When Buffett met Munger: The best friendship in money is so damn beautiful

OMAHA, NEBRASKA - MAY 5: (FILE PHOTO) Warren Buffett (L) and Berkshire-Hathaway partner Charlie Munger in press in 2002. (Photo by Eric Francis/Getty Images)

“I knew after I met Charlie, after a few minutes in the restaurant, I knew that this guy’s going to be in my life forever.

“(I knew) we were gonna have fun together, we were gonna make money together, we were gonna get ideas from each other and we were both going to behave better than if we didn’t know each other…”

– Warren Buffett on Charlie Munger (CNBC, June 30, 2021)

The Oracle of Omaha, Warren Buffett first met Charlie Munger over a small meal 63 years ago. It was a chance dinner which changed many things about the nature of investing in America, how we think of money and without doubt, the mechanics of Capitalism.

Their joint stewardship – Buffett is the chairman of Berkshire Hathaway, Munger his vice-chairman and 2IC – has generated untold wealth.

So a great deal has been made and written and studied about the way the two nonagenarian’s go about their work. I think more should be made of their friendship.

I’ve always liked to read into the way Buffett positions his ‘strong right arm’ to the media. Maybe that’s part of the point. Humility and inclusiveness are the breadcrumbs a good leader makes sure to leave where they can best be found.

Yet Munger, now 99 is just as admiring of his senior partner and younger friend (Buffett is but 92).

Warren Buffett and Charlie Munger met in 1959. They worked together informally until 1978 when Munger joined Berkshire Hathaway as vice chairman. #AllThingsBuffett https://t.co/hhQWH6uN3t pic.twitter.com/LlxYQSJ0qR

— CNBC (@CNBC) May 5, 2018

“It’s better to associate with people that are better than you,” is what Buffett said of Munger on a CNBC interview from 2021 (not the one above). That was a scary televisual encounter for me of what can happen to a smart person who doesn’t get sick, mad or die. I happened to watch it during the lockdown.

When asked what the two admire about each other, Munger said the fact he and Buffett share a sense of humour. Earlier in the IV, Munger said they hit it off over that 1959 meal due to a common, immediately recognisable irreverence – in a very serious world, they just didn’t take themselves, or others, very seriously.

Anyway. Sometimes people with a shared passion just click.

“Charlie and I think pretty much alike. But what it takes me a page to explain, he sums up in a sentence,” Buffett wrote last week in his annual letter to shareholders.

He made much over his choices, paused on some of his philosophies and even spent a few pars defending (or explaining) his program of stock buybacks.

But in this latest missive, Buffett dwelt for a moment on Munger’s thinking and in doing so shared a bullet pointed love letter to the wisdom of a cherished ally.

As I just told my editor Pete, who first got me onto Buffett’s very direct and delightful letters: he writes as well as he invests.

It’s word for word From WB. I’ll add a link. And I just did.

Nothing Beats Having a Great Partner

Charlie and I think pretty much alike. But what it takes me a page to explain, he sums up in a sentence. His version, moreover, is always more clearly reasoned and also more artfully – some might add bluntly – stated.

Here are a few of his thoughts, many lifted from a very recent podcast:

“The world is full of foolish gamblers, and they will not do as well as the patient investor

“If you don’t see the world the way it is, it’s like judging something through a distorted lens.

“All I want to know is where I’m going to die, so I’ll never go there. And a related thought: Early on, write your desired obituary – and then behave accordingly.

“If you don’t care whether you are rational or not, you won’t work on it. Then you will stay irrational and get lousy results.

“Patience can be learned. Having a long attention span and the ability to concentrate on one thing for a long time is a huge advantage.

“You can learn a lot from dead people. Read of the deceased you admire and detest.

“Don’t bail away in a sinking boat if you can swim to one that is seaworthy.

“A great company keeps working after you are not; a mediocre company won’t do that.

“Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time.

“Ben Graham said, ‘Day to day, the stock market is a voting machine; in the long term it’s a weighing machine.’ If you keep making something more valuable, then some wise person is going to notice it and start buying.”

“There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous. A string of wonderful numbers times zero will always equal zero. Don’t count on getting rich twice.”

