ASX Small Caps Lunch Wrap: Who else has some terrible sins they need to confess today?

"Tell me your deepest secrets... and please, be honest. Have you been stealing all the Post-its again?" Pic vua Getty Images.

Local markets have dipped this morning, like a nut-brown, wizened old man who lives by the sea and believes an early morning paddle in the ocean is the secret to maintaining the virility for which he, quite unjustifiably, believes he’s locally well known for.

The 0.3% fall this morning is our local market following the lead of just about every major market around the world, after the US and Europe took a bath overnight thanks to China being stingy with a rate cut that was meant to boost their economy, and – by extension – everyone else’s as well.

I’ll dig into that in a bit more detail in a minute, but first I’ve got a story for you that will make you feel a lot happier about where you work – because a restaurant owner in California has committed an almost unforgivable sin.

Eduardo Hernandez was the owner of a Taqueria Garibaldi restaurant, a local northern Californian restaurant chain which is apparently (and inexplicably) quite popular.

It really doesn’t look all that appealing, to be honest… but I didn’t expect much from a Mexican restaurant named after a habitually bloodthirsty 19th Century Italian nationalist, but this really does look much, much worse than I thought it would.

A quick look at the menu shows that everything is either bright orange, dogshit brown or a virulent shade of green that suggests the dish has been flavoured with clippings from the 16th green at Augusta National Golf Club.

Special mention goes out to the police caution tape by the salad bar, which is either an inexpensive method of crowd control at the buffet, or evidence that someone’s already been killed in the crush to be first to the tub of guacamole before the top turns grey.

Anyway… Senor Hernandez sounds like your typical American food-related small business owner: completely mental with a control fetish so profound he’ll do just about anything to squeeze every last dribbling ounce of capital from his workforce.

I know this because an investigation into his restaurant found a string of terrible worker abuses… stuff like wage theft, lying about how many hours people are being forced to work, and threats of having his staff deported back to Mexico if they don’t do what they’re told.

So far, not a story. But here’s where it gets super-weird.

According to the workers, they turned up at the restaurant one day to find a priest on the premises, who Senor Hernandez said was there “to get the sins out of the restaurant workers”.

“The priest began the meetings with a prayer, Labor Department investigator Raquel Alfaro testified last year. He then asked the employees whether they were loyal to owner Eduardo Hernandez and whether they had ever stolen from him,” The Post says.

That was, apparently, the final straw for the workers, who called in the US Dept of Labor – and the excrement really hit the fan – Herandez and his co-owner Hector Galindo owe 35 employees US$140,000 in lost wages, and damages for the stunt with the would-be priest.

No word on whether Father Sacredeto Falso has been referred to The Vatican for a suitably medieval punishment, but I’m pretty sure there’s going to be a special place in hell for just about everyone behind the stunt.

TO MARKETS

As we roll towards lunch time, local markets recovered a little from this morning’s -0.3% dip, after investors took their cue from major overseas markets which all had a bad night. However, when the bell rang for pie-time at the ASX, the benchmark was back to -0.3% and showing little sign of getting any better.

Our local market dip has been led by a harsh sell-off on the Materials and Energy sectors, which are down 1.2% and 1.1% respectively, which was anything but a ringing endorsement from the markets for Federal Resources Minister, The Hon. Madeleine King MP, dropping her long-awaited government blueprint for Australia’s Critical Minerals future.

It’s a hefty document, full of fluff and hopium about how Australia is about to Ride on Lithium’s Back into the 21st century, like we rode the sheep’s back in the ’50s, and on Paul Hogan’s back in the ’80s. It definitely has all the right buzzwords in it, talks a lot about how enviro-friendly our massive holes in the ground are gonna be and assures us all that the profits made will be shared among all Australians, but doesn’t say how.

