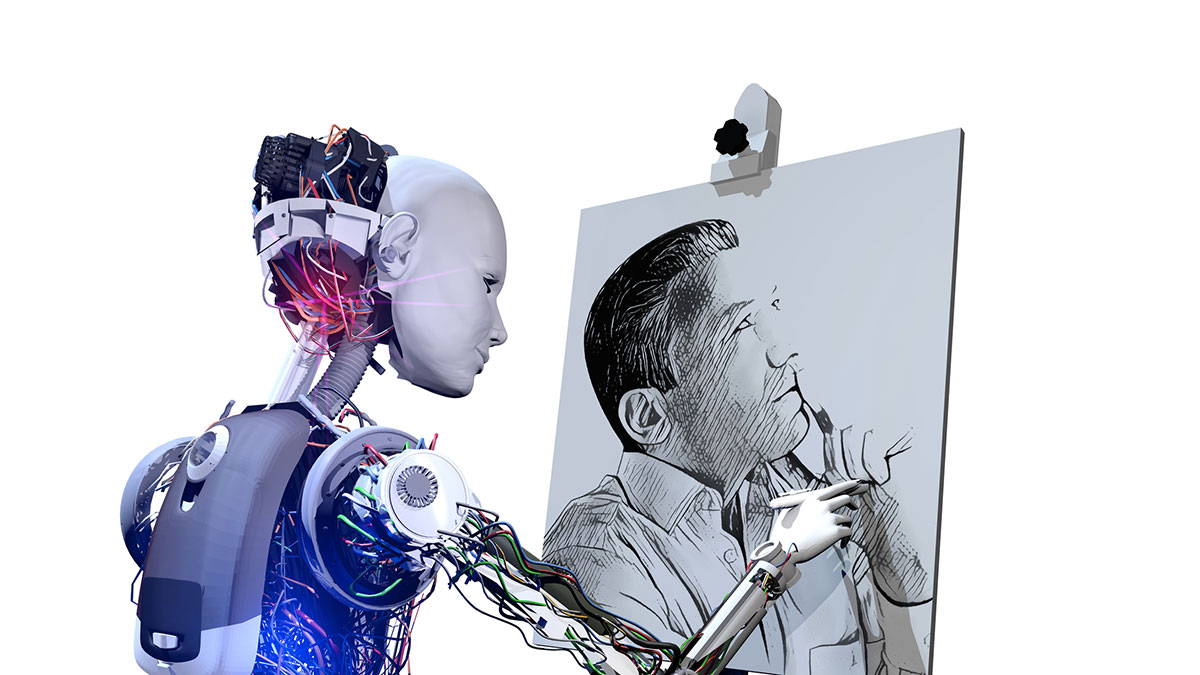

ASX Small Caps Lunch Wrap: Is everyone ready for the rise of the machines?

Smile for the camera! Pic via Getty Images

Before we get into what the ASX is doing this morning, we’d like to take a moment to check that everyone’s cool with the idea of machines taking over.

It’s absolutely a done deal in a lot of areas already; from ultra-strong programmable robot arms that are used to do stuff like clear nuclear waste from blown-up reactors in Japan, through to the French Taxman’s AI drones we talked about earlier this week, there’s little doubt that we are on our way to becoming obsolete meatbags.

The latest indication that we’re becoming more useless as each day wears on comes from the Colorado State Fair’s art competition, where first place in the Digital Art category was won by a fella called Jason Allen. Technically won, that is.

Allen’s been on the receiving end of an enormous quantity of paint-spattered outrage, when it emerged that his winning piece, Théâtre D’opéra Spatial, was created using an AI tool called Midjourney.

Midjourney works by typing “prompt words” into a computer, and the AI spits out a picture – kind of like Google Image Search, but you only get one result and it’s what the computer thinks the image should be… so it’s actually more like using Bing to find a picture, now that we think about it.

Anyway, Award-Winning Artist Allen says he worked tremendously hard on his art project, typing away furiously to produce 900 different pictures before choosing his three favourites and entering them into the competition.

Needless to say, people who self-identify as real artists are pretty cranky about it, with some saying it’s cheating and others too stoned to say very much at all.

Aside from getting a fancy blue ribbon, it doesn’t appear that there’s any sort of prize of any value attached to winning first place, but given Colorado’s famously-lax marijuana laws, it’s probably a pound of weed or something.

So aside from the ribbon and some slaps on the back from his robot pals, Allen’s not exactly defrauding anyone… is he?

Maybe the NFT-worthy price tag Allen’s got on his artwork could be considered a bit rich – US$750 for something printed onto canvas does seem steep.

