8,620,641 LLO Lion One Metals Ltd 0.86 -15% 45,781 $10,937,953 FAU First Au Ltd 0.006 -14% 90,349 $6,519,877 ROO Roots Sustainable 0.003 -14% 25,000 $2,623,714 VRC Volt Resources Ltd 0.025 -14% 26,603,869 $96,299,250 SIX Sprintex Ltd 0.032 -14% 50,000 $9,411,110 SZL Sezzle Inc. 0.48 -14% 1,265,067 $114,413,382 KCC Kincora Copper 0.058 -13% 30,000 $4,930,136 ATH Alterity Therap Ltd 0.013 -13% 15,273,280 $36,103,119 AR1 Austral Resources 0.3 -13% 689,300 $102,105,108 KGD Kula Gold Limited 0.027 -13% 727,666 $8,338,056 HYD Hydrix Limited 0.061 -13% 64,159 $13,835,030 ARO Astro Resources NL 0.0035 -13% 623,762 $19,573,068 TKL Traka Resources 0.007 -13% 407,000 $5,510,196 EYE Nova EYE Medical Ltd 0.22 -12% 20,300 $36,466,112 CUL Cullen Resources 0.015 -12% 469,010 $6,916,601 NRX Noronex Limited 0.039 -11% 670,749 $7,500,231 AVA AVA Risk Group Ltd 0.195 -11% 563,673 $56,174,472 BMR Ballymore Resources 0.195 -11% 27,765 $16,165,178 OAU Ora Gold Limited 0.008 -11% 35,024 $8,858,082

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.