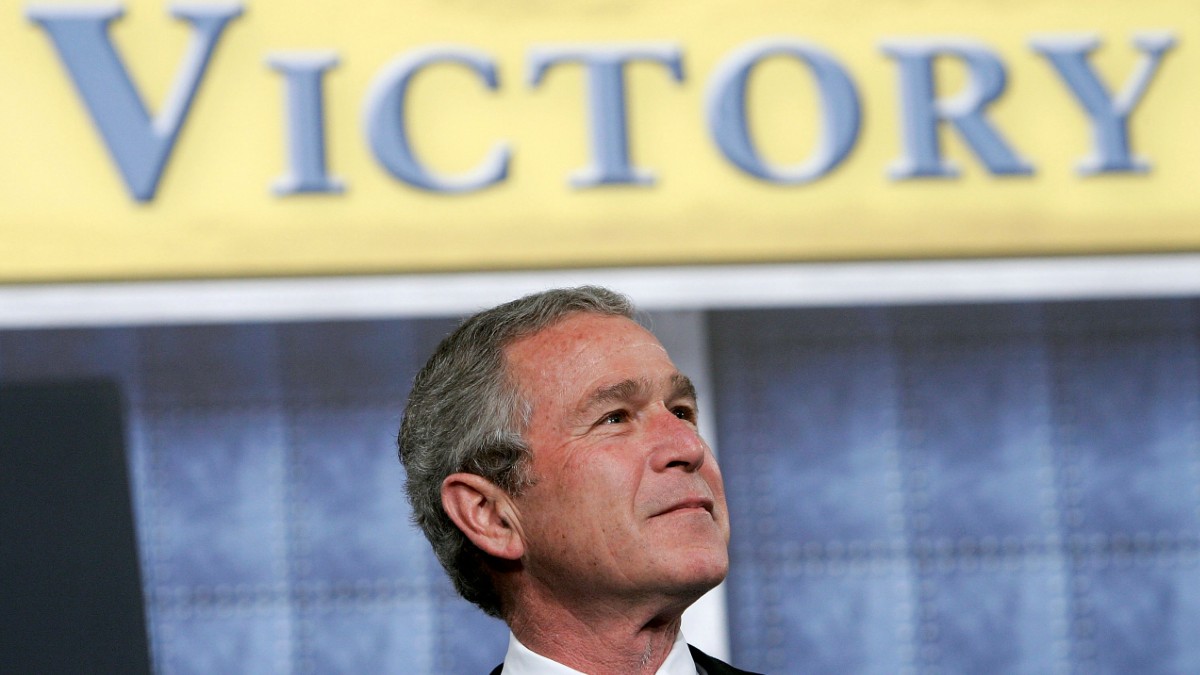

Mission Accomplished: US inflation gets an ass kicking, just like President George W. Bush promised

Then U.S. President George W. Bush smiles prior to a speech on the 'War on Terror' at the U.S. Naval Academy November 30, 2005 in Annapolis, Maryland. Bush was always at war with someone, but victory was harder to declare. (Photo by Alex Wong/Getty Images)

Just pointing out the news is good, the war’s not over.

On one hand, yes US Core Price Inflation just fell by the most (month-on-month) in, like, 34 months.

Around April 2020. That was when the US was discovering the initial joys of locking down COVID-style.

The other view – which no-one’s really interested in right now, especially after the diabolical cycle of rising inflation and central bank tightening – is that year-on-year US CPI rose 6.5%.

Down significantly from the month before, but still a powerful description of the cost-of-living disaster for not just American households, but the rest of the world where these inflationary figures are gruesomely familiar.

Again, however humungous 6.5% might sound for the generation of borrowers that only knew money, like the stuff it bought, cost cheap – that number is the smallest annual rise in prices stateside since October 2021.

The first response was from across the Atlantic where traders have taken out the pan-Euro trash. Overnight the European benchmark Stoxx 600 built nicely on Wednesday’s session of strong gains after the much anticipated US CPI report met wholesale expectations of what now seems to be a pattern of continued easing.

The American’s Bureau of Labor Statistics dropped its final 2022 measurement on the rate of rising inflation from the month of December with the headline read falling a heroic 0.1% month-on-month.

Boom. That met the consensus estimate of Bloomberg’s regular gathering of clever economists who’ve rarely hit these gauges right on the nail for about 2 years. And very occasionally before that, I might add snarkily.

The headline rate was still a haughty 6.5% year on year, but better than the 7.1% of November and one senses at this stage of the game market participants don’t mind the size of the number as much as they do the direction it’s headed.

And it seems to be headed the right way.

That kind of unjustified optimism has really taken, best evidenced by the Wednesday session across the Atlantic and the Thursday session in Asia.

With gains all round, almost everyone appears to have decided the softening which (did in fact) transpire was a sure thing. We did very well. So did Japan. Europe’s Stoxx 600 closed on the precipice of its highest level since April last year which it then went and nailed at the open overnight a few hours ahead of the US inflation drop, Thursday morning their time.

The breathlessly anticipated inflation read, bang on 6.5%, really does suggest The Fed has finally made an impact – a significant one on the US headline rate of inflation.

The core rate meanwhile – that’s the one (and you should be on top of this by now) – which strips out energy and food prices that everyone uses and really don’t deserve to be stripped from anything, rose 0.3%, in line with what the economists pegged but while it was higher than the 0.2% in November, mostly everyone’s chuffed about the other one.

Wall Street is lower in early trade, that’s interesting, but not interesting enough to stay up and write to you lot about it. Buy The Australian this morning.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.