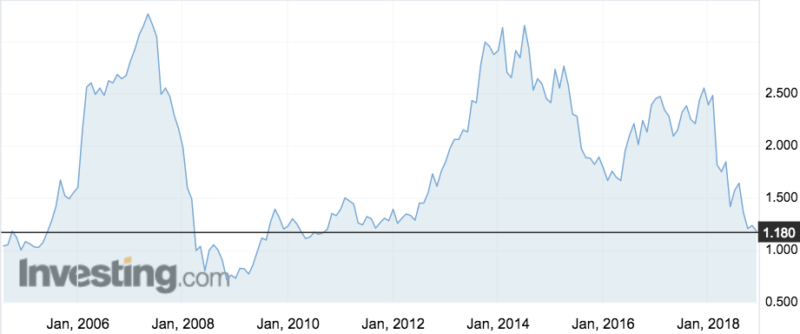

Mortgage Choice shares hit eight-year low as slowing housing market sinks profits

Picture: Getty Images

Popular home loan broker Mortgage Choice has warned investors its 2019 cash net profit after tax (NPAT) will be up to 15 per cent lower than original forecasts due to a slowing property market.

Mortgage Choice (ASX:MOC), which has a market cap of $148 million, issued a statement today adjusting its FY19 cash NPAT to between $14m and $15m, down from the $16.5m forecast when the company released its full-year 2018 results back in August.

And shares in the company fell half a per cent to $1.18 — the company’s lowest point in more than eight years.

However, cash NPAT does not quite reveal the full scale of a company’s financials. Mortgage Choice had a horror 2018, with its full-year profit nosediving 81 per cent from $22.2 million in 2017 to just $4.2m in 2018.

That followed an investigation by Fairfax Media and ABC’s 7.30 in June which reported franchisees had been financially devastated after signing up to the high profile brand.

Mortgage Choice said today that brokers were experiencing longer times for processing loan applications due to tightening lending policies.

“Together with a slowing property market, Mortgage Choice expected to have better clarity on the impact of these conditions on its FY19 settlements as the company moved through the first six months of FY19,” it said.

It has been losing market share and admitted in its 2018 results announcement that a significant rejig was needed to safeguard the company against changing market conditions.

“Mortgage Choice has made significant progress on its company-wide change program to build the platform for growth and long‐term sustainability,” it said today.

“We are on track to achieve a 10pc reduction in our operating cash expense base for FY19 and the new broker remuneration model has been successfully implemented and all franchisees moved onto the new broker software platform.”

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.