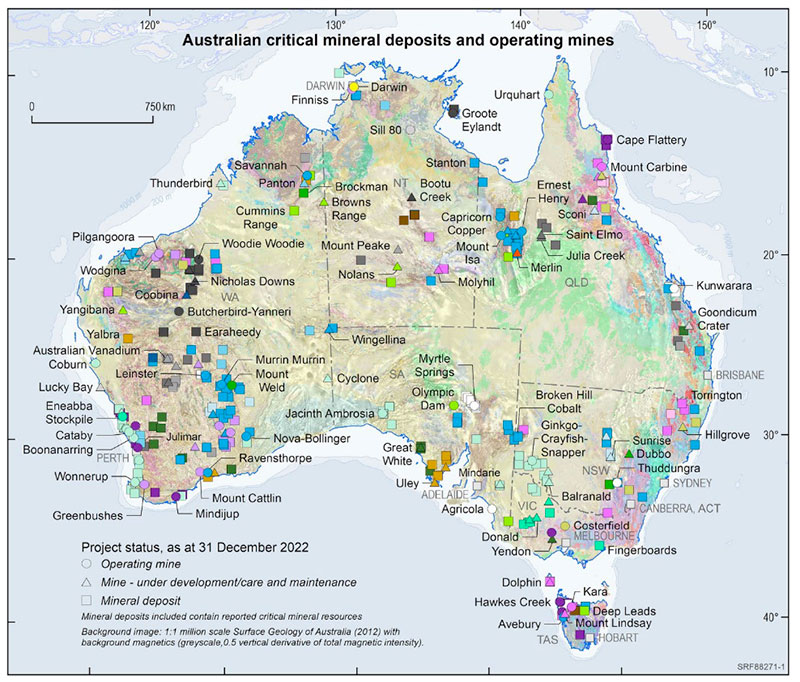

But there is an added bonus in the document for all would-be pirates and other nearby nations who may or may not be quietly preparing to invade: This handy treasure map, to ensure that all of our critical resources are easy to find once the population has been sufficiently subjugated and we’ve accepted our freshly-installed Kiwi overlords.

On the positive side of the ledger, Health Care is recovering well from being eviscerated and emasculated last week, adding 0.75% this morning, but still walking a little gingerly, as you’d expect.

Real Estate and the Telcos are both hovering around the +0.4% mark, and there was a rapid rise and decline for tech stocks this morning, with the XTO All Tech index jumping 23 points at open before dropping slowly back to be just 0.3% higher.

Both Telstra (ASX:TLS) and TPG Telecom (ASX:TPG) got some bad news this morning, after the The Australian Competition Tribunal upheld a previous ACCC decision to stop the pair entering into an agreement that would have seen TPG decommission its regional network to piggyback on the broader existing Telstra network.

It would have seen TPG’s coverage climb from 96% to 98.9% in regional Australia, but the move was shot down on the basis that it would probably result in a drop in infrastructure investment.

At the time of writing, Telstra’s weathering the storm, flat at -0.02%, but TPG is copping a hammering, down 6.6% for the morning so far.

NOT THE ASX

Overnight, Wall Street retreated again from recent highs, as the S&P 500 declined 0.47%, the Dow lost 0.72% and the Nasdaq slipped 0.16%.

And I wouldn’t hold my breath if I were you for a ton of improvement overnight, as US markets brace for the inevitable sour note to emerge from US Fed Chief Jerome “The Harbinger of Doom” Powell’s appearance before Congress in the coming days.

Theories on the current US slow-down are varied, with some analysts pointing the finger at the economic world’s slow-moving target (that’s you, China) and the flow-on from the rate cut that failed to shake the world.

Everyone heard rumblings about it, and hopes were high that there would be enough of a cut to really jiggle China’s economic mandarins, but the nation’s Central Committee on Cutting Things For Economic Long Prosperity decided that a cut on its one-year loan rate of just 10 basis points (from 3.65% to 3.55%) would be ample, while reducing the five-year rate by the same margin to 4.2%.

It’s like poking a cow in the arse with a cattle prod that doesn’t have any batteries in it – and so, even though China’s exports fell a hugely alarming 7.5% in May – China’s economy is really only give us all one of those slow bovine over-the-shoulder looks before dropping an enormous cowpat on the toes of our gumboots.

It’s enough to make you spit out your cud in disgust.

Chinese markets are down again this morning, with Shanghai lower by 0.35%, while in Hong Kong the Hang Seng is down 1.55% because the buildings there are too tall.

However, Japan’s on a hot streak this morning (relatively speaking), up 0.2% on news that an 86-year-old resident of Warabi, in Japan’s Saitama Prefecture, has rescued a young woman he found passed out drunk in the middle of the road.

Hiromitsu Senba, who was awake at 5.30am just like every old person in the world because for some reason they never seem to sleep, found the woman in a near-comatose state, and leapt into action.

After calling for medical help, the 86-year-old got his hands on a light-up baton – like the ones the cops use to pull you over for a “random” breath test – and stood next to the woman, waving it about to stop local motorists from running her over.

Hiromitsu Senba is certainly a front-runner for Best Old Man of 2023, not only for helping to keep that young woman alive, but also for making a complete mockery of every Japanese “man finds unconscious woman” video I’ve ever seen, which usually end in a very different way.

In CryptoWorld, where the coins aren’t real so they’re useless for playing a pinball machine, the entire market is up 4% overnight – which is actually pretty great news, if you’re into that sort of thing.

Our resident crypto fanatic Rob “Our Don” Badman is attributing the rise to the success of the Aussie cricket team at Edgbaston, after the Crickeroos or whatever they’re called won a 5-day marathon by two wickets and 27 balls.

