Net Flux: Why the best drama is always on Netflix

Good telly. Via Getty

So. Wall Street analysts and (sigh) Christian, expected Netflix Inc (NASDAQ: NFLX) to report its slowest quarterly revenue growth ever at the end of last week. That didn’t happen and it was a pretty good twist.

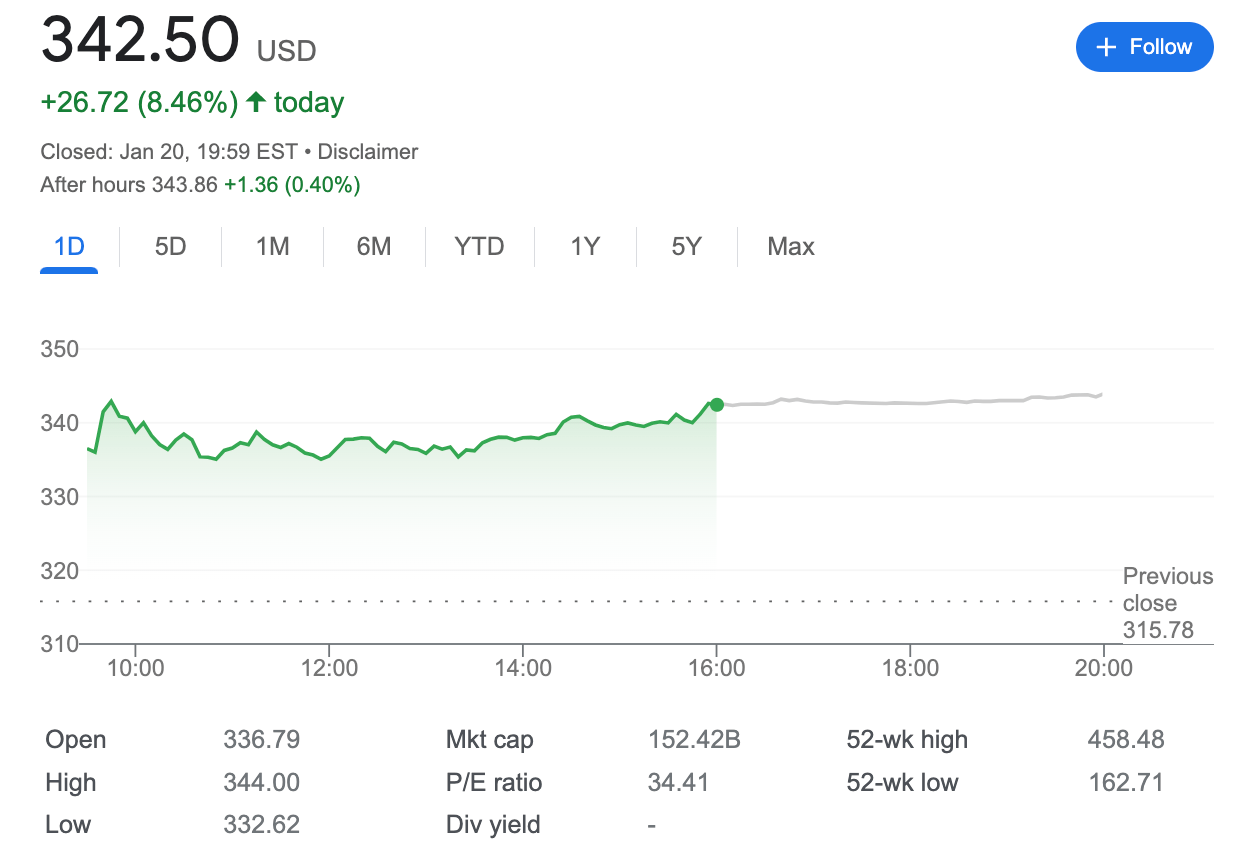

The stock price jumped like it used to on Friday – with easy regularity – up over 8% after the release of said Q4 earnings which smashed expected subscriber growth numbers at the home box office.

