Microsoft Q4 preview: Mega Tech is off the table, we’ll find out this week if it’s on the nose

Pic: Getty Images

- Microsoft to drop Q4 on Tuesday after market close

- Doubts around the sustainability of the Mag 7, AI narrative

- Cloud growth and AI spend in focus

They’ve been the building blocks of Wall Street’s record highs and these seven tech names now account for about a third of the S&P’s entire market value.

They’ve been Magnificent for so long it’s hard to imagine Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla as anything but.

Yet the wheel has turned so quickly this last week that investors are shifting down a gear and looking for almost anything other – including the flotilla of unloved US small caps.

Certainly the prospect of imminent US Fed rate cuts just makes the rest of the neglected US market more attractive.

For now, Wall Street is struggling with the anxiety that perhaps these AI-charged valuations are now stretched – saying nothing about how sustainable the AI boom really is.

But with Microsoft (MSFT) dropping a hotly anticipated quarterly report next week, the fact remains that the entire Magnificent Seven still enjoy sterling earnings.

And seriously, these are the last businesses on Wall Street worried about the cost of money – interest rates mainly bother companies that borrow – and these guys haven’t got anything but love from banks.

Like Bank of America, which quite likes the rotation selling in big tech and reiterated its Buy recommendation on Wednesday, so much so that BoA raised its price target on the stock to US$510 per share, from US$480.

“We concluded a round of Microsoft partner calls ahead of Q2FY24 results, to be reported on July 30,” BoA analysts said in a note. “Most partners tracked above or in line with expectations, largely consistent with Q3.”

Microsoft Q2 earnings: The Goldilocks of AI?

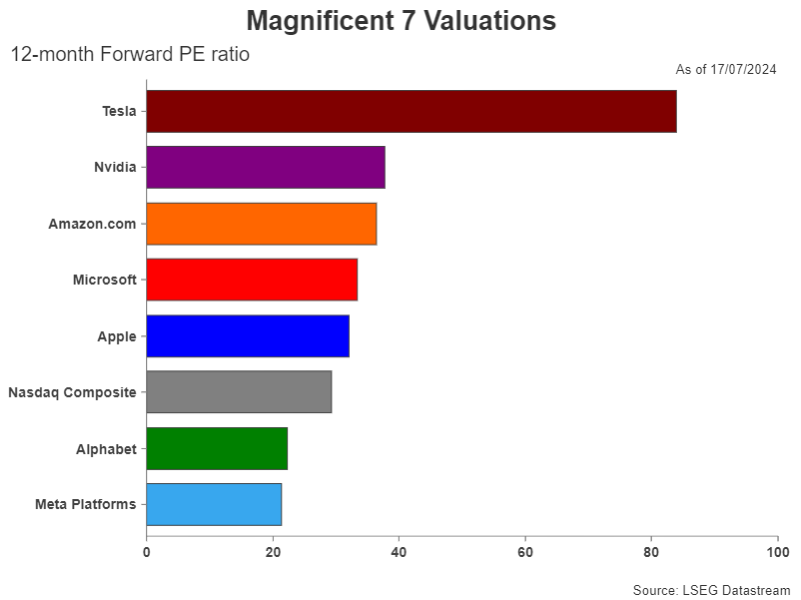

From a valuation perspective, Microsoft is only slightly more expensive than the Nasdaq Composite’s garden variety tech firm.

And among its Magnificent 7 peers it looks pretty good on a trailing price/earnings (PE) ratio.

MSFT also ranks fair to middling when it comes to 12-month forward multiples.

Certainly, it is no Tesla…

According to XM Australia CEO Peter McGuire, all this suggests MSFT isn’t necessarily more vulnerable than its rivals as they face the closest thing to a tech selloff we’ve seen for many moons.

“But with its forward PE higher than those of Apple, Alphabet and Meta, investors have more good news priced in than for some of the AI laggards,” McGuire said.

And with the Company planning on spending even more on AI over the next few years, the stakes are about to get even higher.

Five things Morningstar’s Dan Romanoff is watching for MSFT

Romanoff is Morningstar’s equity research analyst for technology, media, and telecommunications in Chicago. He recently took a look at the tech giant’s quarterly outlook. Here’s his five things to look for:

- (Cloud computing platform) Azure grew 31% year over year vs. guidance of 28% in the third quarter. Artificial intelligence contributed 7 percentage points of that growth.

- Deals: Both large deals and the number of deals were strong. Management commented that it left some revenue on the table because it didn’t have enough AI capacity. So the company will invest heavily next—we estimate $15 billion-$20 billion in capital expenditures, bringing the year total to as high as $50 billion. Chief financial officer Amy Hood said it would step up next year too.

- Progress on Activision Blizzard integration. Reports suggest Microsoft is going to raise prices for Game Pass.

- Commercial bookings and remaining performance obligation growth.

- General demand trends: Microsoft reports early in the cycle, helping to set the tone for software overall. Results from last quarter were generally solid, with strength in large deals, good bookings, and solid RPO growth.

Monetising AI

Microsoft Corp continues to ride high on the artificial intelligence wave, having been among the first to bet big on the AI revolution. The Company’s investment in ChatGPT maker OpenAI, thought to be in the region of $13 billion, so far seems to be paying off.

