Midnight Mass: Traders go insane as central bankers start roaming Wyoming

Traders tread water ahead of J Powell's midnight (AEST) Jackson Hole address. Via Getty

In search of a mission beyond raising rates, which frankly any idiot could do, global central bankers are back combing Wyoming for a raison d’etre.

Meanwhile rehab is filling with wagon-bereft investors, the punters are measuring up the spreads and coked-up US brokers are getting itchy all over – it must be Jackson Hole time.

For people with real lives, the Jackson Hole Economic Symposium has been an annual event held inside a hole called Jackson in Wyoming. This has been happening since 1981 and is one of the longest-standing least-decipherable central banking events in the world.

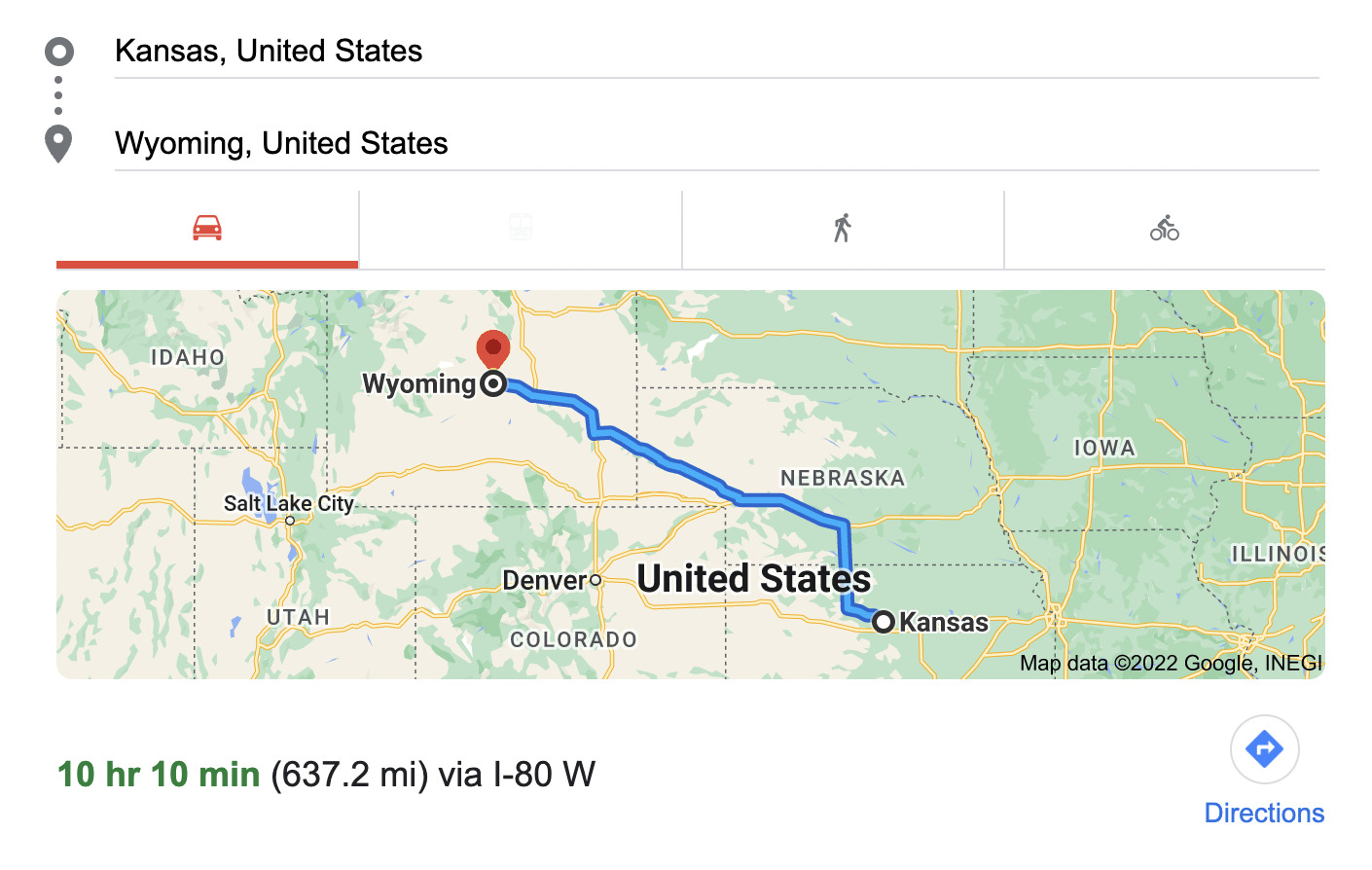

The conference is sponsored by the Federal Reserve Bank of Kansas City.