You can read all the rest of the crypto news at Mooners and Shakers, provided Rob’s done spraying cans of vintage Toohey’s all over the giant fibreglass Boonie that dominates his living room and gives his kids nightmares.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for June 21 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MTH Mithril Resources 0.002 100% 831,593 $3,368,804 AYM Australia United Mining 0.003 50% 469,629 $3,685,155 PUA Peak Minerals Ltd 0.003 50% 590,000 $2,082,753 IR1 Iris Metals 1.63 41% 1,096,662 $92,486,800 MRD Mount Ridley Mines 0.0025 25% 20,906,334 $15,569,766 RML Resolution Minerals 0.005 25% 210,994 $5,029,167 AW1 American West Metals 0.11 21% 4,494,668 $24,220,707 GSR Greenstone Resources 0.018 20% 2,891,240 $18,285,936 RDN Raiden Resources Ltd 0.006 20% 621,304 $10,276,345 SI6 SI6 Metals Limited 0.006 20% 2,052,158 $7,476,973 MMC Mitre Mining 0.33 16% 50,814 $10,897,004 C7A Clara Resources 0.047 15% 536,054 $6,307,230 KRR King River Resources 0.008 14% 682,352 $10,874,675 WCN White Cliff Min Ltd 0.008 14% 125,000 $6,713,381 PSC Prospect Res Ltd 0.125 14% 1,574,840 $50,848,541 VTX Vertex Minerals 0.11 13% 249,649 $4,435,325 DM1 Desert Metals 0.068 13% 32,569 $4,352,465 KGL KGL Resources Ltd 0.13 13% 134,550 $65,238,564 PFE Pantera Minerals 0.09 13% 120,909 $4,120,090 LYN Lycaon Resources 0.2 11% 105,000 $5,925,375 KFM Kingfisher Mining 0.31 11% 1,157,430 $15,040,200 BRX Belararox 0.365 11% 115,888 $13,506,907 BOC Bougainville Copper 0.38 10% 98,962 $138,366,563 E79 E79 Gold Mines 0.098 10% 5,000 $5,033,555 ACP Audalia Res Ltd 0.011 10% 300,000 $6,921,362

At the top of the table this morning is something of a surprise – Iris Metals (ASX:IR1), which has been MIA from the ASX since December, has suddenly emerged from the murk and relisted today.

After falling foul of a few bits of Chapters 1 and 2 of the ASX Listing Rules, and as part of its re-compliance requirements, the company says it has successfully completed the $15 million cap raise required to get back in the good books and start being traded again.

Investors were obviously keen to get back into the lithium and gold explorer, and it’s currently partying under a bright, shiny Welcome Back banner, with a fresh slab of icy-cold 45% gains in the esky.

In second place, Imagion Biosystems Limited (ASX:IBX) is up 29% this morning, with brand new CEO Isaac Bright at the helm, and news that the company’s MagSense HER2 imaging agent Phase 1 study (IBI10103) has achieved its enrolment target, and is set to get rolling.

IBX says the new agent works through showing a change in image contrast in nodes highly suspicious for breast cancer tumours. It shows up as “distinctly different from the contrast seen in non-involved nodes” when used with Magnetic Resonance Imaging (MRI) and Magnetic Relaxometry (MRX), for women who have HER2-positive (HER2+) primary breast cancer.

And in third place, it’s American West Metals (ASX:AW1), up 21% and apparently still riding high on last week’s news that a high-resolution ground gravity survey at the company’s Storm prospect has identified significant new anomalies that support the potential for a large-scale sediment-hosted copper system.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for June 21 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap M2R Miramar 0.036 -28% 629968 $4,019,087 NRX Noronex Limited 0.017 -26% 95209 $5,806,154 CAV Carnavale Resources 0.002 -20% 700000 $6,833,879 LSR Lodestar Minerals 0.004 -20% 313020 $9,216,987 THR Thor Energy PLC 0.004 -20% 1525000 $7,300,064 ENV Enova Mining Limited 0.009 -18% 588000 $4,300,223 RON Ronin Resources 0.16 -18% 948536 $5,654,629 TIG Tigers Realm Coal 0.005 -17% 2129320 $78,400,214 MDI Middle Island Res 0.021 -16% 2203855 $3,060,456 AVM Advance Metals Ltd 0.006 -14% 897448 $4,119,911 PRX Prodigy Gold NL 0.006 -14% 401984 $12,257,755 TMX Terrain Minerals 0.006 -14% 21557291 $7,582,395 XAM Xanadu Mines Ltd 0.1 -13% 14808849 $188,349,782 MHK Metalhawk. 0.082 -13% 79500 $6,291,927 GTR Gti Energy Ltd 0.007 -13% 957346 $15,582,033 M4M Macro Metals Limited 0.0035 -13% 49025 $7,948,311 ERW Errawarra Resources 0.145 -12% 173594 $9,983,160 ESR Estrella Res Ltd 0.008 -11% 6841133 $13,352,147 LRV Larvotto Resources 0.14 -10% 124201 $10,424,482 DUN Dundasminerals 0.087 -9% 603757 $4,554,648 CAZ Cazaly Resources 0.042 -9% 560700 $17,103,802 KTA Krakatoa Resources 0.021 -9% 174515 $8,357,661 PGD Peregrine Gold 0.275 -8% 1924 $16,830,783 CR1 Constellation Res 0.115 -8% 44630 $6,238,178 EMN Euro Manganese 0.175 -8% 67483 $47,439,005

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.