Traders’ Diary: Everything you need to get ready for the week ahead

Via Getty

What grabbed the headlines last week?

On Wednesday in the states, The Fed minutes were released to much anxiety but little actual bloodletting.

Turns out that at the meeting, where the Federal Reserve hiked its benchmark rate by 25 basis points (to a range of 4.5%-4.75%), just a”few” Hawkish Fed members wanted to go for the full 50 basis point hit.

Here are their names, do what you will. Cleveland Fed President Loretta Mester and St. Louis Fed President James Bullard.

Still stateside, the March quarter reports are well nigh done. According to AMP Capital’s Senior Economist Diana Mousina 93% of companies have finished reporting results, with some 69% of earnings surprising on the upside, (compared to a historical average of 76%).

Earnings growth is still running around -2% compared to a year ago.

US December quarter GDP was revised down to 2.7% annualised (from 2.9% previously) because of weaker consumer spending, weekly jobless and continuing claims fell again and January existing home sales declined in January.

Trading at Home

For the week that was at home, the local benchmark (ASX200) made it a hat trick of weekly declines (-0.54%), this time it was the big diggers BHP (-4.29%) and Rio (-4.3%) who ended up dragging the index lower.

Earnings season has been another Forrestian Box of Chocolates. The best I can add is it all wraps this week with reports due Monday from a few more names which can impact the session life Woodside Energy (ASX:WPL), Appen (ASX:APX), Downer EDI, Dicker Data (ASX:DDR) and Healius (ASX:HLS).

BHP (ASX:BHP) will tip $6.6 billion into the pockets of shareholders in the form of a US90c per share ordinary interim dividend, its fifth highest in history, as its profit fell 32% to US$6.457 billion.

Josh Chiat was all over the result which he says was largely impacted by a 16% fall in revenue from US$30.527b in the first half of FY22 to US$25.713b in the first half of FY23, with the payout a 40% fall on last year’s US150c per share offer.

Underlying EBITDA fell 28% to US$13.23b, with profit from BHP’s operations dropping 27% to US$10.833b despite a record production year at its iron ore operations in the Pilbara and record prices for thermal coal.

The numbers were broadly in line with consensus estimates, with BHP’s payout ratio of 69% slightly above Goldman Sachs’ 65% prediction. FY22’s full year payout ratio came in at a haughty 77%.

Our Barry Fitzgerald also noted that the second biggest owner of nickel resources in the world, thinks ‘the worst case scenario for nickel would see demand for it “only” double by 2050.’

“If we’re to meet climate change targets, you have to assume “double again”. That’s part of the reason BHP just shelled out $9.6 billion for OZ Minerals, owner of the $1.7 billion West Musgrave nickel-copper project in WA,” The Fitz said.

Reuben Adams reported that in a half-year reporting season tarnished by falling profits across the ASX gold sector, Perseus Mining (ASX:PRU) continues to claim the title of ‘ASX’s Most Consistently Good Gold Producer’.

The West African miner saw profit after tax rise 60% to $203m, with EBITDA up 40% to $354.4m and revenue up 22% to $665m for the first half of 2022-23.

Home Economics

On the economic front, CBA’s Belinda Allen says the focus was on wages growth data and with two separate indicators being the Q4 Wage Price Index (up less than expected at 0.8%/qtr and 3.3%/yr and the quarterly pulse of wages growth slowed.

Allen notes that the latest wages measures provide ‘another indication that wages growth is not rising at a pace that would alarm the RBA –the so-called wage-price spiral.’

“Together with the weaker labour force prints for January and February it lends weight to the case to pause very soon in the tightening cycle.”

However, she adds that the RBA Minutes though did reinforce the RBA’s wage and price concerns with a 25bp or 50bp hike considered in February.

The Economic Calendar

Monday February 27 – Friday, March 3

Over in Europe, the European Central Bank releases their own version of the rate policy minutes. There’s also a straight fulsh of inflation indicators out of the major member states.

In the US, it’s a full on Fed Speak week with appearances from several of your favourite Fed officials whose soothing tones will be what Wall St watches amid some surprise earnings packets and a few more PMIs.

On the corprorate front Tesla (NASDAQ:TSLA) has another of those all eyes on me investor events and the big to end all banks, Goldman Sachs (GS) holds their annual strategy updates.

The US earnings schedule is getting heavily retail with Target (NYSE:TGT) and Lowe’s (LOW) on the rack.

Elsewhere, there’s GDP growth figures for our little corner of the globe, as well as India Canada, Brazil, Turkey and Switzerland

Caixin’s February PMIs are out for China this week too, dropping about an hour after our data.

