Microsoft’s Magnificent even among The Tropspheric Trio

There can be only 3. Via Getty

Last week’s Mega Tech earnings reports have so far left investors somewhere atop cloud 2.

To repeat, in the first quarter:

– $MSFT reported 17/20% revenue/net income growth (44% operating margin)

– $GOOGL reported 16/57% revenue/net income growth (32% operating margin)

– $META reported 27/117% revenue/net income growth (38% operating margin)And with the broad… pic.twitter.com/oU7sxbsTR4

— Dan Greenhaus (@DanGreenhaus) April 26, 2024

And with more Mag 7 names reporting, this week on Wall St could be just as ionospheric.

We’re midway through the latest round of Mega-tech quarterlies and as of Monday night in Sydney, the big tech analysts are calling the latest round of cloud computing combat for Microsoft.

“This quarter Microsoft Cloud revenue was US$35.1 billion, up 23% year-over-year, driven by strong execution by our sales teams and partners,” an MSFT exec said in the earnings press release.

And there’s broad agreement – the software giant’s cloud segment is killing it, according to the likes of UBS and JP Morgan.

Revenue growth for MSFT’s cloud division accelerated over the quarter, coming in at well over 30%, well ahead of expectations and 3 points ahead of the growth seen in the previous quarter.

Excitingly, analysts have noted, it wasn’t just AI growth driving the result, with non-AI growth also accelerating.

That news’ll certainly excite investors and most likely be a secret relief for the highly paid muffin keeping a low profile in MSFT’s branding division – since the cloud-based computing platform “Azure” actually describes a clear, entirely cloudless sky.

Aside from that it’s pretty hard for anyone at the moment to find fault with what the MSFT peeps have been up to.

There’s pretty much no other way to describe MSFT’s Q3 results other than punchy. Although we’d have accepted strong, impressive, upbeat and/or encouraging.

The bulk of the commentary over the weekend has tended to zero in on the easy integration of Copilot into the lucrative Office suite of toys and, tools and apps, while the continued growth of Azure and the Thanos-like inevitability in its take of cloud-comp market share must have shareholders running some calculations.

At about US$407, the share price is almost a steal when it comes to Mega Tech mania.