Regardless, whether this development is simply the natural evolution of AI’s ability to enhance our lives and alleviate the inherent sadness of the human condition, or another nail in the coffin of human endeavour, it’s something we’re going to have to get used to.

TO MARKETS

Absolutely not winning a pound of weed at the Colorado State Fair this morning were our Aussie markets, which have had a nasty fall this morning following another sour performance from Wall Street overnight.

The benchmark fell more than 130 points on opening today, before wobbling to its feet just in time for a standing 8-count, looking set to battle on until the bell rings for lunch, around -2.0% on yesterday’s close.

Looking across the sectors and we’re not gonna lie: it ain’t pretty. Utilities (-2.27%), Materials (-3.67%), InfoTech (-1.37%) Real Estate (-3.16%) Financials (-2.03%) and Consumer Discretionary (-1.26%) all appear to have missed the memo about getting out of bed before taking their morning dump.

The only green spot in a field of brownish-red is Consumer Staples (+0.94%), and that’s probably only because supermarkets are full of people panic-buying tinned beans and bog roll.

Tellingly, there are no happy billionaires in the winners’ circle this morning, but there are a couple that have dropped a bundle this morning.

BHP (ASX:BHP) gave a few people some serious heartburn this morning before they realised the 6% plunge was due to ex-div activity – but the same can’t be said for Sandfire Resources (ASX:SFR), which is having trouble staunching the bleed that began earlier in the week, losing 7.36% of its life-sustaining value already today.

That’s despite an upbeat results report and news of a DFS landing for the company’s 5.2Mtpa Motheo copper-zinc project, which just goes to show that there’s no pleasing some people, and honestly I don’t know why I even bother sometimes. Sheesh.

Let’s take a trip overseas, because we just need a break from some very ungrateful people. You know who you are.

NOT THE ASX

Oh look. Wall Street’s down. Again. #ShockedPikachuFace. #EtcEtc.

While it’s not as bad as yesterday, the major US indices finished their day lower, the Nasdaq down -0.56%, the S&P down -0.78% and the Dow faring worst of all, at -0.88%.

Our Guy Eddy got up early this morning to report that it’s the fourth straight day US stocks have fallen and for the month of August, the US stock market has slipped by around 4%, with pretty much every major asset class – stocks, bonds, and commodities – down last month.

Some kind-of welcome news, though, in the form of US private payrolls data, which grew by 132,000 for the month of August, a decrease from the 268,000 gain in July. It’s a double-edged sword, though – the data points to a potential economic slowdown, but it could also provide something of a safety valve for inflationary worries.

News out of Europe is dour at best, though, where inflation has hit a new record high in August at 9.1% according to Eurostat, which is like the statistics version of Eurovision, but where everyone votes by burning great big piles of money.

Energy had the biggest increase, up by 38.3% year on year, due in no small part to Russian Stronkman Vladimir Putin’s ongoing impersonation of Immortan Joe, as gas supplies into Europe keep getting choked off.

That, and he’s still busy trying to finish his “it’ll be over in seven days” invasion of Ukraine, which is now only 183 days behind schedule.

In Asian markets news, and things are hobbling like a Geelong full forward with two corked thighs.

Japan is sinking fastest (-1.58%), with Hong Kong not far behind (-1.16%). Shanghai’s faring a little better, down only 0.22% after being distracted by a pot of honey and getting stuck in the entrance to a rabbit hole, the fat bastard.

Commodities are down, execpt for natural gas, which is up +0.46% on short supply.

Oil fell 0.25% and precious metals have lost some of their gleam, gold down 0.72%, silver down 1.66% and even copper’s gotten in on the act, falling 1.22%.

In the World of Crypto, where the coins are made of chocolate but when you unwrap them they’ve gone all chalky and gross, it’s Lido DAO on a charge while the big kids are hanging onto the monkey bars like the playground’s made of actual lava.