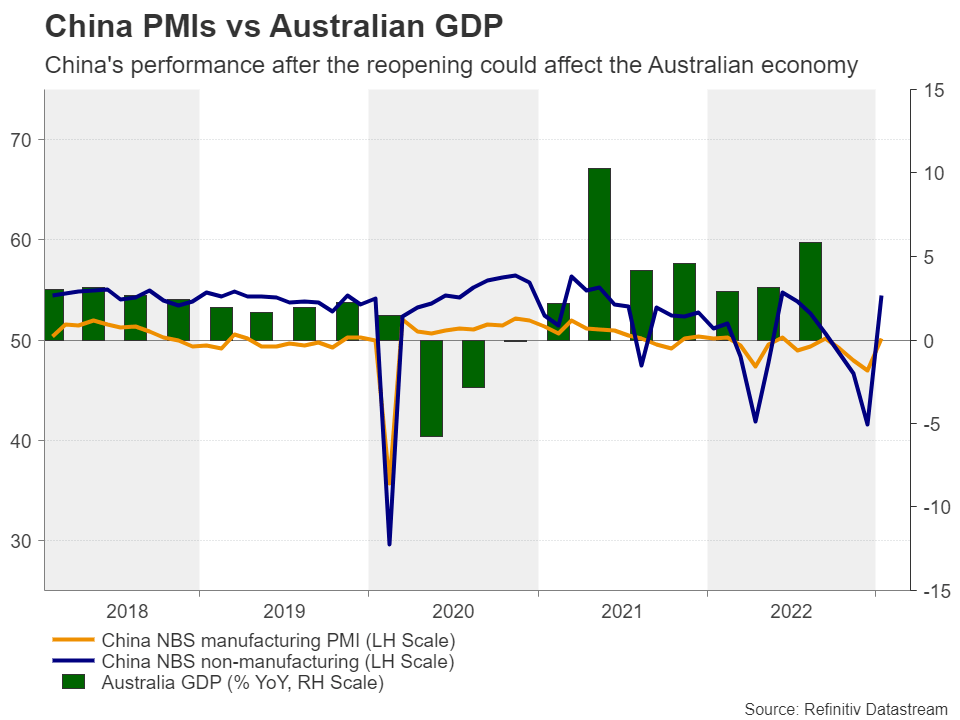

Given that China is Australia’s main trading partner, traders would do well to keep an eye on what they say about China’s reopening and our relationship to it:

All sources from Commsec, Westpac and Trading Economics

Australia and New Zealand

MONDAY

AU Business indicators

AU Inventories,

AU Q4 22 Company profits

TUESDAY

NZ ANZ Business Outlook

AU Jan Housing Credit MoM

AU Jan Retail Sales MoM Preliminary

WEDNESDAY

AU CoreLogic dwelling prices

AU Jan Monthly CPI Indicator

THURSDAY

AU Building Permits MoM Preliminary

FRIDAY

AU New home lending investment ABS

Global

MONDAY

US Durable goods orders, Jan

US Pending home sales, Jan

Fed Speak Fed Gov. Jefferson

TUESDAY

US Pending Home Sales, Jan

US Dallas Fed Manufacturing Index, Feb

US Fed Speak Fed Jefferson

Japan Retail Sales YoY, Jan

India GDP Growth Rate YoY

WEDNESDAY

US S&P/Case-Shiller Home Price MoM

US S&P/Case-Shiller Home Price YoY

US Chicago PMI, Feb

US CB Consumer Confidence

CN Caixin Manufacturing PMI

EU ECB Monetary Policy Meeting Accounts

THURSDAY

US ISM manufacturing, Feb

EU Unemployment rate, Jan

FRIDAY

CN Caixin Services PMI

US Fed Speak Fed Gov Waller

The ASX IPO calendar into early March

The listing date shown is from the ASX, and they could change at short or without notice.

Listing: 9 March

IPO: $25m at $0.20

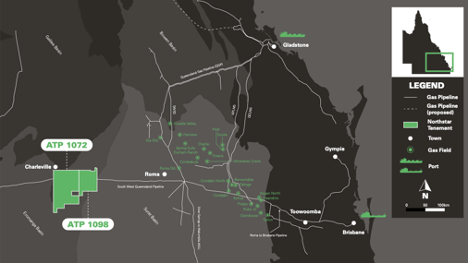

The gas company is focussed on the exploration and delineation of hydrocarbon resources at its flagship project, Project Cosmos, in southwest Queensland which is in the under-explored region of the Surat, Eromanga and Adavale basins.

Following its listing on the ASX, NTH will focus on undertaking systematic exploration aimed at increasing the confidence and scale of the existing prospective resource estimated by an independent technical expert at approximately 1,150 (bcf) and 209 (bcf) within the ATP1072 and ATP1098 tenements, respectively.

The company also plans to undertake pilot production testing to further delineate the reservoir characteristics.

Listing: 10 March

IPO: $7m at $0.20

Evergreen’s flagship Bynoe lithium project is adjacent to Core Lithium (ASX:CXO) and its producing Finniss mine in the Northern Territory.

To date the company has completed an Ambient Noise Topography (ANT) Survey and commenced field mapping and stage 2 soil, rock chip and termite mound sampling at the Bynoe project and says the soil sampling has confirmed its view of strong anomalous lithium in soil anomalies along strike from Finniss.

The company has also completed a comprehensive auger program, drilling 1,731 holes at the Kenny lithium project, with results expected shortly after listing.

EG1 also holds the Fortune project – also in the NT.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.