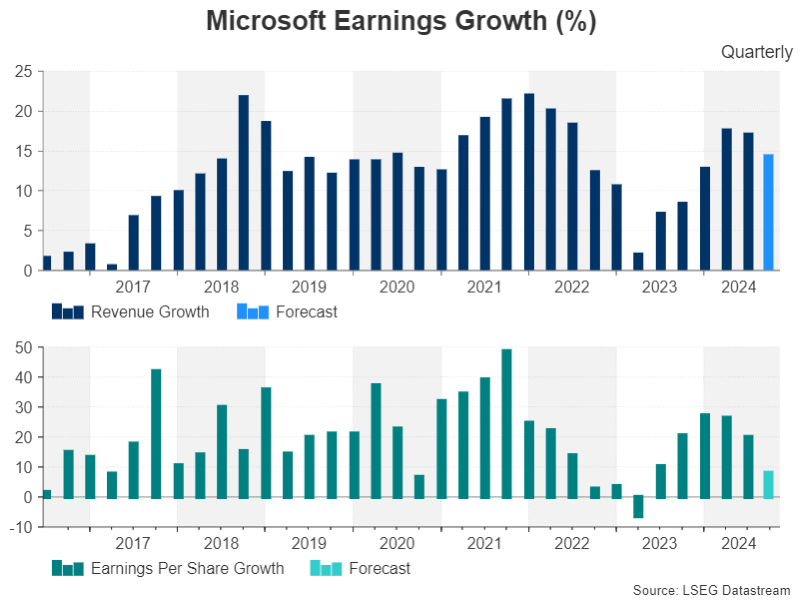

Revenue growth was in double digits in each of the previous three quarters, while earlier this year Microsoft overtook Apple as the world’s most valuable company for the first time since 2021.

Then there’s the balance sheet.

As of June, Microsoft had US $111 billion in cash and equivalents – and the handy tax offset of $47 billion in debt – which according to Math, results in a net cash position of $64 billion. Nice.

Adding to the optimism ahead of Q4 earnings is the recent launch of the next-gen Surface PCs – the first to be fitted with the artfully clever Copilot+, – hello to AI functions at the press of a button.

And the Copilot+ PCs follow on from the launch earlier in the year of Copilot Pro, which is the subscription version of the free Copilot that offers added AI features.

“Microsoft’s ability to not only implement AI in its products and services but to also show to investors that it’s able to monetise its investments in AI has been key in maintaining the AI-fuelled rally, as well as the positive earnings outlook,” McGuire said.

With rivals like Apple announcing competing AI plans, the pressure is on for the likes of MSFT, the ones ahead of the curve on delivering into the hype.

“Looking at the revenue forecasts, Microsoft will probably not disappoint. Revenue is expected to have increased to $64.24 billion in the fourth fiscal quarter – a rise of 14.3% from the same period a year ago,” McGuire added.

“However, earnings per share (EPS) might reflect slowing profitability. According to LSEG IBES data, EPS is projected to have grown by $2.91 in Q4, down from $2.94 in the prior quarter and up just 8.2% from the corresponding period in 2023 versus growth of 20% or more in each of the previous four quarters.”

AI spending spree not over, says XM’s McGuire

“One reason for the expected slowdown in profit growth is the increased expenditure on new investments, particularly on AI infrastructure for its cloud services,” McGuire said.

But this is something that Microsoft had already warned investors about and therefore, you’d reckon it’s unlikely to come as too much of a surprise. Nevertheless, the focus will be on its Azure cloud computing unit and specifically whether cloud income kept up pace with previous quarters.

McGuire says that Cloud services remain by far Microsoft’s biggest source of revenue growth as well as being the largest single segment.

“Any signs that demand is waning, not just for its cloud unit but also for its other products and services such as Office 365, could add to the selling pressure hitting the major tech names this week.”

Technical McGuire: A temporary MSFT pullback?

“Microsoft’s share price is close to breaching its 50-day moving average (MA) amid a broader correction in tech stocks. A drop below it would bring into range the $400.00 level where the 200-day MA is about to intersect,” McGuire said.

The other thing to watch, he says, is for a downbeat forward guidance for the next quarters, which could also send the stock price plunging.

“But if the Company posts better-than-expected results or at the very least, retains an upbeat view on its AI ventures, the stock could rebound towards its recent all-time high of $468.35 before setting sights on the $500.00 mark.

“That’s somewhat above analysts’ median price target of $490.00, although they all maintain their ‘buy’ recommendation.”

Bulls and Bears

Romanoff, meanwhile has pulled together some handy tips on what divides bulls and bears on the Microsoft investment thesis.

As per his assessment, the bulls say public cloud is the future of enterprise computing, with Azure a leading service, Microsoft 365 is continuing to benefit from upselling into higher price stock-keeping units, and it has a ‘cash-cow’ monopoly in areas like OS and Office which can drive growth for Azure.

The bears meanwhile think momentum is slowing for the subscription trend, its mobile presence is weak and there are larger players in its growth areas like Azure in cloud computing and Dynamics in CRM.

Morningstar MSFT Fair Value (price target) Estimate: $435.00

MSFT Q4 earnings release date: July 30, after the close of trade

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.