“You don’t, however, need to own a lot of things in order to get rich.”

“You have to keep learning if you want to become a great investor. When the world changes, you must change.”

“Warren and I hated railroad stocks for decades, but the world changed and finally the country had four huge railroads of vital importance to the American economy. We were slow to recognize the change, but better late than never.”

Finally, I will add two short sentences by Charlie that have been his decision-clinchers for decades:

“Warren, think more about it. You’re smart and I’m right.”

And so it goes.

I never have a phone call with Charlie without learning something. And, while he makes me think, he also makes me laugh.

(I will add to Charlie’s list a rule of my own: Find a very smart high-grade partner – preferably slightly older than you – and then listen very carefully to what he says.)

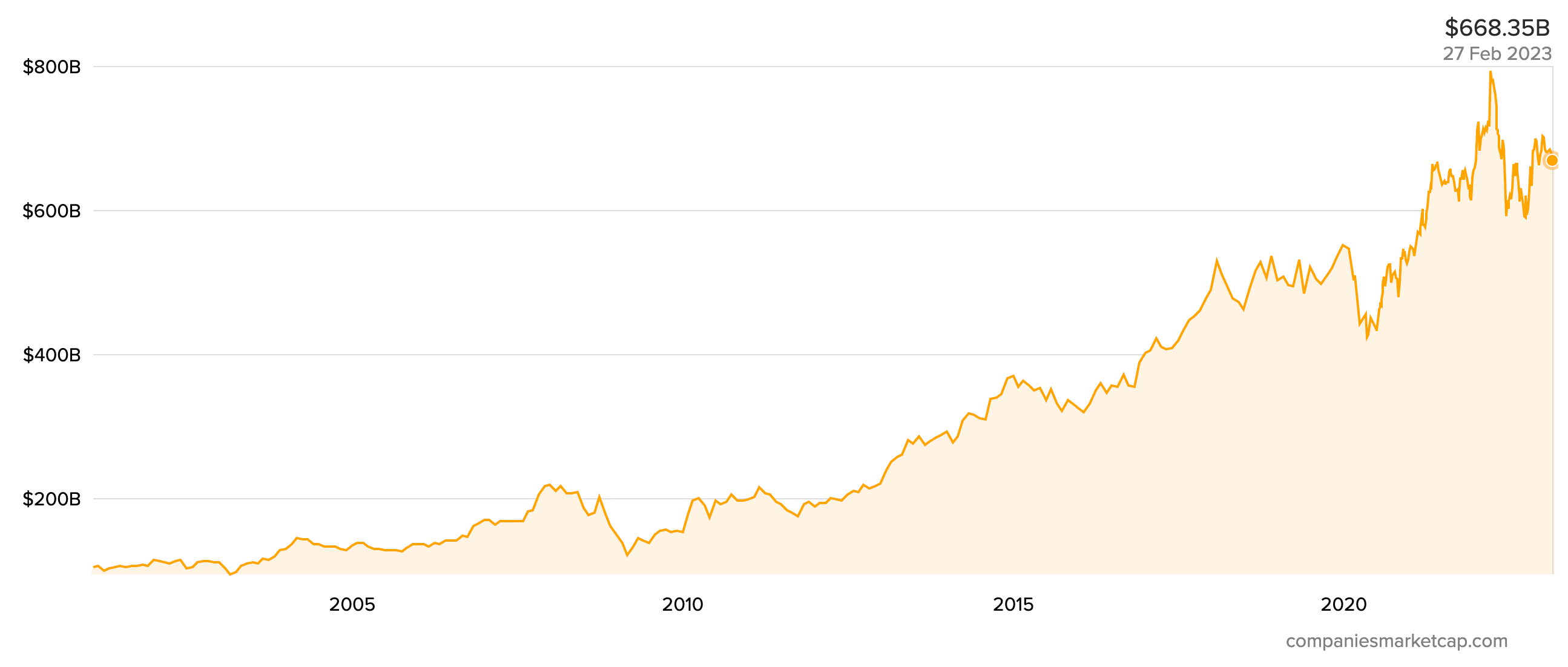

Market cap history of Berkshire Hathaway from 2001 to 2023

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.