And it’s still going to cost you a bunch to buy one share:

Honestly, my take was that in a post Game Of Thrones TV world everyone’s as inoculated of mundane content lacking a galactic budget as they are unvaccinated from the drudgery of TV advertising.

But the outgoing co-founder Reed Hastings bit the bullet and went for an ad-supported platform option and also let the dogs out on password sharing.

The double-tweak and some good watching appear to have been a critical and commercial hit. After finding itself almost gone straight to video for this final quarter, suddenly the original streaming service is gaining some buzz to generate short-term revenue dividends and come out ahead of the awards season – and the streaming wars – looking fresh for more.

The many analysts with eyeballs on the supposedly languishing company said its ‘make ‘em pay’ advertising plan failed to win US customers in a post-GoT mega content saturating market. That’s already led to businesses like Netflix backtracking on big in-house production spend.

Contented

It’s a tough gig, pioneering the entire streaming telly-verse and it’s easy to forget that the streaming giant began life as a kind of send-away for your fav DVD concept.

In doing so, Netflix has always had the most to lose as the punters came in pursuit.

Cashed up newbies like Apple+, and the bludgeoning sort like Amazon (Prime) amplified the costs of financing production, thinned out the supply of talent and increased competition.

Netflix had pinned its hopes on the launch of the ad-supported tier, but Wall Street was adamant Hastings had not won the expected burst of subscriptions.

I said, some 48 hours ago, paraphrasing here: it’d be so awful that watching the numbers drop after market close in New York would be more entertaining than watching Netflix. Funny, but wrong.

According to eToro’s Sydney-based Cornish analyst was who was right, Josh Gilbert, after finding an extra 8.3 million subscribers for the same quarter a year ago, “the expectation was Netflix would be lucky to add 4.5 million subscribers in the fourth” – which would’ve been the lowest addition for the holiday period since 2014.

“Instead, Netflix subscriber numbers have bounced back from the 200,000 loss at the start of 2022, adding 7.6 million new subscribers in the fourth quarter.

“But let’s remember, there’s still a lot of work for Netflix to do. 2022 was its slowest year of subscriber growth since 2011 despite the strong end to the year. Earnings and revenue both missed the street’s expectations,” Josh added.

“Revenue came in at USD$7.85 billion against expectations of US$7.86 billion, and earnings were light at US$0.12c vs the US$0.42c expected.”

Josh told me that in the end content was key in the current streaming showdown, and Netflix apparently “delivered a strong quarter of movies and shows that retained customers and attracted new ones.”

“Investors will hope the streaming giant can continue delivering a steady stream of new releases throughout 2023 instead of one-hit wonders now and then.”

I then asked what those movies were.

Name one, I said.

Then he said something rude in Ancient Cornish, I think.

No good reed goes punished

But the drama Josh has also been watching was the opportunity Netflix took last week to also let the superhero-sounding co-founder Reed Hastings make his semi-exit on a high.

Completely turning the television, film, broadcast, streaming, production and distribution model on its arse, this is a man who once said (in Wired Magazine, 2003) that his aim was that in 20 years his business would go from DVD mail-outs to ‘global entertainment distribution company (that) provides a unique channel for film producers and studios’.

Netflix isn’t a particularly diversified business relative to the biggest Big Tech giants, and the company isn’t investing heavily in cutting-edge technology like virtual reality and generative Artificial Intelligence and the like, although a spin into mobile gaming is underway. Actually, it’s featuring the rockstar little Aussie smallcap game crew, Playside Studios (ASX:PLY)

“Its long-term objectives have remained the same, sustain double-digit revenue growth, failed in 2022, expand operating margin, and continue to grow positive free cash flow,” Josh said.

“Some volatility to shares could be caused by the announcement that Netflix Co-Founder Reed Hastings will be down from his role as Co-CEO, after being at the helm for more than 20 years. Although this is unlikely to bring any dramatic changes, a change in C-suite management may bring some uncertainty for shareholders.

“And the ex-co-CEO is remaining on as executive chairman, so its a transition more than anything else.”