The tropospheric trio

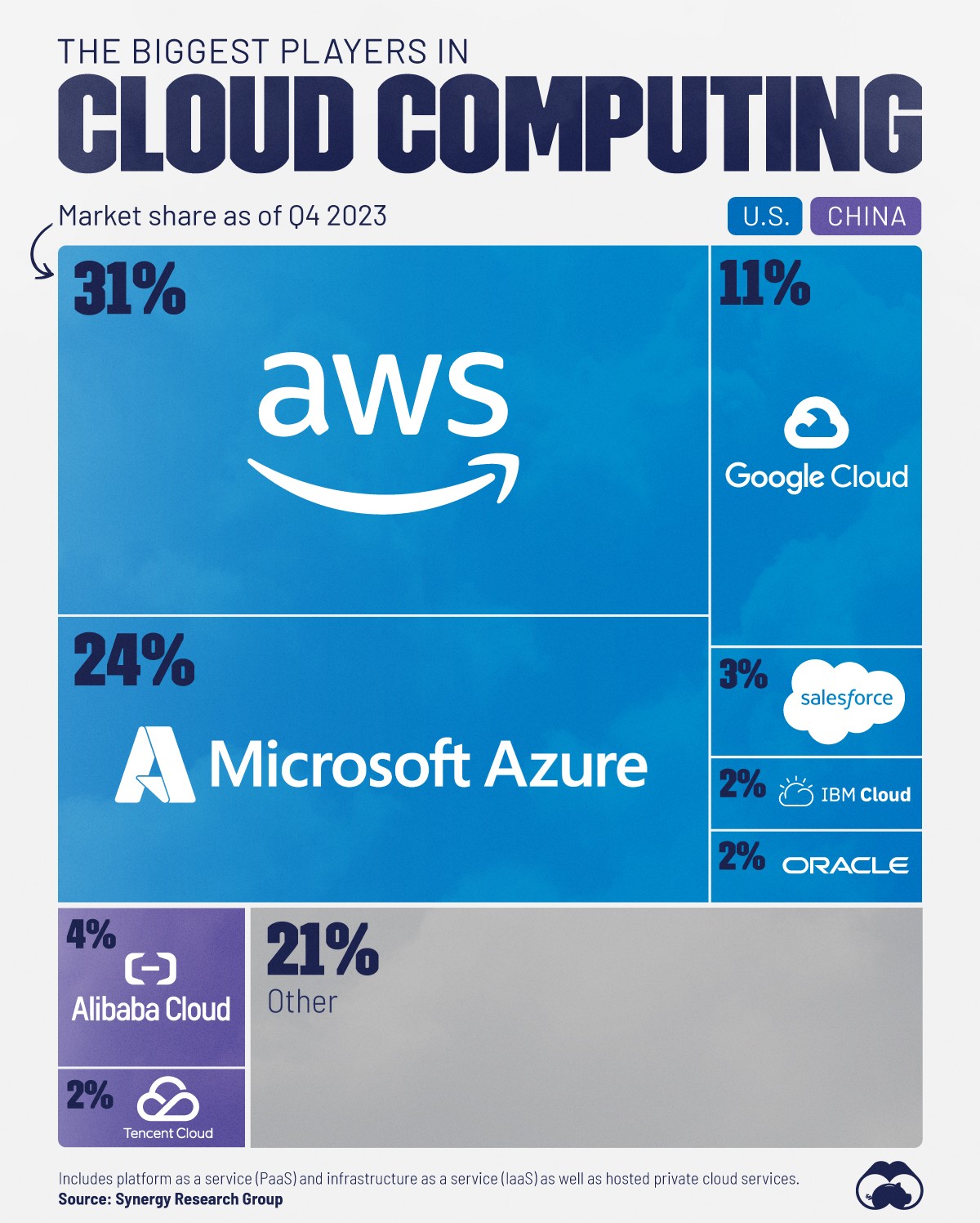

The space in the ether we’ve come to call cloud is dominated by just three of the Magnificent 7.

Amazon, Microsoft, and Google have successfully tapped into what increasingly looks like an infinite resource of revenue, through their respective billowing cloud infrastructures which provide the computing power you and I and all the companies in the world now rely on to store data.

Even better – these are where the proliferating gaggle of AI models are living and breeding, creating a surge in computing demand for cloud stuff which equates to a licence to print money for the tropospheric trio.

The Cloud and the AI

Everyone wants their own large language AI fireworks on the ready – and already a greatly chunk of Artificial Intelligence programs do their dancing on the cloud where the burgeoning industry’s current system specs require as much as 100 times more thinking space than models of late last year.

Considering the pace and exponential nature of AI development thus far, you’d reckon demand for cloud capacity and the services needed to guarantee them will swiftly follow.

Why Microsoft is looking so Mega

Microsoft Corp’s quarter ended March 31, 2024, vs corresponding period of last fiscal:

- Revenue was $61.9 billion and increased 17%

- Operating income was $27.6 billion and increased 23%

- Net income was $21.9 billion and increased 20%

- Diluted earnings per share was $2.94 and increased 20%

- Consensus Recommendation: Buy

- Consensus Price Target US$479.27

MSFT offered decent forward guidance for Q4, with the top-line ever so slightly below expectations but with an ever-so-slight but so significant beat on Intelligent Cloud (public, private, and hybrid server products and cloud services).

More winning was the unprompted offer of FY25 guidance, with MSFT expecting total revenue to grow double digits (the market is at 15%), operating income to grow double digits (the market is at 14%) and CapEx greater in FY25 vs FY24.

Capex is AI investment so anything round that space really is great.

UBS says MSFT happily maintained some stellar cost discipline, which resulted in better-than-expected margins.

Unlike Meta, Capex spend was in-line at $14bn, albeit most analysts forecast upside to estimates over the coming year as it relates to capital expenditure. Gross Margins expanded 60bps year-on-year to 70.1% and Operating Margins of 44.6% improved 230bps on year-ago levels.

Finally, the company’s big commercial Office 365 segment landed in-line for the second straight quarter at 15% growth (down from 16% growth in the December quarter) after a long streak of modest (usually 1-point) beats.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.