About three quarters of Buffett’s Q3 equity smorgasbord consists of just 5 big stocks

No surprises here – a huge chunk of Buffett's smorgasboard is resting on Apple. Pic via Getty Images

Over the weekend: a smorgasbord of Buffett results, including the kernel that during a volatile third quarter, about three-quarters (75%) of Warren Buffett’s Berkshire Hathaway equity portfolio was made up of just five central stocks.

Q3 for the Oracle from Omaha’s multinational conglomerate holding company was typically bumptious – earnings jumped 20% on an operating basis.

The Greatest Ever Investor’s Berkshire Hathaway (BRKB) has a nicely growing war chest going into Q4, not only keeping buybacks modest, but choosing to retain his biggest holdings through the bear market and heightened volatility due to the Federal Reserve’s aggressive tightening.

BRKB took a US$10 billion loss over the last three months of frenetic market activity – the oracle’s investments taking a hit alongside just about all of Wall Street.

The legendary investor again asked investors to not focus on the quarterly fluctuations in its equity investments. Buffett’s Berkshire derives its earnings from an eclectic bunch of operating companies and a laser focus on a surprising handful of equity investments.

‘Tis but a flesh wound

Buffett reminded investors to ignore the bleeding limb and focus on the healthy one.

Operating earnings — Buffett’s preferred measure for assessing performance — rose 20% in Q3 vs. a year earlier to US$7.76 billion.

That’s vs a 39% gain in Q2 to US$9.28 billion.

“The amount of investment gains/losses in any given quarter is usually meaningless and delivers figures for net earnings (losses) per share that can be extremely misleading to investors who have little or no knowledge of accounting rules,” Berkshire said in a statement.

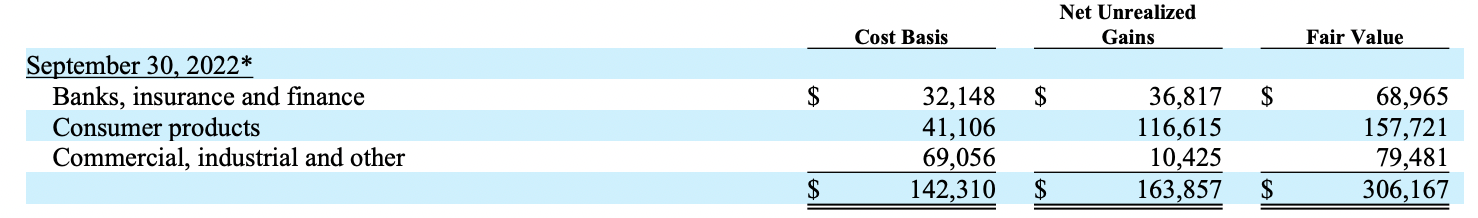

Nevertheless, approximately 73% of the aggregate fair value was concentrated in five companies (American Express Company – US$20.5 billion; Apple Inc. – US$126.5 billion; Bank of America Corporation – US$31.2 billion; The Coca-Cola Company – US$22.4 billion and Chevron Corporation – US$24.4 billion).

And it was the retail names which outperformed.

Analysts polled by FactSet thought that BH would earn US$2.81 a pop, down 2.3% vs a year ago, but Berkshire looked on top of operating EPS estimates.

What else?

Insurance investment income rose to US$1.41 billion, although Berkshire lost US$962 million over the quarter from insurance underwriting, perhaps reflecting some impact from Hurricane Ian, which crashed into Florida around the start of October.

Earnings from the company’s utilities and energy businesses came in at US$1.58 billion, up from US$1.5 billion year over year.

Berkshire spent US$1.05 billion in share repurchases during the quarter, bringing the nine-month total to US$5.25 billion.

The pace of buyback was in line with the US$1 billion of Q2. Repurchases were way, way under expectations of a similar number to the US$3.2 billion total in the first quarter.

Rail earnings slid 6% dipping to US$1.44 billion from US$1.54 billion in 2021 vs a year earlier.

All about Apple

Yes. The house of Apple was and remains Berkshire’s largest holding by far at the end of September – there’s about US$126.5 billion of BH money sloshing about in there.

The tech giant has become The Oracle’s absolute go to name. He cites quality, customer loyalty and Apple’s big buyback program. APPL rose 1% in the third quarter.

Berkshire significantly ramped up the energy bet in the first quarter, and Chevron was the conglomerate’s third biggest holding as of the third quarter.

Chevron just reported its second-highest quarterly profit ever, driven by soaring global demand for its oil and gas and rising production from its US oilfields.

Shares of Chevron have rallied 56% this year.

Other big bets included Coca-Cola, American Express and Bank of America, which have been Buffett’s longtime holdings.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.