Content is still King, Queen and the entire Kingdom

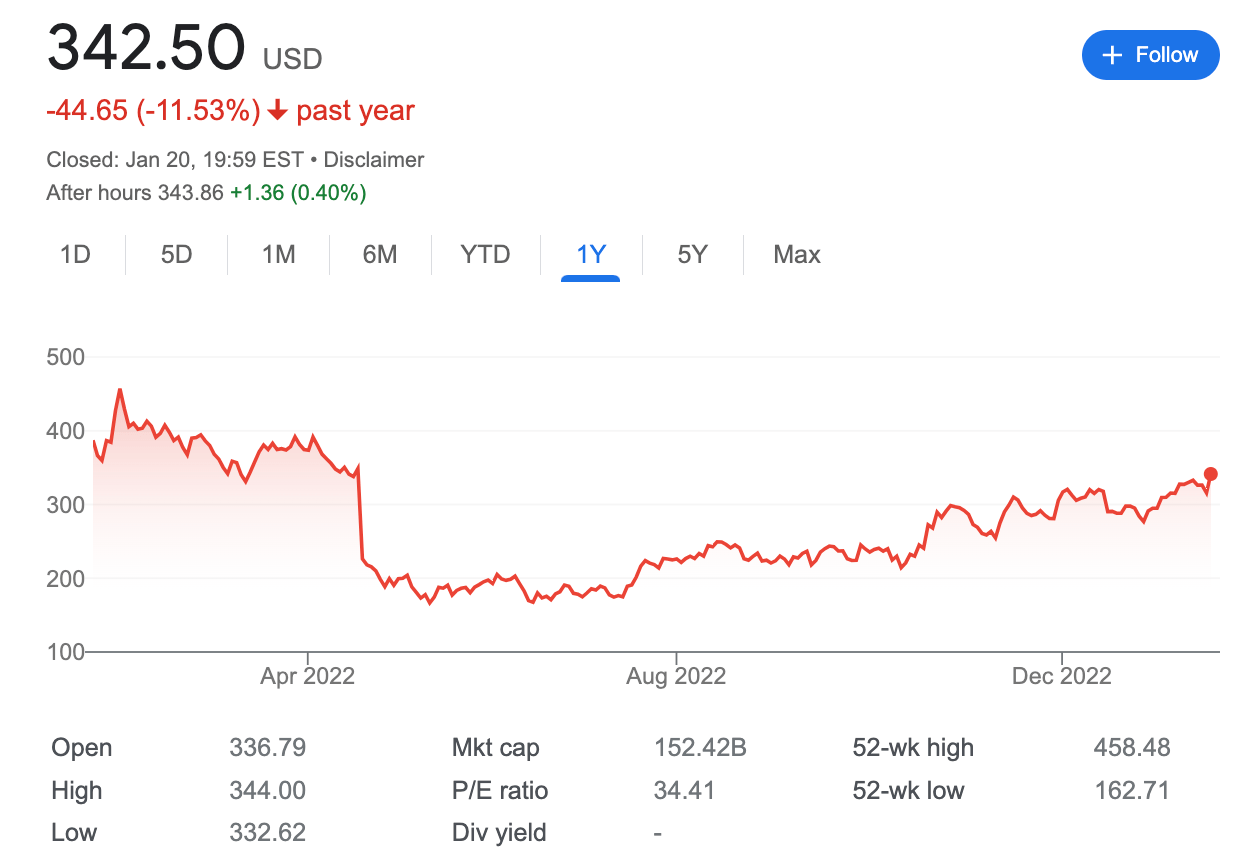

After this surprise Q4 win and enjoying a solid end to the year, Josh says 2022 ended a mixed bag for Netflix.

“They’ve gained as much as 60% in the last six months after a pretty dismal start. In the first half of the year, it lost around 1.2 million subscribers, with the United States and Europe struggling with rising living costs.

“Its valuation fell significantly, trading at 15x P/E, down from the 40x it started the year at, which contrarian investors took as an opportunity to buy and were subsequently rewarded,” he says.

The fastest way to lose subscribers is to have a stagnating library of ordinary telly in an increasingly exciting and competitive space. Josh says investors watch telly too – and that’s what they’re thinking about when the telly is boring.

