Motorcycle Holdings takes ownership of MOJO, expanding its market into ATVs and electric motorcycles

MTO is all set to drop $60m to acquire MOJO and expand into ATVs and electric motorcycles. Pic via Getty Images.

Motorcycle Holdings’ acquisition of MOJO will allow the company to diversify into new markets and benefit from various synergies.

Australia’s largest motorcycle dealership operator, MotorCycle Holdings (ASX:MTO), is set to acquire 100% of the shares in MOJO Group.

MOJO Group – which owns Mojo Motorcycles and Mojo Electric Vehicles – is a motorcycle, scooter, ATV (all-terrain vehicles), electric motorcycle, and genuine spare parts and accessories importer and distributor operating in Australia and New Zealand, with a 150-strong dealer network.

The company is headquartered in Altona North, Victoria, where it owns a purpose-built 5,000-square-metre distribution centre.

That facility is backed up by a 2,000-square-metre facility in Yatala, Queensland, to increase total warehousing capacity to 2,500 vehicles.

MTO will acquire Mojo Group from companies owned by Michael Poynton and Joshua Carter for up to $60 million, which will comprise of:

- 539 million MTO shares (escrowed for two years)

- $20 million in cash; plus

- deferred consideration of up to $10 million earnout dependent on performance in the first 12 months following completion of the acquisition

The cash component will be funded through an increase to its debt facility.

The acquisition price represents an earnings multiple of 4.1 times Mojo Group’s FY22 net profit before tax.

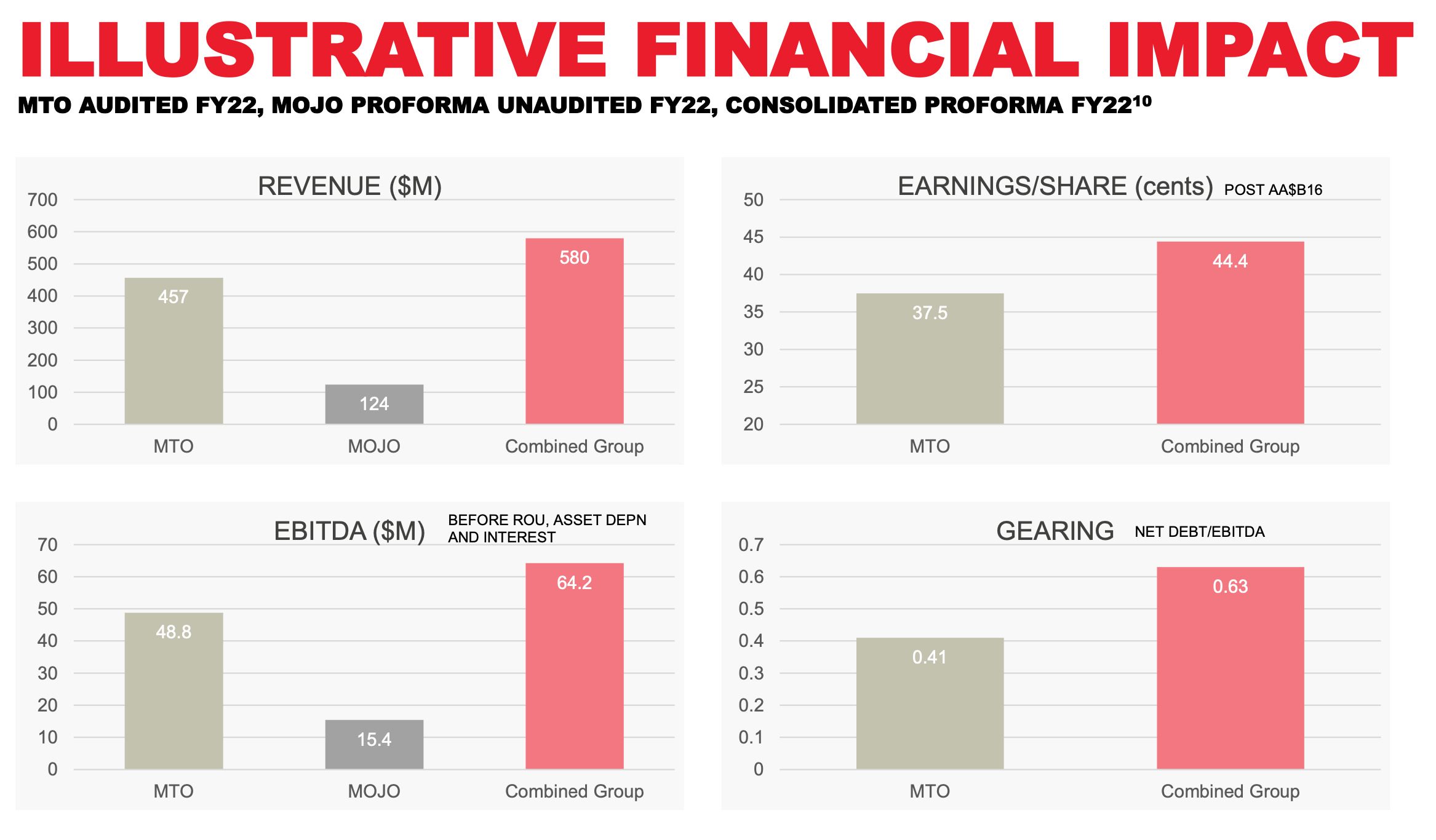

On a proforma FY22 consolidated basis, the transaction is expected to be 18% earnings per share accretive before synergies, integration costs and PPA related amortisation.

Upon completing the acquisition, Poynton and Carter will take up senior executive positions with MTO, with Poynton also joining the MTO board.

“We believe the acquisition of the Mojo Group will present significant growth opportunities by introducing the importation and distribution of motorcycles, ATVs, and scooters (including electric models) into our existing product offering, increasing our warehouse capacity and expanding our distribution network,” said MTO CEO and founder, David Ahmet.

All about synergies

The acquisition of MOJO diversifies MTO into a new market – motorcycle importing and distribution – and gives increased exposure to the scooter, ATV and electric motorcycle segments.

The combined group is expected to enhance its earnings growth through synergies and revenue opportunities across each organisation’s distribution network.

Combined revenue increase is expected to increase from $457 million to $580 million, while bottom line EBITDA is also expected to increase from $49 million to $64 million.

The acquisition will also result in a more resilient business mix, with more than 28% of NPAT to come from importing vehicles.

Other synergies from the combined business include the opportunity to source new products to distribute for MOJO, taking advantage of MTO’s scale and access to the capital markets.

There is also a significant opportunity to retail electric motorcycles through the MTO dealership network as they are brought to market.

It will also allow MTO to take advantage of market conditions, including competitors in ATV market withdrawing their products, new models, and strong supply

The companies can reduce costs by sharing their warehousing facilities in NSW, VIC, and QLD, while pursuing new warehousing opportunities in NZ and WA.

MOJO has seen significant growth over the last two years, which has now shown signs of continuing in FY23.

There are conditions to completing the acquisition including MTO obtaining shareholder approval for the issue of the Consideration Shares at the AGM, and obtaining key contract and third-party consents.

MTO is also considering other acquisition opportunities to rapidly expand its market share.

“MTO continues to explore other motorcycle franchise acquisition opportunities to increase its market share and geographic coverage in Australia,” said Ahmet.

This article was developed in collaboration with Motorcycle Holdings, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.