NAB calls last drinks on the property boom; Australian house prices to fall 9.3% in 2023

Pic: Getty

Among post-COVID asset classes, Australian residential property has been one of the clearest beneficiaries of rock-bottom rates and government liquidity.

But could Australian house prices fall in the months ahead?

The economics team at NAB are calling last drinks for 2022, before the party stops in 2023.

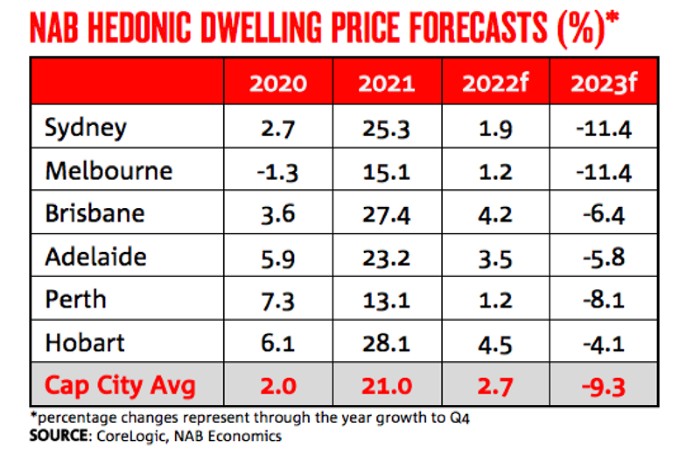

In its latest residential property survey, NAB said house prices growth across Australia’s capital cities will slow to an average of just 2.7% this year.

And they forecast a material cool-off next as rates rise, with steady falls across the board led by double-digit declines in Sydney and Melbourne:

Zero rates phase

Market conditions in the wake of the pandemic gave rise to a property boom that peaked in March last year, when Australian property prices rose at a monthly rate of 2.8% — the fastest pace since 2003.

Steady gains throughout last year saw most capital cities boast historic annual gains north of 20%.

Assessing the market drivers, NAB said falling population growth was offset by a strong labour market and government initiatives — mainly HomeBuilder.

In addition, “sharply lower interest rates have been a key support”, NAB said.

Pending rates phase

Throughout 2021, the RBA held to its view that it wouldn’t expect to raise rates all the way through to 2024.

Increasingly, the market disagreed. Recent pricing suggests rates are set to rise four times this year.

In comments earlier this week, RBA governor Philip Lowe gave back some ground by saying rate hikes in 2022 are at least “plausible”.

Even if Lowe is leaning towards 2023, 2024 is clearly off the agenda.

As the rate-hike timeline moves forward, so too has NAB done for its market correction timeline.

“(We have) brought forward the timing of the correction we expect in house prices to late-2022, as affordability constraints begin to bite and rising mortgage rates place downward pressure on prices”, NAB said.

For now, Australian house prices a still climbing, with a 1.1% gain in January marking a “surprise to the upside”, CoreLogic said in its monthly price update.

But those declines later this year will see annual gains fall to just 2.7%, NAB reckons.

House prices…fall?

Turning to 2023, NAB said that trend will remain in force, with annual house prices across the capital cities set to decline by 9.3%.

One question for investors is how annual falls of almost 10% will flow through to the broader economy.

Even in 2018, when Sydney and Melbourne dragged on the national market, Australian home prices only fell by 4.8%.

That marked the largest decline since the 2008 financial crisis, and is still only around half of what NAB is predicting for next year.

However, factoring in the broader strength of Australia’s post-COVID economic rebound, NAB “does not see these declines as disorderly”.

The bank flagged the strength of Australia’s labour market, with wages growth set to pick up (although “only gradually”) and “rates still relatively low – though steadily increasing”.

Hike ze rates

In that context, a key question for property investors is — just how fast will rates climb?

The NAB economics team have pencilled in the RBA’s first rate hike for November this year.

That’s slightly less hawkish than Commonwealth Bank, which is holding to its forecast of an August 2022 rate hike following a busy week of RBA updates.

For now, the central bank remains confident that while we can expect to watch inflation climb through the middle of the year, it’s not at risk of making a dovish policy mistake that will see CPI growth run out of hand.

In NAB’s view, the housing market won’t really hit the brakes until rates start to rise.

Between November 2022 and February 2023, NAB forecasts interest rates will rise from 0.1% to 0.65%, before “a steady series of increases over 2023 and 2024”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.