Rob “Buy Me a Pony” Badman’s got the rest of the crypto goss in his Mooners and Shakers column, which is always an upbeat, profit-making read, except for sometimes when it’s not, because “crypto”.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for September 1 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap UUL Ultima Utd Ltd 0.125 84% 1,484,584 $4,984,912 AW1 Americanwestmetals 0.23 70% 25,745,110 $14,988,746 MEB Medibio Limited 0.0015 50% 1,094,897 $3,320,594 SEG Sports Ent Grp Ltd 0.28 27% 5,000 $57,444,646 PIL Peppermint Inv Ltd 0.014 27% 11,858,409 $22,416,425 AFW Applyflow Limited 0.0025 25% 500,000 $5,915,216 SIH Sihayo Gold Limited 0.0025 25% 10,422,239 $12,204,256 AQX Alice Queen Ltd 0.003 20% 3,026,000 $5,384,236 RR1 Reach Resources Ltd 0.006 20% 7,223,258 $9,550,253 PVS Pivotal Systems 0.099 19% 54,987 $13,235,699 ICI Icandy Interactive 0.09 18% 20,432,176 $97,911,718 GLV Global Oil & Gas 0.0035 17% 67,615 $5,620,064 PBL Parabellumresources 0.36 16% 369,254 $12,909,175 A4N Alpha Hpa Ltd 0.535 15% 1,224,022 $377,690,030 MX1 Micro-X Limited 0.1375 15% 510,751 $55,380,599 ARO Astro Resources NL 0.004 14% 35,250 $16,468,344 VN8 Vonex Limited. 0.089 14% 178,040 $26,014,648 GSR Greenstone Resources 0.076 13% 10,437,700 $70,581,397 W2V Way2Vatltd 0.043 13% 48,000 $6,082,329 ASQ Australian Silica 0.079 13% 427,929 $19,366,226 BEZ Besragoldinc 0.045 13% 91,750 $6,873,998 DM1 Desert Metals 0.415 12% 589,232 $17,756,973 IDA Indiana Resources 0.068 11% 2,104,578 $29,359,594 EWC Energy World Corpor. 0.059 11% 270,961 $138,231,139 SSH Sshgroupltd 0.2 11% 28,695 $7,224,733

While there’s not heaps to crow about, there are a couple of Small Caps that have grabbed the brass ring this morning, with the biggest leap coming from property developer Ultima United (ASX:UUL).

Ultima’s quarterly came out this morning, showing a stunning turnaround in fortunes for the company, including a 1399% (no, we didn’t miss a decimal) hike in assets YoY to $23 million, and a 94% swing in the right direction of YoY net loss after tax.

Investors beheld this information, and yea verily did they pile on, driving Ultima’s price up more than 80% since breakfast.

Also breaking out the fancy glassware and pricey sparkling this morning was American West Minerals (ASX:AW1), whose news of a belter find at its Canadian Storm project energised the market.

The results from drill hole ST22-05 from the 2750N Zone intersected:

- 41m @ 4.18% Cu from 38m downhole, including;

- 15m @ 10.05% Cu from 47m downhole, and including;

- 5m @ 24.28% Cu from 48m downhole

Those are some lovely numbers, which investors have rewarded with a +75% surge this morning – no doubt helped along by AW1’s talk that there are lots more results on the way in the next few days.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for September 1 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MOB Mobilicom Ltd 0.022 -33% 7,852,395 $39,848,479 DGL DGL Group Limited 2.12 -26% 2,300,223 $798,643,194 GNM Great Northern 0.004 -20% 7,643,610 $8,545,255 WBE Whitebark Energy 0.002 -20% 79,130,867 $14,120,548 DRO Droneshield Limited 0.17 -17% 3,785,854 $88,671,107 AWJ Auric Mining 0.075 -17% 20,000 $5,470,770 TSC Twenty Seven Co. Ltd 0.0025 -17% 1,226,666 $7,982,442 BST Best & Less 2.295 -15% 1,279,190 $338,490,711 IXU Ixup Limited 0.04 -15% 124,115 $42,399,017 ASW Advanced Share Ltd 0.2 -15% 61,002 $45,450,827 IVZ Invictus Energy Ltd 0.265 -15% 10,273,198 $236,249,722 ATP Atlas Pearls Ltd 0.03 -14% 221,465 $14,975,512 GO2 Thego2People 0.012 -14% 361,547 $5,692,936 MEA McGrath Ltd 0.4 -13% 256,845 $74,124,239 FGL Frugl Group Limited 0.014 -13% 383,750 $3,242,435 VOL Victory Offices Ltd 0.028 -13% 104,945 $5,051,137 K2F K2Fly Ltd 0.185 -12% 25,500 $36,498,887 NTD National Tyre&Wheel 0.815 -12% 355,250 $122,040,802 CLZ Classic Min Ltd 0.015 -12% 2,083,035 $3,696,357 TTI Traffic Technologies 0.015 -12% 30,000 $12,276,893 MSG Mcs Services Limited 0.04 -11% 200,000 $8,503,855 PCL Pancontinental Energ 0.004 -11% 10,000,000 $33,994,003 PBH Pointsbet Holdings 2.93 -11% 2,729,915 $1,005,541,312 SNG Siren Gold 0.21 -11% 19,422 $24,487,430 ALM Alma Metals Ltd 0.009 -10% 2,571 $7,394,723

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.