I have no idea why, neither does Google:

As good a place as anywhere for some aggressive tightening, I symposium

The once-a-year-all-you-can-eat economic symposium has swollen with self-importance this year given the gad-damn mess this lot have already made of the cost of living and the subsequent impetus that’s given to what is now essentially a macro-driven market.

US and European shares climbed on Thursday as markets salivated at the idea Fed Chair Jerome Powell will at last be done with his stop-the-clocks speech at Jackson Hole around 12am Sydney time.

The general expectation is that Powell will use the spotlight to reiterate the Fed’s focus on bringing down inflation with further aggressive tightening. He could call for world peace, but why stray from the song sheet?

The chair’s position won’t have been helped by the overnight as measurement of US GDP, which has again contracted – this time at a 0.6% annualised rate in the June quarter. That means the US economy is walking and talking like a recession but maybe isn’t a real one unless we mention it by name.

Most economists watching Wyoming from afar tonight have convinced traders to expect The Fed chief to just bulldoze on through with interest-rate hikes to soften up the spiky US inflation. Sadly that might kill dead the rally traders have ridden since mid-June.

Way down the list of worries is the slowly simmering slowdown chugging through the Chinese economy, but it would seem tweaking the interest rate is all the gathered might of the global central banking immunity can handle over one long-weekend.

Whose saying what of Wyoming?

The Hawk of St. Louis James Bullard wants his Fed fraternity to get cracking and stiffen the US benchmark rate to somewhere between 3.75% to 4% by year end.

Speaking overnight to CNBC from Jackson Hole, (the lucky bugger) Bullard said to absolutely no-one’s surprise that he’s a fan of front-loading the fight against inflation.

“I like the idea that you get the rate increases in earlier, rather than later. You show you are serious about inflation fighting and you want to get up to the level that will put downward pressure on inflation. We are at 2.33% right now. That is not high enough,” The Hawk said of the current benchmark federal funds rate.

“I think (Powell) will lay out a case, as he did in his last press conference, for slowing the pace of increases. We had two 75-basis-point moves. Our expectation would be, barring significant data surprises, that the September move is 50,” said Jan Hatzius, chief economist at Goldman Sachs. “I don’t think he will be specific about the number, but I do think he will be saying there is a risk of over-tightening, and therefore it makes sense to go a little bit more slowly than the outsized increases.”

J.P. Morgan’s global market strategist Gabriela Santos, also told CNBC that US investors are likely to see a bit of a relief run tomorrow, ‘unless we get a big shock from what Powell says.’

“One thing I would keep an eye out on if we look to next week and into the fall… implied bond volatility is still very, very high for where it normally is in late August, suggesting that actually we’re likely to continue seeing a lot of action in the yield curve, which could affect stock markets in the fall.”

“Given the hawkish repricing of FOMC rate hikes over the past few days, we judge there is a risk Powell’s speech disappoints markets and sparks a correction in the USD,” says CBA’s currency strategist and senior economist Kristina Clifton. “The AUD/USD held on to yesterday’s gains and is trading near 0.6980. Stronger commodity pricing and an improvement in risk sentiment as measured by the VIX has supported AUD. The next big move in AUD/USD will likely be guided by the USD’s reaction to Jackson Hole.”

“Throughout this year, what we’ve seen is the volatility around the Fed-funds rate has created market volatility,” says Michael Arone, managing director at State Street Global Advisors. “I think that all of this ‘trying to find that level’ has induced this volatility, and I think the markets are underestimating where the Fed will end up.”

Pete McGuire CEO of XM says even though investors are still wary that the Fed might use the Jackson Hole symposium to put its foot down, especially with inflation expectations grinding higher, it seems that the promise of more fiscal juice was enough to eclipse those concerns for now.

“Overall, the risk/reward profile for stocks doesn’t seem particularly attractive at this stage. Valuations are likely to compress again now that yields on government bonds have started to regain their former might, ‘real’ earnings growth for the S&P 500 is negative once adjusted for inflation, while demand from energy-squeezed Europe and property-troubled China could struggle.”

Marko Kolanovic, chief global markets strategist at J.P. Morgan: “We maintain that inflation will resolve on its own as distortions fade, and likely drive a Fed pivot… In Chair Powell’s remarks, we do not expect him to tip his hand on the size of the next move, which will depend on upcoming releases, but we believe he will push back against the idea that a dovish policy pivot is coming soon.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.