Bottom line is investor confidence is being undermined, not just critical.

“A new movie launch may not boost your portfolio’s profits, but it can help to attract new subscribers, which could reap longer-term rewards,” Josh says.

In Q3, Netflix did pretty well, releasing headline content such as Stranger Things 3 (or is it 4?), Dahmer and The Gray Man starring everyone’s boyfriend Ryan Gosling (and Captain America), which was the channel’s top movie last year.

This helped subscribers grow by 2.41 million after two-quarters of declines, and revenue jumped 6% to US$7.93 billion. Shares climbed as much as 11% after the result, showing content is king.

“Unlike Disney or Amazon, Netflix’s content calendar is critical, given they have no other revenue streams in comparison. However, content comes at a cost. 2022 looks set to be Netflix’s only Free Cash Flow positive year in a decade after 2020’s record year.

“Essentially, it’s not sustainable for Netflix’s movies to be anything but successful,” Josh reckons.

What can consumers look forward to in 2023

“However, it looks like things might finally be falling into shape for Netflix, with a solid content slate planned that could help to push new subscribers back above 4.5 million in the quarter, the most additions for two years.

“A hit show or movie can be huge for a streaming service such as Netflix. Take Squid Game, which saw record streams but also helped support Netflix’s growth in Asia Pacific, its best-performing region in 2021 and 2022.”

“Straight off the bat, Netflix’s new movie ‘Glass Onion’ was watched for 253.7 million hours in its first 17 days of release, putting it in the top 5 movies for the service’s all-time ranking.”

Josh told me Netflix has plenty more Hemsworth up its sleeve as well.

Always good for consumers and investors:

- Extraction 2: The hit movie ‘Extraction’ featuring Chris Hemsworth, is coming back for another movie. The first film was a huge hit in 2020, with 99 million views in the first four weeks of release.

- Chicken Run: Dawn of the Nugget: Yeah, that’s right, Chicken Run is set to be back on our screens in 2023. The sequel, set to be released in 2023, will attract families all over the world and could be a major success for Netflix, given that Chicken Run remains the most successful stop-motion movie ever made, even 22 years later.

- Luther: The hit BBC detective series has a feature film coming to Netflix in Q1. The show, which has an outstanding rating of 91% on Rotten Tomatoes and was nominated for multiple awards, could be a hit for those looking to get their crime fix.

Netflix is also rehashing new series derived from previous success stories – F1: Drive to Survive, ‘You’, That ‘90s Show and Bridgerton.

I thought they were pretty ordinary, except maybe that amazing F1 doco-series.

What will investors be watching?

Investors’ attention will likely be drawn to the uptake and adoption of its new ad-supported subscription model, which seems to have, so far, started well. Netflix will stop offering forward guidance on subscribers, with management wanting investors to focus on revenue which encapsulates the whole Netflix story.

Josh says Netflix’s original movie content is doing well for three main reasons:

- Exclusive content: Netflix’s original movies are exclusive to the platform, meaning that they can only be watched on Netflix. This exclusivity helps attract and retain subscribers, as they may be more likely to pay for a subscription if they know they will have access to unique and high-quality content.

- Wide appeal: Netflix produces a wide range of movies, from indie films to big-budget blockbusters. This diversity appeals to a wide range of audiences, which helps to attract and retain subscribers from diverse demographics.

- Positive reputation: Netflix’s original movies have received critical acclaim, winning awards and earning nominations at major film festivals. This positive reputation helps to attract new subscribers, as well as retain existing ones, by providing a high-quality viewing experience.

Content with content for now

Josh says overall, Netflix’s original movie content is seen as a key driver of the company’s subscriber growth and revenue, and therefore, a major factor in the company’s share price and something investors will be making investment decisions about.

Focusing solely on the content side is a sensible approach for now, given the uncertain market for expensive speculative ideas like the metaverse, experiential stuff and VR headsets and so on.

That’s worked so far. But it won’t forever. In the end Netflix will need to decide what it is and if another major pivot is required to stay in the game.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.